Uday Tharar

@udaytharar

Vice President at Morgan Stanley Investment Management, Emerging Market Equities

Bunları beğenebilirsin

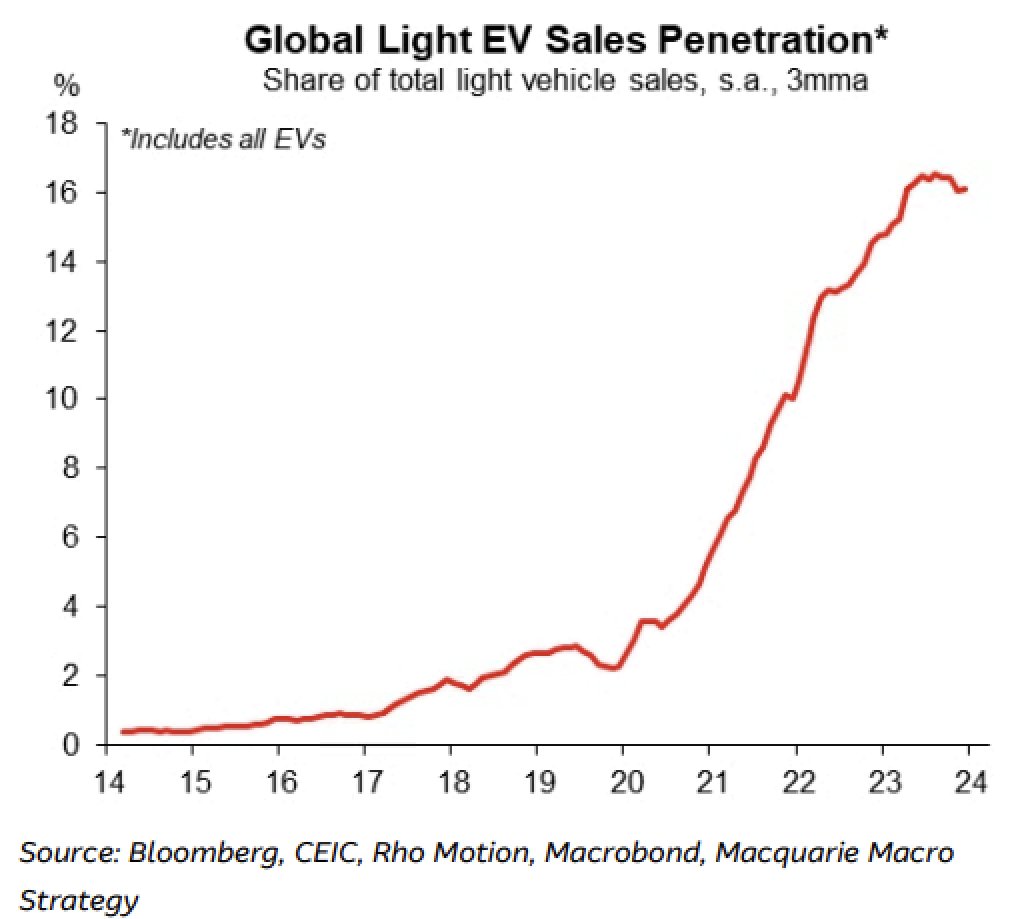

Globally total car sales have had a weak cycle with current sales still 8% below 2017 levels. Non-EV (ICE) car sales are down 25% from 2017 peak. However, EV sales growing at strong pace with global penetration hitting 20%. Led by China at 40%, 25% in Europe and 9% in US.

Total value of equity issuance in India's stock market in the first 6-months of 2024 at $40 billion is already the highest ever. While primary issuance (IPO) is still low, its the block deals and secondary issuances that have sky rocketed.

India today gets included in the JPM Emerging Market Global Bond Index. Foreign inflows of about $25bn (0.6% pf GDP) expected. India's weight to rise by 1%pt each month and capped at 10%. Most EM countries (except China, Indonesia, Mexico) will lose share at India's expense.

The top two telecom players in India that are Jio + Airtel now control 78% of total telecom revenue rising from 43% in FY18. This comes at the loss of Vodafone Idea + Others whose combined share has fallen from 57% in FY18 to just 22% now.

