#gstnotification نتائج البحث

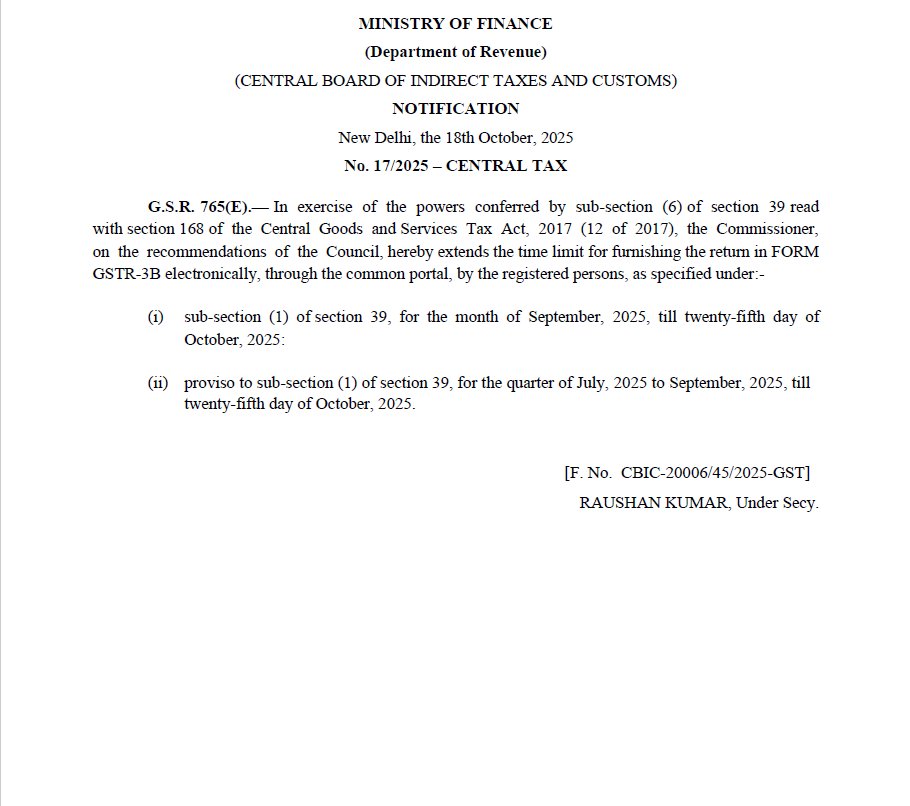

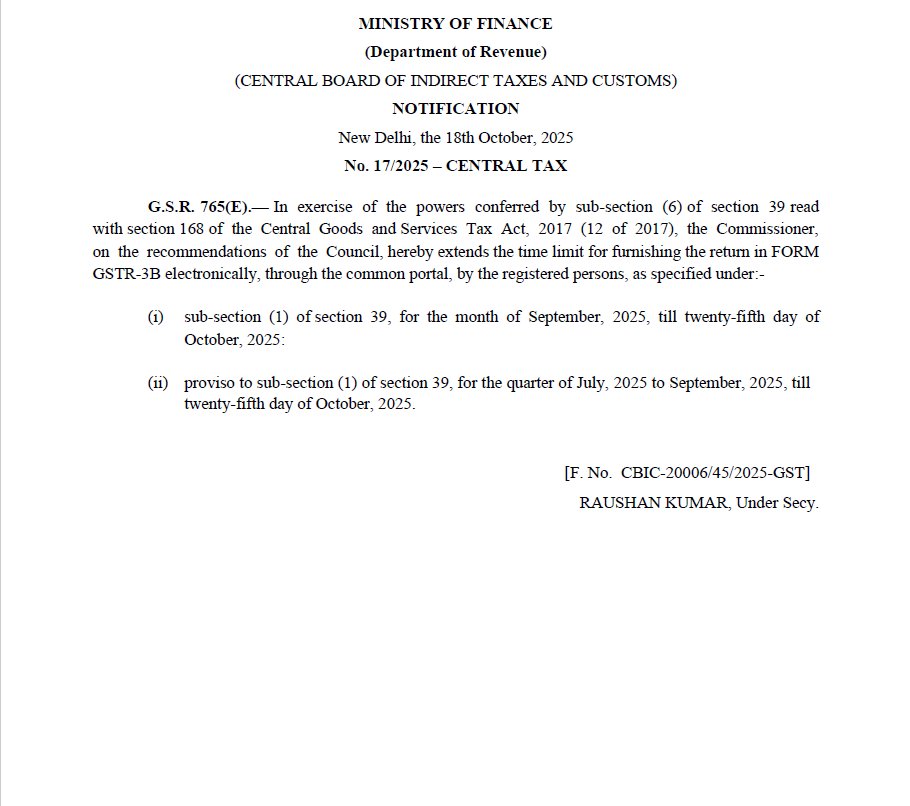

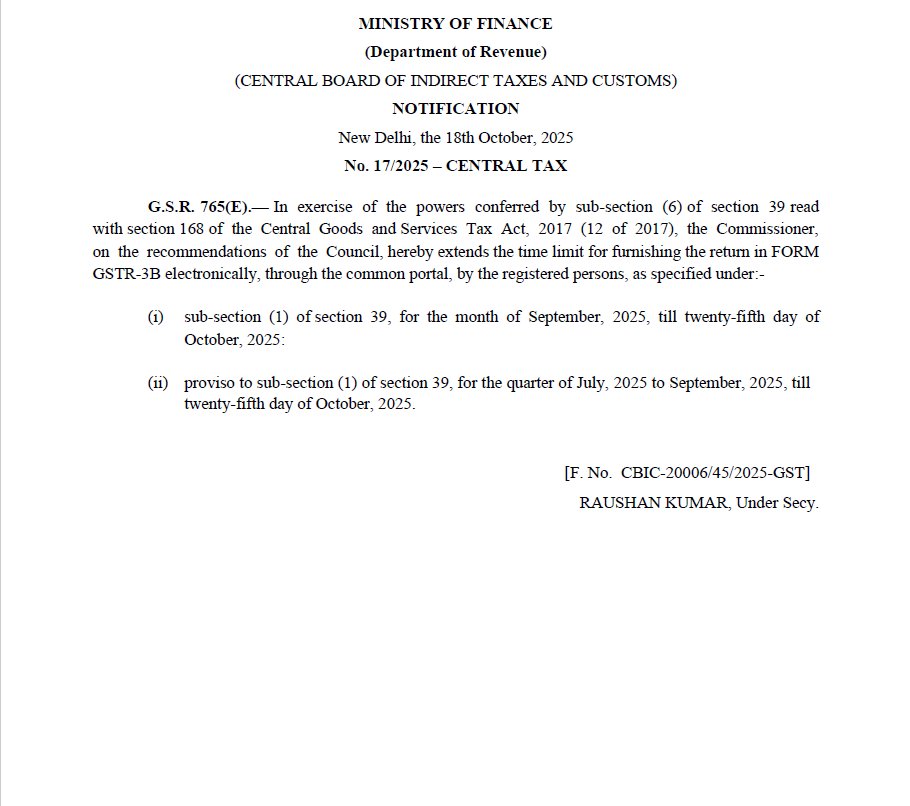

🚨 GST Return Due Date Extended! CBIC's Notification Central Tax 17/2025 extends the GSTR-3B due date for September 2025 to 25th Oct 2025. 🗓 Applies to both monthly & quarterly filers. #IndiaTaxNews #TaxUpdates #GSTNotification #GSTReturn #GSTR3B #GSTUpdates #CBIC #GSTNews

