내가 좋아할 만한 콘텐츠

Kuch Log "Bhed ki Khal mai, Bhosdiwale hote h.."

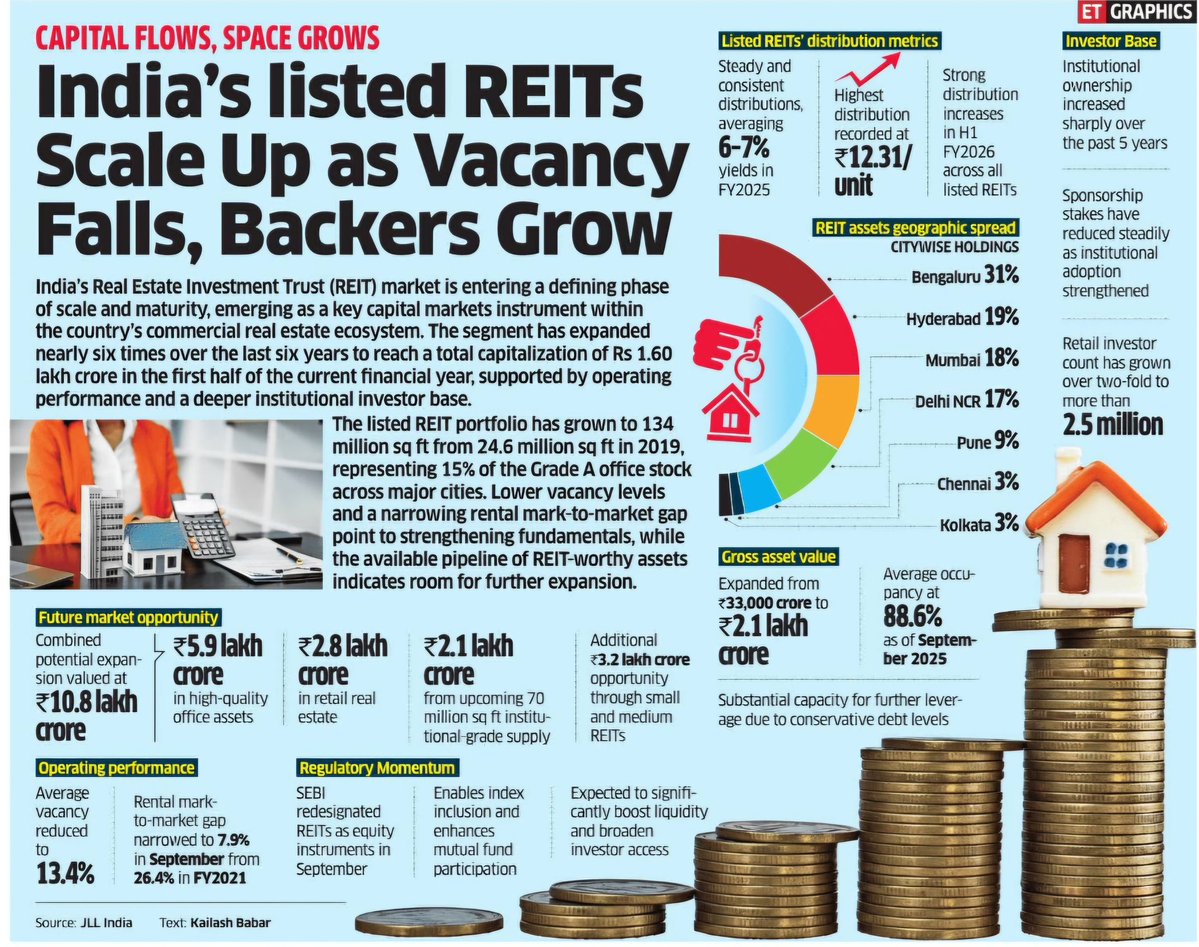

Indian REIT Market - Expanded 6x in 6 years 🔥 1. Market Overview • India’s REIT market has entered a scale + maturity phase • Total market cap reached ₹1.6 lakh crore in H1 FY25 - 6x growth in six years • Growth driven by strong operating performance and deepening…

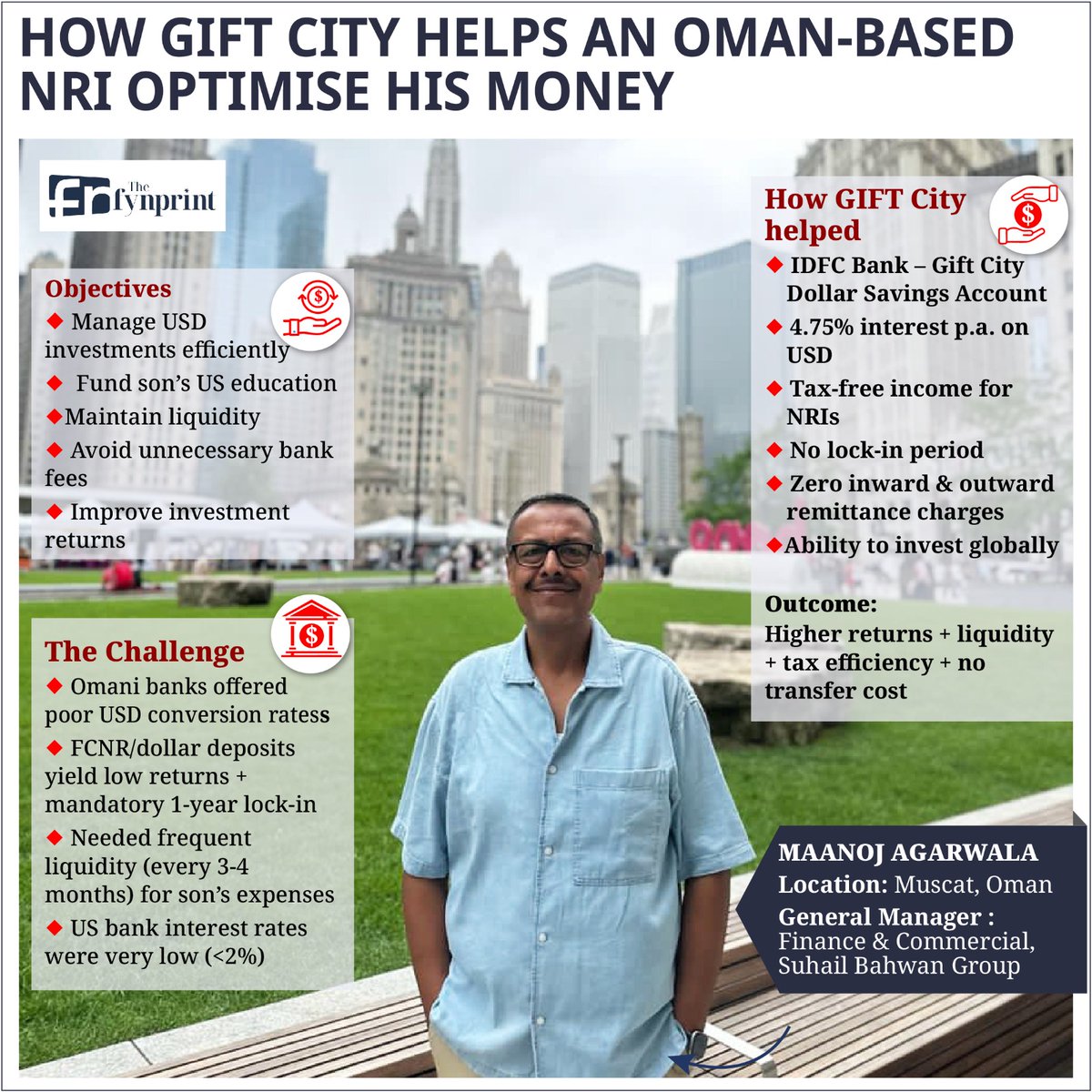

The GIFT City disruption has begun! NRIs can keep money in USD. No tax on it in India. 1) Better than FCNR. Get savings interest in GIFT or FD vs only FD in FCNR. 2) Video KYC for those with Aadhar 3) Get card against it & spend anywhere (See next) thefynprint.com/640dpJDI5

