#creditutilization search results

💭 Myth: “If I max out my credit card but pay it off, I’m good!” ✅ Fact: Credit doesn’t care about your intentions 😬 — only your utilization. Keep it under 30%, not “I’ll pay it later” levels. 😂 #CreditUtilization #FunnyFinance #CreditHelp #AMarieFinancial

A lower utilization ratio demonstrates responsible credit management, making you a more attractive candidate for an auto loan. Read more 👉 lttr.ai/Aivke #CreditUtilization #CreditUtilizationRatio #LearnStrategies

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization

Keep your credit utilization low to maintain a healthy credit score. This is especially important when planning to buy a home. #CreditUtilization

Did you know that your credit utilization rate can be one of the most important factors in your credit score? Keeping your balances below 33% of your total credit limit can help keep your credit score high! #CreditScore #CreditUtilization

Repayment isn’t the only key to a great credit score—credit utilization plays a major role too! 💳 Keep it low to see your score grow! 🌟 #creditcards #creditutilization #billpayment #repayment #cibilscore #creditscores #bhoolbhulaiyaa

📉 A high credit utilization ratio can tank your score. 💳 Keep usage under 30% — 10% is ideal. 🔁 Check it monthly, especially on statement dates, not just due dates! #CreditScore #BadCredit #CreditUtilization #CreditTip

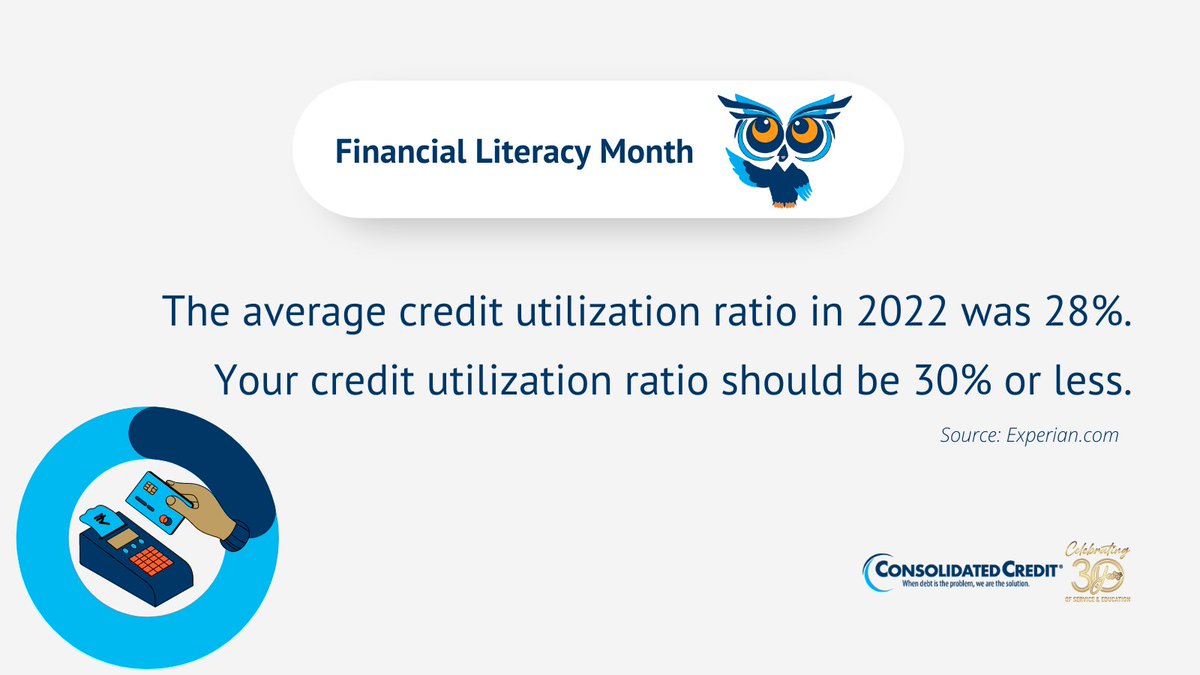

The average American uses 28% of their available credit. Credit utilization is one of the biggest factors in determining a credit score — and keeping it under 30% is generally considered healthy. #CreditUtilization #MoneyStats #FinancialWellness

You’re doing everything right—paying on time, avoiding debt—so why is your credit score still falling? The answer might be hiding in plain sight: credit utilization. #Creditfixrr #CreditUtilization #CreditHacks #FinancialFreedom #CreditScoreTips

'Time' isn't going to improve your #creditscore; it requires intentional effort and consistency. Yes, you need to make responsible financial decisions and take steps like make timely payments, keep #creditutilization low, & monitor your #creditreport for any discrepancies.