Gst alert Gstr-3b for the September month tax period extended up to 25 Oct 2025. Enjoy happy dhanteras and diwali it is a gift from the government to professionals. #GSTR3B #gstupdates2025 #GSTnotification #gstindia

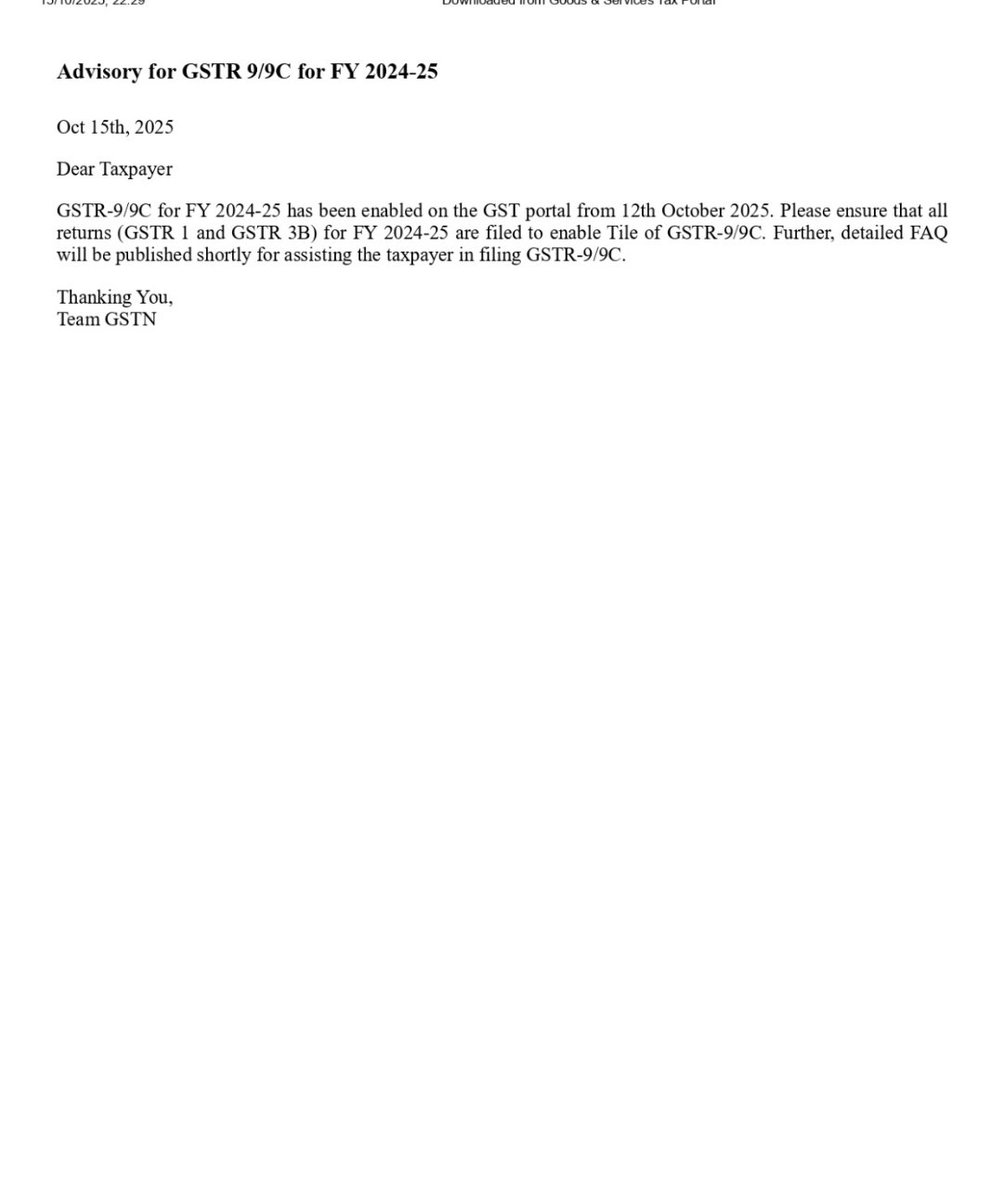