🚨Gift City-The path to international investments! As international investment resumes, Parag Parekh has just launched an S&P 500+Nasdaq 100 FoF Who can invest in these funds? What is the minimum investment size? A thread🧵on PPFAS gift city funds & should u invest thru it?👇

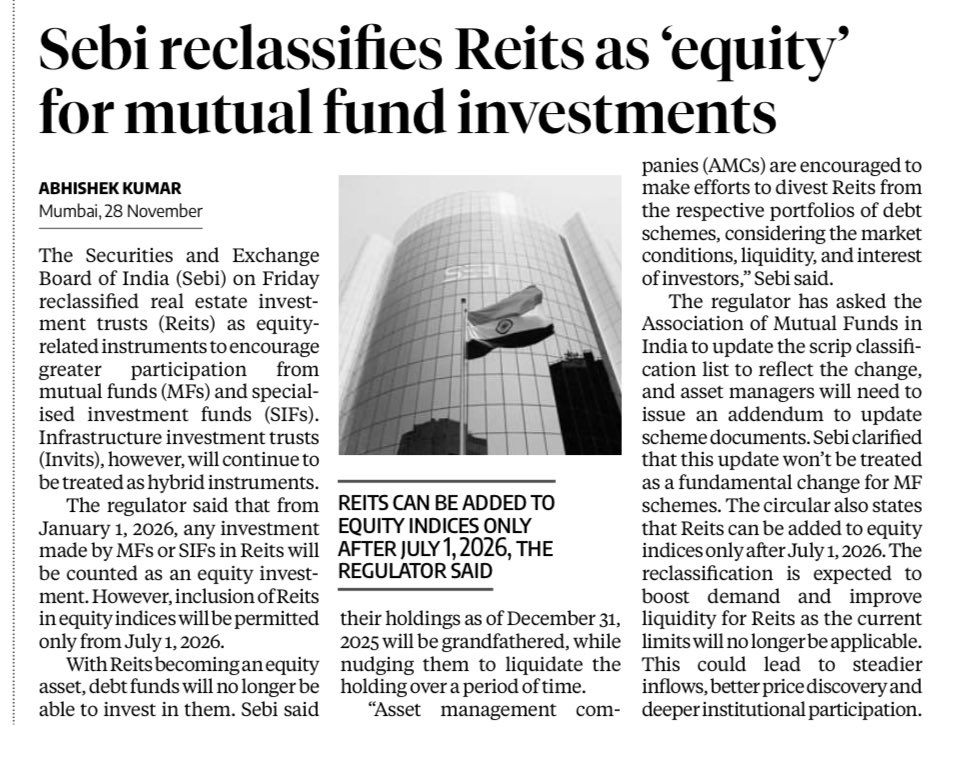

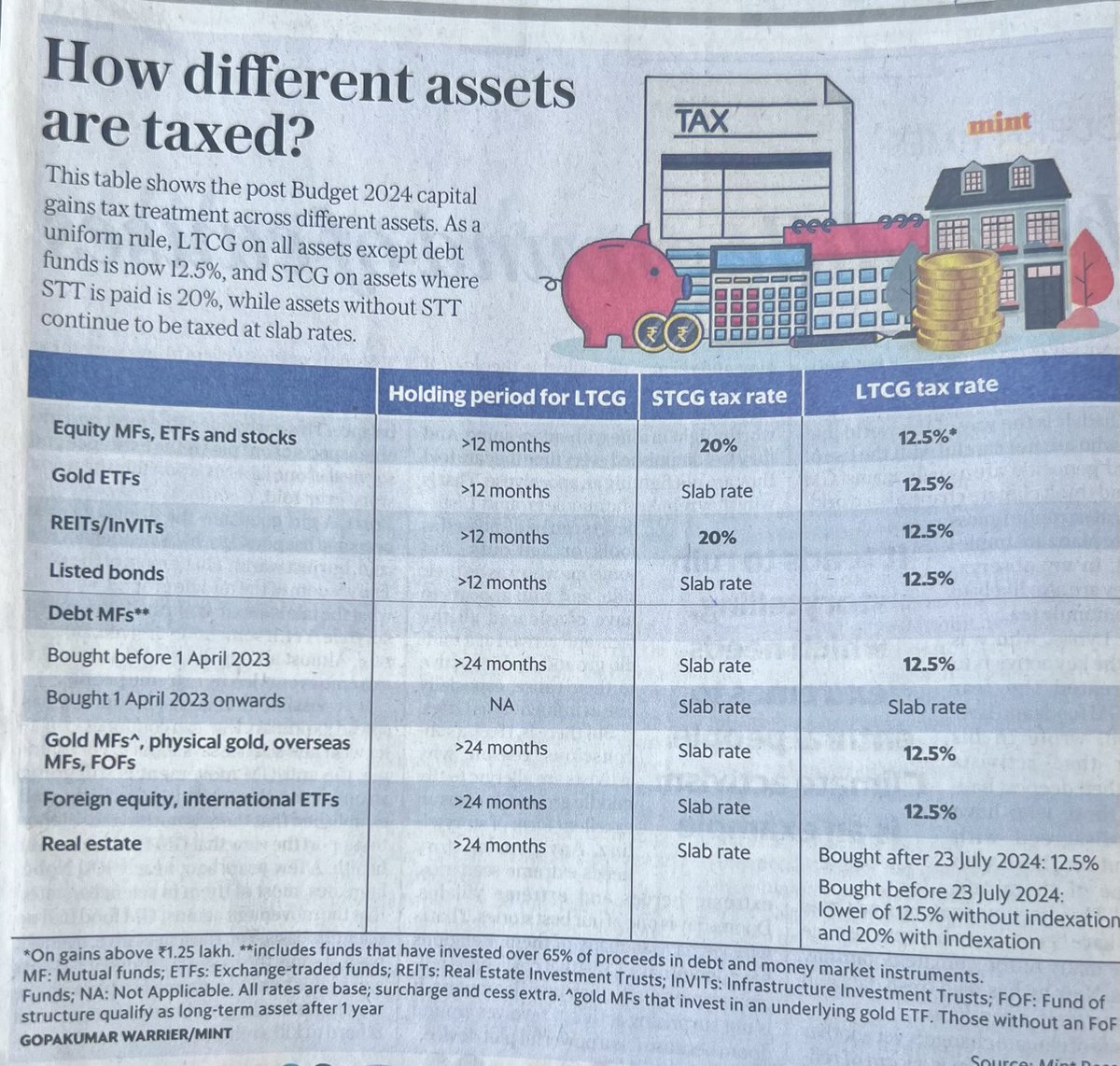

REITs investment by mutual funds will be considered "equity" from Jan 1, 2026. Equity indices can only add REITs from July 1.

