#creditutilization resultados da pesquisa

💭 Myth: “If I max out my credit card but pay it off, I’m good!” ✅ Fact: Credit doesn’t care about your intentions 😬 — only your utilization. Keep it under 30%, not “I’ll pay it later” levels. 😂 #CreditUtilization #FunnyFinance #CreditHelp #AMarieFinancial

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization #IndiaFinance

A lower utilization ratio demonstrates responsible credit management, making you a more attractive candidate for an auto loan. Read more 👉 lttr.ai/Aivke #CreditUtilization #CreditUtilizationRatio #LearnStrategies

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization

Keep your credit utilization low to maintain a healthy credit score. This is especially important when planning to buy a home. #CreditUtilization

Did you know that your credit utilization rate can be one of the most important factors in your credit score? Keeping your balances below 33% of your total credit limit can help keep your credit score high! #CreditScore #CreditUtilization

📉 A high credit utilization ratio can tank your score. 💳 Keep usage under 30% — 10% is ideal. 🔁 Check it monthly, especially on statement dates, not just due dates! #CreditScore #BadCredit #CreditUtilization #CreditTip

Repayment isn’t the only key to a great credit score—credit utilization plays a major role too! 💳 Keep it low to see your score grow! 🌟 #creditcards #creditutilization #billpayment #repayment #cibilscore #creditscores #bhoolbhulaiyaa

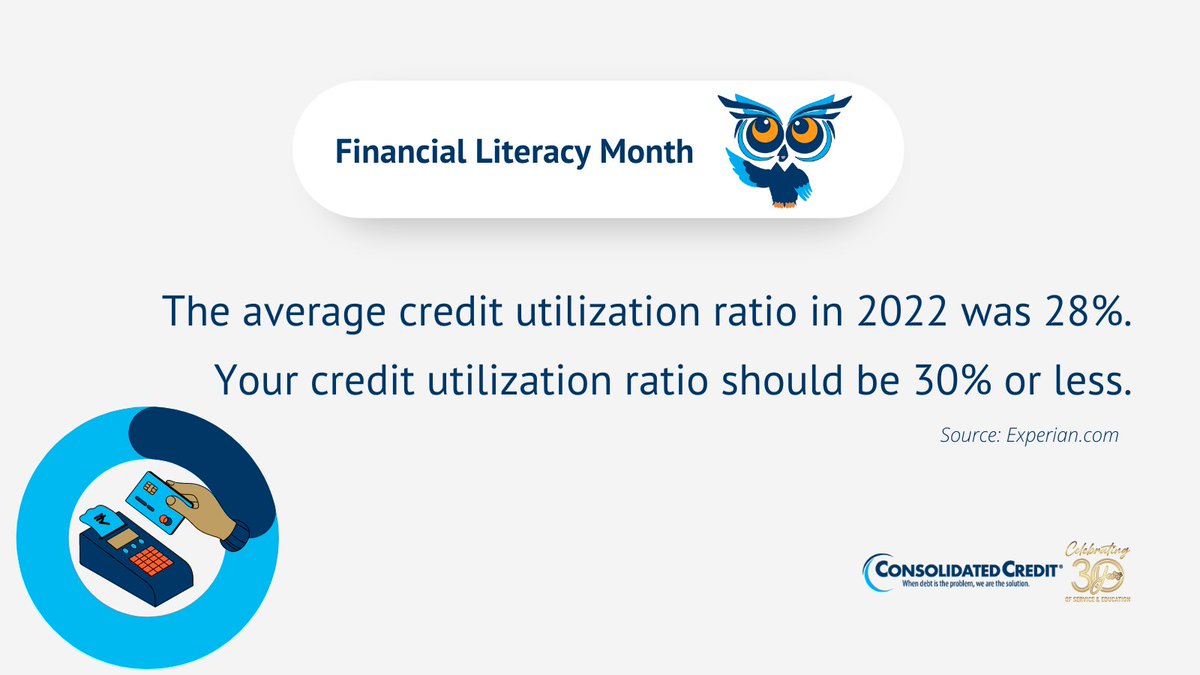

The average American uses 28% of their available credit. Credit utilization is one of the biggest factors in determining a credit score — and keeping it under 30% is generally considered healthy. #CreditUtilization #MoneyStats #FinancialWellness

You’re doing everything right—paying on time, avoiding debt—so why is your credit score still falling? The answer might be hiding in plain sight: credit utilization. #Creditfixrr #CreditUtilization #CreditHacks #FinancialFreedom #CreditScoreTips

'Time' isn't going to improve your #creditscore; it requires intentional effort and consistency. Yes, you need to make responsible financial decisions and take steps like make timely payments, keep #creditutilization low, & monitor your #creditreport for any discrepancies.

