Saurabh Neema

@saurabhneema1

..😜😜😜

You might like

Kuch Log "Bhed ki Khal mai, Bhosdiwale hote h.."

Indian mutual funds journey and history- 1st Episode of MF Chronicles. Check out this very interesting trip down memory lane. youtube.com/watch?v=xDA9kU…

youtube.com

YouTube

Samir Arora: The SRK of Mutual Fund Industry | Vikaas M Sachdeva |...

Succession planning is essential for passing on assets to legal heirs, but it becomes even more significant and urgent if one has children with special needs. @RijuMET copiously explains three tools that help parents plan for succession for their disabled kids. And a primer…

Some very imp and useful links For Mutual Fund Utility: CAMS Email Id. / Mobile No. Updation & Family Declaration- camsonline.com/Investors/Serv… Nomination Opt-In / Opt-Out- Online: digital.camsonline.com/changeofnomina… Physical Form : camsonline.com/Investors/Serv… KFintech Change in Email &…

If you can’t go to the gym, start walking daily. If you can’t do HIIT at home, start climbing stairs. If you can’t cook your own meals, just add salads before eating it. If you can’t buy whey protein, grind and mix soya chunks in your regular wheat flour. Achieving good…

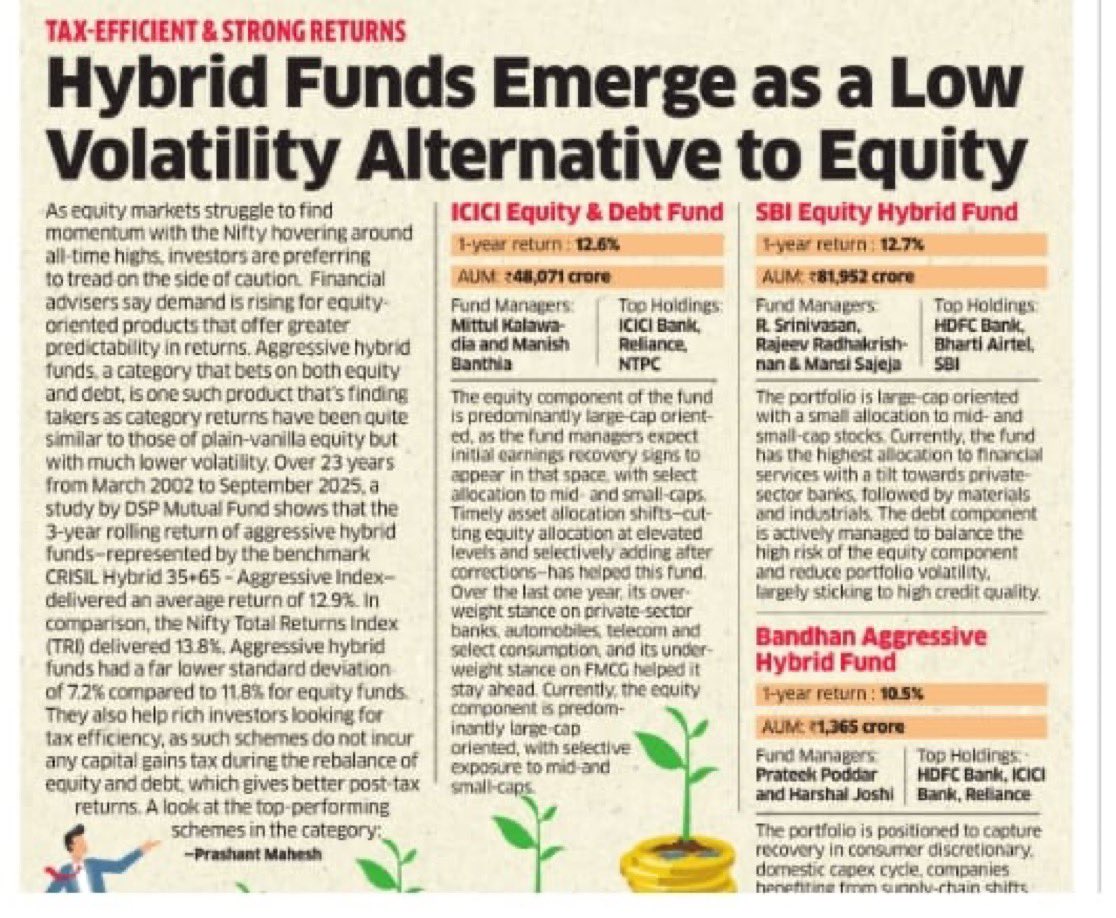

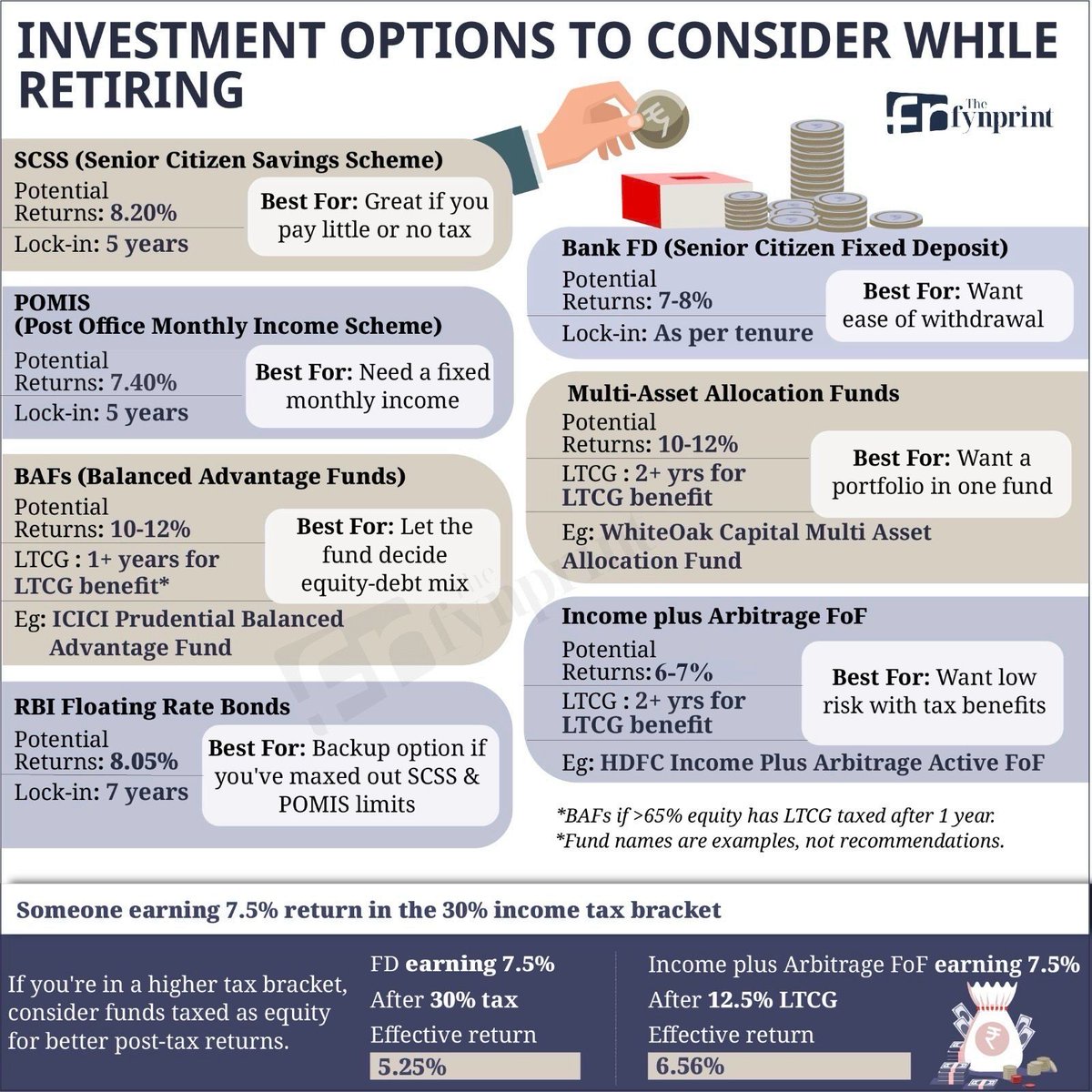

Though some advisors prefer keeping equity & debt separate, hybrid as a category is catching on. It does serve a certain type of investor.

I don’t know what is “quality” but yeah, I get the point.

NPS/UPS Gets a Major Boost with Two New High-Growth Investment Options! - PFRDA has introduced two new Auto Choice investment options for central government NPS/UPS subscribers. - The additions — Life-Cycle 75 (High) and Life-Cycle Aggressive — expand the total choice set to…

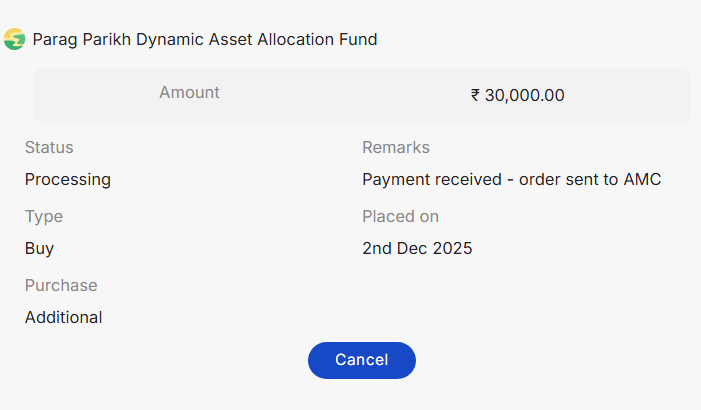

Invested ₹30,000 in PPFAS Dynamic Allocation Fund. Discipline = Wealth. SIP continues every month, despite any market noise; it's anyway not under my control. Only discipline is in my control. Small small steps 🏃 → Financial Freedom 💸