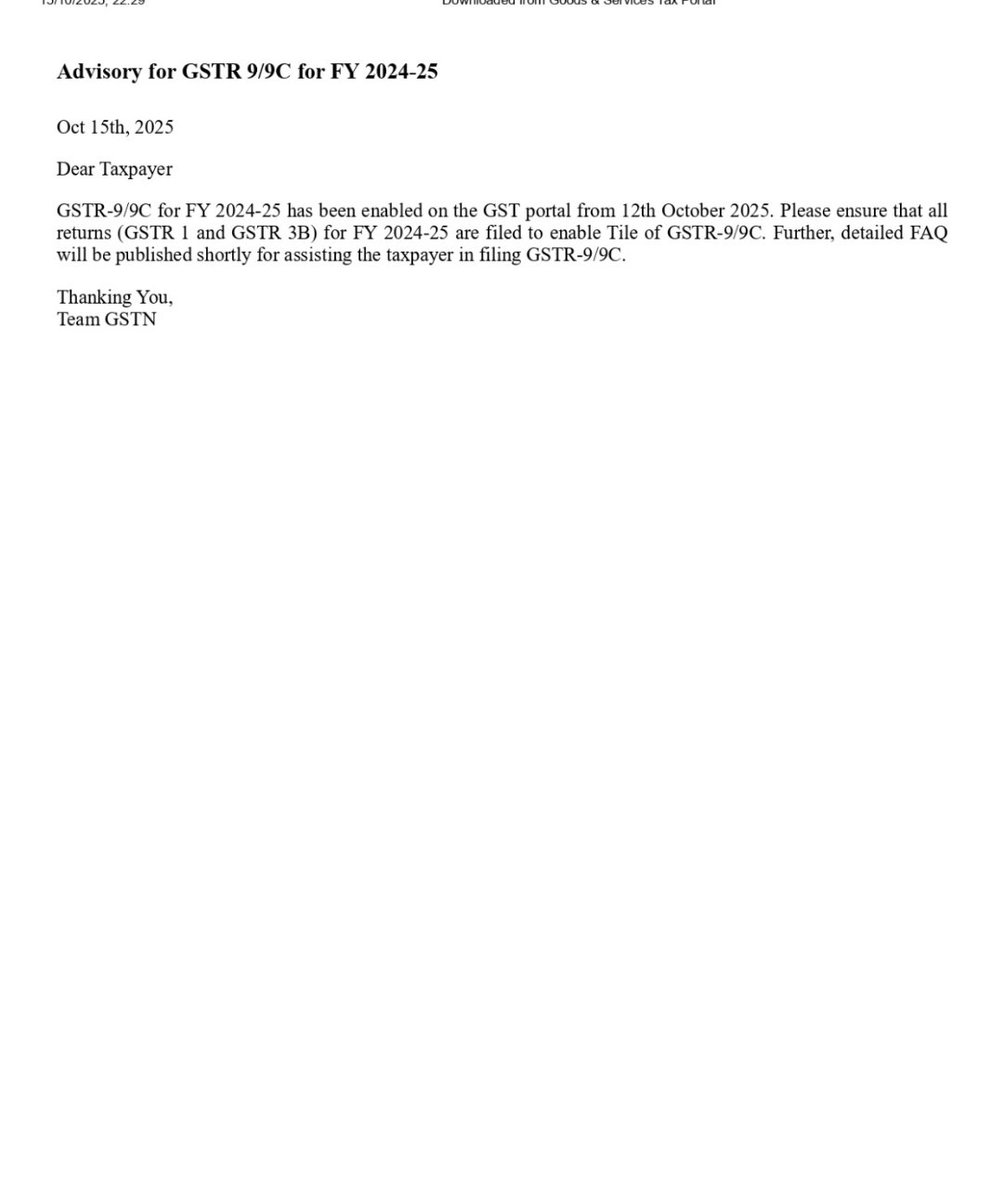

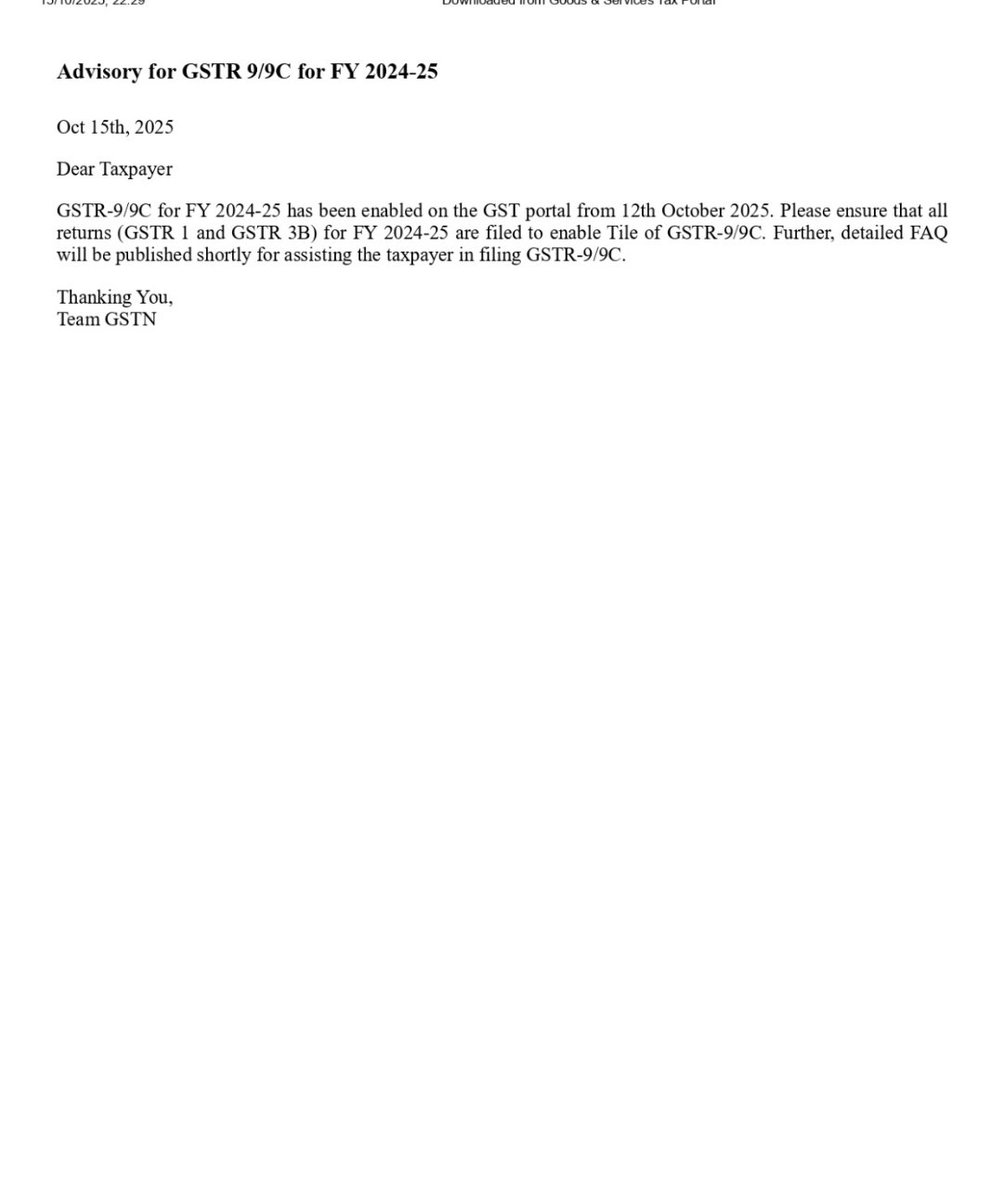

Gst Alert for Taxpayers Gst-9 and 9C enable on the gst portal now you can file up to 31st Dec 2025. #gstupdates2025 #GSTnotification #GSTR9 #gstr9c