Credit Usage Timing Hack 😎 Can you use more than 30% of your credit card 💳 limit without damaging your credit score? Absolutely 👍 if you understand this timing HACK! #creditrepair #millennialmoney #creditutilization #creditcardstrategy #scoredrop #badcredit #highusage

Understanding and managing credit utilization is essential for maintaining a strong credit profile. If you have specific questions or need tailored advice for your financial situation, feel free to ask! 616-800-1017 #credit #creditrepair #creditutilization #credittips

Improve Your Chances of Getting a Credit Limit Increase: The Importance of Credit Utilization Attention #creditutilization #creditlimitincrease #balance #creditscore #financialresponsibility

Learn how to boost your credit score for a successful mortgage approval. Find out how rapid rescore can help improve your credit quickly. #CreditScoreTips #MortgageApproval #CreditUtilization #RapidRescore #CreditRepair #FinancialPlanning #CreditEducation #HomeOwnership

Master Your Credit Utilization: Ideal Limits for Lenders #CreditUtilization #LenderTips #FinancialHealth #CreditScore #LoanApproval #SmartBorrowing #MoneyManagement #PersonalFinance #CreditAdvice #DebtManagement

Keeping your credit card utilization below 30% of your credit limit is generally recommended. High utilization can negatively impact your credit score, especially when applying for a mortgage. #CreditUtilization

🦉#FinancialLiteracyMonth #CreditUtilization is an important indicator of your credit health. This guide will teach you what it is and what you can do to make it better: ow.ly/KuUl50NPVvC #ConsolidatedCredit #CreditCounseling #CreditRating #DebtSucks ☎️ 844-450-1789

Keep your credit utilization below 30% to boost your credit score. Manage your balances wisely! 💳 #CreditUtilization #CreditTips bit.ly/3x7H384

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization

Keep your credit utilization low to maintain a healthy credit score. This is especially important when planning to buy a home. #CreditUtilization

Your Credit Utilization Ratio is a major piece of your credit score puzzle! 🧩 Keep your credit card balances low—ideally under 30% of your limit—to show lenders you're a responsible borrower. #CreditScore #FinancialLiteracy #CreditUtilization #kenstonecapital #kenstone

💭 Myth: “If I max out my credit card but pay it off, I’m good!” ✅ Fact: Credit doesn’t care about your intentions 😬 — only your utilization. Keep it under 30%, not “I’ll pay it later” levels. 😂 #CreditUtilization #FunnyFinance #CreditHelp #AMarieFinancial

How much of your available credit you use matters more than you think. 💡 Keep utilization low to boost your CIBIL score. 👉 creditcares.in/how-credit-uti… #CreditUtilization #CIBILScore #CreditCares #FinanceTips #SmartCredit use

creditcares.in

How Credit Utilization Affects CIBIL Score (2025 Guide)

Learn how credit utilization impacts your CIBIL score and discover effective strategies to maintain an ideal credit utilization ratio for a healthy credit profile.

Keeping your credit card utilization below 30% of your credit limit is generally recommended. High utilization can negatively impact your credit score, especially when applying for a mortgage. #CreditUtilization

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization #IndiaFinance

You Are in Good Hands: wix.to/70X7uQe Imagine being approved for the mortgage you deserve, moving into your dream apartment, or lowering your insurance premiums—all with confidence. ✨ 👉 maximumficoscore.com #creditutilization #removecollections #maximumficoscore

maximumficoscore.com

Maximum FICO Score Bakersfield | Maximum Fico Score

Achieve your maximum FICO score in Bakersfield with Maximum Fico Score. Start your path to financial freedom today with expert credit repair services.

A lower utilization ratio demonstrates responsible credit management, making you a more attractive candidate for an auto loan. Read more 👉 lttr.ai/Aivke #CreditUtilization #CreditUtilizationRatio #LearnStrategies

The average American uses 28% of their available credit. Credit utilization is one of the biggest factors in determining a credit score — and keeping it under 30% is generally considered healthy. #CreditUtilization #MoneyStats #FinancialWellness

Questions about credit card utilization are a frequent top item on Reddit. Keeping your score high is crucial, and repairing past mistakes is the first step. #CreditCards #CreditUtilization #FinancialHealth beacons.ai/tendollarcredi…

beacons.ai

tendollarcreditrepair - Link in Bio & Creator Tools | Beacons

@tendollarcreditrepair | Check out my links to (MyScoreIQ, TikTok, Instagram). Subscribe to my email list.Shop my products (Ten Dollar Credit Repair Ultra Edition Volume 2).