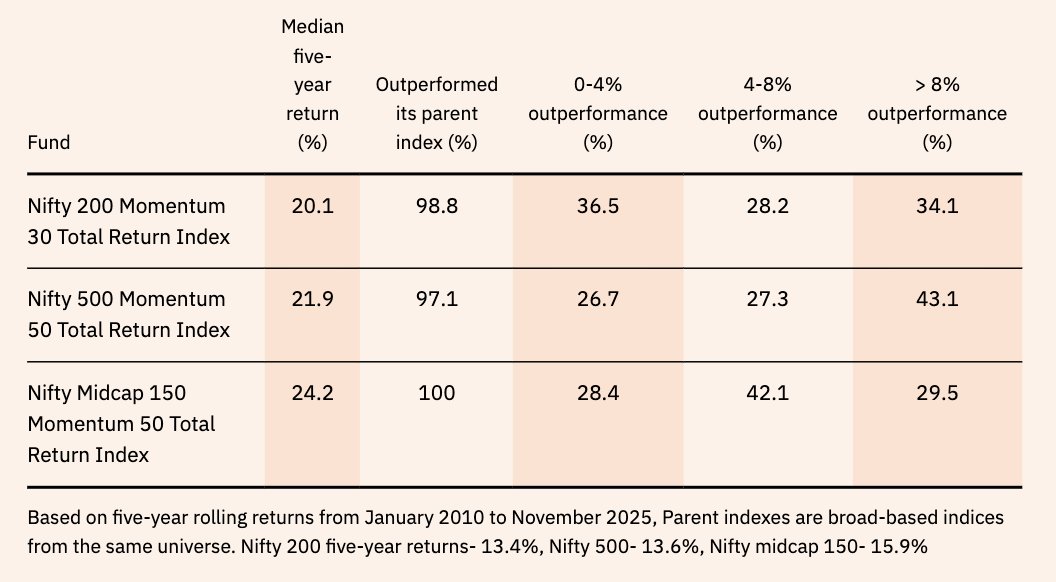

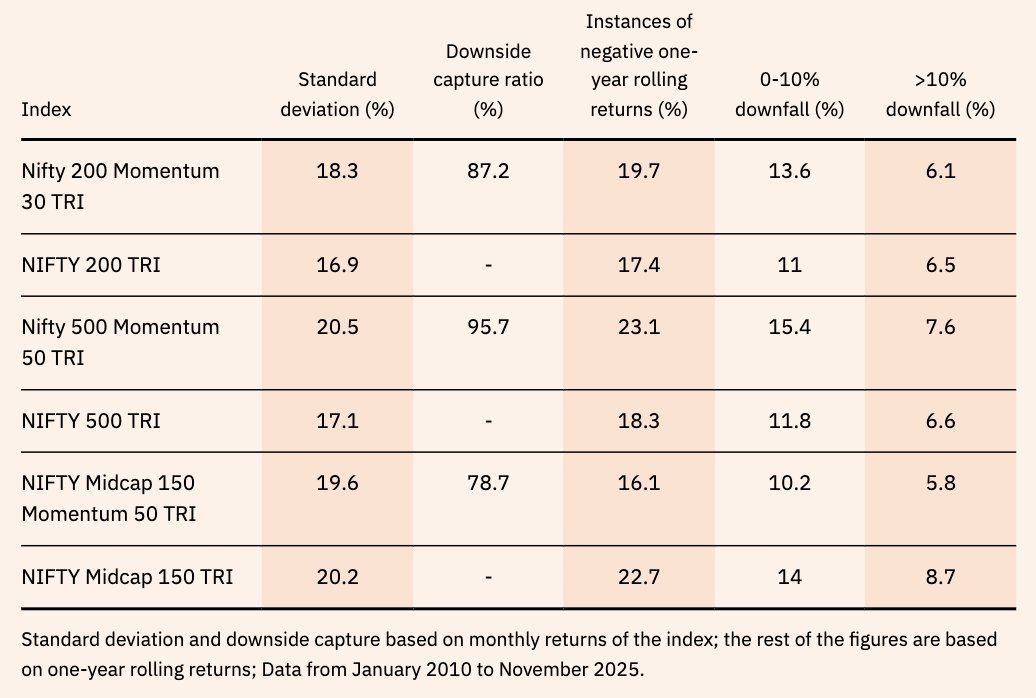

⚡️"Nifty Midcap Momentum 50 TRI" is currently the strongest momentum strategy; delivered the highest average returns and the most consistent outperformance across market cycles. Although the mid-cap momentum index is more volatile than its large-cap version, it surprisingly is…

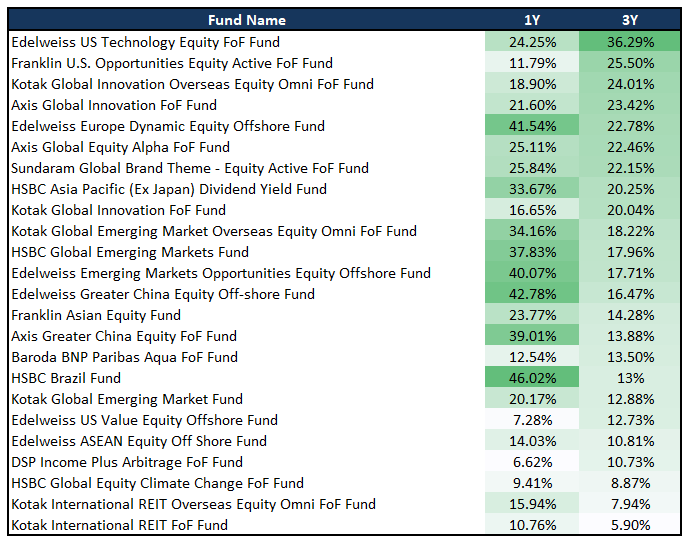

⚡️24 international mutual funds are now open for investments (as of Dec 2, 2025).

