#cyclicalsectors search results

Why do we favor #RiskAssets and #CyclicalSectors, and what can investors learn from past economic cycles? More in this week’s chart. on.wf.com/6010yqXBM

Maybe 4 years until the next bus... Maybe longer. Maybe shorter. #CyclicalSectors

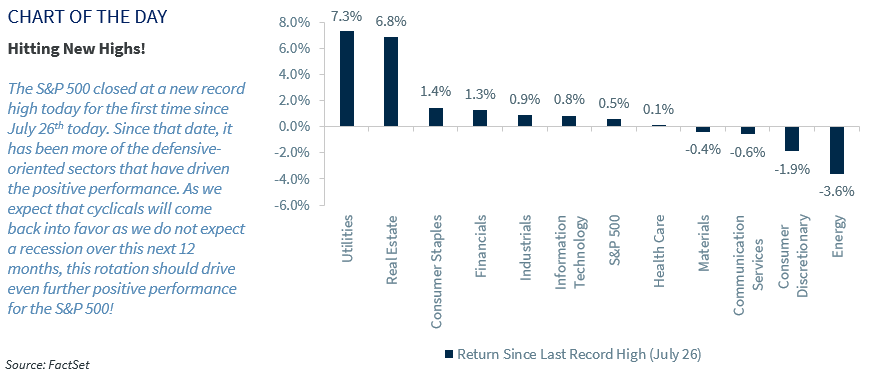

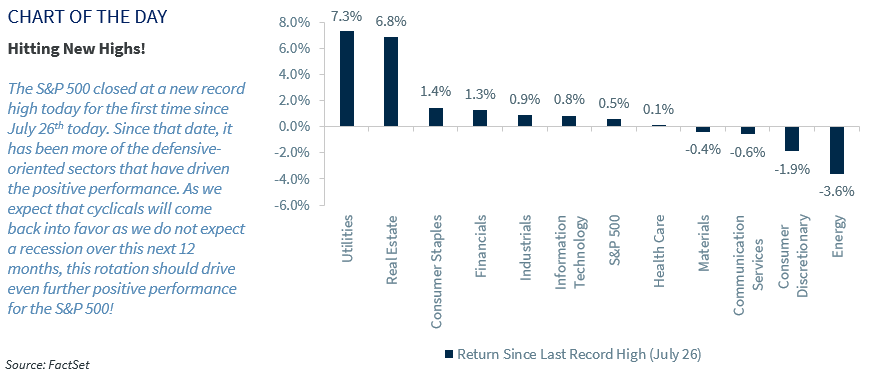

Congratulations on the new record high for the #SP500! Driving the positive performance on this leg has been the defensive-oriented sectors. A rotation back into our favored #cyclicalsectors should continue to propel #equityprices higher!

4Q19 Beating Expectations! With ~70% of the #SP500 market cap having reported, consensus S&P 500 4Q19 #EPS forecasts are currently reflecting ~+1.0% YoY EPS growth (should ultimately end up at ~+2.0% YoY). Select #cyclicalsectors are seeing the largest aggregate EPS beats.

Yardeni: "Defensive sectors of the S&P 1500 have outperformed cyclical sectors through February. LargeCaps have also outperformed SmallCaps and MidCaps this year." #SP1500 #DefensiveSectors #CyclicalSectors #LargeCaps #SmallCaps #StockMarket

#Cyclicalsectors outperform #Defensivesectors registering a fresh 4 year high on ratio chart. #Riskon approach continues. #EdelweissDailyResearchUpdates

"Consumer-related and other #CyclicalSectors will benefit from the unleashing of pent-up demand as the economy reopens; among them, small companies as the operational leverage will be much more significant." – César Pérez Ruiz, @PictetWM

...History shows that if a portfolio invested in #cyclicalsectors frm Nov-Apr & then #defensivegroups frm May-Oct recorded CAGRs that outpaced their benchmarks by nearly 600 basis pts, & did so 3 out of every 4yrs. This strategy worked even in bear mrkts & pres election yrs.

Cyclical sectors का जब बुरा वक्त चल रहा हो net profit नेगेटिव मे हो तब उसको buy करना चाहिए और जब सब चीजे positive हो जाए तब उसको sell करना चाहिए Cyclical sectors मे ट्रेड करने का best और simple यही तरीका है #Cyclicalsectors #trader #investor #sharemarketnews

U.S. sector rotation is in full swing, w/investors rotating out of #DefensiveGroups & towards some of the #CyclicalSectors. #ConsumerDiscretionary #Financials & #Industrials groups are now in the lead, while #CommunicationServices #RealEstate groups cont to struggle.

📈#CyclicalSectors have outperformed over the last month, and we had a look at why that’s the case 📉#NaturalGas prices in #Europe have plunged since August, despite the start of winter and more reductions in supply from Russia simplywall.st/article/cyclic…

It is recommended to favor growth and #cyclicalsectors over #defensivegroups. To learn more, join @cfraresearch's webinar Hike, Skip, and a Jump; my colleague @CMTRandazzo & I will evaluate the headwinds & tailwinds facing equity investors today. bit.ly/3phgr0s

Defensive stocks on the other hand are low beta stocks which have a lower correlation with business cycle and are generally more stable. So which are these sectors? Take a look... #stockmarkets #cyclicalsectors #defensivesectors #sectors #investment #diversification #portfolio

In managing employees during demand’s ups and downs, their welfare must be put as number one priority. Here are several things you can do to better lead the workforce in the face of fluctuating demand: bit.ly/3icw3MH #cyclicalsectors #seasonalsectors #hospitality

...As a result of this year's predictions, @cfraresearch recommends a neutral allocation to #equities and #fixedincome. Finally, we currently lean toward the #cyclicalsectors and favor higher-quality equities that offer growth at a reasonable price.