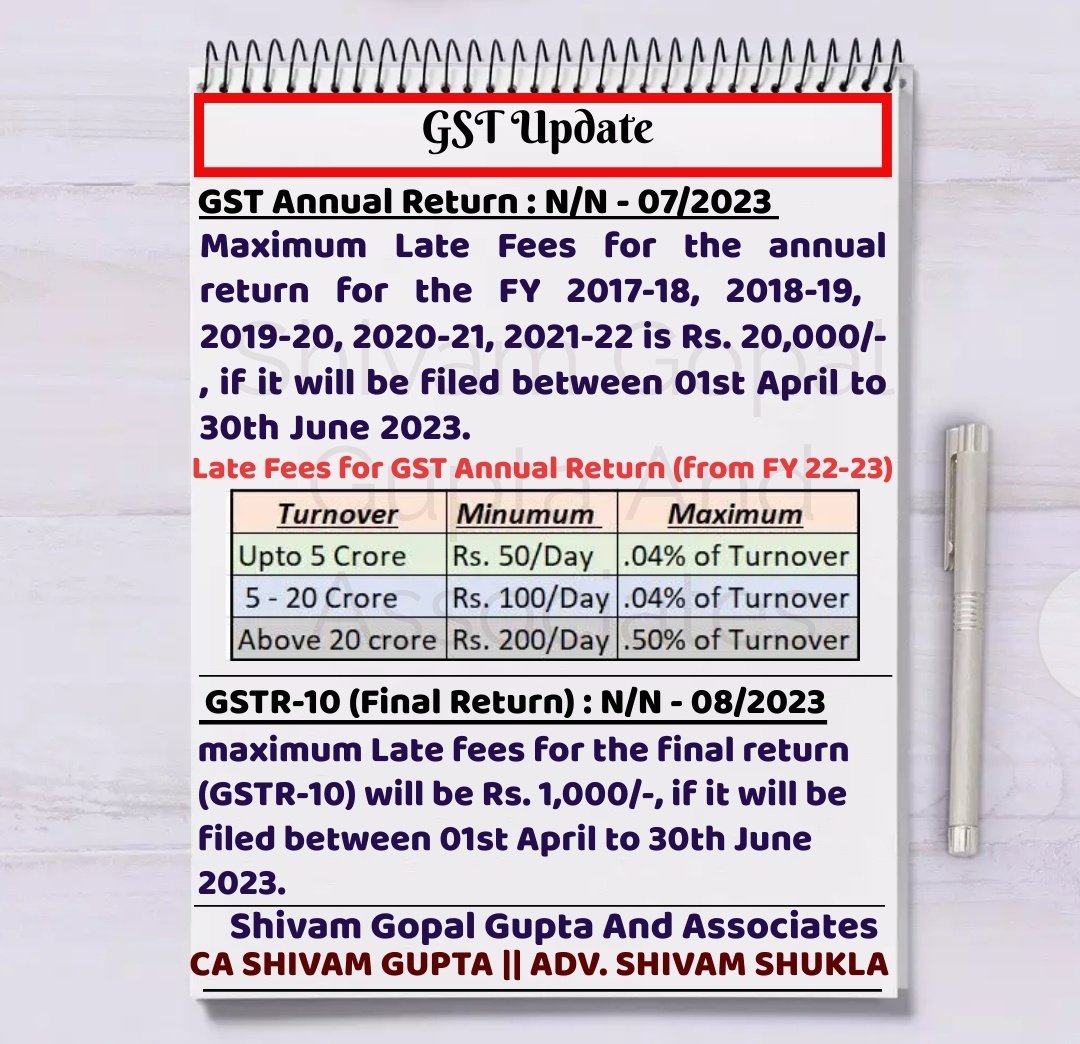

Amnesty Scheme for GSTR-10 Notification No 08/2023- Central Tax dt. 31/03/2023 #gst #gstnews #gstnotification #gstupdates

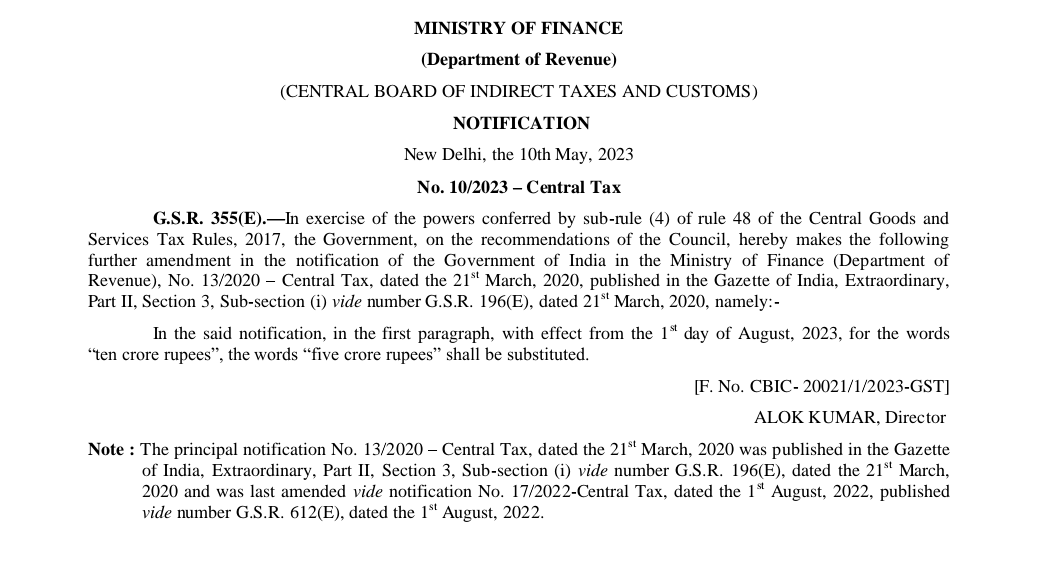

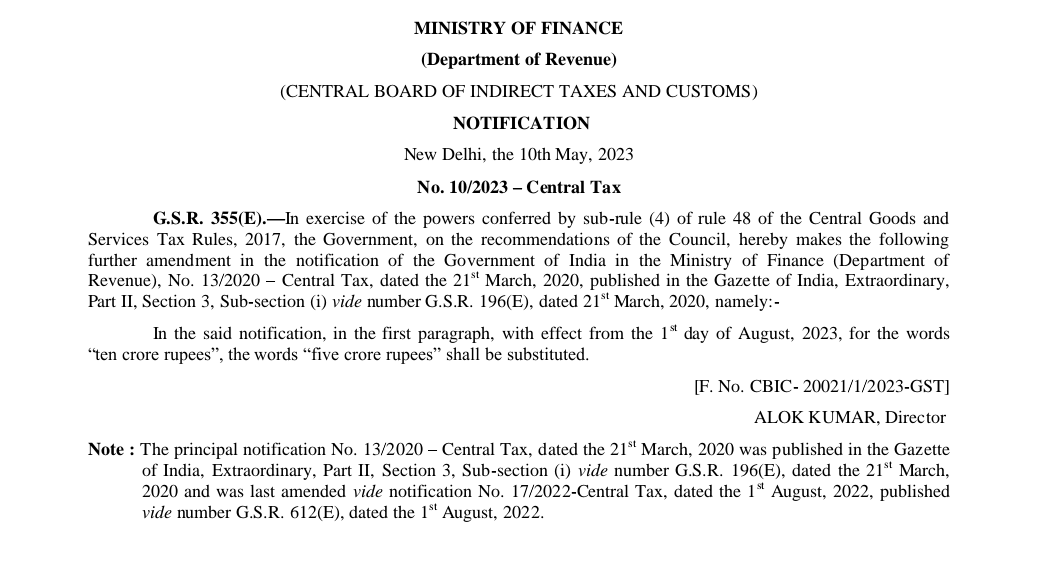

GST Update E-invoice limit reduced from 10 crore to 5 crore w.e.f. August 01, 2023 Notification No. 10/2023 – Central Tax dated May 10, 2023 #gst #gstupdate #gstnotification #E_invoice #taxguidenilesh #nileshujjainkar @Taxguidenilesh

