Prash

@prashct

I don’t post. Follow me and you’ll get blocked.

You might like

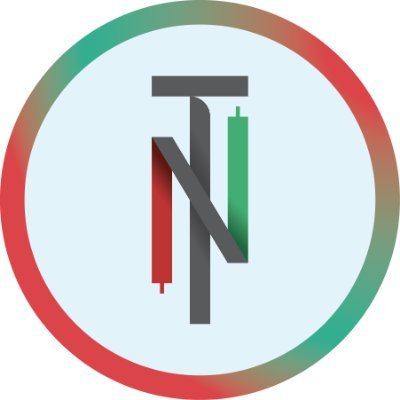

Knowing what to buy is more than half the battle. Get into the right name, follow your process, and let it work in your favor is how to be consistent at this. There is a clear reason why $APLD has been leading. The reported a revenue increase of 250% YoY and an EPS increase of…

$ETH Well, not a perfect Po3 here Bulls too strong on that dip 🧐

$CMG - Chipotle as many of you know, I'm not a big fan of downtrend charts 95% of the time unless it's too hard to ignore like $UNH at $240's that's the only name I did bottom fishing in this entire year! that being said, I would expect $25 should act strong support level!

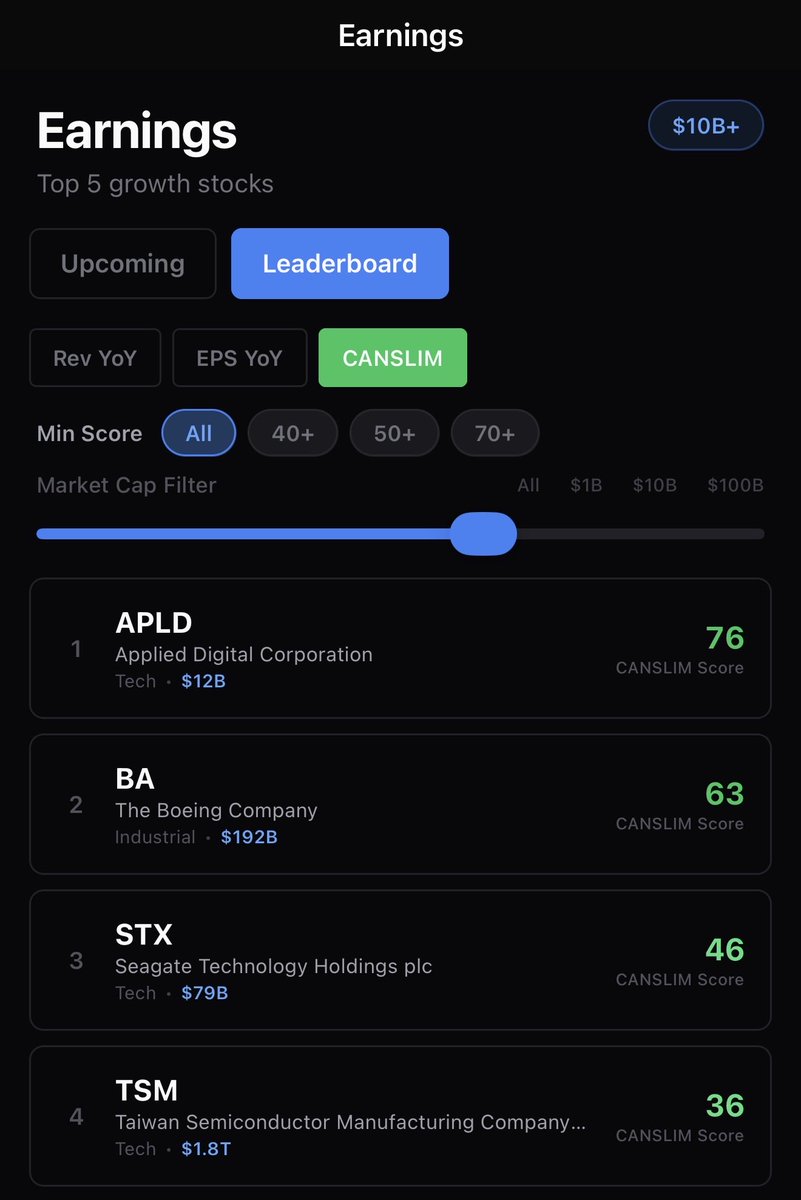

$ALTS Season indicator Euphoria is coming

When people talk about AI leading to no humans needing to work anymore in the distant future I think of this.