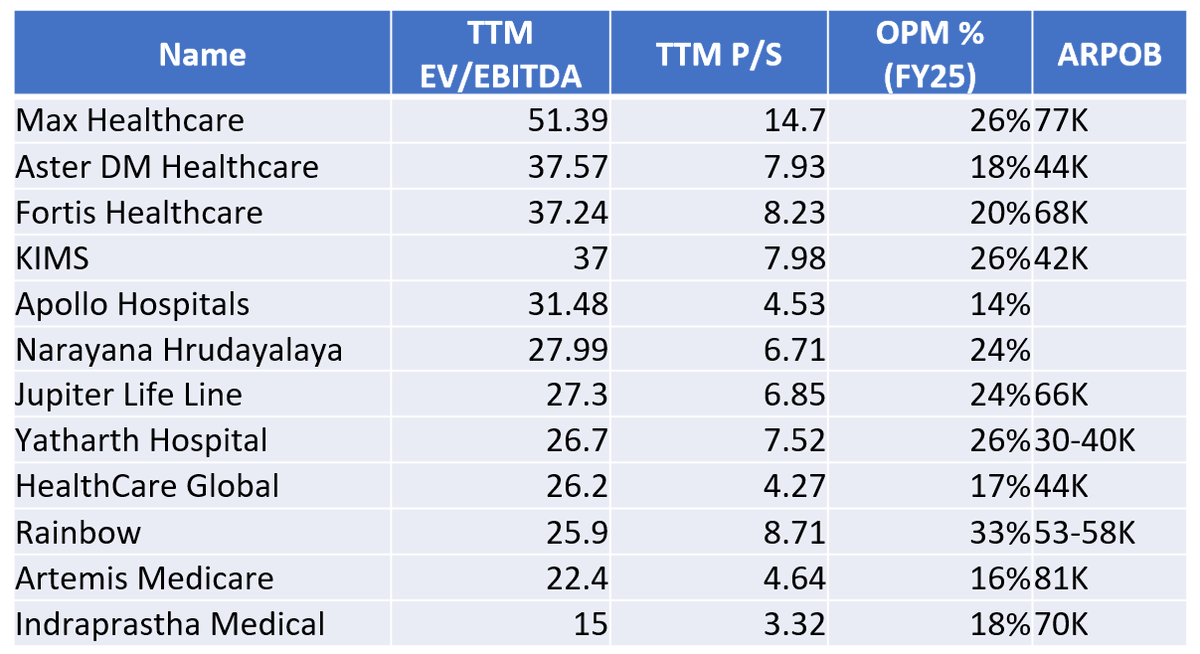

Hospitals Peer review Max vs Aster DM vs Fortis vs KIMS vs Apollo vs NH vs Jupiter vs Yatharth vs HCG vs Rainbow vs Artemis vs Indraprastha Depending on which report to believe, India currently expected to have anywhere between 1.2 to 1.9 million beds. About 60-65% of these…

Senior Citizens have many fixed income options. SCSS gives 8.2% and you can put 30 lakh in it. RBI floating rate bonds give 8.05%. These are taxable, but good for fixed income. Rest of the corpus can be SWPs in MAAFs/BAFs which keep compounding. More at thefynprint.com

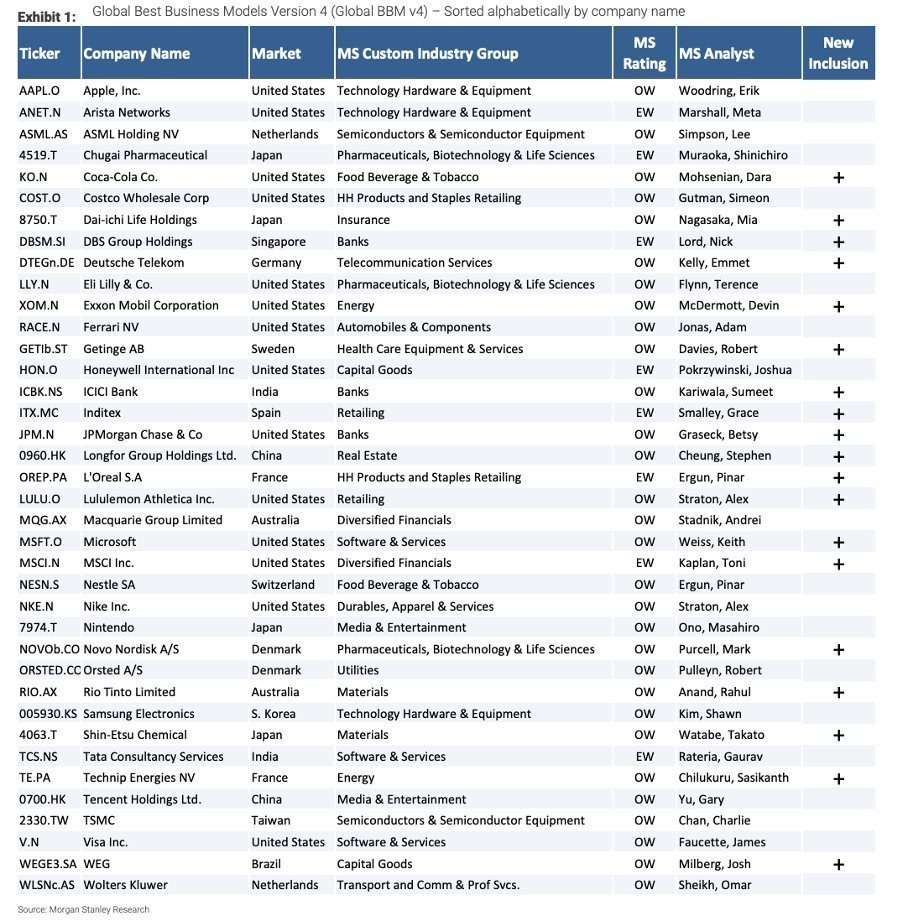

The best business models according to Morgan Stanley:

