You might like

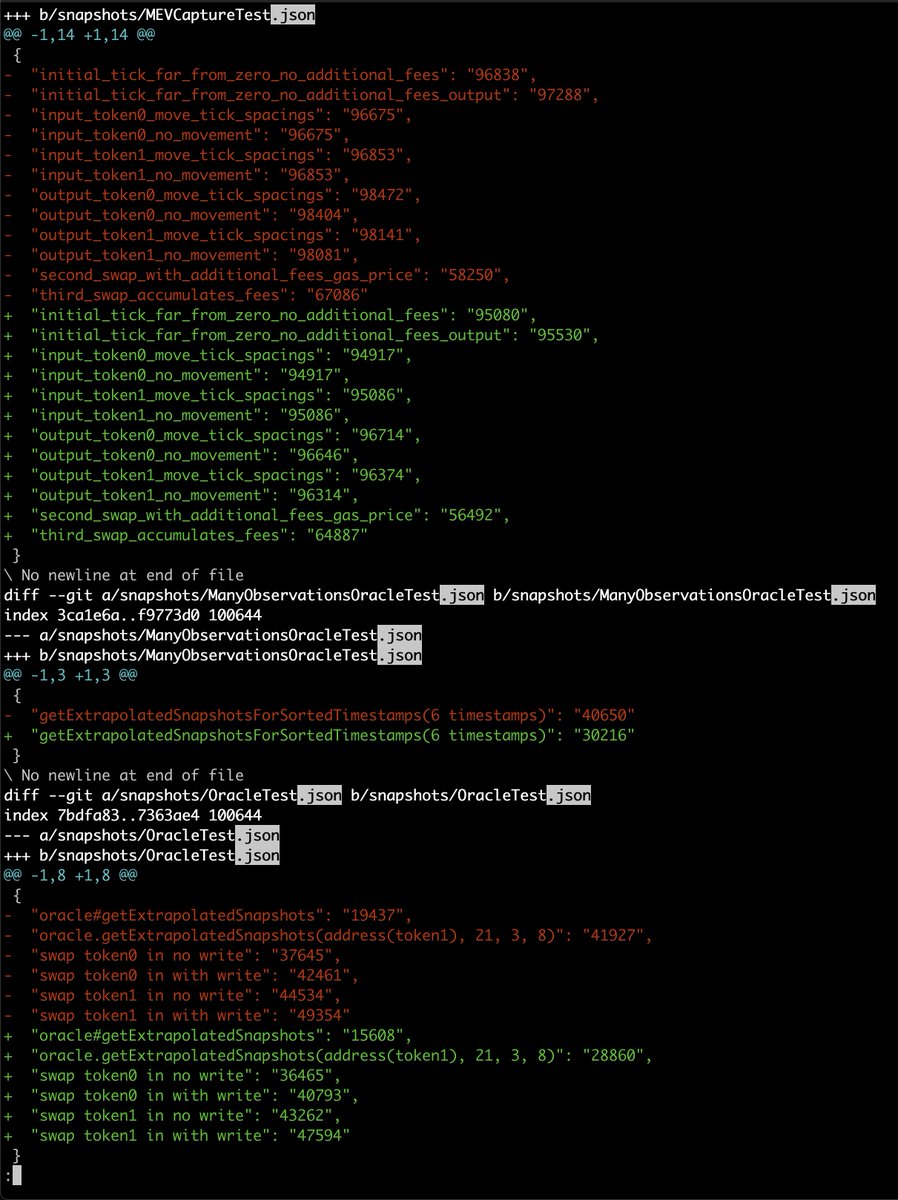

We've saved 20% off the fixed swap gas costs so far for the open source version of Ekubo (25k -> 20k). This translates to better pricing for traders, more fees for liquidity providers, and more possibilities for builders: a huge advantage for anyone who builds on top

The hardest part about writing smart contracts is how bad the Solidity VSCode extension is. No refactoring, no automatic imports, useless autocomplete, go to definition hardly ever works, the tiniest syntax error breaks everything, and it regularly freezes & crashes. I miss Java

The last 1 week of optimizing the next version @EkuboProtocol was especially good for the Oracle What use cases are there for having asset price history on-chain? It just keeps getting cheaper