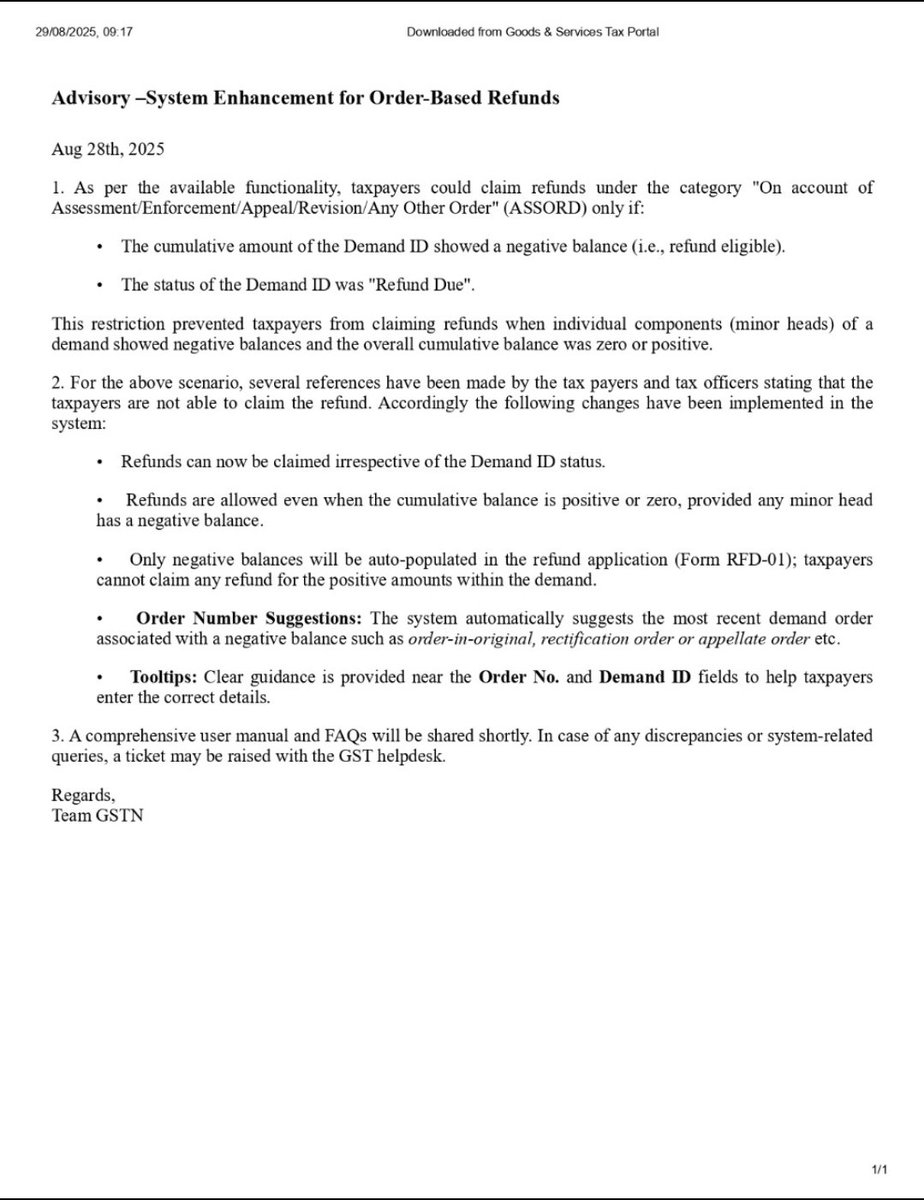

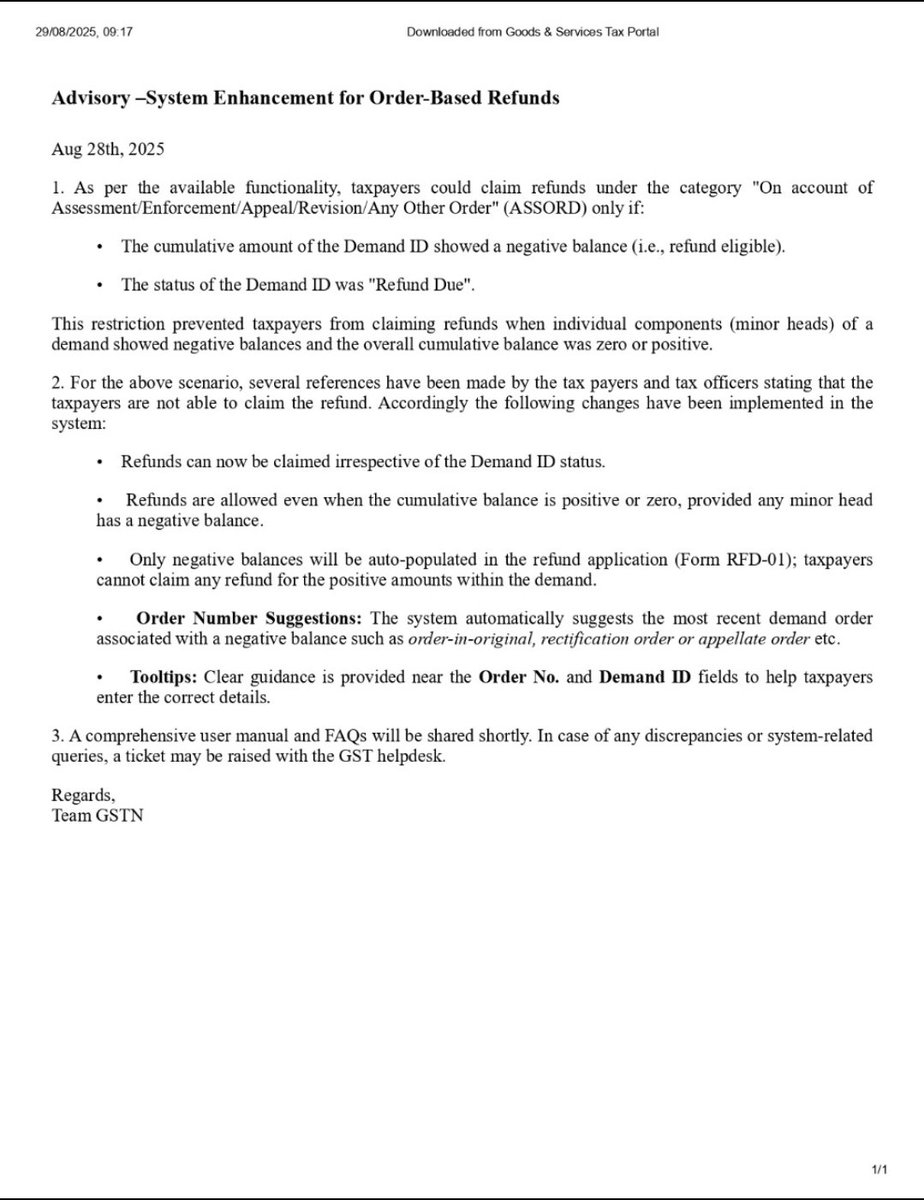

Notification of order based Refunds in Gst. If any taxpayer is eligible for refund in gst by demand or order then taxpayer can claim gst refund from the department irrespective of the demand ID status. #GSTnotification #gstupdates #gstrefund #Klath05 #Klath24 #dekhoaccountant

