RyshabTalks

@RyshabTalks

Methodology driven High Growth Investor. My tweets are my opinion, not investment advice.

Portfolio Update as of Oct 10, 2025 🟢 YTD Returns: +85% 🟢 $SPY +12% 🟢 $QQQ +16% 🟢 $IWM +8% $ALAB 12% $TARS 11% $DAVE 10% $RDDT 10% $CRDO 10% $ETON 9% $HIT 9% $CRMD 8% $MDGL 6% $AVDL 5% $HALO 5% $DCTH 4% Cash 1% Portfolio is currently 99% long…

Considering BIG change to portfolio allocation I am starting to like higher beta stocks more than lower beta ones. Think 60+, 80+ beta. But to pivot to this style of investing, I need to keep valuation into mind as when these things turn, the unrealistic valuation businesses,…

How my portfolio generally moves compared to Nasdaq...

Generally, my portfolio goes down 2x Nasdaq move. Not that I did well today but relatively not terrible. With Nasdaq down 3.5% today, I lost 4.9%. Definitely one of the worst days of the year but nowhere near the darkest days of April. When my worst day, for entire portfolio…

Markets ended the day with a waterfall finish. Ended up with 82% YTD returns instead of 85% as earlier reported. This has every look of spilling into next week. Stay nimble.

The only silver lining today is there is a good chance markets close down 2%. Thereby, resetting one of the most extended valuation indicator.

The ultimate level to watch for in Nasdaq $NDX $QQQ is around 22150. That's about 11% from here. Why that level? Because that is the last pivot high. Markets, when they are coming down love two things, moving averages and last pivot highs. Now, markets can bounce right here…

Perfect day to remind all high beta portfolio holders that high beta cuts both ways. Risk management is number one skill to learn.

My Methodology Cheat Sheet 1⃣ Methodology Score above 40 2⃣ NTM Growth above 40% 3⃣ TTM Dilution below 15% 4⃣ TTM Gross Margins above 40% 5⃣ Gross Margins trending higher 6⃣ FCF trending higher 7⃣ Last Quarter Earnings = Beat & Raise 8⃣ Intrinsic Volatility above 50 (avg of 30…

Perspectives! Always look at multiple time frames before making decisions. Here's an example. My conversation with myself... 1⃣ Daily Chart: "Man, this is looking tired. Need to sell" 2⃣ Weekly Chart: "Wow, this looks explosive" 3⃣ Monthly Chart: "Damn, this is just getting…

If what you own shows up in $MEME etf. Oh boy!!! At least there is one place now to know what not to touch 😂

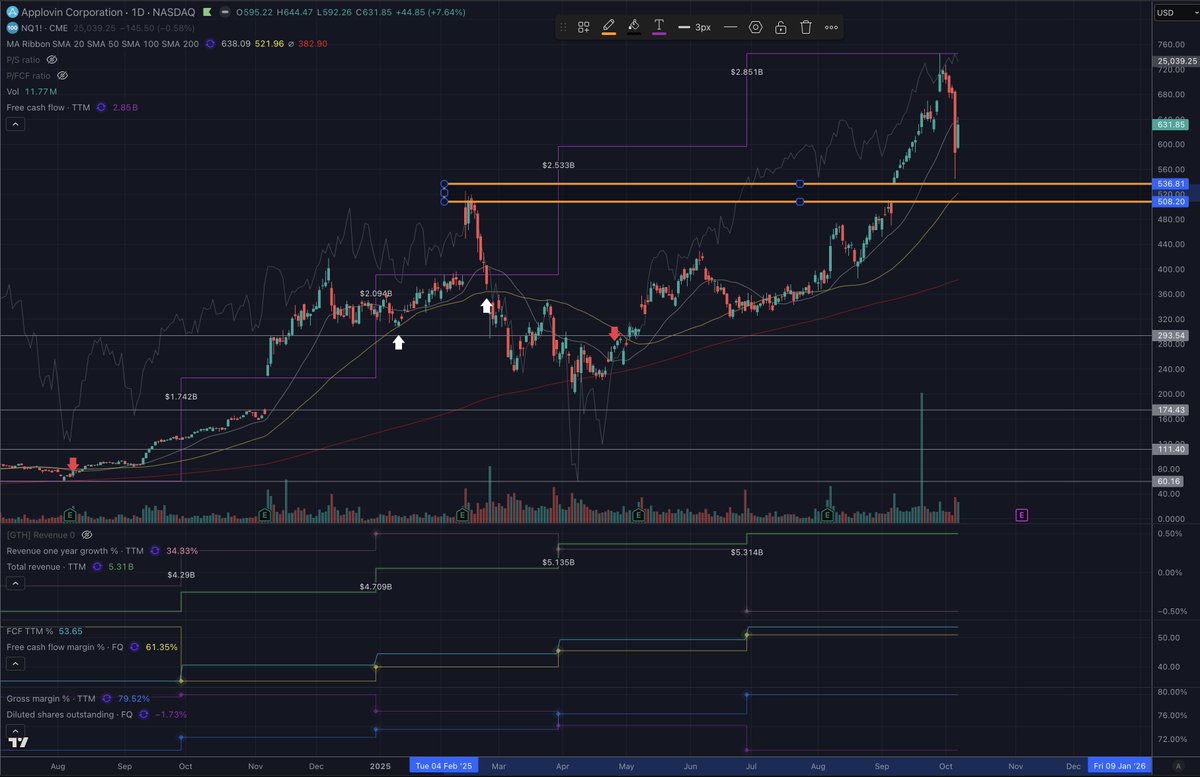

I don't know if $APP will give an entry. But i really like the spot between $520 and $536. Here it is visually. If markets come in here, $APP might do a leg 2 and slow bleed to that area. Let's see.

I did some shopping today. Didn't want to but couple of positions looks attractive. Credo $CRDO and Avadel $AVDL came in to touch their 50 moving averages. For both of them, since the April lows, this is the second hit. So how did I play it? I sold some 40 delta options for…

Here's another reason I think we go higher! All names that looks like they are in a bubble, you know the vertical chart ones, the first step is them crashing as a group and hitting 50 day moving average. Then a rally starts. Everyone on the sidelines that have been waiting for…

Selling some 30 delta puts on $APP tomorrow sounds like a pretty good deal to me. There is nothing like panic driven opportunities.

United States 趨勢

- 1. Auburn 45.4K posts

- 2. Brewers 64.2K posts

- 3. Georgia 67.5K posts

- 4. Cubs 55.7K posts

- 5. Kirby 23.9K posts

- 6. Utah 24.7K posts

- 7. Arizona 41.4K posts

- 8. #byucpl N/A

- 9. Gilligan 5,943 posts

- 10. #AcexRedbull 3,849 posts

- 11. #BYUFootball 1,008 posts

- 12. Michigan 62.6K posts

- 13. Hugh Freeze 3,235 posts

- 14. #Toonami 2,725 posts

- 15. Boots 50K posts

- 16. Amy Poehler 4,489 posts

- 17. Dissidia 5,794 posts

- 18. Wordle 1,576 X N/A

- 19. Kyle Tucker 3,180 posts

- 20. #GoDawgs 5,562 posts

Something went wrong.

Something went wrong.