LongGameEquity

@LongGameEquity

Long-term investor focused on compounding wealth through disruptive tech. 🚀 5-10 year time horizon. AI • SaaS • Software. Patiently building.

RATE MY 2026 PORTFOLIO (1-10) 🏛️📊 The strategy is locked in. Be brutal. $AMD $META $SOFI $CAKE $ADBE $BTC $AMZN $ZETA $ELF $CEG $FUBO If you had to sell one of these tomorrow and rotate into a different sector for the rest of the year, what is the move? Rate the setup 1-10…

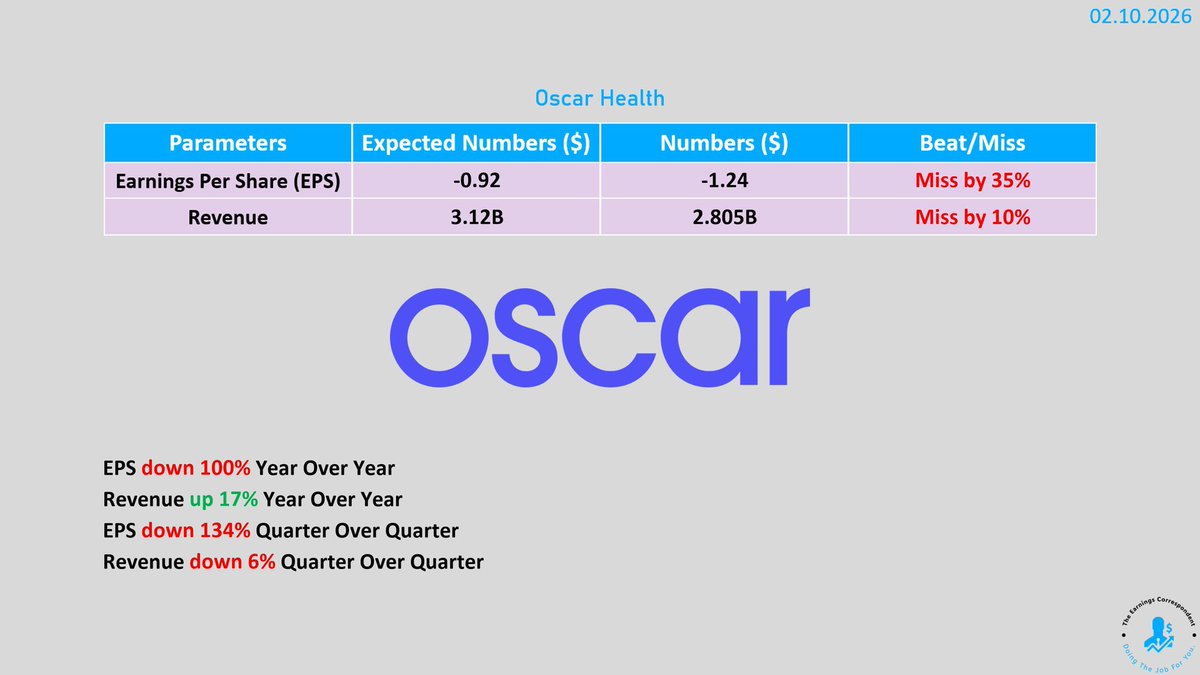

$OSCR rises 6% today on strong on strong revenue guidance and record membership growth despite Q4 earnings Miss 🤔

ALPHABET'S $GOOG $GOOGL SECURES UNCONDITIONAL EU ANTITRUST APPROVAL FOR $32 BLN ACQUISITION OF WIZ 💪 📈

$SPOT Q4 Earnings 🏛️🚨 ✅ EPS: €4.43 (Huge beat vs. €2.85 expected) ✅ MAUs: 751M (Beat vs. 745M expected) ✅ Revenue: €4.53B (Beat vs. €4.52B expected) ✅ Gross Margin: 33.1% (Record high) Why they won: Pricing power held up despite hikes, and cost discipline finally…

Pretty solid deep dive on $ZETA Only thing i would add it their acquisitions that they fully integrate in under a year like Marigold.

$ZETA is a data-driven marketing technology company that uses AI to help large brands acquire, grow, and retain customers. Founded in 2007 by David A. Steinberg and former Apple CEO John Sculley, it has evolved from an email-centric marketing firm into a comprehensive, AI-powered…