TLDR of this proposal: the next version of @EkuboProtocol will be deployed on every EVM chain. We will deploy to all the big ones, and on top of that anyone can deploy the code to their own chain by broadcasting a presigned transaction. The Core protocol will have no built-in…

The OP stack model for AMMs

Explainer on gEKUBO since people are asking questions about it gEKUBO-26Q2 is a transferable token that can be converted 1:1 to EKUBO after March 31st, 2026 It was created via a call to TokenWrapperFactory: etherscan.io/tx/0xf7c484518… Anyone can deploy their own token wrapper by…

I love this feature because I don't have to send approval transactions or leave the app to rebalance my positions and I still get best price. It's also fun to see that in some cases e.g. stable swaps or high gas prices, our algorithm is very competitive

DO IT ALL FROM 1 UI - 0x SUPPORT IS NOW LIVE! 🔥 The best yields and no fee swap rates on Ekubo, combined with 0x aggregation that allows for rate comparison and exotic swaps, means that you can do it all in one place! And not only that - you can now swap without approvals…

Using centralized exchanges for this when the perfect solution already exists on Ethereum is disappointing. DCA orders would give everyone a fair opportunity to bid on the ETH. Innovation needs to be recognized and supported by the EF. evm.ekubo.org/dca?amount=100…

The Ekubo DAO is incidentally creating the best incentive infrastructure on Ethereum as part of the proposals to incentivize Ekubo Protocol liquidity We already have the best algorithm, utilizing time-weighted market depth contributed by each position, which requires less…

60%+ on USDe/USDT

If only there were a live audited solution on Ethereum

Selling ICO tokens at a flat rate is a bad idea. Needs some price discovery. The market should declare the listing price, not the team.

Chatting about Ekubo Protocol in an hour w/ community members--AMA

Impressive out-performance from the MEV-resist EURC-USDC pool over the last 24 hours with only 2 aggregator integrations live, and none of this volume comes from sandwiches Source: evm.ekubo.org/charts/EURC/US…

There is already an Oracle pool for ETH/USDC. The point is to create an incentive to test the pool for manipulation resistance, and also provide a way to hedge against manipulation. Eg if you were securing 50 ETH with it and the market is 50:1 you might bet 1 ETH on "Yes." If it…

Easiest way to bet is to create a ETH/USDC market with TWAP oracle and lend USDC in it

United States Trends

- 1. Good Sunday 58.7K posts

- 2. Troy Franklin N/A

- 3. #sundayvibes 5,401 posts

- 4. Brownlee N/A

- 5. #AskFFT N/A

- 6. #AskBetr N/A

- 7. Rich Eisen N/A

- 8. Pat Bryant N/A

- 9. Muhammad Qasim 18.5K posts

- 10. Mason Taylor N/A

- 11. #DENvsNYJ N/A

- 12. #NationalFarmersDay N/A

- 13. Miary Zo 2,080 posts

- 14. Jermaine Johnson N/A

- 15. Discussing Web3 N/A

- 16. KenPom N/A

- 17. Wordle 1,576 X N/A

- 18. Trump's FBI 14.5K posts

- 19. The CDC 33.2K posts

- 20. Biden FBI 22.1K posts

You might like

-

Noah Zinsmeister

Noah Zinsmeister

@NoahZinsmeister -

Dave White

Dave White

@_Dave__White_ -

Dan Robinson

Dan Robinson

@danrobinson -

brock

brock

@brockjelmore -

Stephane

Stephane

@thegostep -

0age

0age

@z0age -

Will Sheehan

Will Sheehan

@wilburforce_ -

sarareynolds.eth

sarareynolds.eth

@saraareynolds -

frankie

frankie

@FrankieIsLost -

proto.eth

proto.eth

@protolambda -

🤖

🤖

@phildaian -

David Mihal.eth

David Mihal.eth

@dmihal -

zefram.eth

zefram.eth

@boredGenius -

Dean Eigenmann

Dean Eigenmann

@DeanEigenmann -

Ian Lapham

Ian Lapham

@ianlapham

Something went wrong.

Something went wrong.