@SEBI_India @amfiindia @FinMinIndia No wonder Debt Mutual Funds have de-grown over last many years as % of other tax friendly investments.

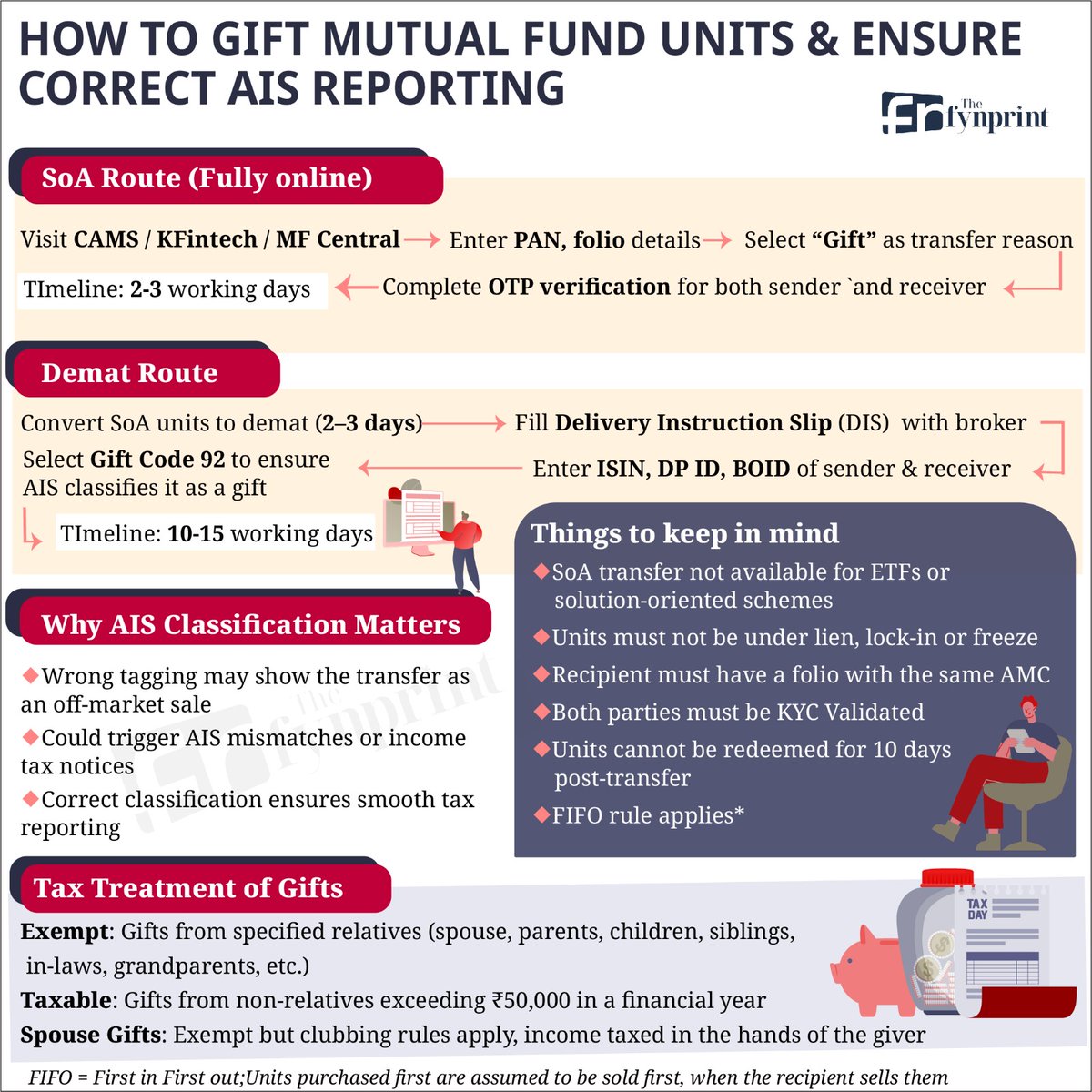

How to correctly gift mutual fund units by @PosteAnil thefynprint.com/iqjKEuNRe

By aug 1929, SPX/Gold ratio had reached 5 std dev for the series since apr 1884. Gold price was fixed then, that is why mkt crashed by 80%+

