Asymmetric Research

@stonkanalysis

Citadel Analyst targeting asymmetric risk/reward | Equities guided by sentiment, volume, and catalysts | Conviction before consensus | NOT financial advice

DeepSeek showed that memory, not just compute, is now a core scaling law for AI. By keeping reasoning on HBM and offloading knowledge to CXL-attached DDR5, models can scale even with limited GPUs. Bullish $MU, Samsung, and SK Hynix.

Long Tin. Tin has one of the strongest setups in critical metals right now, especially as an under the radar play on the AI/semiconductor boom. Tin is essential for soldering in circuit boards, chips, and advanced electronics. Simply put, AI doesn’t happen without it.

Trump has spoken. Data Centers need captive “inside the fence” power generation. The shortest term solution (with $GEV $SIEGY sold out on gas turbines) and nukes taking 6-10 years… are things like $BE $FSLR $TE. Our note on $TE is below. $VST $TLN $NRG $CEG and more are all…

$TE $FSLR Our second note on $TE is ⬇️ ⬇️. One of the things we like about the trade is the huge positive sector beta in solar. $FSLR surging today on the $GOOG deal for Intercept as $FSLR their big supplier of modules. See graph of domestic solar modular capacity. This…

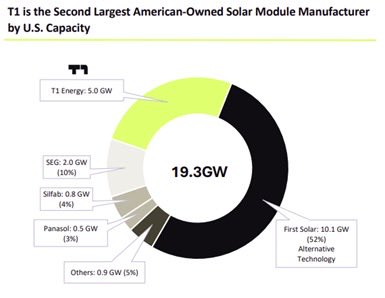

Total AI compute is doubling every 7 months. We tracked quarterly production of AI accelerators across all major chip designers. Since 2022, total compute has grown ~3.3x per year, enabling increasingly larger-scale model development and adoption. 🧵

Top 2026 investment themes: Power + Networking + Deployment Friction. Specifically: - Grid capacity - Cooling / thermal - Interconnect / networking - Enterprise integration + governance

If you choose to buy the S&P500 index, you are making an active choice to bet on the winners.

