你可能會喜歡

Customer obsession youtu.be/GltlJO56S1g

youtube.com

YouTube

Jeff Bezos In 1999 On Amazon's Plans Before The Dotcom Crash

Love Buffett’s response to “when did you know you were rich?” Particularly the highlighted part.

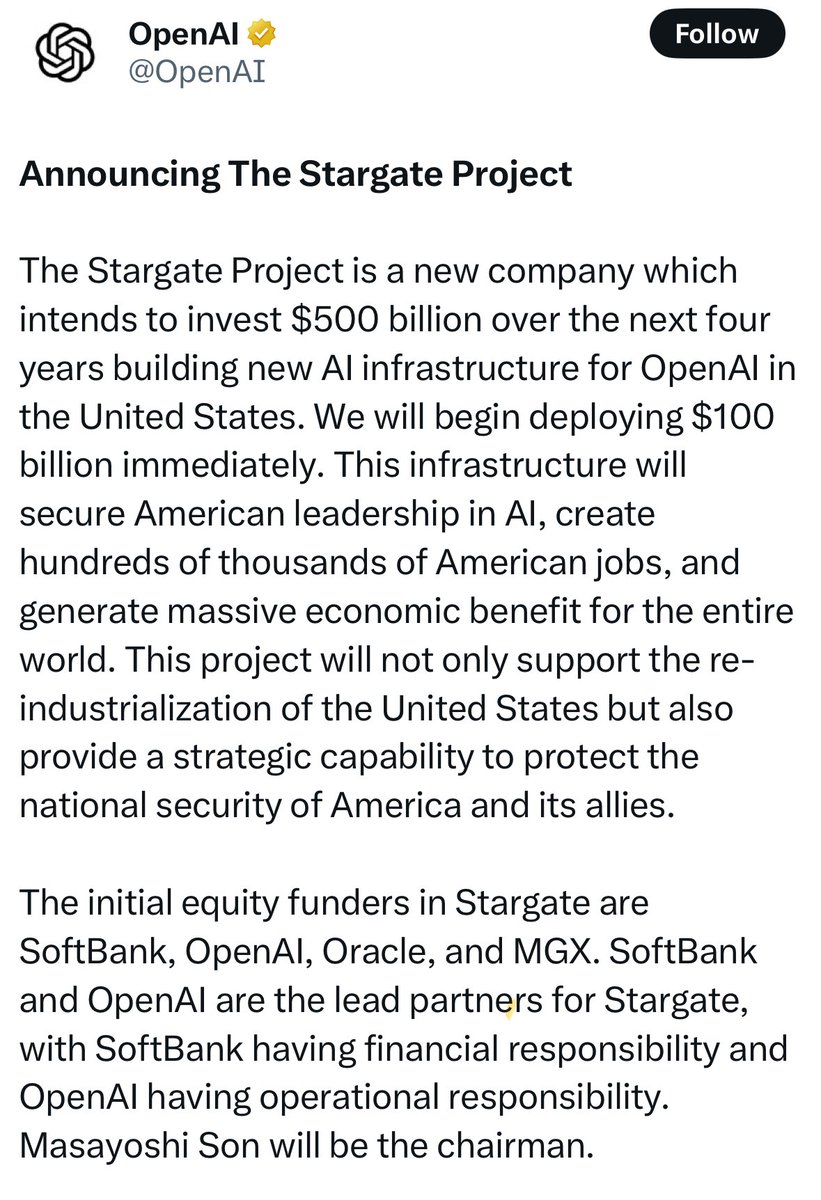

Everything seems to have an extra zero in front of it these days. Signs of a bubble, or maybe i need to accumulate 10-20years of inflation in my head?

Warren Buffett on inflation proof businesses

Munger epitomized 3 traits– rationality, judgment, bluntness. He saw the world as it actually was. He saw through the world, to distil its essence. He said it as he saw it. He didn’t merely teach us how to invest, he showed us how to think. My eulogy ... buggyhuman.substack.com/p/charlie-mung…