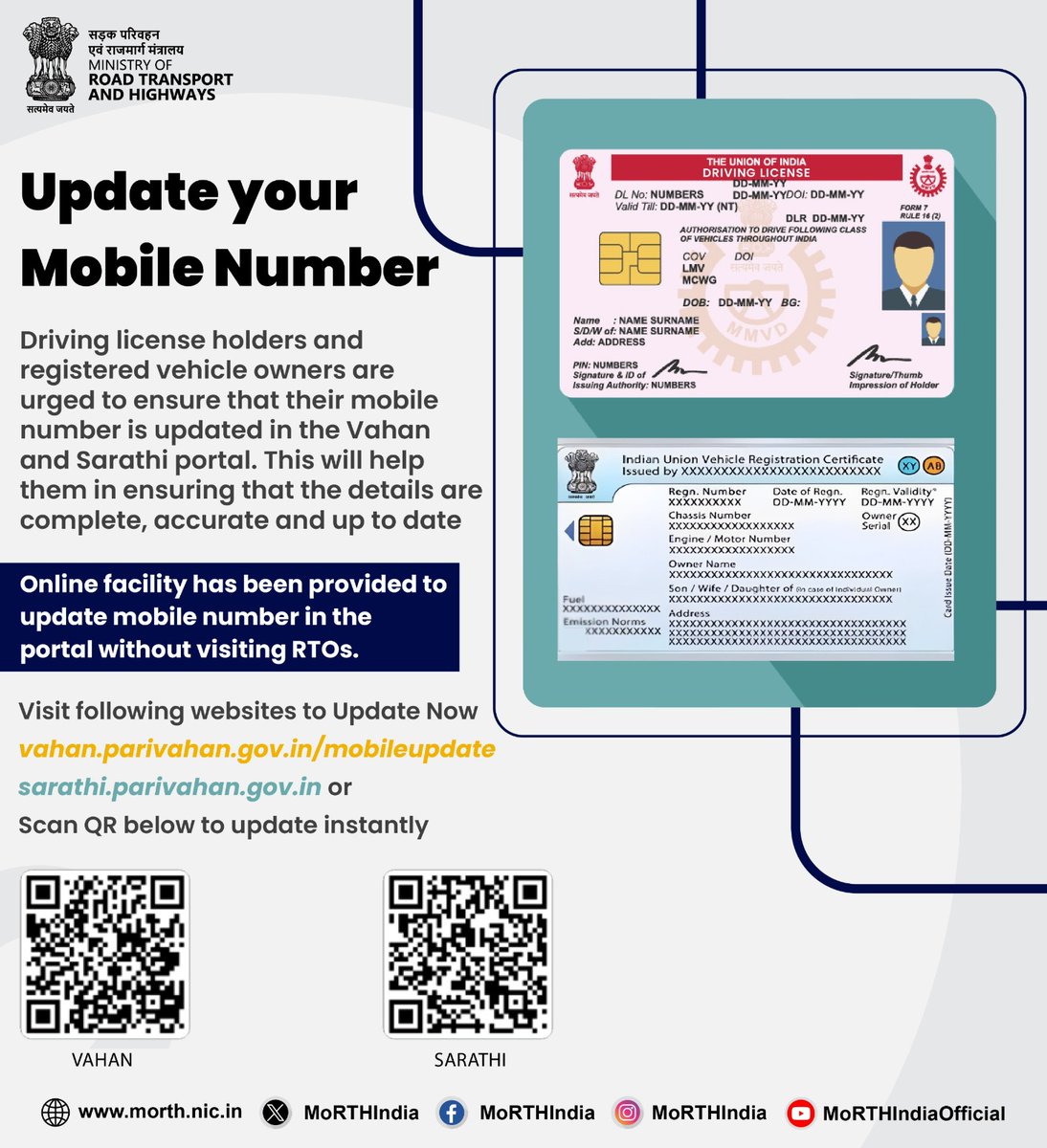

Driving license holders and vehicle owners are requested to update their mobile numbers on the Vahan and Sarathi portal to ensure their details are complete and up to date. Visit: vahan.parivahan.gov.in/mobileupdate sarathi.parivahan.gov.in #Parivahan #DigitalIndia #TransportServices

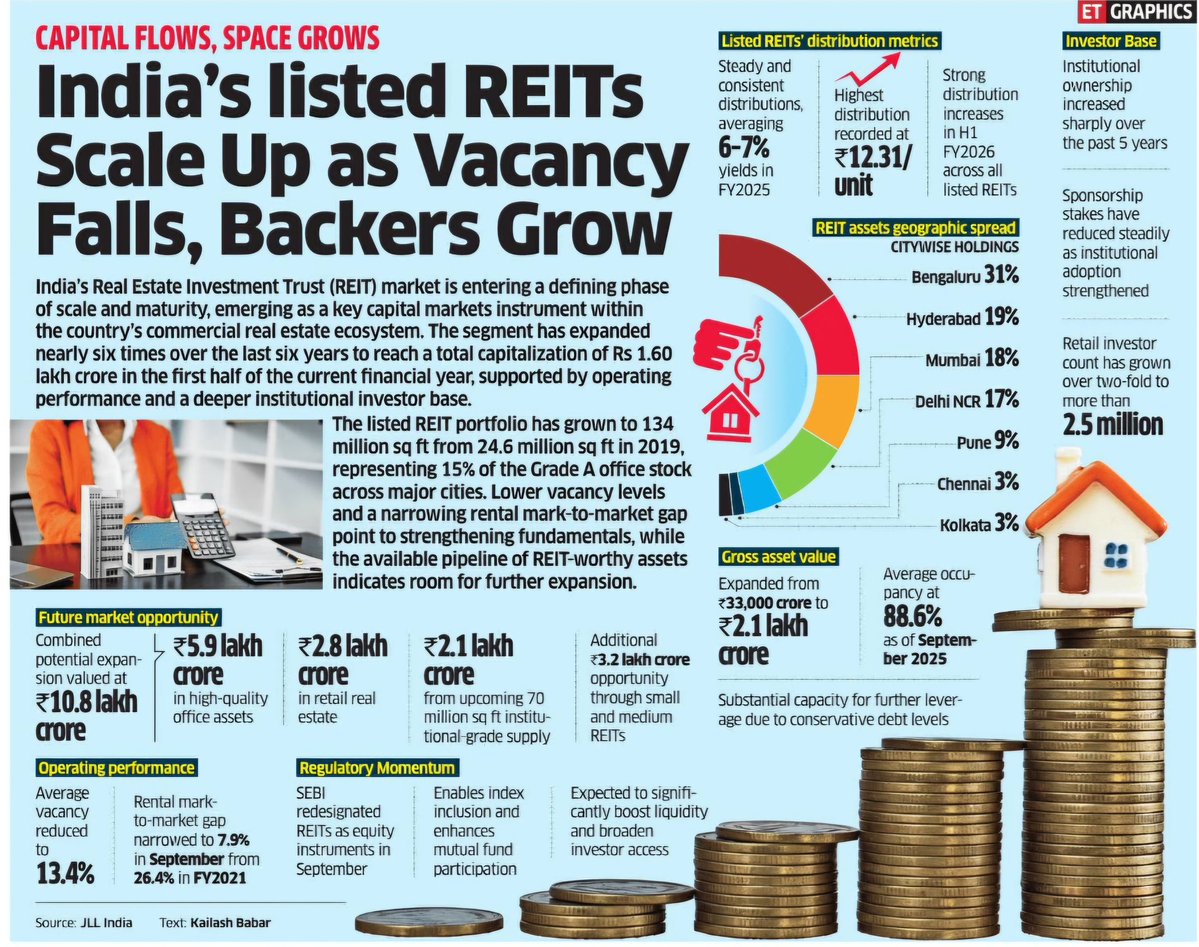

Indian REIT Market - Expanded 6x in 6 years 🔥 1. Market Overview • India’s REIT market has entered a scale + maturity phase • Total market cap reached ₹1.6 lakh crore in H1 FY25 - 6x growth in six years • Growth driven by strong operating performance and deepening…

