SpatialKey (an Insurity company)

@spatialkey

Our Twitter page is merging with Insurity... Follow Insurity now!

You might like

The past is no longer representative of the future when #underwriting #wildfirerisk. Read how #propertycasualty insurers can implement more strategic & innovative approaches--like correlated risk zones, innovative scoring, and more data points hubs.ly/H0n5Vbq0

We're proud to be working with data partners like @RedZone_co, @Willis_Re and @HazardHubUSA to help #propertycasualty insurers implement more strategic and innovative approaches to underwriting #wildfirerisk. Read more: hubs.ly/H0n5fKM0

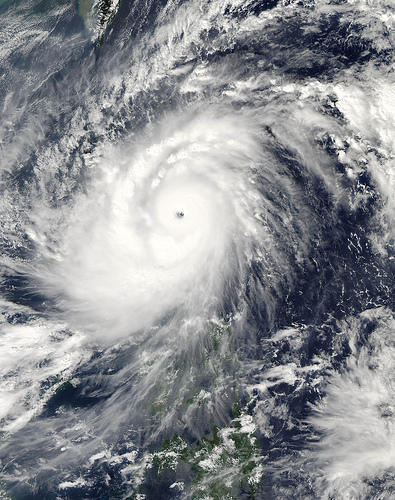

Flood losses will account for a large proportion of the overall losses from UK #StormCiara and #StormDennis as #floodrisk is expected to become an increasingly important consideration for the UK #insurance sector... hubs.ly/H0n5VVP0

reinsurancene.ws

Storms Ciara & Dennis could push UK insurers to underwriting loss: Fitch - Reinsurance News

Analysts at Fitch Ratings believe that costs from storms Ciara and Dennis will increase pressure on UK household insurers’ profitability in 2020,

Read why #propertycasualty insurers have struggled with #wildfire event response and how new data and technology solutions are helping them move from "react and respond" to "prepare and serve" #wildfirerisk hubs.ly/H0n5yH-0

Read how SpatialKey (now part of the @Insurity family) is working with our data partners like @RedZone_co, @Willis_Re and @HazardHubUSA to help #propertycasualty insurers implement more strategic and innovative approaches to underwriting #wildfirerisk hubs.ly/H0n5g3C0

From simplified applications to #underwriting and #claims, automation and analytics play vital roles in commercial #insurance. In her latest article, @Insurity EVP of Data Solutions, @kirstinmarr, explains the top 3 areas seeing the greatest impact hubs.ly/H0n48P20

A new study has found that atmospheric rivers caused 84% of the flood damage suffered in 11 western states over 40 years with an average annual cost of $1.1 billion #floodrisk hubs.ly/H0n3kKg0

Kirstin Marr, head of data solutions at @Insurity, explains why the full potential of analytics goes beyond the insights it provides insurers. When merged with modern technology, data and analytics can fuel efficiency, accuracy and productivity... hubs.ly/H0n06Jd0

A new flood bill seeks to reduce the number of repeat #flood #claims and loss properties within the NFIP. As of 2015, FEMA had identified 160,000 repetitive loss properties, defined as insured structures that have been paid 2+ NFIP claims #floodrisk hubs.ly/H0m_KM-0

Great viewpoints from Fathom's Dr. Andy Smith on #floodrisk: Increasingly open and transparent data is vital in order to drive a greater understanding of, and demand for, #flood #insurance around the world... hubs.ly/H0m_pcT0

Kirstin Marr, head of data solutions at @Insurity, shares what #underwriters can learn from this essential advice from hockey great, Wayne Gretzky: ‘I skate to where the puck is going, not where it has been.’ Read more: hubs.ly/H0m-94X0

Great article from Kirstin Marr, head of data solutions at @Insurity, about why insurers must be sophisticated in applying performance-enhancing technologies and fostering a data and innovation mindset in order to remain competitive hubs.ly/H0mZ2hh0

Our resident #insurance expert Rebecca Morris explains why #propertycasualty insurers have struggled with #wildfirerisk and how new data and technology solutions are helping them move from react and respond to prepare and serve hubs.ly/H0mVwHr0

A new report from @WTWrisk shows that #propertycasualty insurers are ambitious with wanting to implement advanced data and analytics capabilities, but in reality, they still have a ways to go with implementation. hubs.ly/H0mT5nQ0

What does the year have in store for property/casualty insurers? Let's find out... Property/Casualty Insurance Outlooks: What Experts Say to Expect in 2020 - Carrier Management hubs.ly/H0mR9q_0

Three challenges to effective data analytics use in insurance | PropertyCasualty360 hubs.ly/H0mQKSj0 #P&CInsurance #dataanalytics

Bushfire losses will dent earnings, but insurers are well placed, says AM Best - Reinsurance News hubs.ly/H0mNS910 #P&CInsurance

While 8K TVs are intriguing, many other tech products and advancements at CES2020 have important implications for #P&C insurance. CES2020: Big Themes for P&C Insurance - Insurance Thought Leadership hubs.ly/H0mM4Th0

"The Federal Emergency Management Agency (FEMA) FEMA reported its 2020 traditional reinsurance placement for the National Flood Insurance Program (NFIP) in a transaction in which 27 private reinsurers assumed $1.33 billion of NFIP’s financial risk." hubs.ly/H0mKqf40

#P&C Insurance Outlooks: Find out what the year has in store for property/casualty insurers. Property/Casualty Insurance Outlooks: What Experts Say to Expect in 2020 - Carrier Management hubs.ly/H0mJPsH0

United States Trends

- 1. #CARTMANCOIN 1,572 posts

- 2. Broncos 64.6K posts

- 3. Broncos 64.6K posts

- 4. yeonjun 191K posts

- 5. Bo Nix 17.8K posts

- 6. Geno 18.2K posts

- 7. $SMILEY N/A

- 8. Sean Payton 4,682 posts

- 9. Kenny Pickett 1,501 posts

- 10. daniela 38.5K posts

- 11. #TNFonPrime 3,976 posts

- 12. #criticalrolespoilers 4,741 posts

- 13. Chip Kelly 1,947 posts

- 14. Bradley Beal 3,391 posts

- 15. Jalen Green 7,168 posts

- 16. TALK TO YOU OUT NOW 25.2K posts

- 17. Pete Carroll 1,914 posts

- 18. Kehlani 8,990 posts

- 19. Jeanty 6,481 posts

- 20. byers 28.7K posts

Something went wrong.

Something went wrong.