Domestic inflows into India's equity market so far this year have been at a staggering US$ 7 billion per month. Annualised $ 85 billion. This is nearly 2x the previous high seen in 2022 and more than 3x of 2023. Are domestic investors positioning for strong election results?

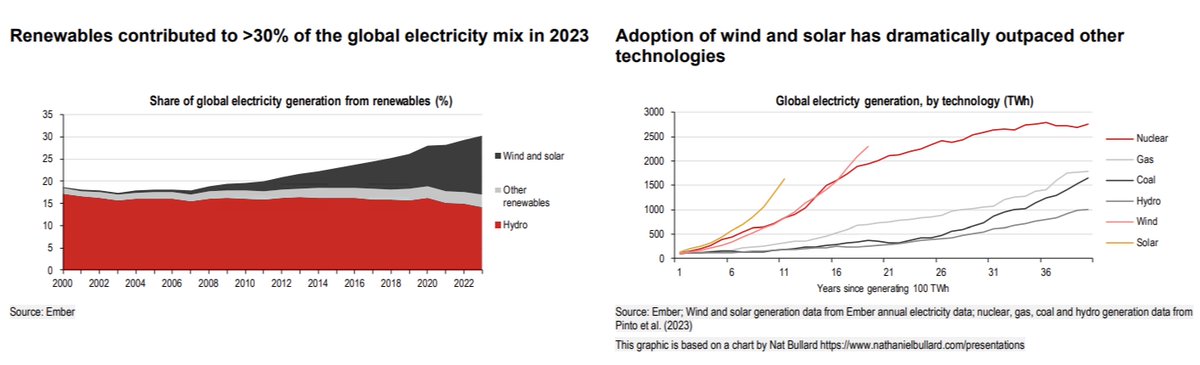

Global share of electricity generation from renewables passed 30% in 2023. Solar + Wind rising from 3% in 2013 to 13% in 2023. Including nuclear the share of zero-carbon electricity is about 40%. Solar has significantly outpaced other technologies in term of speed of adoption.

India has one of the lowest mobile data tariffs globally. Last 5-years have seen only two tariff hikes by Indian telcos despite heavy capex. Post elections telcos are expected to take price hikes of about 20% which would still keep Indian tariffs one of the lowest in the world.