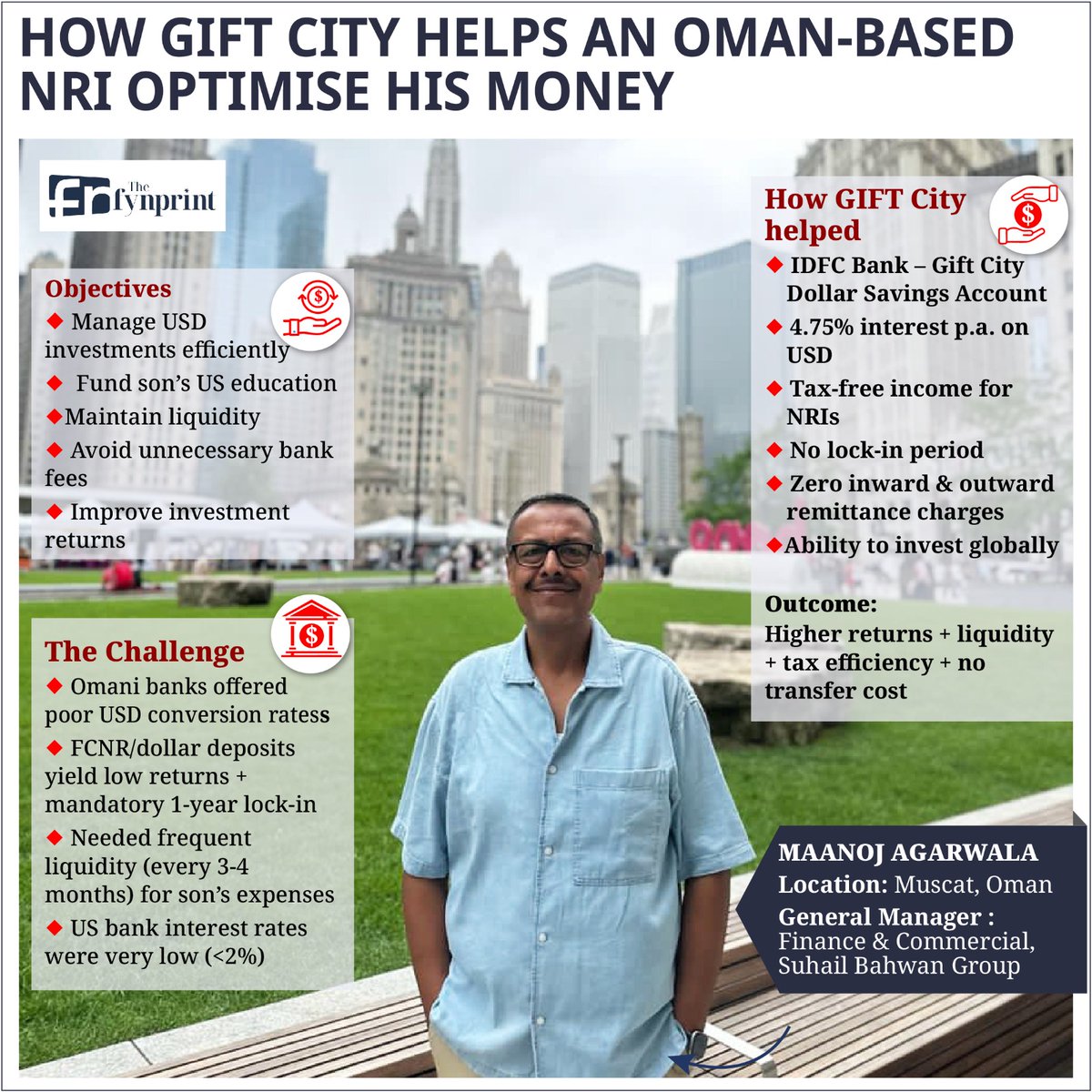

The GIFT City disruption has begun! NRIs can keep money in USD. No tax on it in India. 1) Better than FCNR. Get savings interest in GIFT or FD vs only FD in FCNR. 2) Video KYC for those with Aadhar 3) Get card against it & spend anywhere (See next) thefynprint.com/640dpJDI5

🚨Gift City-The path to international investments! As international investment resumes, Parag Parekh has just launched an S&P 500+Nasdaq 100 FoF Who can invest in these funds? What is the minimum investment size? A thread🧵on PPFAS gift city funds & should u invest thru it?👇