In 2021, everyone thought $100K was a sure thing. I remember thinking we'd even have a shot at $400K in a blow off top. I told my wife that we were about to reach a completely different level of wealth... Because the blow off top was imminent. Then we topped at $69K and it…

$AGI gold behaving like it knows that this administration wants the printer to go brrt again or you get fired

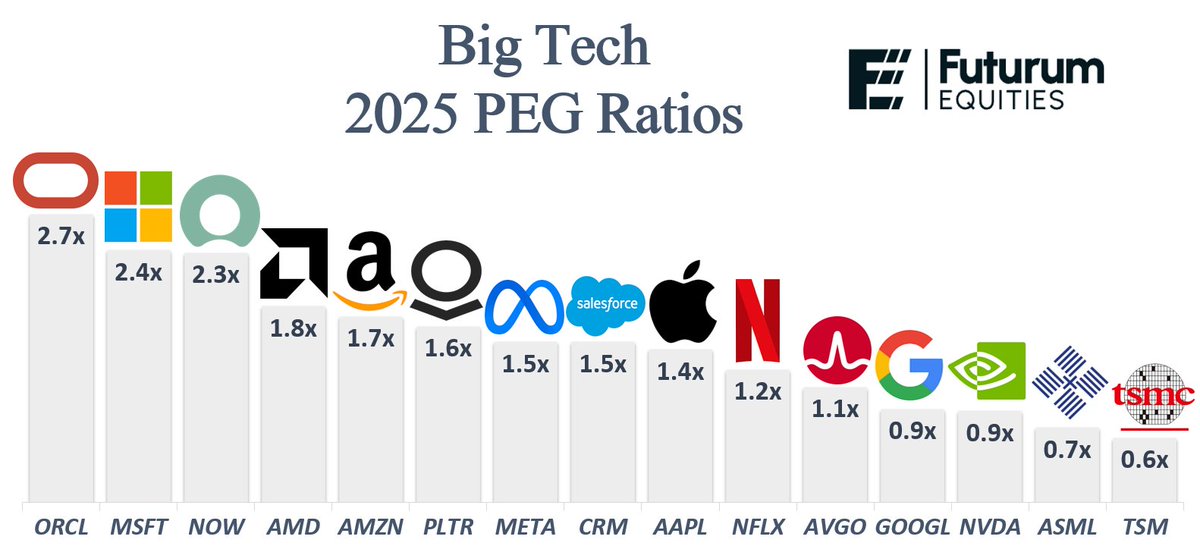

PEG RATIO IS THE SLEEPER VALUATION METRIC MOST IGNORE PEG < 1 = mispriced growth PEG > 2 = danger zone Here’s how Big Tech stacks up: • $ORCL ~2.7x • $MSFT ~2.4x • $NOW ~2.3x • $AMD ~1.8x • $AMZN ~1.7x • $PLTR ~1.6x • $META ~1.5x • $CRM ~1.5x • $AAPL ~1.4x • $NFLX…

Stock market books: The Intelligent Investor chapter 1, 8, 20 One up on Wall Street How to Make Money in Stocks Market wizards series Reminiscences of a stock operator Buffett and the interpretation of financial statements. Buffets annual shareholder letters on Berkshire Baruch-…

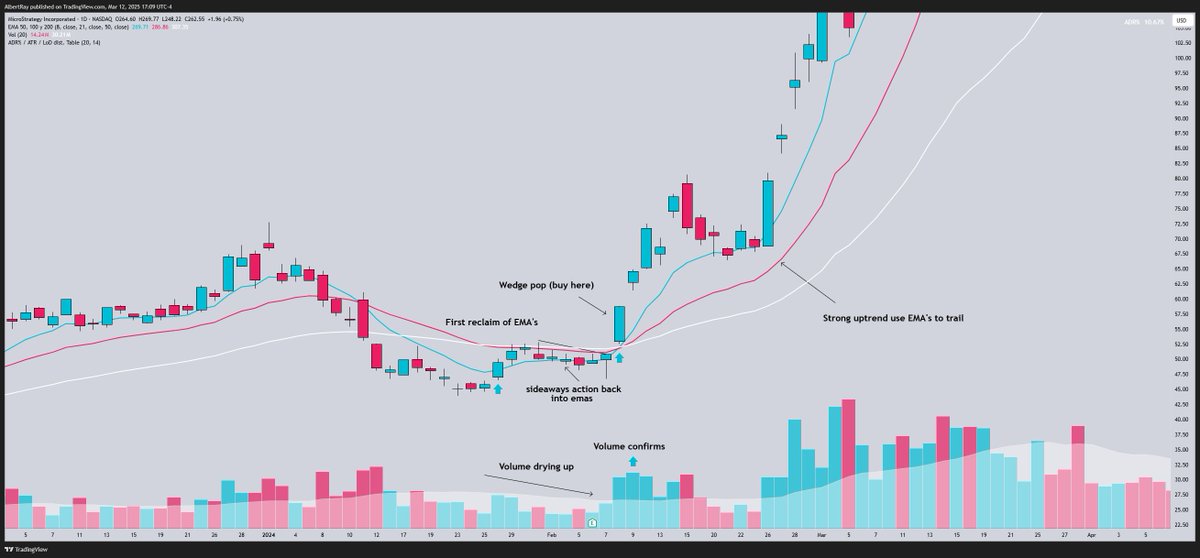

If you are looking to trade trend reversals the highest probability setups for these are "wedge pops" chart will begin to display accumulation volume as the price reclaims the moving averages but dont buy on the first reclaim look for a retest of the moving averages + tight…