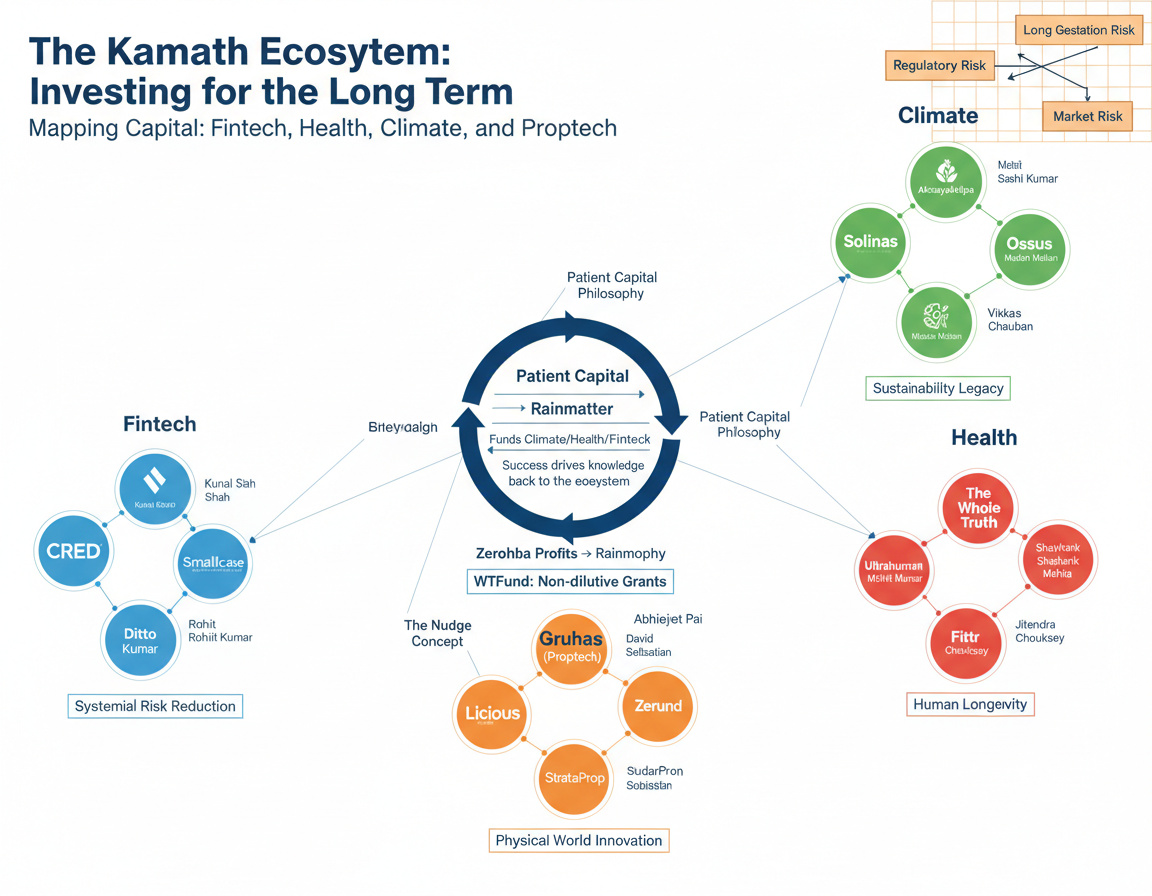

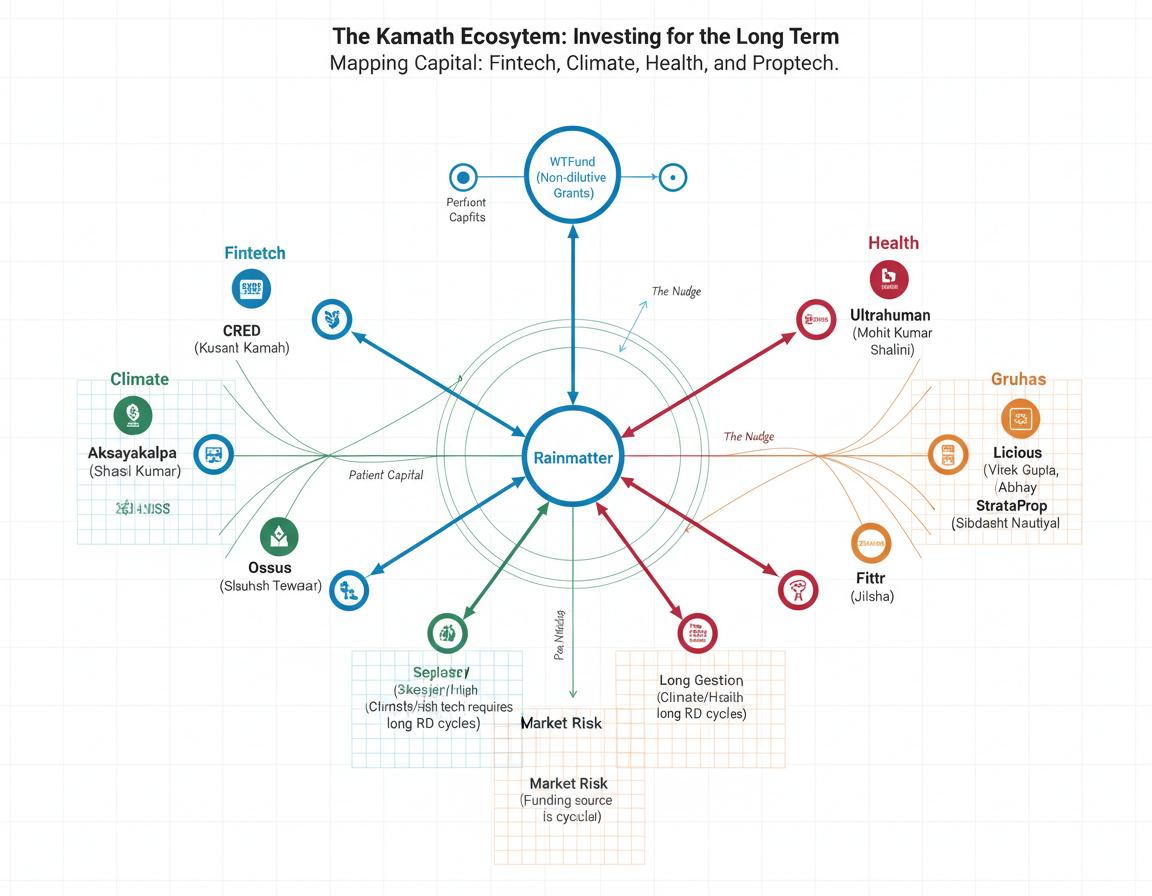

My friends work at Zerodha and its portfolio company. They often talk about its investments and more. Sometimes its difficult for me to keep up. So I asked nano banana to create a fly wheel for me. >While the visualization is pretty cool, the info is not that well represented.…