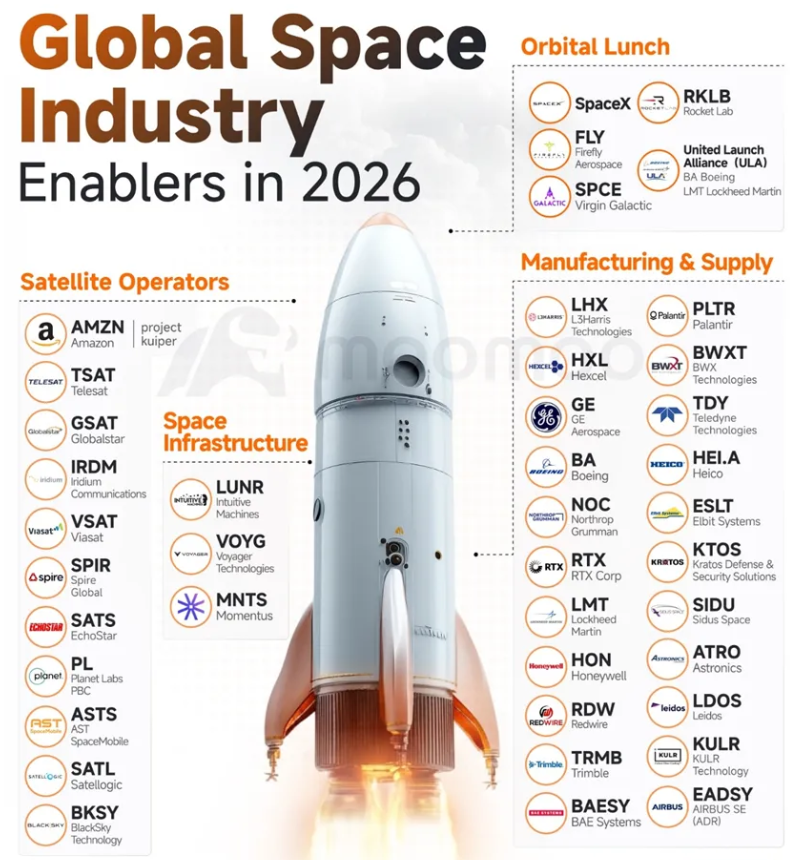

2026 WILL BE THE YEAR OF SPACE Orbital Launch (access to space) • $SPACEX enables low-cost, high-cadence launch that underpins the entire ecosystem • $RKLB provides dedicated launch and integrated space services for small and mid-size missions • $FLY, $SPCE, $ULA expand…

Imagine winning $3 over and over… 80,000 times That’s exactly how this wallet made $270,000 on Polymarket Wallet: polymarket.com/@ca6859f3c004b… The strategy is brutally simple: It just farms 15 min markets Clipping ~$3 systematically Repeated ~80k times Just the same loop, nonstop

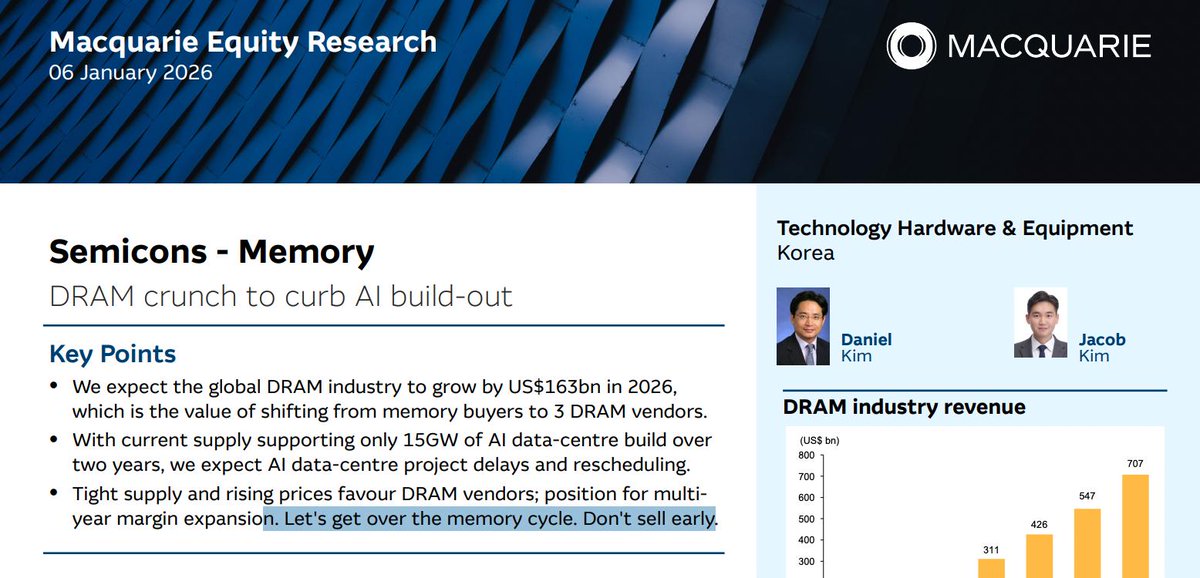

Macquarie made a very interesting claim in its latest memory report. - The combined supply capacity of the three major memory makers is only sufficient to support the build-out of about 15GW of AI data centers over the next two years. - In other words, memory constraints are…

Bought Sandisk around this time and never sold and I am still not selling anytime soon. My thesis has always been the same… In modern LLM’s storing & referencing KV Cache is the largest bottleneck. For models like ChatGPT & Gemini it has got so big that you can’t fit it on a…

Compute & storage demand would go parabolic once proper long video generation comes online (15min-1hr) Lots of good memory (SSD & HDD) stocks can be picked up rn

$TSLA looking very attractive here. 1/16 $460C @ $3.3

Late Dec selling is driven by tax loss harvesting. Investors dump losers before year end, creating temporary pressure, especially in small caps. In Jan the pressure lifts. Capital resets, investors rebuy exposure, and prices rebound. It’s literally known as the January Effect.