2/6 क्रेडिट लिमिट का सही चुनाव करें। अधिक लिमिट से खर्च बढ़ सकता है, कम लिमिट से जरूरी खरीद में परेशानी। 30% से कम उपयोगिता बनाए रखें—यह आपके क्रेडिट स्कोर को मजबूत करता है। #CreditUtilization #FinancialDiscipline

Maxed-out cards? 😣 Your utilization rate drastically impacts your score. Good news? It’s fixable — fast. 📩 We’ll guide you. #CreditUtilization #CreditRepair #BoostYourScore #SmartCredit #CanadianLending #SunMicroFinancial

Understanding #CreditUtilization: A Quick Guide!🎥 Have you ever wondered how your credit utilization affects your score? 🤔 In this video, we break down the impact of high credit utilization. Tune in for tips to boost your #creditscore and manage your accounts smarter! 📈

Credit utilization – the amount of credit you're using vs. your total available credit – also plays a big role! Keep it low for a healthy score. #CreditUtilization #MSIEducation

Credit utilization plays a significant role in your credit score. Keep your credit card balances low, especially in the months leading up to a mortgage application. #CreditUtilization

💳 Keep credit card balances below 30% of your limit to improve your utilization rate! The Best Credit Repair Business and Credit Training: myepiccredit.com 🧠 Smart spending habits rebuild trust fast. #CreditUtilization #SmartCredit #RepairTips #EpicCredit

Curious about how credit utilization affects your score? 📊✨ Discover the secrets to mastering your credit with our latest video! Unlock your potential for a stronger financial future today! 💪 #CreditUtilization

A lower utilization ratio demonstrates responsible credit management, making you a more attractive candidate for an auto loan. Read more 👉 lttr.ai/Aivke #CreditUtilization #CreditUtilizationRatio #LearnStrategies

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization #IndiaFinance

Turning your dreams of homeownership into reality can also come with an added benefit - improved credit utilization and higher credit scores! 💰#creditutilization #creditscore

💳 High Credit Utilization = Lower Scores 📉 Keep it below 30% to boost your credit! #CreditTips #CreditUtilization #BetterScores #iCreditworx #CreditEducation #CreditScore

Your Credit Utilization Ratio is a major piece of your credit score puzzle! 🧩 Keep your credit card balances low—ideally under 30% of your limit—to show lenders you're a responsible borrower. #CreditScore #FinancialLiteracy #CreditUtilization #kenstonecapital #kenstone

Did you know that your credit utilization rate can be one of the most important factors in your credit score? Keeping your balances below 33% of your total credit limit can help keep your credit score high! #CreditScore #CreditUtilization

The average American uses 28% of their available credit. Credit utilization is one of the biggest factors in determining a credit score — and keeping it under 30% is generally considered healthy. #CreditUtilization #MoneyStats #FinancialWellness

The 30% rule is not a specific target but a maximum limit. Exceeding the 30% credit utilization ratio will most likely hurt your credit score. In other words, the lower an individual’s utilization ratio, the better it is from a scoring standpoint. #CreditUtilization

Let's start rebuilding your credit, one step at a time! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

Always ready to gain new clients! Set up your consultation today. #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

🦉#FinancialLiteracyMonth #CreditUtilization is an important indicator of your credit health. This guide will teach you what it is and what you can do to make it better: ow.ly/KuUl50NPVvC #ConsolidatedCredit #CreditCounseling #CreditRating #DebtSucks ☎️ 844-450-1789

Knowing your #Net30 vendor's reporting schedule can enhance your financial management. Inquire about when they close credit reports to pay down balances beforehand, lowering #CreditUtilization & boosting your score. Frequency varies by vendor; at Growegy, we report monthly.🗓️

'Time' isn't going to improve your #creditscore; it requires intentional effort and consistency. Yes, you need to make responsible financial decisions and take steps like make timely payments, keep #creditutilization low, & monitor your #creditreport for any discrepancies.

After reviewing your debt report, we can compare and dispute inaccurate reports! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #smartcredit

Boost your credit score by keeping your credit utilization ratio below 30%. It shows lenders that youre responsible with credit and can improve your chances of approval for loans and credit cards. #CreditTips #CreditUtilization #lenders #americanexpress #loan #creditcard

There's nothing better than ending the year with a great credit score. It's never too late to start! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

Programa tu cita con nosotros para comenzar tu viaje hacia la libertad financiera hoy! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

Wishing you all happy holidays from our company to yours! Stay warm and cozy, and enjoy every festive moment! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

There are many myths surrounding the credit repair industry, so make sure you use reliable sources to check your credit. #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #smartcredit

Something went wrong.

Something went wrong.

United States Trends

- 1. Eagles 145K posts

- 2. Lions 73.6K posts

- 3. Goff 15.6K posts

- 4. Dan Campbell 8,933 posts

- 5. Jalen 29.7K posts

- 6. Gibbs 7,207 posts

- 7. Chiefs 88.3K posts

- 8. #OnePride 5,013 posts

- 9. AJ Brown 7,404 posts

- 10. Nakobe Dean 1,328 posts

- 11. Broncos 64.3K posts

- 12. Kevin Patullo 5,290 posts

- 13. Adoree Jackson 1,999 posts

- 14. Collinsworth 2,175 posts

- 15. #DETvsPHI 3,194 posts

- 16. Vic Fangio 2,473 posts

- 17. Shedeur 51.2K posts

- 18. Jamo 4,211 posts

- 19. Sirianni 3,196 posts

- 20. NFC North 3,970 posts