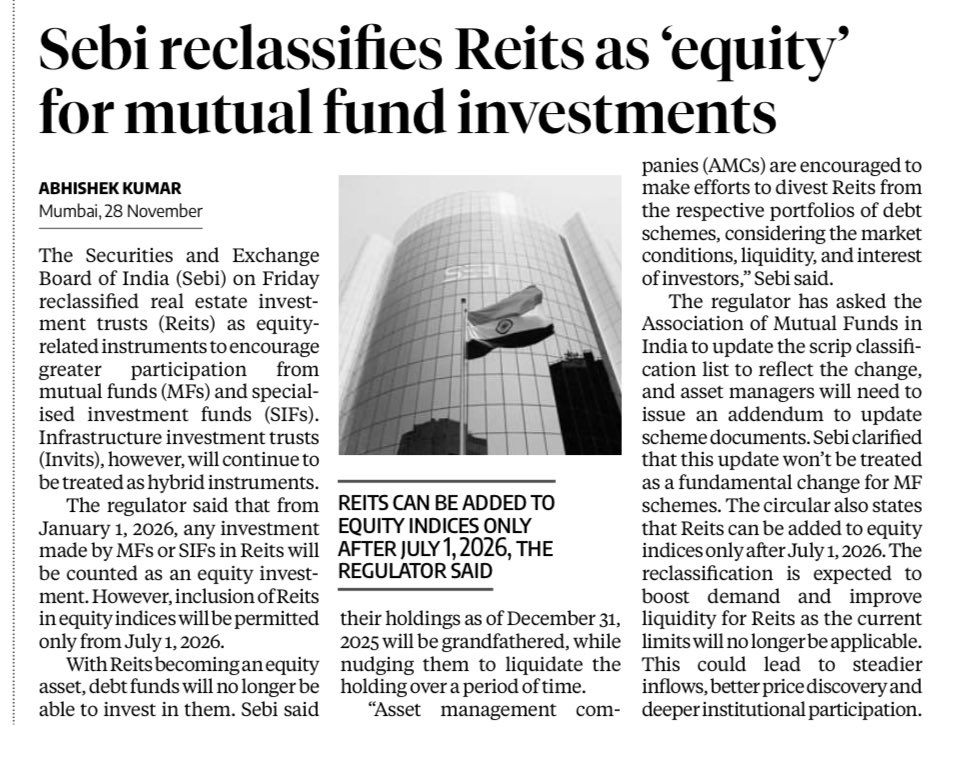

REITs investment by mutual funds will be considered "equity" from Jan 1, 2026. Equity indices can only add REITs from July 1.

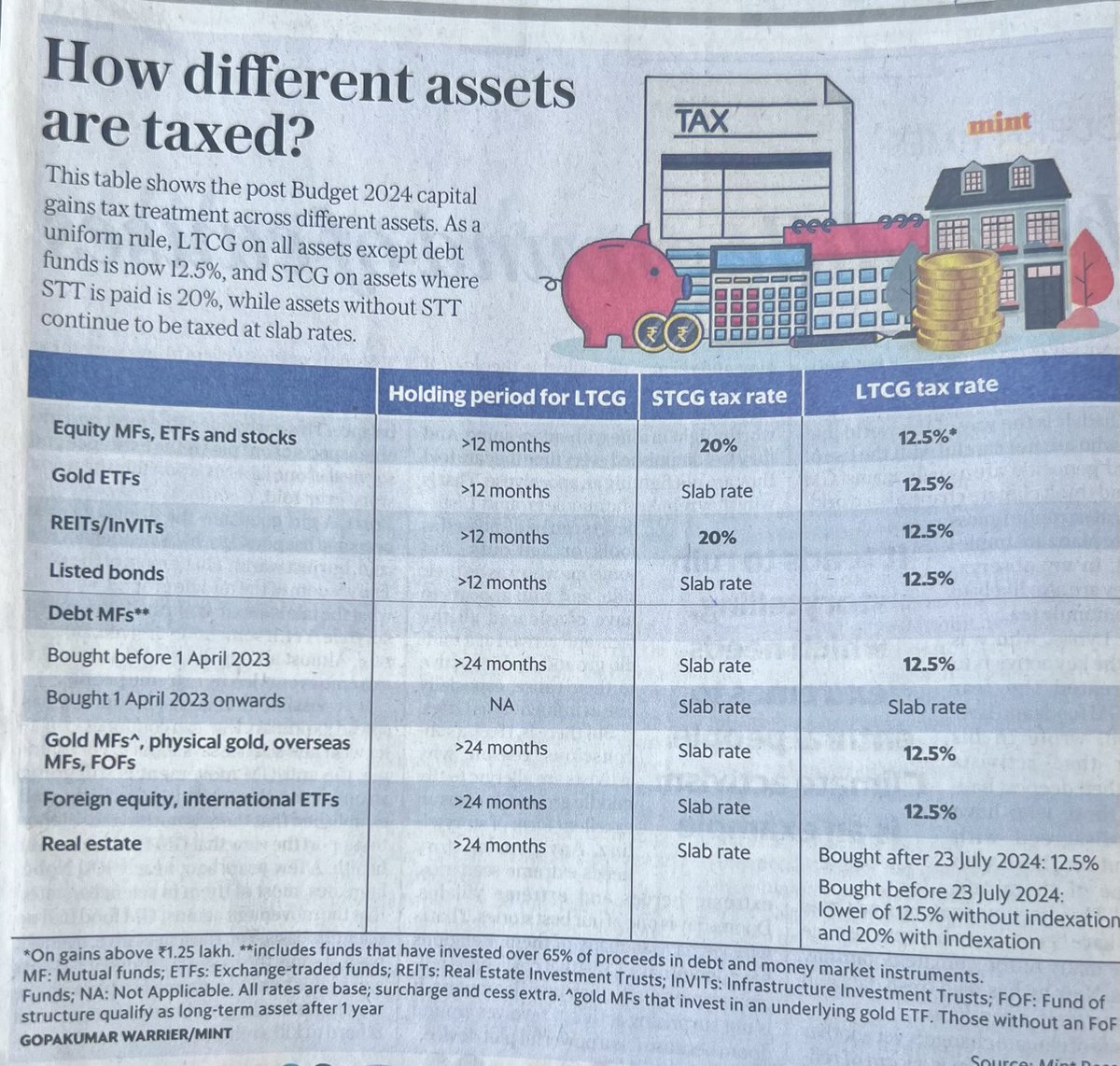

@SEBI_India @amfiindia @FinMinIndia No wonder Debt Mutual Funds have de-grown over last many years as % of other tax friendly investments.

