#capitalstructure search results

1️⃣ Sources of Capital: Debt or Equity? Debt = Loans to the company (bank loan, bonds) paid back with fixed interest. Equity = Ownership shares giving profit stake, no fixed payback.Example: FFGL had $2M debt & $18M equity.#FinanceBasics #CapitalStructure

4️⃣ Why care about Debt : Equity Ratio? It shows a company’s financial health & balance between risk & ownership. Too much debt = higher risk, too much equity = diluted ownership.Example: FFGL’s $2M debt/$18M equity = low leverage, less risk.#CapitalStructure #FinancialEducation

Continuously monitor and manage the debt-to-equity ratio to optimize the capital structure. Balancing debt and equity strategically ensures cost-effective financing for business operations. #DebtEquityRatio #CapitalStructure

📍Excited to introduce Francesco Del Vecchio, our next #EMI Conference 2023 speaker. With 20+ years of expertise in Capital Structure Advisory, he's advised globally on restructurings, financing, and investments. Join us! #EMIConference2023 #CapitalStructure #FinanceExpert

Windsor Machines converts warrants into 26 lakh equity shares at ₹191.85 per share, strengthening its capital structure. A key move for growth. #CorporateAction #CapitalStructure

Profits aren’t enough—how you fund growth defines your company’s strength. From debt vs equity to key ratios, your capital mix can make or break success. 👉 Read more: qapita.com/blog/everythin… #CapitalStructure #StartupFunding #Qapita

qapita.com

What You Need to Know About a Capitalization Structure

This blog covers capitalization structure for Startup Founders, Investors, Advisors, and Financial Analysts.

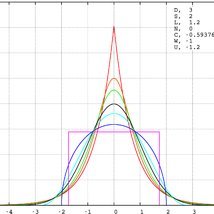

The #WeightedAverageCostOfCapital ( #WACC ) is the average rate a company must pay to all its capital providers weighted by the proportion each source represents in the firm's #CapitalStructure .. More - wp.me/paWI18-dfTE #TermOfTheDay #RequiredRateOfReturn #DiscountRate

Continuously assess and optimize your capital structure. Balancing debt and equity ensures an efficient mix that supports growth while managing financial risk. #CapitalStructure #FinancialManagement #Debt #Equity

A shortening weighted average life and gradual deleveraging benefit the top of the #capitalstructure of European #CLOs outside their reinvestment period, while par losses and refinancing risk pressure the junior notes. Learn more: ow.ly/80y150PzREm

Rollers (of #Bonds) Beware: Not long ago did we hear someone talking about "Higher, Faster and Longer Rates". #CapitalStructure #HighYield

Strong Capital Structure = Investor Confidence. More from CPA Adisa Patricia's insights below. #PKFInsights #CorporateFinance #CapitalStructure pkfea.com/services/corpo…

Scaling Mezzanine Debt Closing Hurdles. shorturl.at/ftmRF #mezzaninedebt #capitalstructure #privateequity #leveragedbuyout #structuredfinance #debtfinancing #corporatefinance #growthcapital #financingsolutions #subordinateddebt

Arre Modi ji aap FM ki book m bhi aa gaye 😭😭. Iska question sir ne bola 100% aayega 😂. Waah Modiji waah #CA #FinancialDecision #CapitalStructure

Mezzanine Debt vs. Senior Debt: How to Strike the Perfect Balance. shorturl.at/jmqM1 #MezzanineDebt #SeniorDebt #CapitalStructure #CorporateFinance #DebtFinancing #InvestmentStrategy #FundingSolutions #PrivateEquity #FinancialPlanning #BusinessGrowth

Assessing business goals and strategy is a crucial first step in developing an optimal capital structure, as it sets the foundation for all subsequent financial decisions. buff.ly/3Tz39Jd via @Dstrategystory #strategy #capitalstructure #finance #leadership