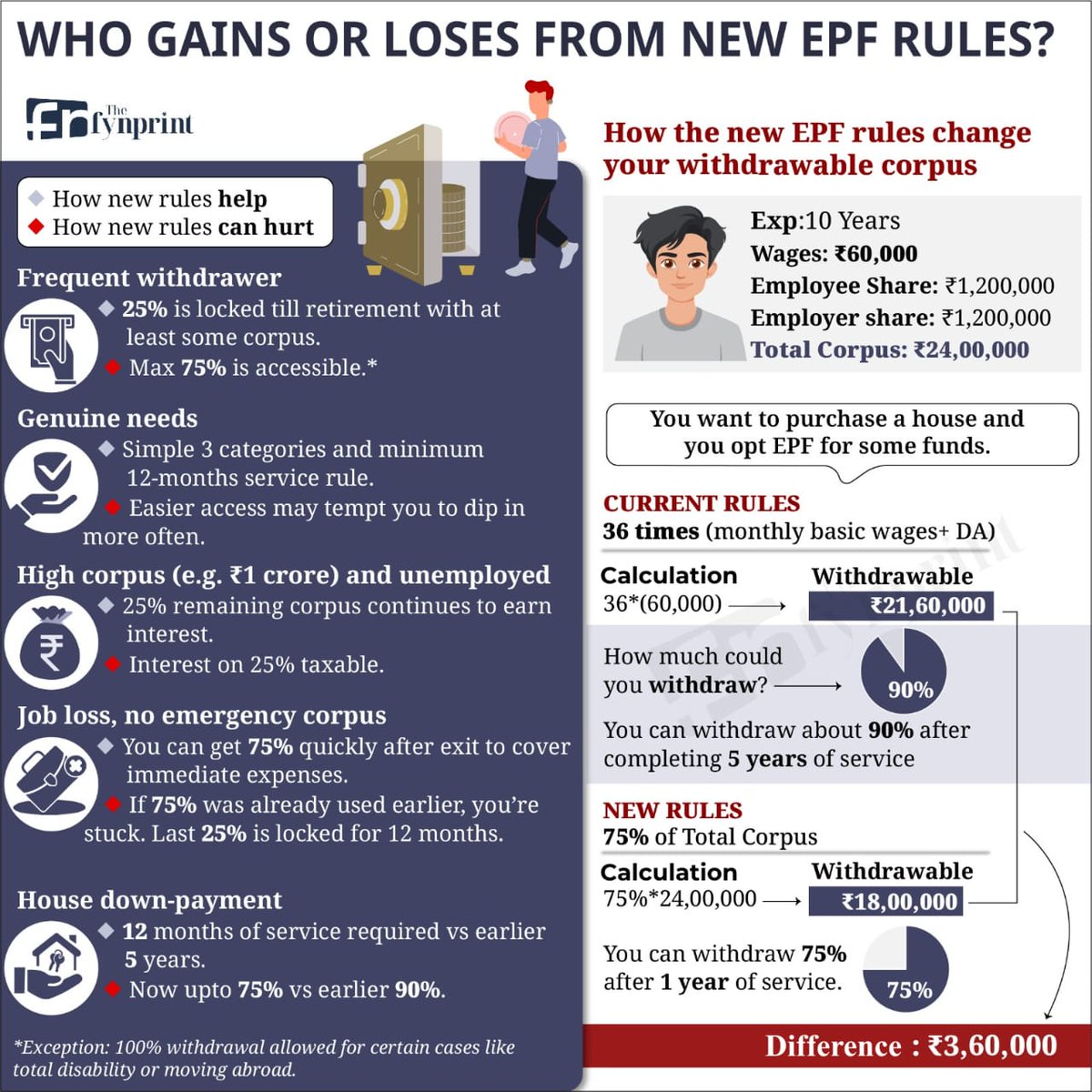

The biggest change in EPF withdrawals in a decade is here — and your retirement corpus may not be as flexible as you think. The new EPF rules quietly change the math for every saver. What used to be a 90% withdrawal window for housing and big-ticket needs is now capped at 75%.…

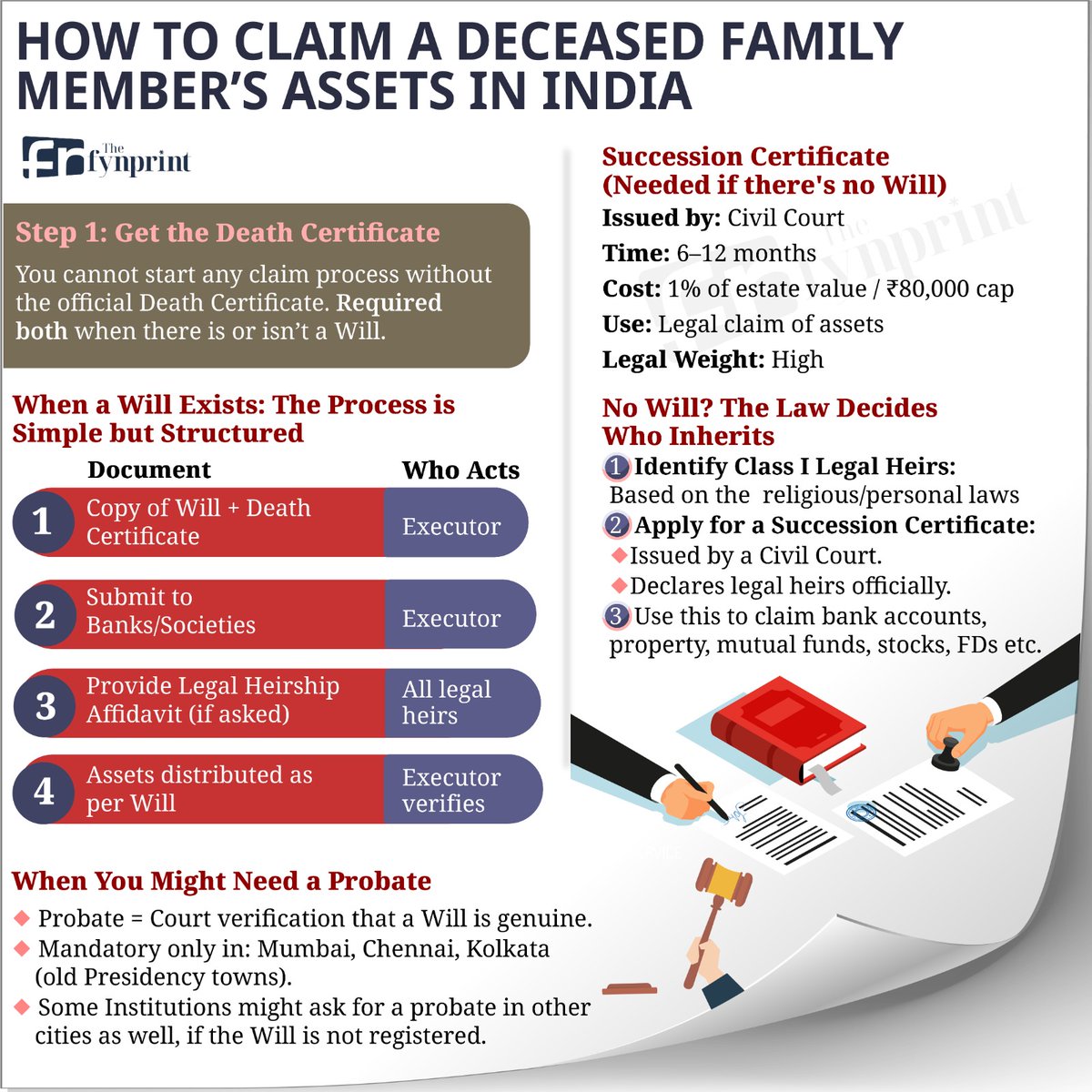

🏦 How to Claim a Deceased Family Member’s Assets in India Step 1: Get the official Death Certificate — mandatory for all claims. If a Will exists: Executor submits Will + Death Certificate. Executor approaches banks/societies. Legal heirs give a Legal Heirship Affidavit (if…