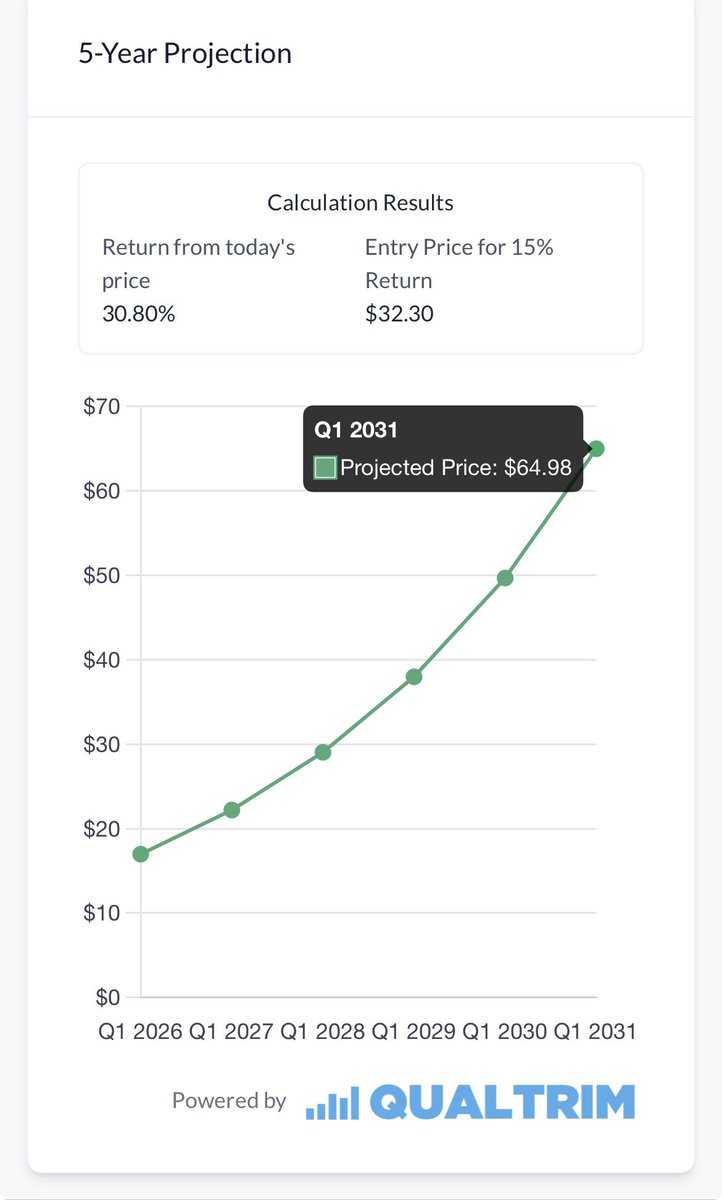

30% FCF growth is a beast, but for $ZETA, I honestly think that’s the floor. 🏛️📈 Modeling this out to 2031 gives me a $64.98 target—and that feels conservative. While most people are losing sleep over a 2% red day, I’m just looking at the cash flow machine. The 5-Year Outlook:…

$CRM Is starting to look extremely attractive below $200. I might start a position tomorrow 👀

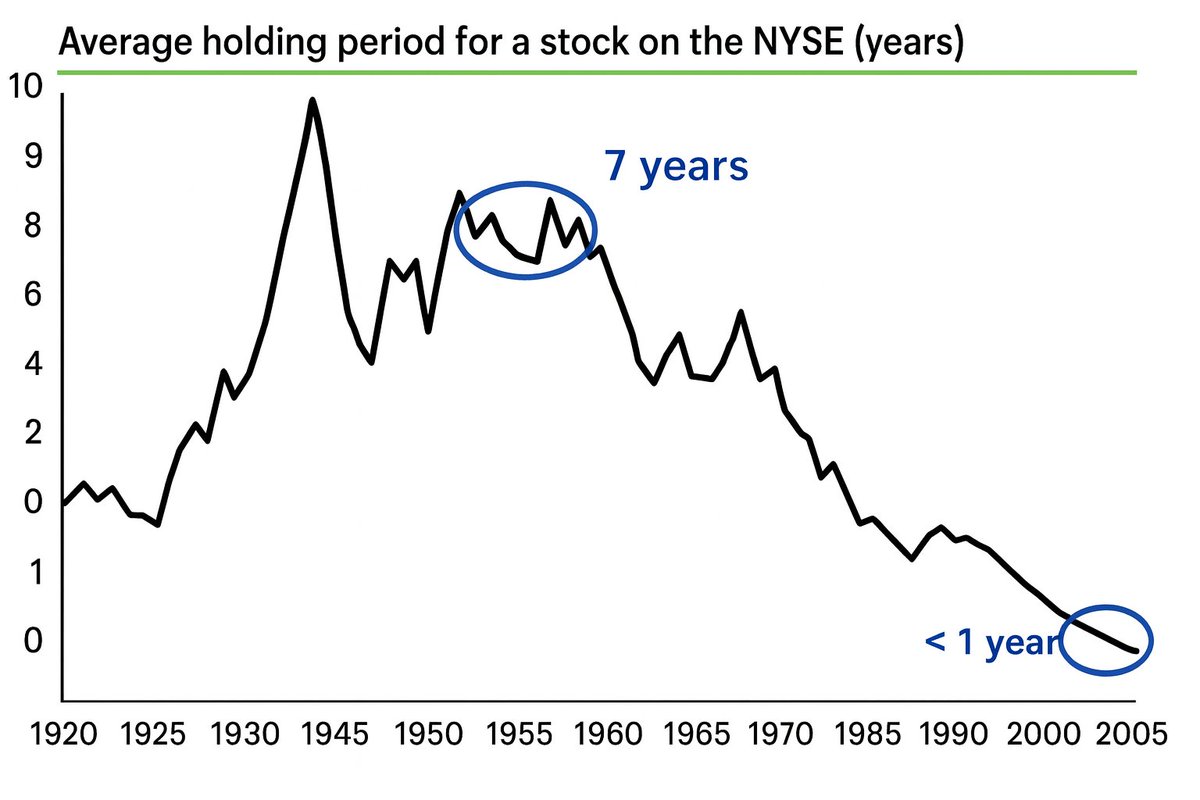

Most modern day investors are gamblers. Only hold a stock for 6 months is not investing 😂😂 $SPY $QQQ

