The Safe Leaps

@safeleaps

Pre-earnings analysis | Capital rotation Options with discipline -Weekly newsletter ↓ No financial advise

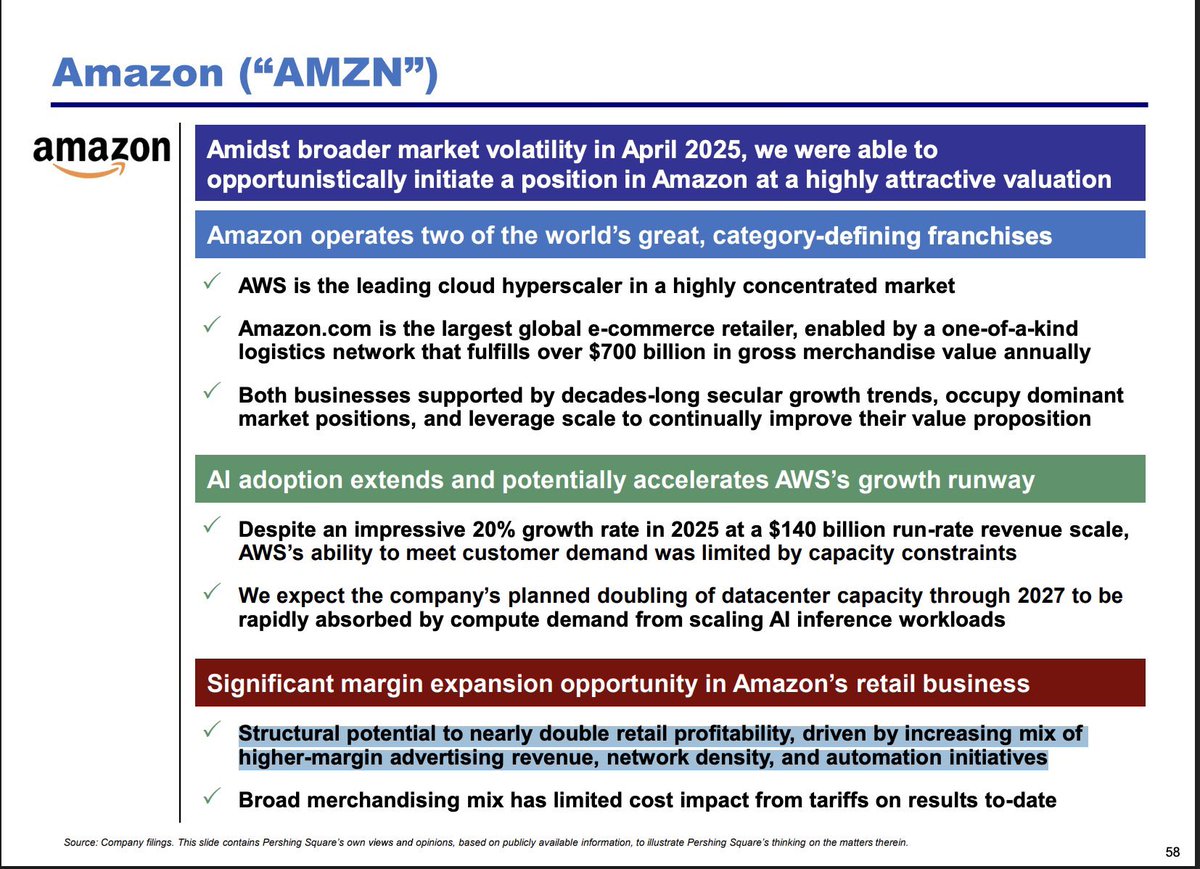

$AMZN Exclusive Analysis: What the Pro data is telling us. 🏛️📊 The price is coiled in a consolidation rectangle ($215 - $259). ADX is at historical lows, meaning the market is literally holding its breath before Earnings. The Indicators (InvestingPro Data): 🛡️ Support: Solid…

Long term holdings portfolio + 10 years: 1 $AMZN – Core AI + cloud infrastructure winner. AWS, logistics scale and operating leverage still underappreciated. Long-term cash flow machine. 2 $ONDS – Autonomous defense is no longer optional. Mission-critical tech, real-world…