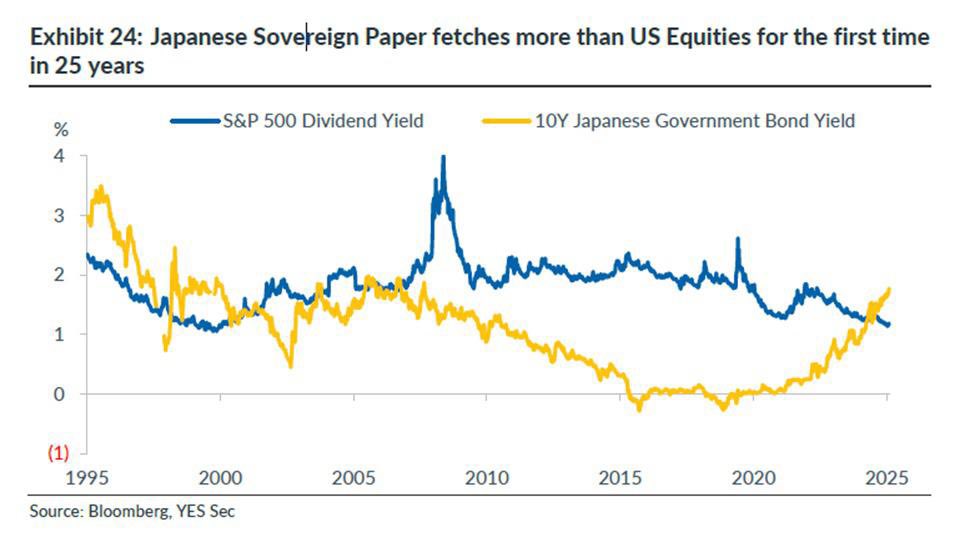

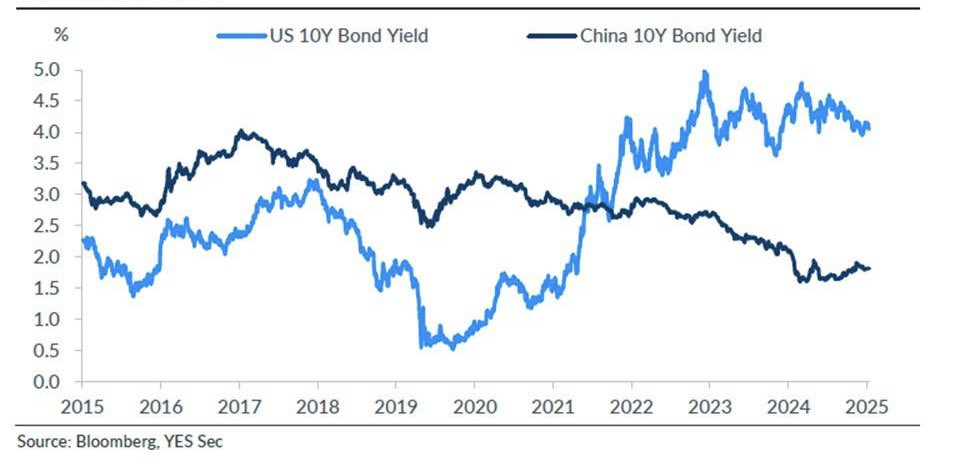

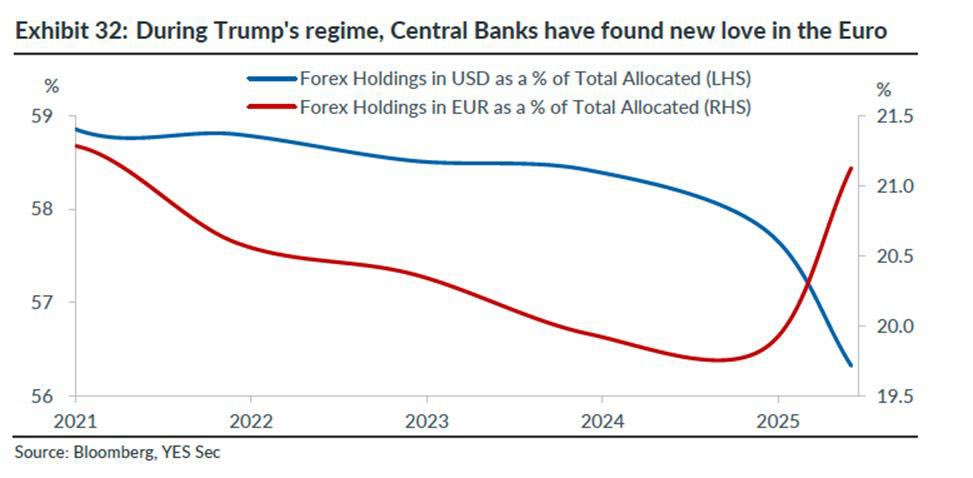

Massive changes are happening in global financial markets but we don’t realize it till it hits us in the face 1) Japanese bond yields are more than US equity dividend yields after 25 years 2) Chinese bond yields are below US yields for the past 3 years 3) Central banks are…

This could be the last leg of bull market which started from march 2020, I don't know whether it goes on for 6 mts or 4-5 yrs, but in any case it could be the most hated leg of the bull market, full of skepticism. *over valuation in absolute terms can persist for yrs, e.g - U.S.

Credit Card spends in Dussehra and Diwali month grew a healthy 20% YoY. Electronics, Autos, Grocery, Travel and Furnishings spends saw strong growth in Oct '25.

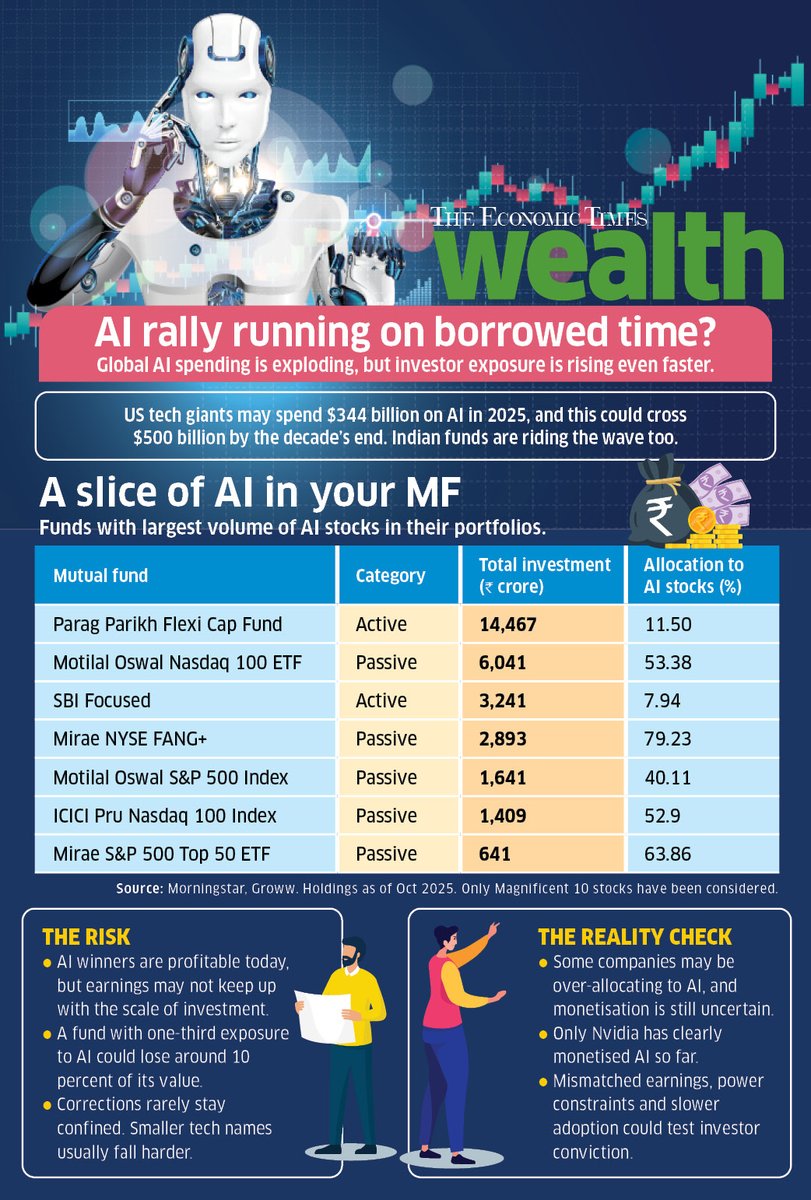

Is AI theme overvalued and overhyped? Global chip giant @nvidia reported that its revenues had soared 62% to $57 billion in the quarter ending October 2025, and projected sales would climb to $65 billion in the current quarter, topping estimates. Companies like Google, Oracle,…

The risk of dumb Mutual Funds Manager (who invest in loss making companies, just to get self benefits under the table) is way bigger now, then Equity Risk itself ..

