You might like

Venezuelan oil production is not quite at its lowest point in a century, but it isn't too far off that level (even while no other country, including Saudi Arabia, has larger proven reserves). (@JavierBlas)

Information technology is now a larger part of the S&P 500 index than it was at the peak of the DotCom bubble, and is more dominant than any other sector in the past half century. (@MikeZaccardi)

Credit card delinquency rates in the US look like they may have peaked for the current cycle, and could be heading back down to less risky levels. Time will tell though, how this trend develops. (@unusual_whales)

Small cap value stocks from markets outside the US have not been this cheap on a relative basis since the very peak of the DotCom era bubble. (@Callum_Thomas)

Deal volumes in the Japanese market have been rising at a very healthy clip for more than a decade now. (@JamieHalse)

The smallest cap US stocks have been under-performing the largest, by a degree and duration this past decade-plus, in a way hardly seen over the last 90 years. (@lhamtil)

US stocks on a combined valuation basis (from P/E, to P/B, to P/S, to EV/EBITDA, and beyond) are now at their most overvalued in over a century. (@joosteninvestor)

The energy sector's weight in the S&P 500 index is now once again nearing its absolute lowest reading in over half a century. (@SoberLook)

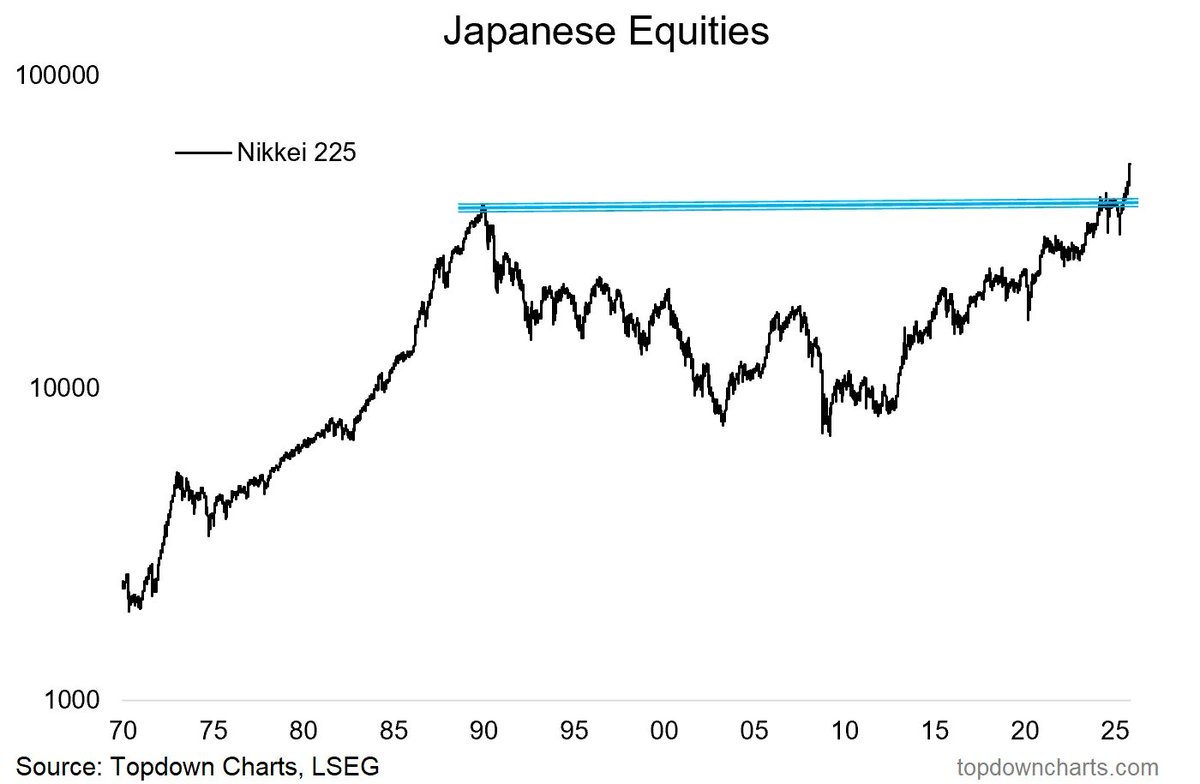

After more than 30 years of brutal consolidation, Japanese equities have now clearly and emphatically broken out to new all-time highs. (@topdowncharts)