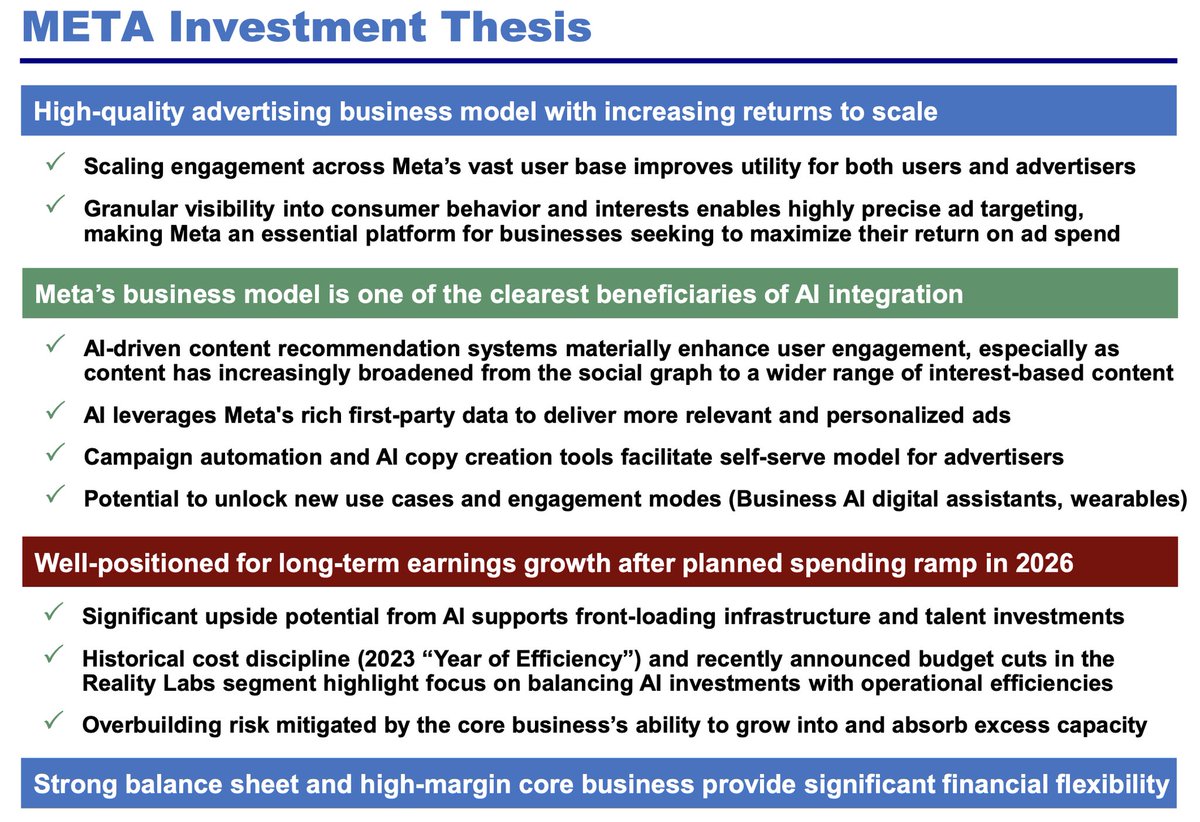

$META

Bill Ackman just revealed a position in $META. Not because it’s “cheap.” Because the business is compounding. Meta isn’t just a social media company anymore: • 3B+ users = unmatched ad scale • AI is lifting engagement and ad ROI • First-party data = pricing power • Cost…

Save for later

I DON’T UNDERSTAND WHY PEOPLE DON’T USE GROK FOR STOCKS. Most traders are looking at charts from 6 months ago. Grok analyzes real-time sentiment on X to predict future. Here are 20 prompts to find the next 10x stock:

Long term holdings portfolio + 10 years: 1.$AMZN – Core AI + cloud infrastructure winner. AWS, logistics scale and operating leverage still underappreciated. Long-term cash flow machine. 2.$ONDS – Autonomous defense is no longer optional. Mission-critical tech, real-world…

Thinking out loud ahead of $ONDS I’m considering buying calls on $ONDS. High short interest + improving fundamentals + rising defense spending = asymmetric setup. If momentum kicks in, this could turn into a short squeeze scenario. Risk defined. Upside convex. Position sizing…

$NBIS buying Tavily is a bet on agentic AI infrastructure. Real-time search is a bottleneck for autonomous agents. Solve that, and you’re not just a cloud provider anymore.

Building my trading account publicly starting this week Positions: • $AMZN long @ $210 (AWS re-acceleration thesis) • $NVDL cash-secured PUT $85 (wheel strategy) Weekly updates: Full transparency