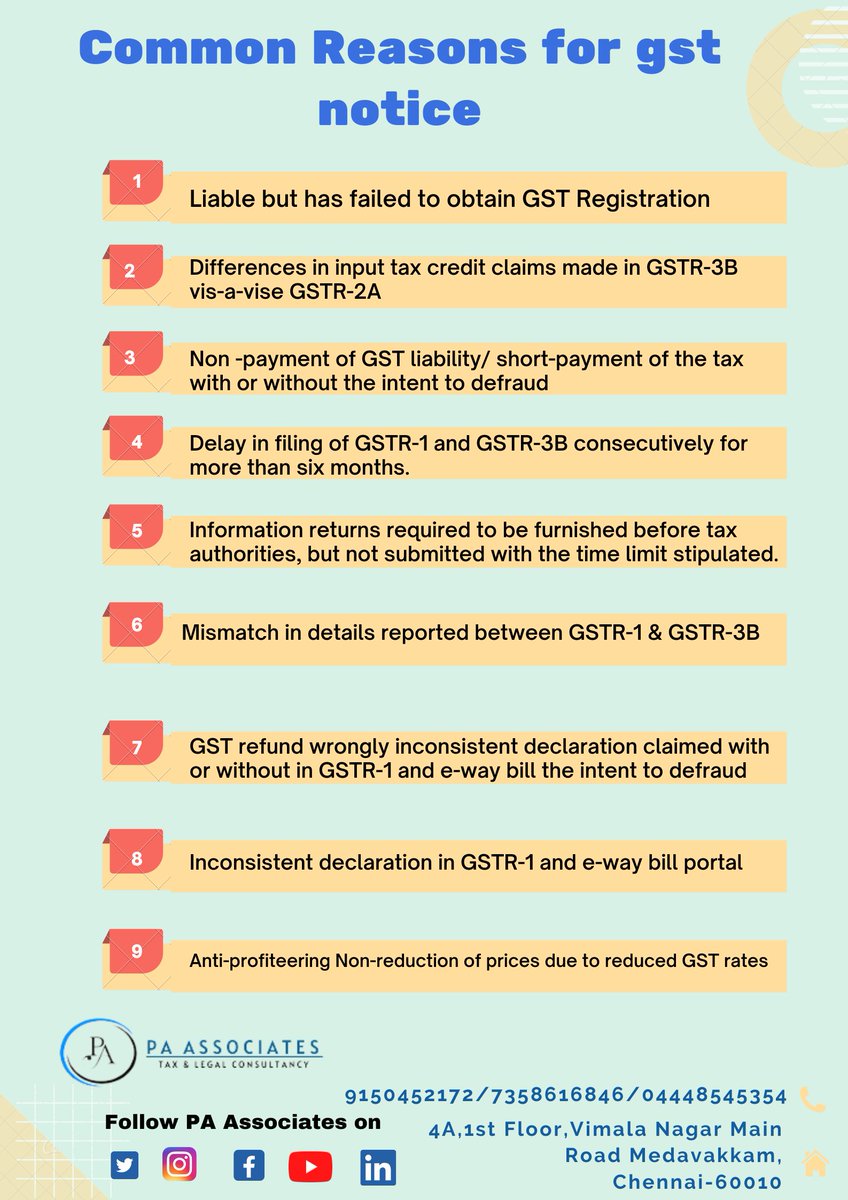

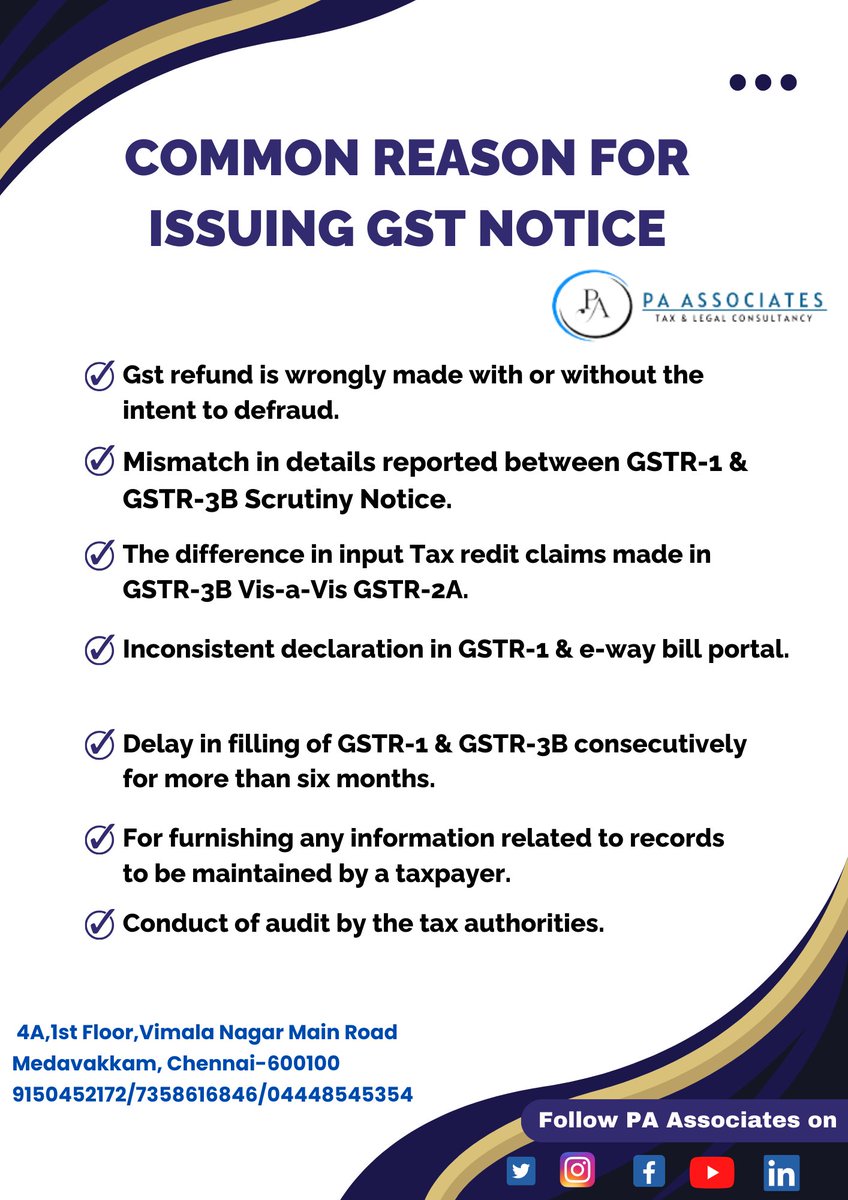

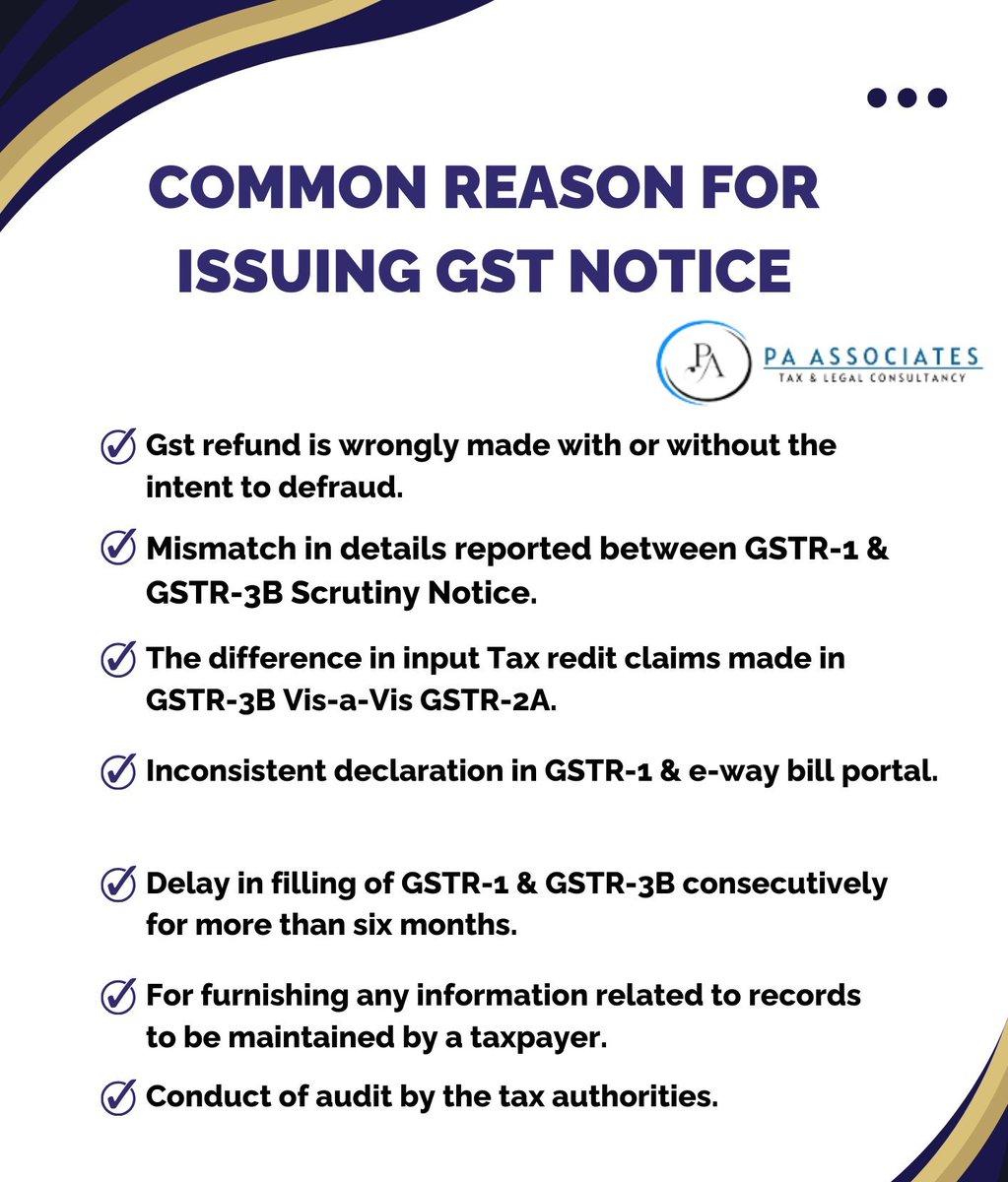

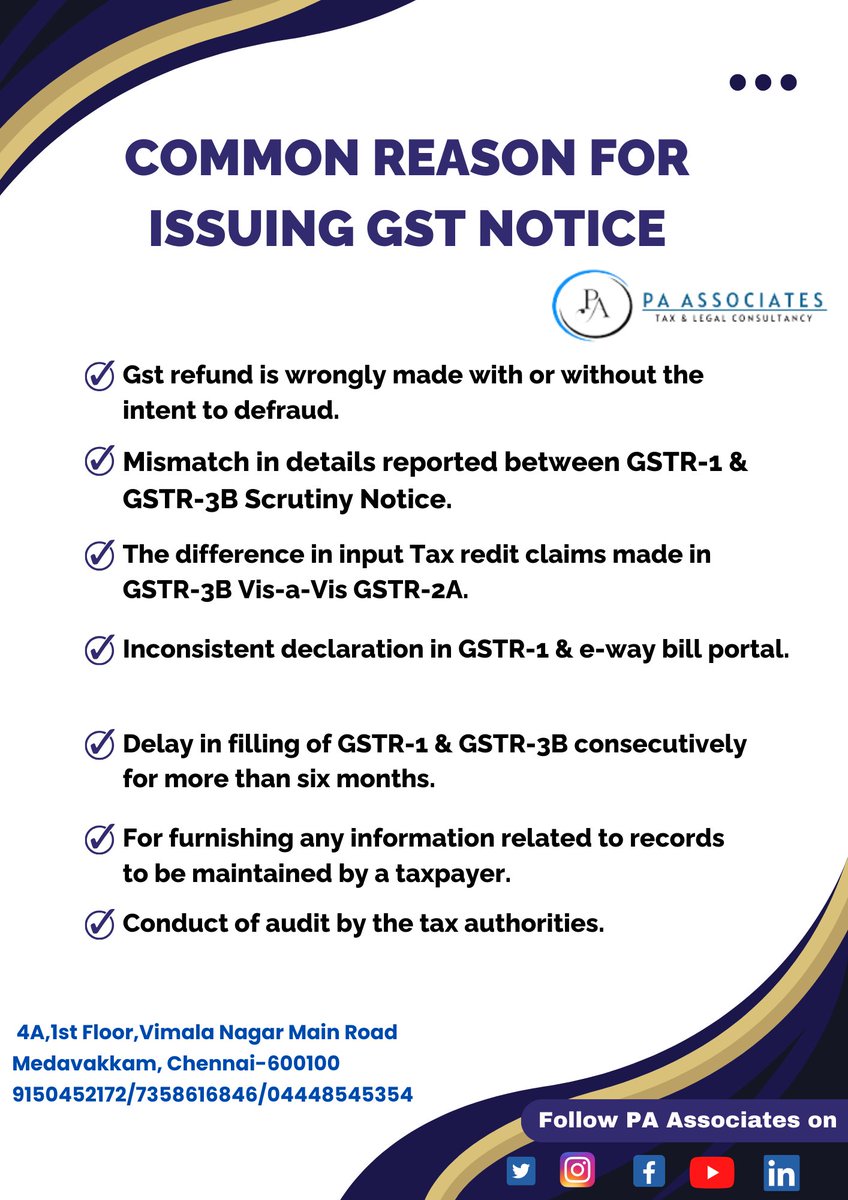

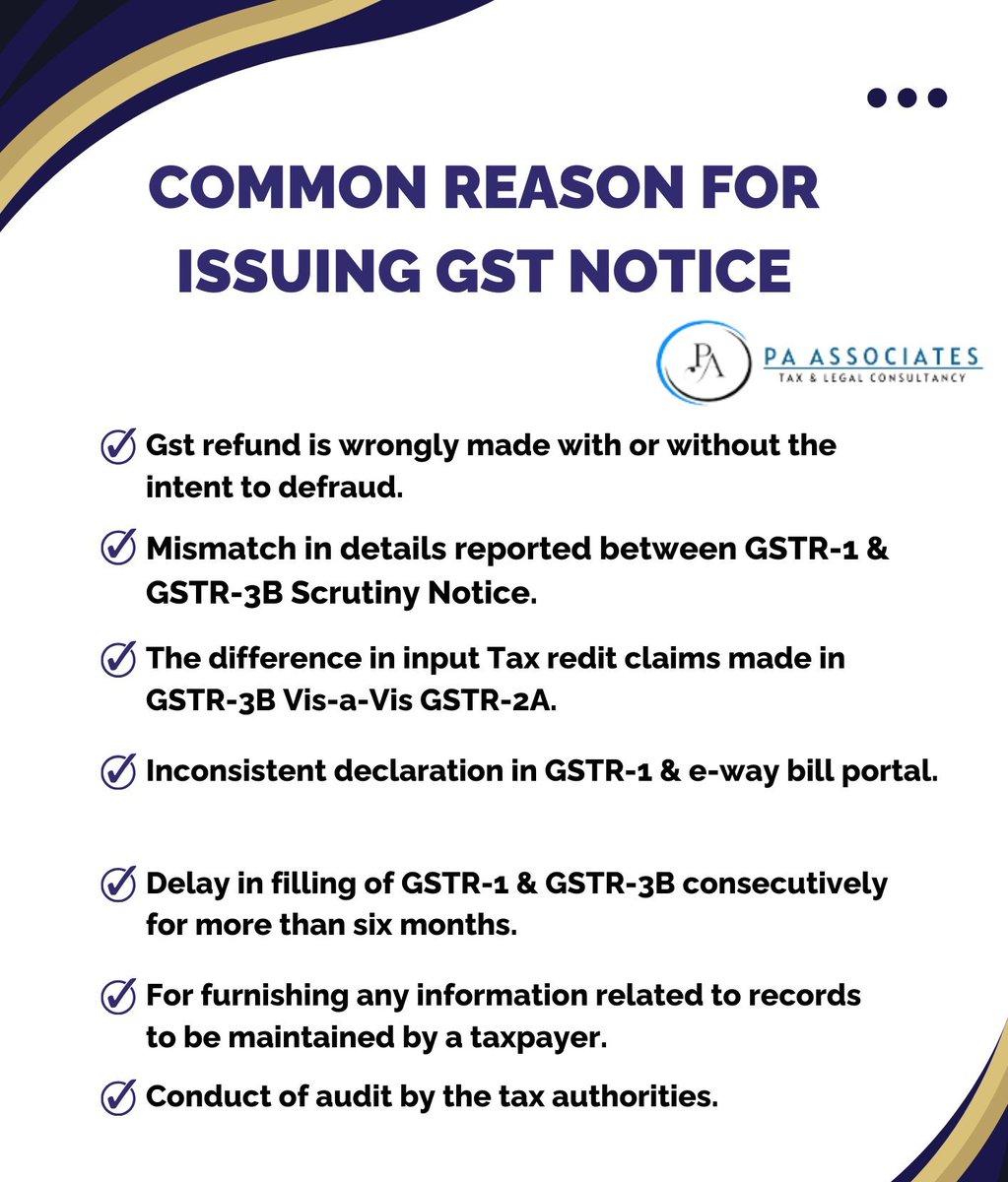

Common Reason for issuing Gst notice #gst #gstnotification #gstnotice #notice #issuing #commonreason #gstupdates

Common Reason for issuing Gst notice #gst #gstnotification #gstnotice #notice #issuing #commonreason #gstupdates

Read more at: studycafe.in/no-igst-on-oce… #GST #GSTNotification #IGSTACT #IGSTNOTIFICAIONS #IGSTRATENOTIFICAIONS #OceanFreight