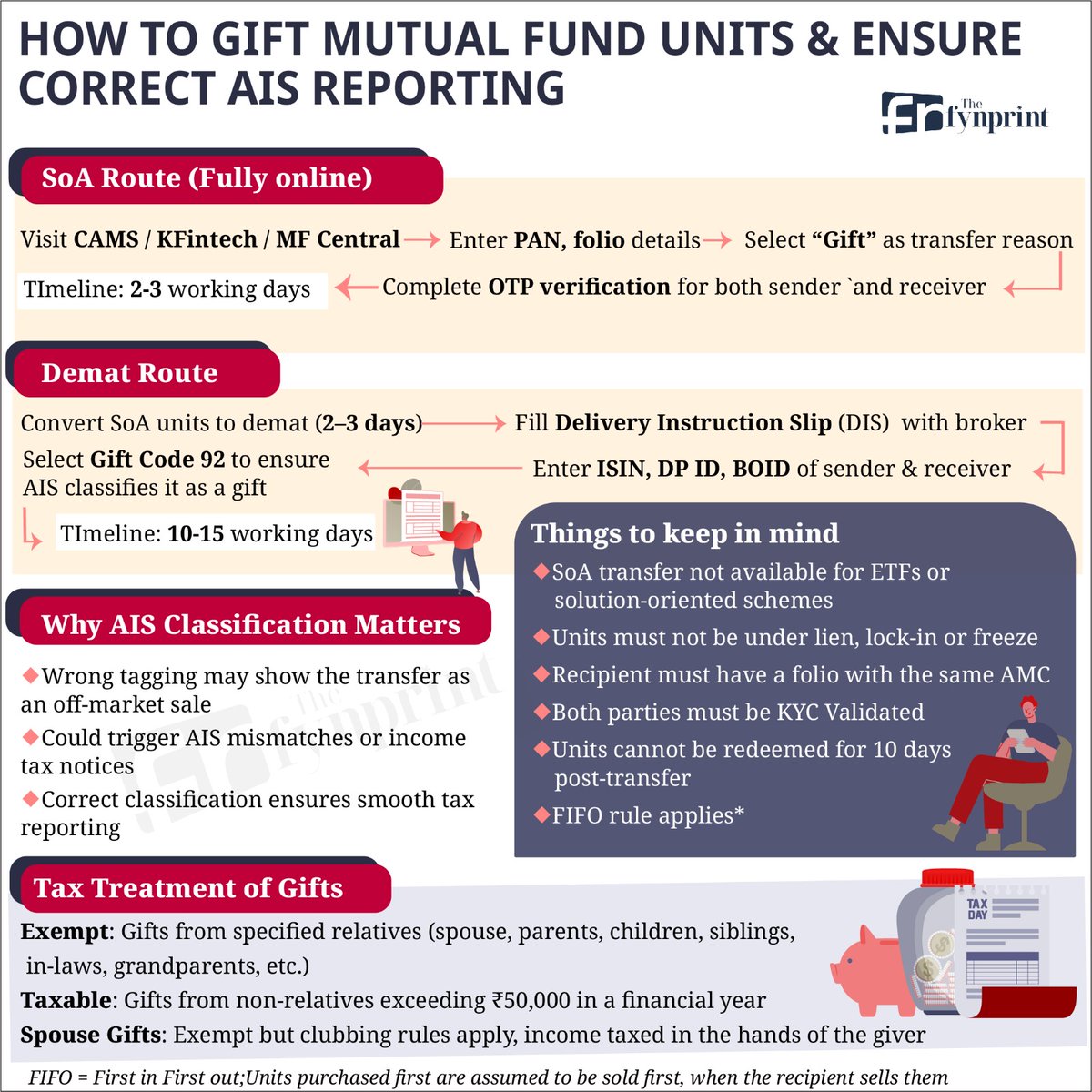

How to correctly gift mutual fund units by @PosteAnil thefynprint.com/iqjKEuNRe

United States Trends

- 1. Spotify 1.29M posts

- 2. #WhyIChime N/A

- 3. Chris Paul 40K posts

- 4. Clippers 54.5K posts

- 5. Ty Lue 5,124 posts

- 6. Hartline 13.8K posts

- 7. Giannis 25.8K posts

- 8. Apple Music 233K posts

- 9. Henry Cuellar 10.9K posts

- 10. SNAP 167K posts

- 11. ethan hawke 6,620 posts

- 12. #HappyBirthdayJin 119K posts

- 13. David Corenswet 10.5K posts

- 14. Lawrence Frank 3,928 posts

- 15. Chris Henry Jr 3,028 posts

- 16. Jonathan Bailey 11.5K posts

- 17. Jack Smith 22.7K posts

- 18. Duncan 8,156 posts

- 19. Jackson Ford N/A

- 20. Courtois 6,973 posts

You might like

-

The Indian Investor

The Indian Investor

@Anvith_ -

MANISHA PASWAN

MANISHA PASWAN

@MANISHAPASWAN16 -

ArunaGiri

ArunaGiri

@giri_arun -

Quess Corp Limited

Quess Corp Limited

@Quess_Corp -

Nihit Kshatriya

Nihit Kshatriya

@NihitKshatriya -

DravidianSir

DravidianSir

@rahul93shukla -

Jeet

Jeet

@Jeet1081 -

Plutus Advisors

Plutus Advisors

@plutusadvisors -

Seby Joseph,Purappanthanam ❤🇮🇳❤

Seby Joseph,Purappanthanam ❤🇮🇳❤

@josephseby78 -

TN Investors' Assn

TN Investors' Assn

@TIA_Investors -

Sanjay Kumar Elangovan

Sanjay Kumar Elangovan

@sanjaylangval -

Ⓜukesh ₹ai

Ⓜukesh ₹ai

@mukesh_rai -

Peeyush kumar singh

Peeyush kumar singh

@Peeyush_86 -

Indian Sharemarket Updates

Indian Sharemarket Updates

@stocks_in -

TrustLine Holdings Pvt. Ltd

TrustLine Holdings Pvt. Ltd

@TrustPMS

Something went wrong.

Something went wrong.