Concentration in the S&P 500 across the top 3 holdings is at its highest level in well over forty years. Nvidia, Microsoft, and Apple, are currently closing in on nearly a quarter of the entire index weighting alone. (@PeterMallouk)

The University of Michigan unemployment expectations index is at its highest level in 45 years, a data point that usually coincides with recessionary environments. (@Barchart)

US micro cap stocks haven't been this generally overvalued on a price-to-sales basis since the end of the DotCom bubble, during the late 1990's. (@MikeZaccardi)

Net-nets as a percentage of all Italian stocks are slightly below the mid-point of their historical range. Currently, that means 4 listed firms there meet Graham's criteria. (@DismissedEurope)

According to Fidelity, the US market cycle is currently late stage - while China, the EU, and Canada, are all just beginning theirs. (@MikeZaccardi)

Consumer sentiment is near its lowest reading in over half a century, though traditionally it has not stayed at such depressed levels for long periods. (@valuedontlie)

Starting from the 2007/08 Global Financial Crisis, US households have delevered on a debt-to-assets basis to levels not seen since the 1970s. (@Callum_Thomas)

On a price-to-book basis, the cheapest quartile of S&P 500 stocks trade at slightly above fair value on average - while the most expensive quartile are well beyond overvalued. (@topdowncharts)

On a CAPE ratio basis, the Israeli market currently looks like it trades at a very attractive level compared to all other major markets globally. (@MebFaber)

Of the top 10 most visited websites globally, ChatGPT has seen the greatest increase in visitors these past twelve months - while Bing has seen the largest drop-off. (@Similarweb)

US business bankruptcies have been on an upward trajectory for a few years now, but are currently not at alarming levels when looked at on a historical basis. (@dailychartbook)

United States Trends

- 1. South Carolina 32K posts

- 2. Bama 10.8K posts

- 3. #EubankBenn2 27.8K posts

- 4. Mateer 2,598 posts

- 5. Ty Simpson 2,371 posts

- 6. Texas A&M 31.5K posts

- 7. Oklahoma 19.3K posts

- 8. Arbuckle N/A

- 9. #UFC322 24.9K posts

- 10. Beamer 9,171 posts

- 11. Ryan Williams 1,504 posts

- 12. Camilo 8,553 posts

- 13. Heisman 9,214 posts

- 14. Daniel Hill N/A

- 15. #Sooners 1,593 posts

- 16. Makai Lemon N/A

- 17. Georgia Tech 2,161 posts

- 18. Michigan 43.9K posts

- 19. Aggies 9,225 posts

- 20. #RollTide 2,519 posts

You might like

-

Tilman Versch | Good Investing

Tilman Versch | Good Investing

@goodinvestingc -

Global Value Hunter

Global Value Hunter

@stockjock84 -

David Polansky

David Polansky

@davidhpolansky -

blueflowers

blueflowers

@valuedelay -

Walnut Ave Value

Walnut Ave Value

@walnutavevalue -

Cane Island Digital Research

Cane Island Digital Research

@CaneDigital -

Eric Sprague

Eric Sprague

@ftreric -

David Belson (@[email protected])

David Belson (@[email protected])

@dbelson -

MASi

MASi

@TOWiU2 -

Cashman

Cashman

@thecashman22 -

Jameson

Jameson

@jce05 -

White Fox

White Fox

@dwgg33 -

Sawbuckd

Sawbuckd

@sawbuckd -

Brad Schultz 🇺🇸 🇺🇦

Brad Schultz 🇺🇸 🇺🇦

@BradleyDSchultz -

Giblet Stocks

Giblet Stocks

@GibletStocks

Something went wrong.

Something went wrong.