RCM Alternatives

@rcmAlts

Get additional details on RCM here: http://linktr.ee/RCMALTS

You might like

How are leading managers blending alpha + beta to make hedge fund-style strategies more accessible and effective for RIAs? Join @CMEGroup, @InvestReSolve, Welton, and @EquityArmor for a live panel unpacking innovative approaches to portfolio design, client alignment, and…

New pod 🎙️ with @BrianStutland Brian Stutland shares insights on volatility markets, portfolio construction, and what the '90s tech cycle might tell us about today's AI buildout Listen: rcmalternatives.com/2025/11/volati… #derivatives #volatility

The ’96 Bulls weren’t just champions, they were a blueprint for portfolio design. Great teams, and great portfolios, win through balance, complementary roles, and smart strategy. 🔗rcmalternatives.com/2025/11/the-96… #financeevents #networking #lunchandlearn #portfoliodesign

October kicked off Q4 with renewed market momentum. Our latest Asset Class Scoreboard explores where investors are finding opportunity and how market dynamics are evolving into year‑end. Read the full insights: ➡️ hubs.ly/Q03RHKFL0 #Markets #Investing #AssetManagement…

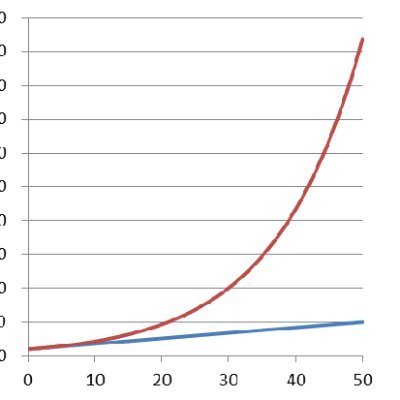

Patience over perfection. In the latest Derivative podcast, Eric Leake shares insights on how staying disciplined and looking beyond market noise allow trends to unfold and compound over time. Listen/Watch: rcmalternatives.com/2025/10/engine… #TrendFollowing #InvestmentStrategies…

From music to markets, it’s all about patterns. Hear Eric Leake of Altus Private Capital on The Derivative discuss data, discipline, and what really drives investor behavior. 🎧 rcmalternatives.com/2025/10/engine… #TheDerivative #BehavioralFinance

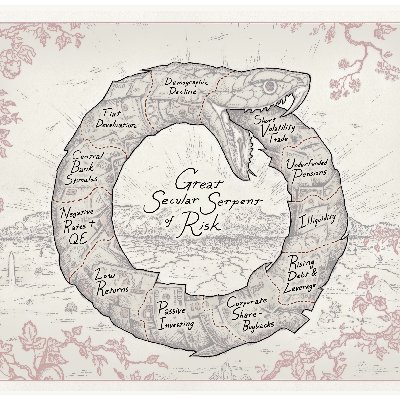

While global macro and managed futures managers trade similar markets, macro is best thought of as a more strategy diversified approach.

T-2 days! Last chance to save your seat ➡️ info.rcmalternatives.com/nashville-oct-… #nashvilleevents

Looking forward to digging into the @returnstacked approach to incorporating diversifying value adding startgies WITHOUT reducing exposures to the stocks or bonds you're investors know, love and trust!

Well thought out. Well researched. Well run. Well earned. Congrats on $1B. 🎉

$0 to $1 billion in 987 days. Thanks for all the support along the way.

A stacked lineup. Even better conversations. 🎧 Overheard at The Return Stacking Symposium: Our recap from one of the most insightful events in alternatives. Listen here: rcmalternatives.com/2025/10/overhe… @jasoncbuck @AttainCap2 @MikePhilbrick99 @RodGordilloP @choffstein @dillonjpierce16…

Spots are filling up! Register today: info.rcmalternatives.com/nashville-oct-…

How are leading managers blending alpha + beta to make hedge fund-style strategies more accessible and effective for RIAs? Join @CMEGroup, @InvestReSolve, Welton, and @EquityArmor for a live panel unpacking innovative approaches to portfolio design, client alignment, and…

In this episode of The Derivative, Brad Giaimo talks about the power of simplicity in strategies and why transparency beats the black box every time. 🎧 Listen here: rcmalternatives.com/2025/10/beyond… #Investing #Finance #Transparency #Strategies #Advisors

September kept the rally alive, with Managed Futures leading the charge and most major asset classes closing the month in positive territory. Dive into the details and see how Q3 wrapped up in our latest Asset Class Scoreboard: September 2025. 👉 Read the full recap:…

New pod: From the trading pits to quant. Q3’s Brad Giaimo & Bruce Greig share PTJ-inspired risk discipline, why transparent rules-based models build client trust, how mean reversion complements trend/momentum, and what it takes to scale from SMAs to 40 Act funds & ETFs—plus…

Stocks, bonds, ETFs… and a futures undercurrent powering modern portfolios. Here’s what we saw at Future Proof 2025: hubs.li/Q03LQ4rC0 💼 #WealthManagement #FutureProofFestival2025

Kevin Davitt of @Nasdaq on NDX vs SPX: 🔹 Larger notional size in NDX = fewer contracts for the same exposure 🔹 Premiums look more alike once adjusted for notional value Full episode: rcmalternatives.com/2025/09/nasdaq… #Options #Derivatives #Markets #RiskManagement

Nick Smith on exports, growth, & why the world looks to the #Nasdaq100 👉rcmalternatives.com/2025/09/nasdaq… #Markets #Investing #Options #GlobalEconomy

United States Trends

- 1. $PUFF N/A

- 2. #FanCashDropPromotion 1,159 posts

- 3. Good Friday 53.7K posts

- 4. #FridayVibes 4,242 posts

- 5. Talus Labs 25.3K posts

- 6. #PETITCOUSSIN 10.3K posts

- 7. Publix 1,644 posts

- 8. #FridayFeeling 2,622 posts

- 9. Happy Friyay 1,192 posts

- 10. #SomosPuebloImperturbable 1,427 posts

- 11. Elise 9,075 posts

- 12. RED Friday 3,836 posts

- 13. Finally Friday 4,158 posts

- 14. Tammy Faye 3,112 posts

- 15. Sydney Sweeney 108K posts

- 16. Kehlani 16.8K posts

- 17. John Wayne 1,593 posts

- 18. Blockchain 198K posts

- 19. Piggly Wiggly N/A

- 20. Out The Window 11.7K posts

You might like

-

Kris Sidial🇺🇸

Kris Sidial🇺🇸

@Ksidiii -

FuturesTrader71

FuturesTrader71

@FuturesTrader71 -

TopTradersLive.com

TopTradersLive.com

@TopTradersLive -

Jay Soloff

Jay Soloff

@jsoloff -

Benn Eifert 🥷🏴☠️

Benn Eifert 🥷🏴☠️

@bennpeifert -

Trading Volatility

Trading Volatility

@TradeVolatility -

Jason C. Buck 🪳🏴☠️

Jason C. Buck 🪳🏴☠️

@jasoncbuck -

Cem Karsan 🥐

@jam_croissant -

Hari P. Krishnan

Hari P. Krishnan

@HariPKrishnan2 -

Double Chin Capital

Double Chin Capital

@OffTheRunTrades -

Erik Townsend 🛢️

Erik Townsend 🛢️

@ErikSTownsend -

Quantifiable Edges

Quantifiable Edges

@QuantifiablEdgs -

ConvexityMaven

ConvexityMaven

@ConvexityMaven -

Kris

Kris

@KrisAbdelmessih -

Jeff Malec

Jeff Malec

@AttainCap2

Something went wrong.

Something went wrong.