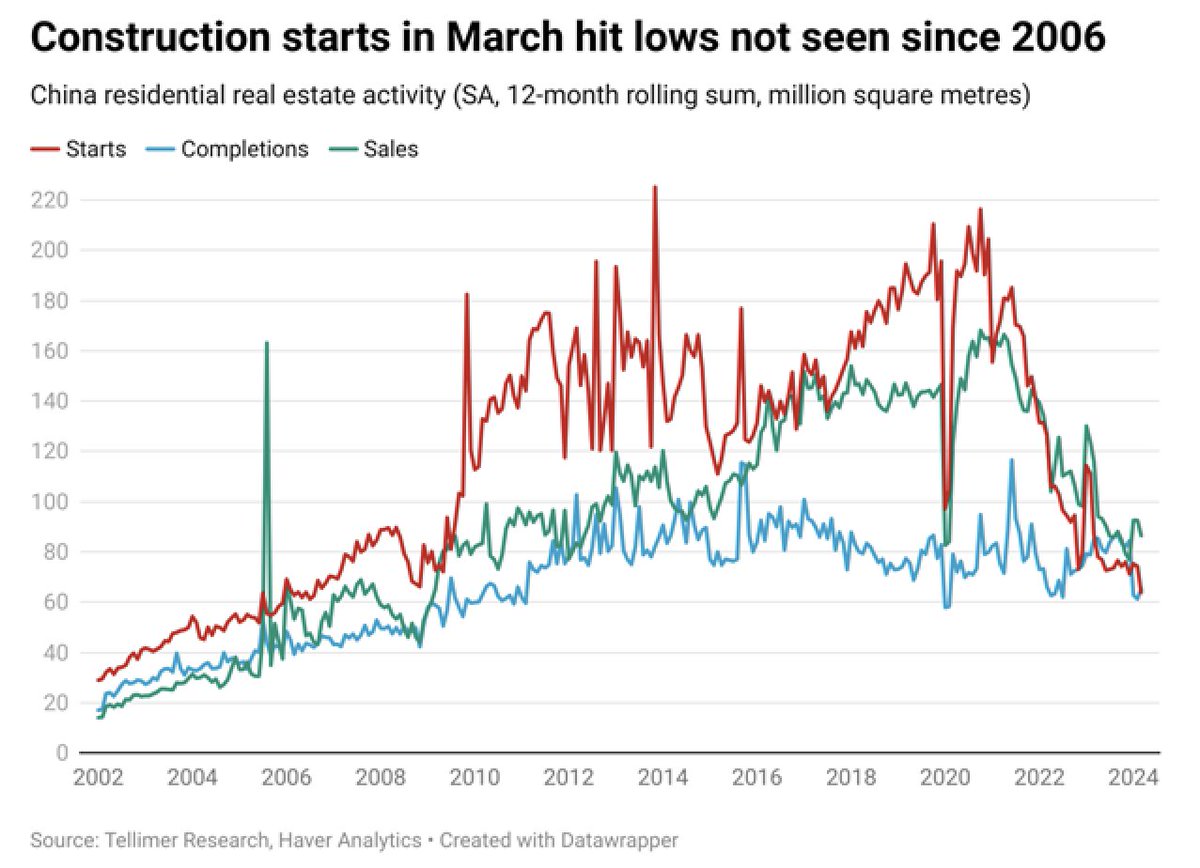

Chinese housing market showing no signs of bottoming. Housing starts hit lows last seen in 2006. Completion and sales at 10-year lows. Construction + Real Estate now accounts for 12.5% of GDP falling from 14.5% of GDP just 3-year back. Will be a large drag on overall GDP growth.

Chinese government started the new energy vehicle (NEV) program in 2009. NEVs are fully or predominantly powered by electricity. Today NEV penetration in China is 42%. A country where annual car sales is around 30 million (7 times of India). Heavy discounts are helping.

