The Intellectual Edge

@thebigideas_

In search of the most valuable investing insights

New Michael Mauboussin paper just dropped: morganstanley.com/content/dam/im…

Been thinking a lot about Michael Mauboussin's depiction of investing vs gambling again...

Babe, wake up, new Howard Marks memo just dropped.

Ed Thorp is a true master at probability games and really an exceptional individual. Notes and systems from his autobiography to think in new ways: - 'It felt good to know that, just by sitting in a room and using pure math, I could change the world.' - Guiding questions to…

In celebration of the 35th anniversary of @HowardMarksBook's memos, we released the first and only complete collection of all the memos in a single volume, from the first one in 1990 to the latest as of publication. Read now: bit.ly/42Posuk #AlternativeInvesting

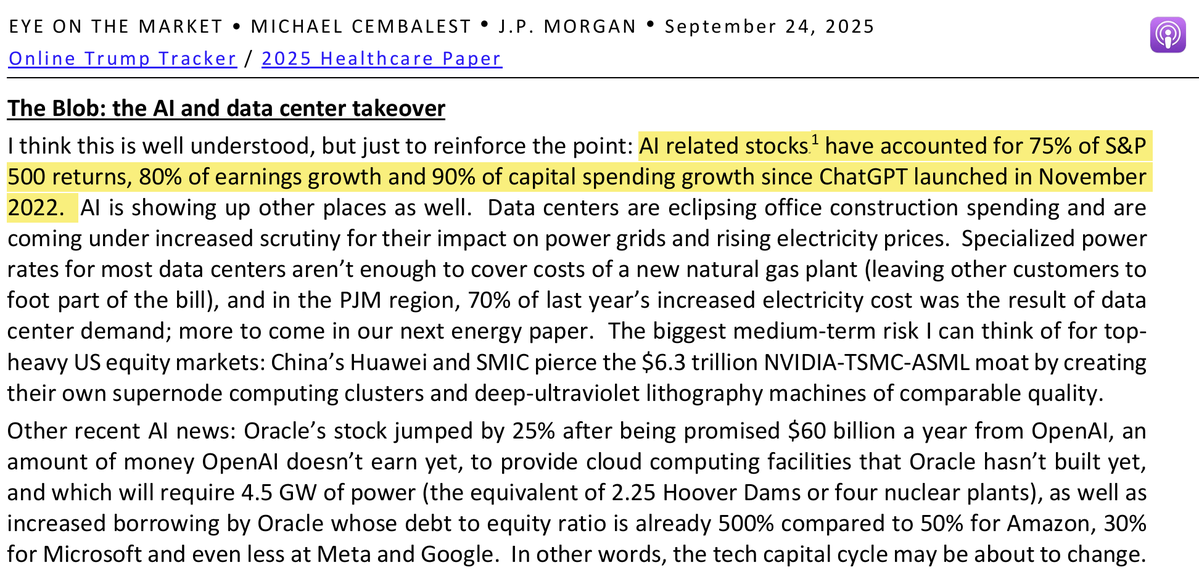

.@BerkelKip flagged this to me today. I knew it was a lot, but 75% is out of this world.

What platform do you guys use to research stocks? (Ideally not too expensive and good data on small cap obscure stuff)

Distorted risk perception has always fascinated me. We view risk inversely to its reality. When prices rise we relax our tolerance for risk, which is odd because a higher price comes with additional risk. From Excess Returns

Investment media is playing a very different game to us long term investors, so why listen to their advice? Love this passage from Excess Returns.

Outcomes are subject to all kinds of randomness and luck, it’s better to analyse your processes if you want real improvement.

The power of accepting your own ignorance—an insight found in Ancient Greece. A nice reminder to acknowledge how little we know.

This is six years old and still incredibly relevant. Such a fantastic conversation. Every time I listen to Marks I learn something new, his thinking is ridiculously clear. @HowardMarksBook @farnamstreet

Buy-and-hold isn’t as easy as it’s made out to be. Snippet from a previous blog

Buybacks as a method of signalling undervaluation are no longer what they once were. This ‘signalling theory’ of undervaluation does however have a few scenarios where it remains true. Knowing the difference between a good and a bad buyback allows you to distinguish between…

United States Trends

- 1. #UFC322 78.7K posts

- 2. Kirby 16.9K posts

- 3. Prates 23K posts

- 4. Sark 4,828 posts

- 5. Georgia 79.4K posts

- 6. Leon 67.2K posts

- 7. Bo Nickal 6,383 posts

- 8. Ole Miss 10.1K posts

- 9. #GoDawgs 7,683 posts

- 10. Arch Manning 2,906 posts

- 11. Dillon Danis 4,393 posts

- 12. Bama 21.2K posts

- 13. Texas 187K posts

- 14. Ewing 6,923 posts

- 15. Gunner 5,256 posts

- 16. Lebby 1,209 posts

- 17. Ahmad Hardy N/A

- 18. #AEWCollision 9,552 posts

- 19. Shapen 1,026 posts

- 20. Bronny 7,886 posts

Something went wrong.

Something went wrong.