S&P 500 futures closed last week at the worst closing price since June, but the index futures are attempting to rebound this morning trading around the 4,371 level. #Defensivesectors continue to outperform #cyclicalsectors. Find out more here: spr.ly/6014uDxNm #trading

This indicates a possible earnings #slowdown for India Inc. Pumped-up earnings post-pandemic were driven by #cyclicalsectors like #mining & #metal, #oil & #gas, and #banks & financial firms. The fading windfalls are driving the pressure on overall #corporateearnings. (5/7)

CFRA Chief Investment Strategist @StovallCFRA joined @CNNBusiness on how to position your portfolio. Watch the replay below. #phaseone #postiveinflation #cyclicalsectors $XLB $XLRE cnn.it/2NAcWw9

Yardeni: "Defensive sectors of the S&P 1500 have outperformed cyclical sectors through February. LargeCaps have also outperformed SmallCaps and MidCaps this year." #SP1500 #DefensiveSectors #CyclicalSectors #LargeCaps #SmallCaps #StockMarket

Maybe 4 years until the next bus... Maybe longer. Maybe shorter. #CyclicalSectors

Cyclical sectors का जब बुरा वक्त चल रहा हो net profit नेगेटिव मे हो तब उसको buy करना चाहिए और जब सब चीजे positive हो जाए तब उसको sell करना चाहिए Cyclical sectors मे ट्रेड करने का best और simple यही तरीका है #Cyclicalsectors #trader #investor #sharemarketnews

S&P 500 futures closed last week at the worst closing price since June, but the index futures are attempting to rebound this morning trading around the 4,371 level. #Defensivesectors continue to outperform #cyclicalsectors. Find out more here: spr.ly/6014uDxNm #trading

It is recommended to favor growth and #cyclicalsectors over #defensivegroups. To learn more, join @cfraresearch's webinar Hike, Skip, and a Jump; my colleague @CMTRandazzo & I will evaluate the headwinds & tailwinds facing equity investors today. bit.ly/3phgr0s

U.S. sector rotation is in full swing, w/investors rotating out of #DefensiveGroups & towards some of the #CyclicalSectors. #ConsumerDiscretionary #Financials & #Industrials groups are now in the lead, while #CommunicationServices #RealEstate groups cont to struggle.

📈#CyclicalSectors have outperformed over the last month, and we had a look at why that’s the case 📉#NaturalGas prices in #Europe have plunged since August, despite the start of winter and more reductions in supply from Russia simplywall.st/article/cyclic…

Defensive stocks on the other hand are low beta stocks which have a lower correlation with business cycle and are generally more stable. So which are these sectors? Take a look... #stockmarkets #cyclicalsectors #defensivesectors #sectors #investment #diversification #portfolio

This indicates a possible earnings #slowdown for India Inc. Pumped-up earnings post-pandemic were driven by #cyclicalsectors like #mining & #metal, #oil & #gas, and #banks & financial firms. The fading windfalls are driving the pressure on overall #corporateearnings. (5/7)

#Cyclicalsectors outperform #Defensivesectors registering a fresh 4 year high on ratio chart. #Riskon approach continues. #EdelweissDailyResearchUpdates

Maybe 4 years until the next bus... Maybe longer. Maybe shorter. #CyclicalSectors

Congratulations on the new record high for the #SP500! Driving the positive performance on this leg has been the defensive-oriented sectors. A rotation back into our favored #cyclicalsectors should continue to propel #equityprices higher!

4Q19 Beating Expectations! With ~70% of the #SP500 market cap having reported, consensus S&P 500 4Q19 #EPS forecasts are currently reflecting ~+1.0% YoY EPS growth (should ultimately end up at ~+2.0% YoY). Select #cyclicalsectors are seeing the largest aggregate EPS beats.

Yardeni: "Defensive sectors of the S&P 1500 have outperformed cyclical sectors through February. LargeCaps have also outperformed SmallCaps and MidCaps this year." #SP1500 #DefensiveSectors #CyclicalSectors #LargeCaps #SmallCaps #StockMarket

#Cyclicalsectors outperform #Defensivesectors registering a fresh 4 year high on ratio chart. #Riskon approach continues. #EdelweissDailyResearchUpdates

Something went wrong.

Something went wrong.

United States Trends

- 1. Sonny Gray 6,904 posts

- 2. Dick Fitts N/A

- 3. Red Sox 6,900 posts

- 4. Godzilla 20.1K posts

- 5. Rush Hour 4 6,084 posts

- 6. #yummymeets N/A

- 7. National Treasure 5,152 posts

- 8. Raising Arizona N/A

- 9. Clarke 6,355 posts

- 10. Gone in 60 1,876 posts

- 11. Happy Thanksgiving 21.1K posts

- 12. Giolito N/A

- 13. 50 Cent 3,660 posts

- 14. Thankful 51.1K posts

- 15. #GMMTV2026 4.2M posts

- 16. NextNRG Inc N/A

- 17. Lord of War 1,335 posts

- 18. Academic All-District N/A

- 19. Breslow N/A

- 20. Joe Ryan N/A