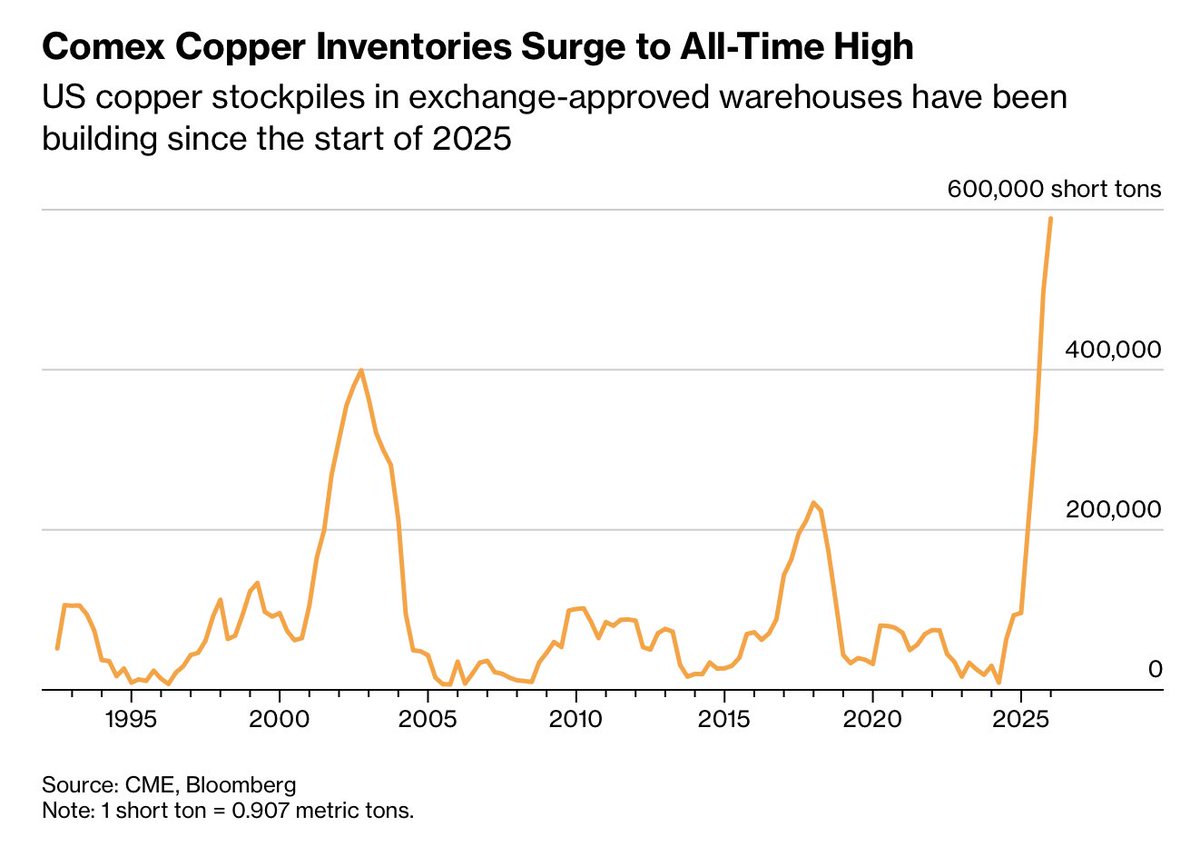

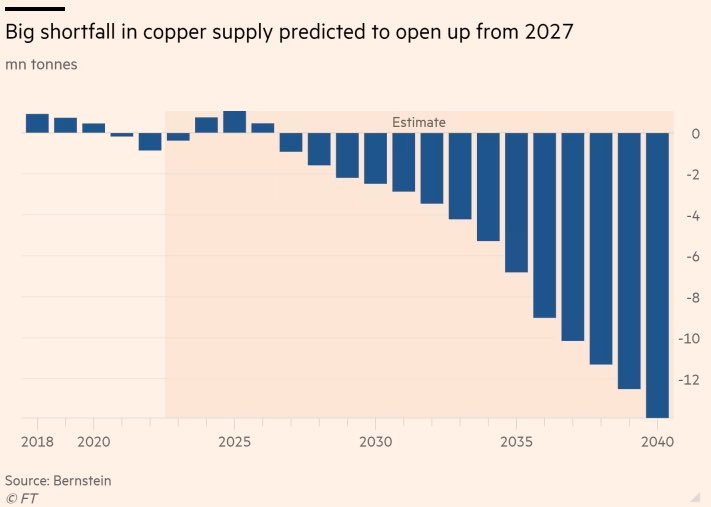

U.S. has built its largest copper inventory in decades. Copper shortfall is projected to start in 2027 and reach nearly 15 million tonnes in 2040. U.S. is preparing for the shortage as data centers and energy transition require massive amounts of copper.

$UBER: The next trillion-dollar giant? It’s just a matter of time. 🏛️🚗 Uber isn't just a ride-hailing app; it’s the global operating system for local commerce. Daily fluctuacions doesn’t matter #OptionsTrading

•AWS Revenue -- $35.6 billion, up 24% year over year; highest growth rate in thirteen quarters. •AWS Annualized Run Rate -- $142 billion; AWS added $2.6 billion sequentially and nearly $7b Yoy •AWS Backlog -- $244 billion, up 40% YOY and 22% sequentially.

AMAZON EARNINGS — $AMZN - TAKEAWAYS: •Revenue -- $213.4 billion, representing a +12 % yoy •Operating Income -- $25 billion, includes $2.4 billion in special charges for tax disputes, severance costs, and asset impairments. •Free Cash Flow (TTM)-- $11.2 billion, directly…

United States Trends

- 1. Pam Bondi N/A

- 2. Dawson N/A

- 3. James Van Der Beek N/A

- 4. Massie N/A

- 5. Bates N/A

- 6. Sochan N/A

- 7. Varsity Blues N/A

- 8. The Dow N/A

- 9. Culver City N/A

- 10. SAVE America Act N/A

- 11. Attorney General N/A

- 12. Diablo 2 N/A

- 13. #Unrivaled N/A

- 14. Aurora N/A

- 15. Sonia N/A

- 16. Piper N/A

- 17. Stewie N/A

- 18. Merrick Garland N/A

- 19. Kelsey Mitchell N/A

- 20. Real ID N/A

Something went wrong.

Something went wrong.