$BTC DOMINANCE Update With recent market condition & what I see, I think one more pump is likely on the dominance. We can reach 62% IMO then once we top on Dominance chart, I think we will see 34/33% at the end of the cycle with average, 120/160 days from the top 😌

$BTC DOMINANCE Update Still valid so far, just a matter of time now until the real fun begins ✍️

If the market pullbacks sometime before the election -- here are the prices for my top 10 holdings that would trigger a green light for me to add 🧐 1. $PLTR -- $32 2. $CRWD -- $245 3. $SNOW -- $110 4. $TSLA -- $180 5. $TMDX -- $120 6. $AMZN -- $165 7. $MELI -- $1400 8. $TTD…

12 Stocks with Key Fundamentals What drives growth in a stock? - Earnings Growth - Sales Growth - Net Income Positive - Cash Flow Positive - EBIT Positive Excluding the well-known high-performing stocks such as $NVDA $AAPL $AMZN $GOOGL $MSFT $GOOGL $META $TSLA, here are 12…

Some favorite posts about OpenAI o1, as selected by researchers who worked on the model 🧵

I'll give you a bible for trading: - have stop loss - buy retest of breakout - have stop loss - sell when you screenshot - have stop loss - good above EMAs, bad below - trade top 2/3 stocks of leading sectors - scan weekly, chart daily, trade hourly - 9/20/50/100 EMAs holy furu

the choose rich package #2 (also known as - best names to spark up longs should markets cooperate) $UBER $LYFT $PLTR $APP $PINS $CRWD $HOOD $MARA $FSLR $ARM $NXT no charts, just listing names to save your time - these have nice bases/coiling with supportive derivatives action

the choose rich package (also known as - best names to spark up longs should markets cooperate) $AVGO $SMCI $NVDA $MU $ENPH $VRT $FOUR $ENPH $FUTU $RKT $ONON $PDD no charts, just listing names to save your time - these have nice bases/coiling with supportive derivatives action

In algebra, we can solve systems of equations by simplifying them by eliminating one variable. Eliminating the variable of time via options helped me become a better trader. I still simulate leverage with size without having to introduce another variable into the equation.

A friend of mine asked me to share some advice on how I was having a green year. I’d like to share what I told him in case it helps any struggling traders: I stopped playing options for the most part brother and focused on trading shares with size. I also focused on the…

what I did w/ software names last week, a recap: - bought commons for $S - sold puts for $MDB - sold puts + bought LEAPS for $PANW - sold puts + bought commons for $PLTR - sold puts for $NET - sold puts + bought commons + bought calls for $NOW - sold puts for $CRM - bought…

these software dips should get you excited. After exiting in Q1, various names are now presenting themselves in my accumulation board most of them are going through consolidation/PE rebrand periods, and prepare for some dull & void 1/2 Qs of action $NET $DDOG $PANW $S $SNOW $ZS

it's high time to realize if your name did not touch and/or break ATH while SPY went from 350 to 530 it's probably a shit name

these software dips should get you excited. After exiting in Q1, various names are now presenting themselves in my accumulation board most of them are going through consolidation/PE rebrand periods, and prepare for some dull & void 1/2 Qs of action $NET $DDOG $PANW $S $SNOW $ZS

People have been asking me this a lot lately. What books do you recommend for trading / charting? I’ve retweeted a list of some I bought years ago but to be perfect honest I haven’t read them all yet. I learned the most from two things: 1) Watching @RichardMoglen YouTube videos…

United States Trends

- 1. El Paso N/A

- 2. #njnbg N/A

- 3. Rio Rico N/A

- 4. Jake Lee N/A

- 5. Wemby N/A

- 6. Carlos Palazuelos N/A

- 7. #njpw N/A

- 8. Nancy Guthrie N/A

- 9. Tumbler Ridge N/A

- 10. Bronny N/A

- 11. Finlay N/A

- 12. British Columbia N/A

- 13. Dahyun N/A

- 14. Tucson N/A

- 15. Pacers N/A

- 16. #OlandriaxYSLBeauty N/A

- 17. Mizuki N/A

- 18. Victor Wembanyama N/A

- 19. #T20WorldCup N/A

- 20. Spring Festival N/A

Something went wrong.

Something went wrong.