Funding Leveraged Dividends Through Mezzanine Debt Capital #MezzanineDebt #CorporateFinance #CapitalStructure #PrivateEquity #DebtFinancing #BusinessFunding #InvestmentStrategy #LeveragedFinance #StructuredFinance #FinancialLeverage shorturl.at/gtEMO

Regularly review your capital structure to ensure optimal balance. #CapitalStructure #FinancialHealth

Maximize business value with the ideal debt-equity mix! Learn how optimal capital structure fuels growth. 🚀💼 Read more: bit.ly/4duhwpi #CapitalStructure #FinancialPlanning

#SUERFpolicybrief “Inflation, Capital Structure and Firm Value” by @AndreaFabiani89 and Fabio Massimo Piersanti, @bancaditalia tinyurl.com/37tsyt32 #Inflation #CapitalStructure #Leverage #DebtMaturity #StockReturns #HighFrequency

4️⃣ Why care about Debt : Equity Ratio? It shows a company’s financial health & balance between risk & ownership. Too much debt = higher risk, too much equity = diluted ownership.Example: FFGL’s $2M debt/$18M equity = low leverage, less risk.#CapitalStructure #FinancialEducation

1️⃣ Sources of Capital: Debt or Equity? Debt = Loans to the company (bank loan, bonds) paid back with fixed interest. Equity = Ownership shares giving profit stake, no fixed payback.Example: FFGL had $2M debt & $18M equity.#FinanceBasics #CapitalStructure

4️⃣ Why care about Debt : Equity Ratio? It shows a company’s financial health & balance between risk & ownership. Too much debt = higher risk, too much equity = diluted ownership.Example: FFGL’s $2M debt/$18M equity = low leverage, less risk.#CapitalStructure #FinancialEducation

@ProfLowell #Fin2209 A balanced capital structure of about 60% equity and 40% debt gives Eli Lilly flexibility. This is enough leverage to boost returns, but not enough to threaten solvency. ⚖️💵 #CapitalStructure

Windsor Machines converts warrants into 26 lakh equity shares at ₹191.85 per share, strengthening its capital structure. A key move for growth. #CorporateAction #CapitalStructure

OpenAI is broadening the scope of its Stargate initiative and exploring debt issuance to finance chip procurement, reflecting the mounting capital demands of scaling compute. #AIInvestment #ComputeStrategy #CapitalStructure reuters.com/business/media…

reuters.com

OpenAI, under pressure to meet demand, widens scope of Stargate and eyes debt to finance chips

At the White House this year, OpenAI outlined its lofty "Stargate" infrastructure project that would cost half a trillion dollars and be developed with partners including SoftBank and Oracle .

Exactly. “indie” is about independence of capital and decision-making, not aesthetics or headcount. Financing defines control. Without independence from external balance sheets, you’re not indie, you’re corporate. #Markets #CapitalStructure

Profits aren’t enough—how you fund growth defines your company’s strength. From debt vs equity to key ratios, your capital mix can make or break success. 👉 Read more: qapita.com/blog/everythin… #CapitalStructure #StartupFunding #Qapita

qapita.com

What You Need to Know About a Capitalization Structure

This blog covers capitalization structure for Startup Founders, Investors, Advisors, and Financial Analysts.

Debt ladder: revolver → venture debt → term loan—match instrument to risk. #CapitalStructure

The #WeightedAverageCostOfCapital ( #WACC ) is the average rate a company must pay to all its capital providers weighted by the proportion each source represents in the firm's #CapitalStructure .. More - wp.me/paWI18-dfTE #TermOfTheDay #RequiredRateOfReturn #DiscountRate

Alpha Modus (NASDAQ: $AMOD) just delivered a powerful capital restructure: ▶ 4.3M Series C Preferred → 40.11M Class A Common shares ▶ Eliminates ~$41M in mezzanine equity ▶ CEO’s affiliated trust locked up shares until June 13, 2026 #AMOD #CapitalStructure #AI

Equity vs. Debt Capital: Equity = ownership stake Debt = borrowed funds We help you choose the right mix. #FinanceTips #CapitalStructure

Good poll. I’m personally a big fan of #capitalstructure in microcaps. It’s almost always a make or break scenario.