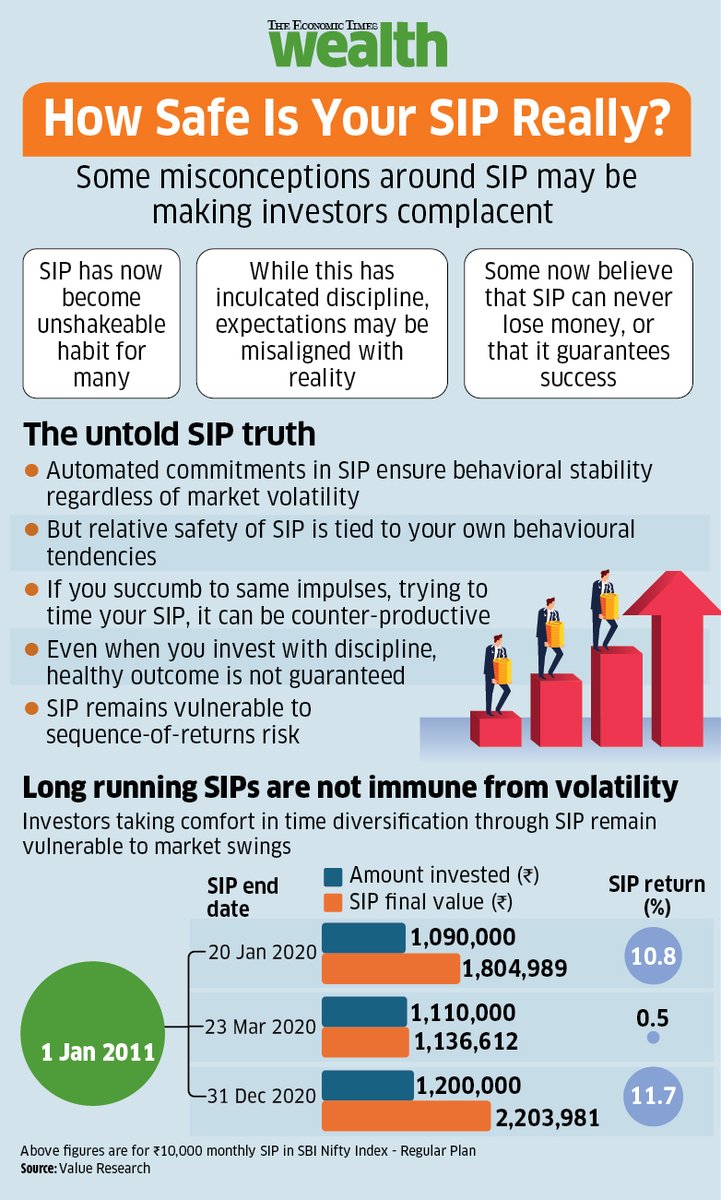

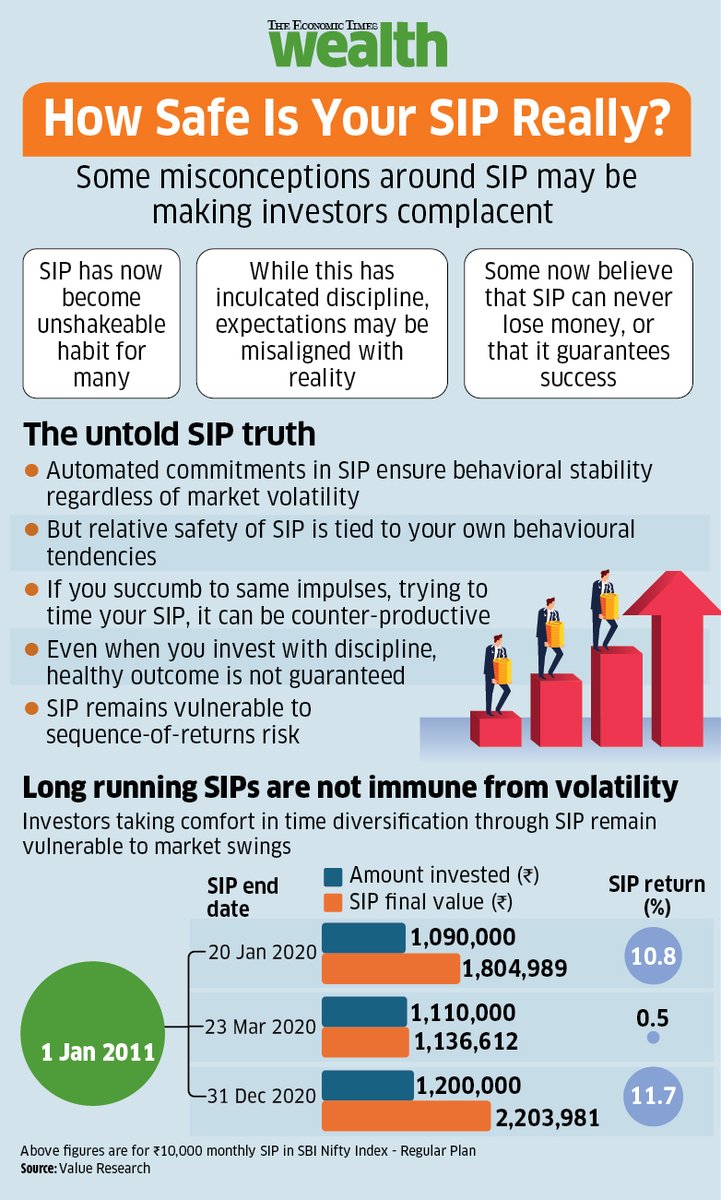

With SIP inflows nearing the historic Rs 30,000 crore a month mark, it’s time to reiterate: SIP is not a magic pill for wealth creation. The risk of the underlying asset class (mostly equities), is still there. In this week’s @ET_Wealth, @SanketD_ET takes a look at what can…

With SIP inflows nearing the historic Rs 30,000 crore a month mark, it’s time to reiterate: SIP is not a magic pill for wealth creation. The risk of the underlying asset class (mostly equities), is still there. In this week’s @ET_Wealth, @SanketD_ET takes a look at what can…

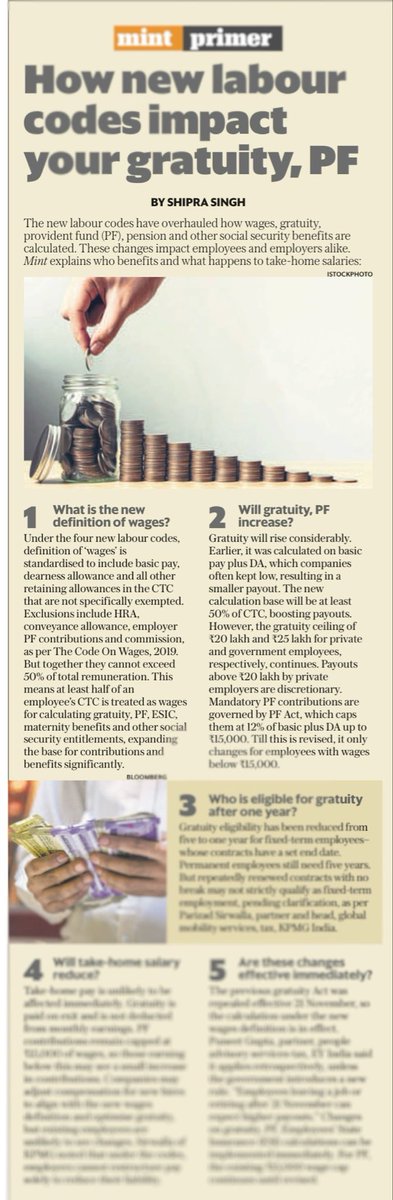

Now, under the new wage code, gratuity, PF, ESI and other benefits will be calculated on at least 50% of your CTC. - Higher gratuity for anyone leaving job or retiring after 21 Nov - Minimal change in PF contributions How will this affect your CTC and take-home? Read the full…