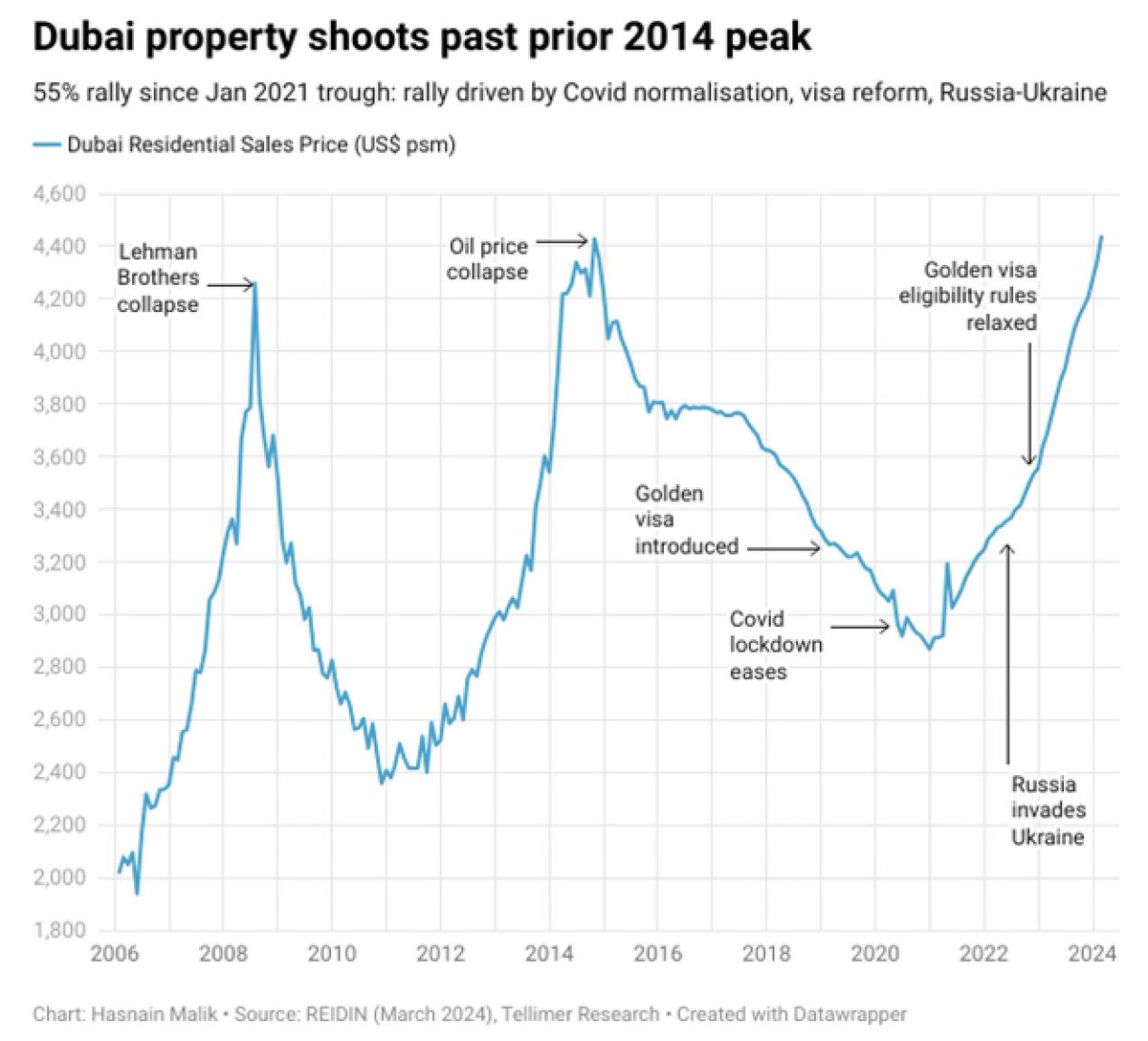

Dubai residential real estate prices are now at all time high. Goes past the peak seen a decade ago. Up 55% since Jan 2021 after Covid lockdowns were eased. A bunch of other factors have also helped with Indians and Russians among foreigners being heavy buyers. Another bubble?

Last 10-years saw global electric vehicle (EV) sales growing at a remarkable 50% CAGR. Rising more than 40-times from 30k in 2014 to 13.5 million in 2023. At a time when global car market was stagnant. As a result, EV share of total has risen from 0.5% in 2014 to 16% in 2023.

United States Trendler

- 1. Branch 37.4K posts

- 2. Chiefs 112K posts

- 3. Red Cross 55.1K posts

- 4. Lions 89.8K posts

- 5. #njkopw 8,890 posts

- 6. Exceeded 5,862 posts

- 7. Binance DEX 5,166 posts

- 8. Mahomes 34.9K posts

- 9. Rod Wave 1,687 posts

- 10. Air Force One 58.3K posts

- 11. #LaGranjaVIP 83.7K posts

- 12. Eitan Mor 18K posts

- 13. #LoveCabin 1,393 posts

- 14. Ziv Berman 21.1K posts

- 15. Alon Ohel 18.5K posts

- 16. #TNABoundForGlory 60.1K posts

- 17. Tel Aviv 60.3K posts

- 18. Matan Angrest 16.6K posts

- 19. Knesset 14.8K posts

- 20. Omri Miran 16.7K posts

Bunları beğenebilirsin

-

Lakshmi Iyer

Lakshmi Iyer

@Lakshmi1876 -

Leading Nowhere

Leading Nowhere

@leading_nowhere -

Tijori

Tijori

@Tijori1 -

Amit Mantri

Amit Mantri

@amitmantri -

Neelkanth Mishra

Neelkanth Mishra

@neelkanthmishra -

Vinayak Chatterjee

Vinayak Chatterjee

@Infra_VinayakCh -

Jatin Khemani, CFA

Jatin Khemani, CFA

@Jatin_Khemani -

Ira Dugal

Ira Dugal

@dugalira -

Vishal Bhargava

Vishal Bhargava

@VishalBhargava5 -

Nimesh Shah

Nimesh Shah

@nimeshscnbc -

Andy Mukherjee

Andy Mukherjee

@andymukherjee70 -

Savi Jain

Savi Jain

@savijain -

Jiten Parmar

Jiten Parmar

@jitenkparmar -

Anisha Jain

Anisha Jain

@_anishaj -

ashish kila

ashish kila

@ashishkila

Something went wrong.

Something went wrong.