$PATH officially joins the S&P 400 🚀 Massive forced buying from ETFs starts hitting the tape at close today. With $1.5B+ in cash, zero debt, and GAAP profitability, the fundamental story is strong. Passive flows + AI tailwinds = 📈🐂

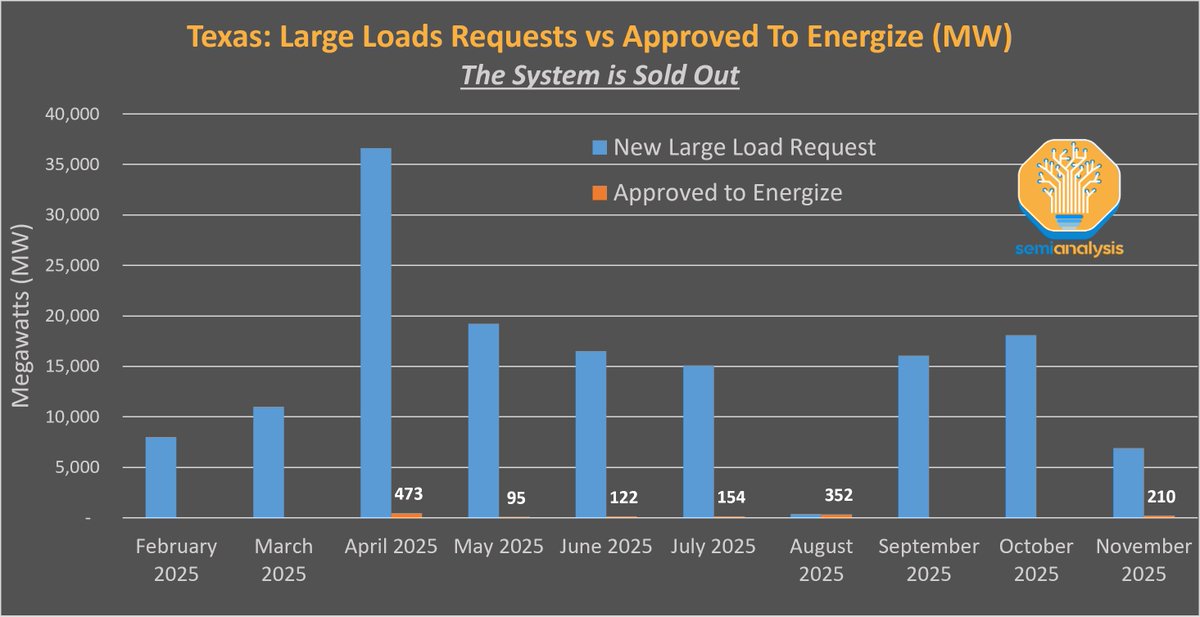

In the AI boom, power is the bottleneck. In TX alone, tens of gigawatts of load requests apply for connection every month. And barely 1 GW has been approved in the past 12 months. THE GRID IS SOLD OUT But that won't stop datacenter developers.(1/4)🧵

I suspect 2026 will kick off with a bang in markets. Current vol seems to largely be a product of tax loss harvesting, etc. There’s just too much going right be negative on the market atm.

Haven't shouted out creators in a while so why not here are some of my favs... @BarbellFi @KrisPatel99 @QualityInvest5 @StealthQE4 @KyleAdamsStocks @HeroDividend @dividendology @TheAlphaThought @DividendDynasty @TacticzH @BourbonCap @BoringBiz_ @Mr_Derivatives…