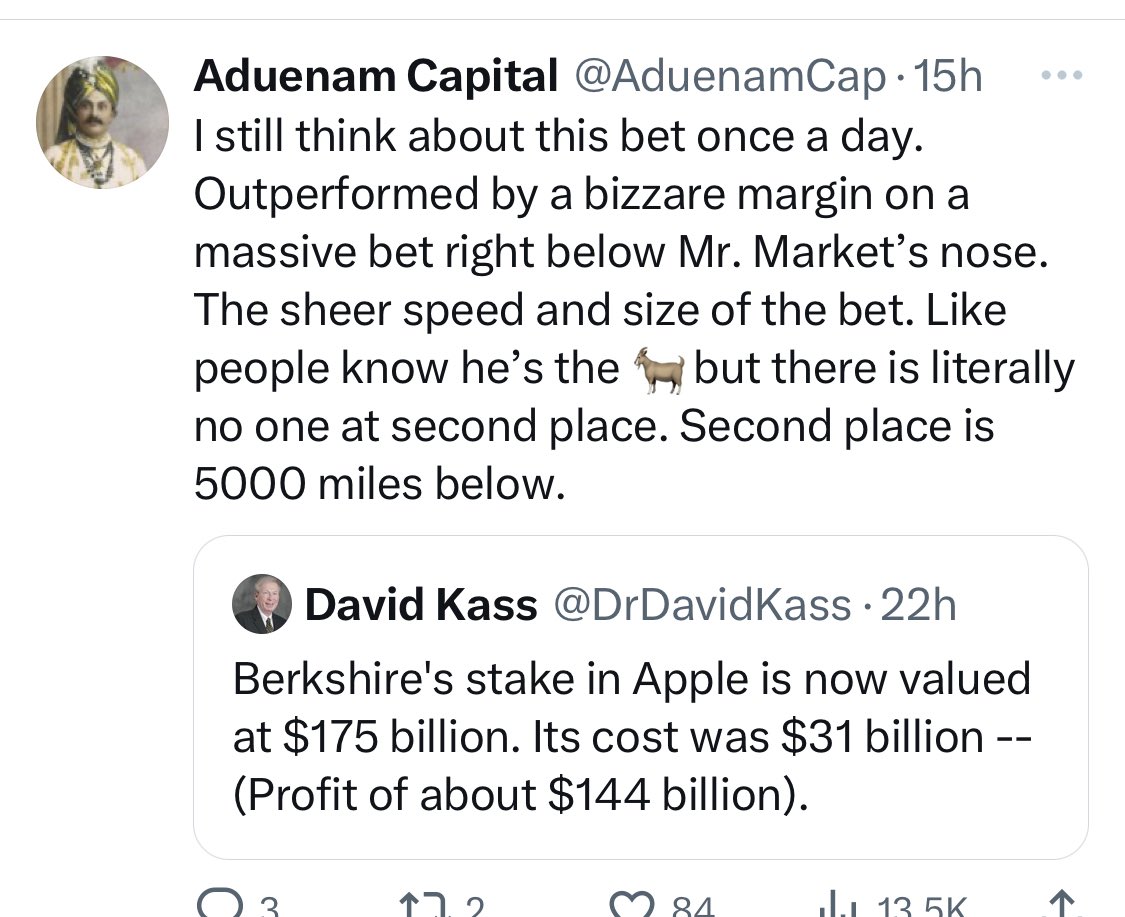

A timeless reminder from Warren Buffett: "The behavior of peer companies, whether they are expanding, acquiring, setting executive compensation or whatever, will be mindlessly imitated."

Reporting FCF and adj. Ebitda without factoring in stock based comp (that companies often buyback from the market in real cash) is trickery All tech companies figured out a way to constantly raise capital from employees; a ceo confident in the business’ future shouldn’t do this..

Hope zuck is also accounting for the fact that threads may be taking engagement away from instagram, vs twitter

Many investors dont want to bet on the multiple and just on earnings growth, but being wrong on the multiple is just being wrong on the projection of LT cash flow, as the fundamental value equation doesnt talk about a multiple which is just a short hand

"I am inclined to agree with Francis Galton in believing that education and environment produce only a small effect on the mind of any one, and that most of our qualities are innate." — Darwin

Warren Buffett: “When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).”

I can see very limited future worlds where at least 95% of the crypto ecosystem doesn’t go to zero. (This had to be the final outcome; ftx is not the culprit just the chosen path)

Given good businesses get stronger in a recession (market share gain), we will finally get to apply this ‘good business’ filter after 13-14yrs

I have always instinctively been against the use of the LTV / CAC formula - for me it was qualitative reasons that drive customer acquisition resulting in the math and not the other way round. Came across a 2012 post from @bgurley who puts it beautifully abovethecrowd.com/2012/09/04/the…

Slide decks hide can shallow thinking. Narratively structured memos are harder to write because they require better thinking. It’s worth it.

I see a lot of organizations relying too much on slide decks relative to actual written memos for their internal communications. Presentations are great but prose has a unique value in clarifying thought and creating an unambiguous record.

United States 趨勢

- 1. Spotify 1.26M posts

- 2. #WhyIChime N/A

- 3. Chris Paul 39.7K posts

- 4. Clippers 54.5K posts

- 5. Ty Lue 5,075 posts

- 6. Hartline 13.7K posts

- 7. Giannis 25.7K posts

- 8. Apple Music 233K posts

- 9. Henry Cuellar 10.8K posts

- 10. SNAP 176K posts

- 11. ethan hawke 6,572 posts

- 12. #HappyBirthdayJin 118K posts

- 13. David Corenswet 10.5K posts

- 14. Lawrence Frank 3,891 posts

- 15. Jonathan Bailey 11.5K posts

- 16. Chris Henry Jr 3,014 posts

- 17. Jack Smith 22.4K posts

- 18. Courtois 6,854 posts

- 19. Duncan 8,132 posts

- 20. Garcelle N/A

Something went wrong.

Something went wrong.