Recent NYSE data shows the average US stock is now held for about 6 months, down from over 8 years in the 1970s. That isn’t investing, it’s churn. Zero-commission apps make rapid bets easy, but brokers profit from your activity, not your long-term returns.

Big earnings week on deck. 🏛️🚨 Watching these closely this week: $SHOP $DDOG $NET $COIN $ANET $HOOD $NBIS $AMKR

$AMD looking like a potential multi-bagger fire 🔥

$AMD stock projections from a 1000xStocks member: 40% revenue growth 50–150% net income growth P/E: 40–50 Price targets: Low: $263 → $888 (2026–2029) High: $329 → $1,110 (2026–2029) Are you bullish on AMD long-term?

$AMKR Q4 Earnings: Significant beat on the bottom line. 🏛️🚨 ✅ Net Sales: $1.89 Billion (+16% YoY) ✅ GAAP EPS: $0.69 (Massive beat vs. $0.44 est.) ✅ Q1 Revenue Guidance: $1.60B – $1.70B ✅ Full Year 2026 Capex: $2.5B – $3.0B Advanced Packaging and Computing are the clear…

$META is doubling down on the "Clone and Conquer" strategy with Peek. 🧪 Just like Stories and Reels before it, $META is targeting $SNAP ‘s core territory with raw, disappearing photos. Another growth vertical or just a classic defensive move? Either way, the $META ecosystem is…

$PGY is down 22% today. 📉 Value trap or generational entry? The Business: $PGY is an AI matchmaker. They plug into banks, use AI to approve "rejected" loans, and sell them to Wall Street. They take a fee and pass the risk. The Bull Case 🚀 ✅ Profitable: Just hit $81M GAAP…

Build a portfolio of stocks you have such deep conviction in that you can't wait to add on the dips. 🏛️📈 If a 15% drop makes you want to sell, the thesis wasn't there to begin with. Real wealth is built by having the stomach to stay the course when the market gets loud. My…

The $ELF commercial was actually a strategic win. Most people didn't find it funny, but that's irrelevant. It was highly memorable and perfectly tailored for its target demographic of teenage women. Whether a commercial is "cool" to the general public doesn't matter long-term.…

AI PORTFOLIO REVIEW: 8.5/10 🤖📊 Ran the 2026 strategy through Gemini's latest model for a high-conviction audit. The vision is solid, but the AI flagged some retail noise. THE VERDICT: 8.5/10 THE WINS: ✅ Deep vertical tech stack. Owning the compute $AMD and the platforms…

I’m considering launching a PUBLIC portfolio challenge: • Deposit: $200 per month • Fully transparent trades • Track performance vs SPY • Long-term focus With 10 years of investing experience, would this be a worthwhile project to share publicly? What would you want to see…

$ELF Q4 Earnings (CY 2025): 🚀 Revenue: $489.5M (+38% YoY) 💰 Adj. EPS: $1.24 (vs $0.72 est) 📈 Adj. EBITDA: $123M (+79% YoY) ⬆️ Raised FY26 Outlook: $1.61B Revenue Stock is down 8% today insane!

Sydney Sweeney ringing the opening bell today 🔔 Markets aren’t even open yet and I can already feel the pump coming 🚀📈 $SPY $QQQ about to act different.

Another ugly day in SaaS: $PGY -20% $MNDY -20% 😬 Earnings season claiming more victims

250 FOLLOWERS 🏛️📈 Honestly, I didn’t expect 250 people to care about my personal research and long-term views, but here we are. Time in the markets has taught me one thing: the system is designed to distract you. Most people burn energy chasing hype and daily candles, but the…

United States Trends

- 1. Noah Kahan N/A

- 2. Nancy Guthrie N/A

- 3. Nest N/A

- 4. Ticketmaster N/A

- 5. Baby Keem N/A

- 6. Mustache N/A

- 7. Justin Verlander N/A

- 8. Lutnick N/A

- 9. Todd Lyons N/A

- 10. Carl Eller N/A

- 11. Bob Brown N/A

- 12. Tangle and Whisper N/A

- 13. Brandon Ingram N/A

- 14. Susan Collins N/A

- 15. 1-800-CALL-FBI N/A

- 16. Swalwell N/A

- 17. Elsa N/A

- 18. #mcnuggetcaviar N/A

- 19. Anthony Bourdain N/A

- 20. Ashe N/A

Something went wrong.

Something went wrong.