📊 When investing in microcaps, what matters most to you? Let us know if you think there are other important criteria 👇 #MicroCap #SmallCap #SmallCapInvesting #TSXV #CSE

A&M’s Tony Alvarez III #Edcon #ChiefRestructuringOfficer, "Co. not shackled by #CapitalStructure" @IFLR_online #AMon ow.ly/b37w309iggd

Unique Abengoa #restructuring, led and discussed by Tony Alvarez III @GTurnaround #CRO #CapitalStructure #AMon ow.ly/hkvE30akPUh

#capitalstructure is the mix of debt, equity and asset finance that is used to fund a business, and this balance can make a huge difference to the business' sustainability and success buff.ly/2Mc59pA

🔗 lnkd.in/epi-vgJb 📘 Cost of capital and firm value: Evidence from Indonesia 👥 Augustina Kurniasih , Muhamad Rustam , Heliantono , Endri Endri #capitalstructure, #costofdebt, #costofequity , #pulppapercompanies

☑🆕The determinants of capital structure in coal mining industry on the Indonesia Stock Exchange 🔗🔓dx.doi.org/10.21511/imfi.… 👥Sutomo Sutomo, Sugeng Wahyudi, Irene Rini Demi Pangestuti, Harjum Muharam #capitalstructure #coalmining #Indonesia

Capital Structure: What is it and Why it Matters via @QuestFusion ow.ly/iuzr304CjeS #CapitalStructure #Finance #Business

buff.ly/29ZbPj0 #CapitalStructure #Unsurpassed #reader #retailers #toolkitaddict #great #writers #special #…

Can your corporate’s capital structure withstand the next recession? We explore some of the tests that can help corporates evaluate this. Read on for some surprising results! av.sc.com/corp-en/conten… #CapitalStructure #Recession #StandardChartered

#PropertyValue allots the right #capitalstructure when financing #RealEstate Development. buildafrique.com/our-solutions/…

buff.ly/1QDXkOY #CapitalStructure #toolkitreview #Shocked #retweet #Valueadded #Guarantee #GTM #WriterRT #d…

buff.ly/1YMufqZ #CapitalStructure #delightful #Definite #writerlife #helpful #preorder #reviews #Power #Tea…

buff.ly/1U5XaZ1 #CapitalStructure #YouKnowYouAreAWriterWhen #Amazing #Convenient #Results #np #oomf #sharea…

"Stock buybacks continue to be misunderstood." #Competency #CapitalStructure #Equity buff.ly/39kWHf7

A shortening weighted average life and gradual deleveraging benefit the top of the #capitalstructure of European #CLOs outside their reinvestment period, while par losses and refinancing risk pressure the junior notes. Learn more: ow.ly/80y150PzREm

Capital Planning tools are essential when preparing for a capital raise. Most CFO’s and accountants are not familiar with all of the variables involved. #capitalplanning #capitalstructure #funding bit.ly/2zCxIon

Something went wrong.

Something went wrong.

United States Trends

- 1. Packers 98K posts

- 2. Eagles 127K posts

- 3. Jordan Love 15.1K posts

- 4. #WWERaw 131K posts

- 5. LaFleur 14.4K posts

- 6. Benítez 11.6K posts

- 7. AJ Brown 6,962 posts

- 8. Jaelan Phillips 7,877 posts

- 9. Jalen 24K posts

- 10. Patullo 12.3K posts

- 11. Sirianni 5,019 posts

- 12. Smitty 5,514 posts

- 13. McManus 4,370 posts

- 14. Grayson Allen 3,797 posts

- 15. #GoPackGo 7,916 posts

- 16. James Harden 1,831 posts

- 17. Cavs 11.6K posts

- 18. Vit Krejci N/A

- 19. Berkeley 56.6K posts

- 20. Veterans Day 29.9K posts