Credit Usage Timing Hack 😎 Can you use more than 30% of your credit card 💳 limit without damaging your credit score? Absolutely 👍 if you understand this timing HACK! #creditrepair #millennialmoney #creditutilization #creditcardstrategy #scoredrop #badcredit #highusage

Understanding and managing credit utilization is essential for maintaining a strong credit profile. If you have specific questions or need tailored advice for your financial situation, feel free to ask! 616-800-1017 #credit #creditrepair #creditutilization #credittips

Improve Your Chances of Getting a Credit Limit Increase: The Importance of Credit Utilization Attention #creditutilization #creditlimitincrease #balance #creditscore #financialresponsibility

Learn how to boost your credit score for a successful mortgage approval. Find out how rapid rescore can help improve your credit quickly. #CreditScoreTips #MortgageApproval #CreditUtilization #RapidRescore #CreditRepair #FinancialPlanning #CreditEducation #HomeOwnership

Master Your Credit Utilization: Ideal Limits for Lenders #CreditUtilization #LenderTips #FinancialHealth #CreditScore #LoanApproval #SmartBorrowing #MoneyManagement #PersonalFinance #CreditAdvice #DebtManagement

Keeping your credit card utilization below 30% of your credit limit is generally recommended. High utilization can negatively impact your credit score, especially when applying for a mortgage. #CreditUtilization

Keep your credit utilization below 30% to boost your credit score. Manage your balances wisely! 💳 #CreditUtilization #CreditTips bit.ly/3x7H384

🦉#FinancialLiteracyMonth #CreditUtilization is an important indicator of your credit health. This guide will teach you what it is and what you can do to make it better: ow.ly/KuUl50NPVvC #ConsolidatedCredit #CreditCounseling #CreditRating #DebtSucks ☎️ 844-450-1789

𝐅𝐨𝐥𝐥𝐨𝐰 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐭𝐢𝐩𝐬 👇 When it Comes to Credit, ChatGPT is Wrong: youtu.be/zVlec8dkqO4?fe… Mastering Your Credit: The 1-5% Rule for Optimal Scores! youtu.be/VXsnNbGjeBM?fe… #CreditScore #CreditBuilding #CreditUtilization #FICOScore

Check your credit report regularly to stay informed and catch errors early. Get a free report annually from each major bureau. Make it a habit and protect your financial health. #CreditUtilization #FinancialTips #CreditRepair #CreditRepair #FinancialFreedom #CreditScore #DebtFree

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization

Keep your credit utilization low to maintain a healthy credit score. This is especially important when planning to buy a home. #CreditUtilization

Your Credit Utilization Ratio is a major piece of your credit score puzzle! 🧩 Keep your credit card balances low—ideally under 30% of your limit—to show lenders you're a responsible borrower. #CreditScore #FinancialLiteracy #CreditUtilization #kenstonecapital #kenstone

💭 Myth: “If I max out my credit card but pay it off, I’m good!” ✅ Fact: Credit doesn’t care about your intentions 😬 — only your utilization. Keep it under 30%, not “I’ll pay it later” levels. 😂 #CreditUtilization #FunnyFinance #CreditHelp #AMarieFinancial

How much of your available credit you use matters more than you think. 💡 Keep utilization low to boost your CIBIL score. 👉 creditcares.in/how-credit-uti… #CreditUtilization #CIBILScore #CreditCares #FinanceTips #SmartCredit use

Keeping your credit card utilization below 30% of your credit limit is generally recommended. High utilization can negatively impact your credit score, especially when applying for a mortgage. #CreditUtilization

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization #IndiaFinance

You Are in Good Hands: wix.to/70X7uQe Imagine being approved for the mortgage you deserve, moving into your dream apartment, or lowering your insurance premiums—all with confidence. ✨ 👉 maximumficoscore.com #creditutilization #removecollections #maximumficoscore

A lower utilization ratio demonstrates responsible credit management, making you a more attractive candidate for an auto loan. Read more 👉 lttr.ai/Aivke #CreditUtilization #CreditUtilizationRatio #LearnStrategies

The average American uses 28% of their available credit. Credit utilization is one of the biggest factors in determining a credit score — and keeping it under 30% is generally considered healthy. #CreditUtilization #MoneyStats #FinancialWellness

Questions about credit card utilization are a frequent top item on Reddit. Keeping your score high is crucial, and repairing past mistakes is the first step. #CreditCards #CreditUtilization #FinancialHealth beacons.ai/tendollarcredi…

2/6 क्रेडिट लिमिट का सही चुनाव करें। अधिक लिमिट से खर्च बढ़ सकता है, कम लिमिट से जरूरी खरीद में परेशानी। 30% से कम उपयोगिता बनाए रखें—यह आपके क्रेडिट स्कोर को मजबूत करता है। #CreditUtilization #FinancialDiscipline

Maxed-out cards? 😣 Your utilization rate drastically impacts your score. Good news? It’s fixable — fast. 📩 We’ll guide you. #CreditUtilization #CreditRepair #BoostYourScore #SmartCredit #CanadianLending #SunMicroFinancial

Understanding #CreditUtilization: A Quick Guide!🎥 Have you ever wondered how your credit utilization affects your score? 🤔 In this video, we break down the impact of high credit utilization. Tune in for tips to boost your #creditscore and manage your accounts smarter! 📈