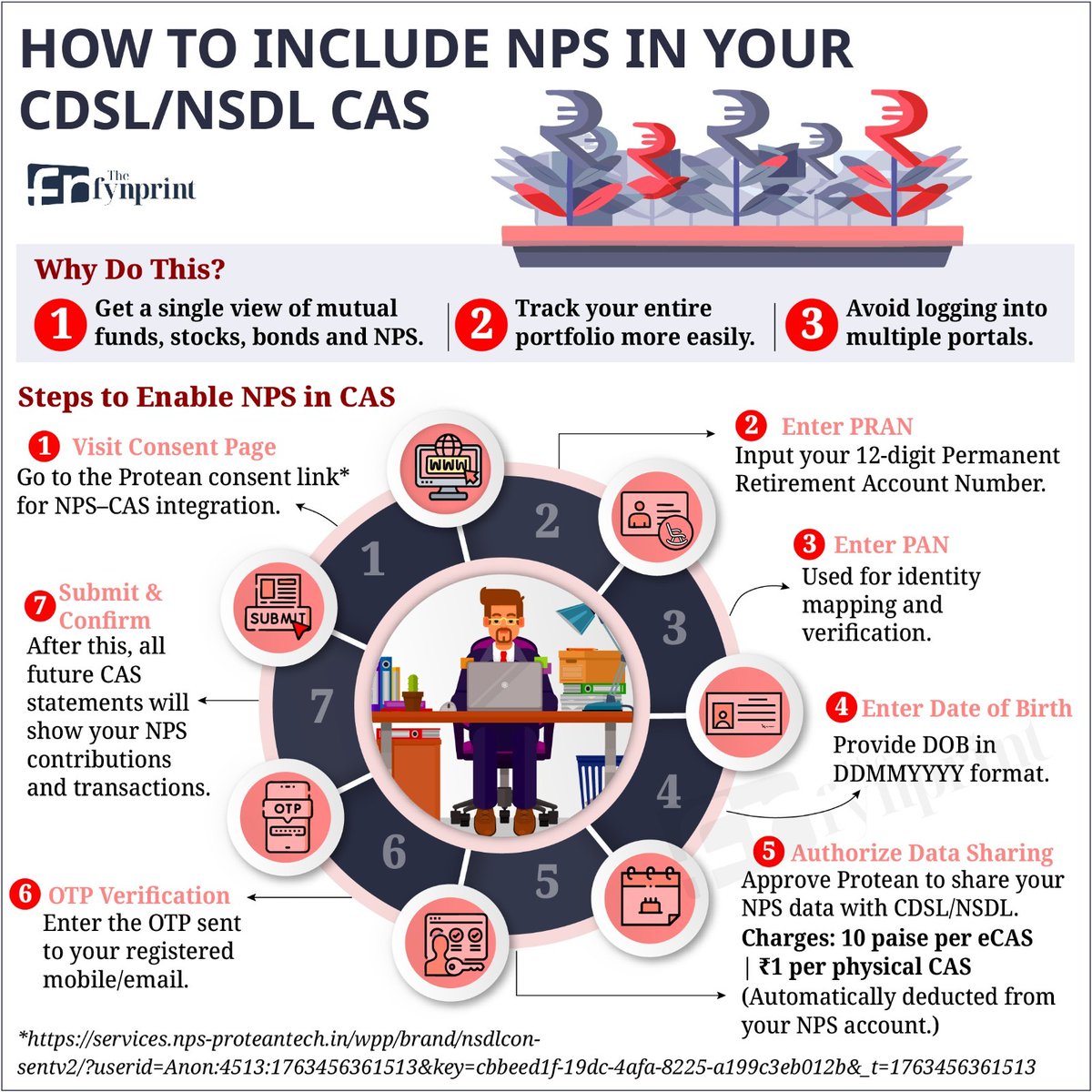

Your CAS statement gives you all your stocks and mutual funds. Today @PosteAnil tells you how to connect your NPS to it (Link: shorturl.at/utoXE). One-time online process. Bookmark and try it. For questions on personal finance, join our community docs.google.com/forms/d/e/1FAI…

Market has turned truly unpredictable. Today we are seeing a strange situation — Sensex is at record highs, but most investors’ portfolios are at their lowest. Even top-quality, blue-chip stocks have corrected in a way no one ever imagined. This time, both value investors and…

India’s liquidity squeeze is getting real. • FPIs have been selling for 11 straight weeks (₹1,700 Cr today). • Sensex -400 pts. • Rupee hits record 89.48/USD. • Investors hoarding cash as selling intensifies. IPOs draining liquidity: New-age listings—Lenskart,…

United States 트렌드

- 1. Broncos 46.7K posts

- 2. Mariota 13K posts

- 3. Ertz 3,098 posts

- 4. Commanders 33K posts

- 5. Bo Nix 9,997 posts

- 6. #RaiseHail 5,736 posts

- 7. Happy New Month 178K posts

- 8. Riley Moss 2,281 posts

- 9. #BaddiesUSA 25.7K posts

- 10. Treylon Burks 12.2K posts

- 11. Terry 20.2K posts

- 12. Bonitto 5,682 posts

- 13. Deebo 3,126 posts

- 14. Collinsworth 3,062 posts

- 15. #RHOP 12.4K posts

- 16. Dan Quinn N/A

- 17. Sean Payton 1,637 posts

- 18. Jake Moody N/A

- 19. Chrisean 9,673 posts

- 20. Dolly 14.5K posts

내가 좋아할 만한 콘텐츠

-

The Indian Investor

The Indian Investor

@Anvith_ -

MANISHA PASWAN

MANISHA PASWAN

@MANISHAPASWAN16 -

ArunaGiri

ArunaGiri

@giri_arun -

Quess Corp Limited

Quess Corp Limited

@Quess_Corp -

Nihit Kshatriya

Nihit Kshatriya

@NihitKshatriya -

DravidianSir

DravidianSir

@rahul93shukla -

Jeet

Jeet

@Jeet1081 -

Plutus Advisors

Plutus Advisors

@plutusadvisors -

Seby Joseph,Purappanthanam ❤🇮🇳❤

Seby Joseph,Purappanthanam ❤🇮🇳❤

@josephseby78 -

TN Investors' Assn

TN Investors' Assn

@TIA_Investors -

Sanjay Kumar Elangovan

Sanjay Kumar Elangovan

@sanjaylangval -

Ⓜukesh ₹ai

Ⓜukesh ₹ai

@mukesh_rai -

Peeyush kumar singh

Peeyush kumar singh

@Peeyush_86 -

Indian Sharemarket Updates

Indian Sharemarket Updates

@stocks_in -

TrustLine

TrustLine

@TrustPMS

Something went wrong.

Something went wrong.