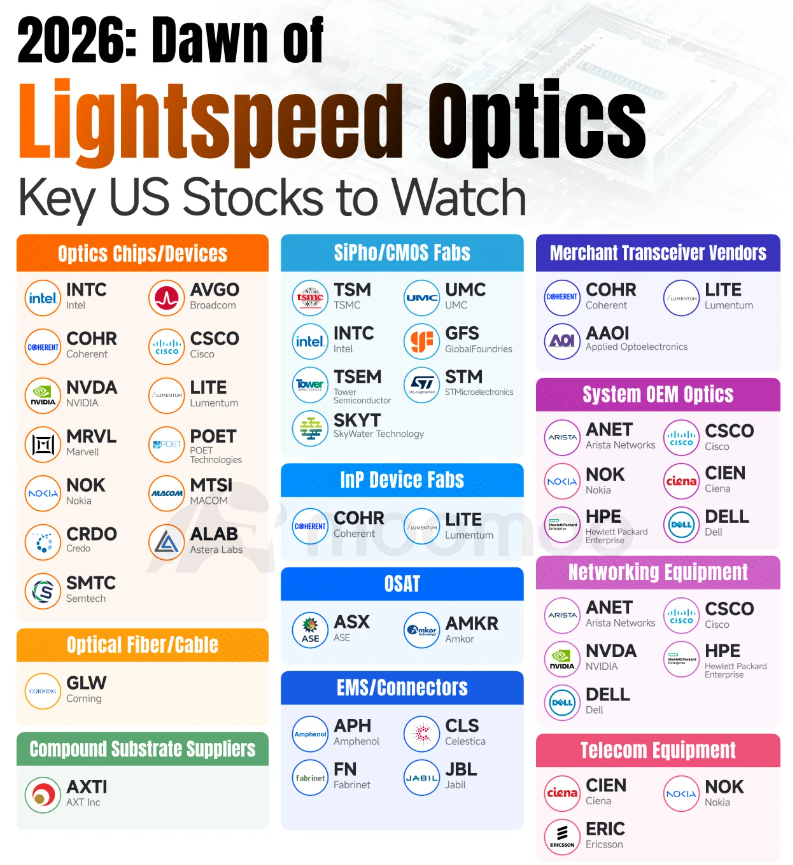

OPTICS WILL BE A DEFINING THEME OF 2026 AI has turned data movement into the bottleneck and at scale only photons can move information efficiently enough. The ecosystem breaks down like this: • Companies That Package Advanced Chips | $ASX, $AMKR • Hardware That Sends Data as…

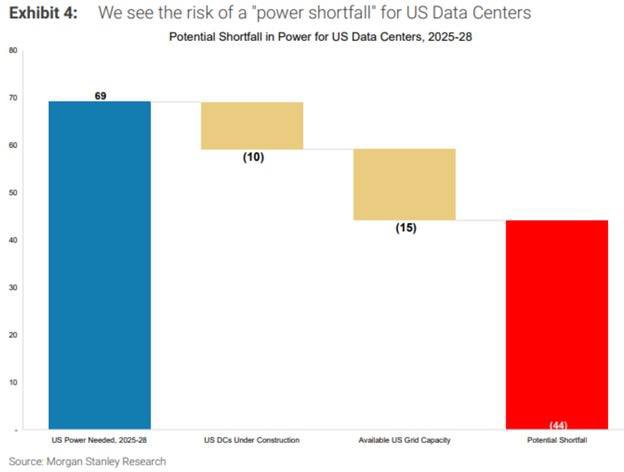

Data centers hitting a hard energy wall in the US. @MorganStanley research projects a 44GW power gap, that current grids & construction plans cannot fill. US data centers are expected to need 69GW of power between 2025 ~ 28, but only 10GW are coming from projects w their own…

United States Trends

- 1. #alert N/A

- 2. #signal N/A

- 3. Ford N/A

- 4. Anton N/A

- 5. Corey N/A

- 6. TJ Sabula N/A

- 7. Lakers N/A

- 8. thalia N/A

- 9. #ErfanSoltani N/A

- 10. AI Summary N/A

- 11. #RHOSLC N/A

- 12. #ComingDokkan11th N/A

- 13. Columbina N/A

- 14. Wemby N/A

- 15. Peyton Watson N/A

- 16. Zetarium N/A

- 17. Joe Rogan N/A

- 18. Hytale N/A

- 19. Kai Cenat N/A

- 20. Cenk N/A

Something went wrong.

Something went wrong.