Credit utilization – the amount of credit you're using vs. your total available credit – also plays a big role! Keep it low for a healthy score. #CreditUtilization #MSIEducation

Credit utilization plays a significant role in your credit score. Keep your credit card balances low, especially in the months leading up to a mortgage application. #CreditUtilization

💳 Keep credit card balances below 30% of your limit to improve your utilization rate! The Best Credit Repair Business and Credit Training: myepiccredit.com 🧠 Smart spending habits rebuild trust fast. #CreditUtilization #SmartCredit #RepairTips #EpicCredit

Curious about how credit utilization affects your score? 📊✨ Discover the secrets to mastering your credit with our latest video! Unlock your potential for a stronger financial future today! 💪 #CreditUtilization

A lower utilization ratio demonstrates responsible credit management, making you a more attractive candidate for an auto loan. Read more 👉 lttr.ai/Aivke #CreditUtilization #CreditUtilizationRatio #LearnStrategies

🔑 #CreditScoreTip: Maintain a low credit utilization ratio (below 30%) for a better score! #CreditScoreTips #CreditUtilization #IndiaFinance

Turning your dreams of homeownership into reality can also come with an added benefit - improved credit utilization and higher credit scores! 💰#creditutilization #creditscore

Your Credit Utilization Ratio is a major piece of your credit score puzzle! 🧩 Keep your credit card balances low—ideally under 30% of your limit—to show lenders you're a responsible borrower. #CreditScore #FinancialLiteracy #CreditUtilization #kenstonecapital #kenstone

💳 High Credit Utilization = Lower Scores 📉 Keep it below 30% to boost your credit! #CreditTips #CreditUtilization #BetterScores #iCreditworx #CreditEducation #CreditScore

Did you know that your credit utilization rate can be one of the most important factors in your credit score? Keeping your balances below 33% of your total credit limit can help keep your credit score high! #CreditScore #CreditUtilization

The average American uses 28% of their available credit. Credit utilization is one of the biggest factors in determining a credit score — and keeping it under 30% is generally considered healthy. #CreditUtilization #MoneyStats #FinancialWellness

The 30% rule is not a specific target but a maximum limit. Exceeding the 30% credit utilization ratio will most likely hurt your credit score. In other words, the lower an individual’s utilization ratio, the better it is from a scoring standpoint. #CreditUtilization

Let's start rebuilding your credit, one step at a time! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

Always ready to gain new clients! Set up your consultation today. #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

Knowing your #Net30 vendor's reporting schedule can enhance your financial management. Inquire about when they close credit reports to pay down balances beforehand, lowering #CreditUtilization & boosting your score. Frequency varies by vendor; at Growegy, we report monthly.🗓️

After reviewing your debt report, we can compare and dispute inaccurate reports! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #smartcredit

Boost your credit score by keeping your credit utilization ratio below 30%. It shows lenders that youre responsible with credit and can improve your chances of approval for loans and credit cards. #CreditTips #CreditUtilization #lenders #americanexpress #loan #creditcard

'Time' isn't going to improve your #creditscore; it requires intentional effort and consistency. Yes, you need to make responsible financial decisions and take steps like make timely payments, keep #creditutilization low, & monitor your #creditreport for any discrepancies.

There's nothing better than ending the year with a great credit score. It's never too late to start! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

🦉#FinancialLiteracyMonth #CreditUtilization is an important indicator of your credit health. This guide will teach you what it is and what you can do to make it better: ow.ly/KuUl50NPVvC #ConsolidatedCredit #CreditCounseling #CreditRating #DebtSucks ☎️ 844-450-1789

Programa tu cita con nosotros para comenzar tu viaje hacia la libertad financiera hoy! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

Wishing you all happy holidays from our company to yours! Stay warm and cozy, and enjoy every festive moment! #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #SmartCredit

There are many myths surrounding the credit repair industry, so make sure you use reliable sources to check your credit. #CreditScore #CreditTips #CreditUtilization #FinancialHealth #CreditManagement #BuildCredit #CreditAwareness #CreditRepair #CreditGoals #smartcredit

Something went wrong.

Something went wrong.

United States Trends

- 1. #FaithFreedomNigeria N/A

- 2. Good Wednesday 25.5K posts

- 3. #hazbinhotelseason2 77.4K posts

- 4. Hump Day 9,980 posts

- 5. #wednesdaymotivation 5,617 posts

- 6. Peggy 22.2K posts

- 7. Happy Hump 6,344 posts

- 8. #Wednesdayvibe 1,725 posts

- 9. For God 213K posts

- 10. Dearborn 276K posts

- 11. #InternationalMensDay 32.4K posts

- 12. Abel 15.7K posts

- 13. Cory Mills 12.9K posts

- 14. Gettysburg Address N/A

- 15. Kwara 205K posts

- 16. LeBron 94.4K posts

- 17. Tinubu 169K posts

- 18. Grayson 7,580 posts

- 19. Nigerians 149K posts

- 20. Baxter 2,977 posts