Bihar Tax Consultant provides GST Appeal Services and reply to Show Cause Notice #gst #gstupdates #gstnotification #gstnotice #gstdemand #gstregistration #gstregistrationconsultant #gstregistrationonline #gstregistrationservices #bihar #patna #taxseason #taxconsultant

GST not payable on Govt incentives to banks for promoting low value BHIM-UPI transactions : : PH: 8881-069-069 follow - @estartupindia1 web- e-startupindia.com : : #bank #gstupdates #gstnotification #bhim #UPI #govt #government #gstnotice #RuPaydebit #rupay #cbic #cbicindia

10 Questions to ask while reading a #GST Order. taxonation.com/show-detail-ar… #gstupdate #gstnotification #finance

CBIC extends Due Date of Amnesty Scheme for GSTR-9 Non-Filers #GST #CBIC #GSTNotification #GSTR9 #NonFilers #amnesty #AmnestyScheme #DueDateExtension

CBIC extend due date for filing FORM GSTR-1 for period April to June 2023 #GST #CBIC #GSTNotification #GSTR1 #FormGSTR1 #Duedateextension #GSTRDueDate

Key Highlights of the 55th GST Council Meeting on 21 Dec 2024. taxonation.com/show-detail-ne…… #COUNCILMEETING #GSTPRESSRELASE #GSTNOTIFICATION #GSTNEWS #GSTUPDATE

Maharashtra GST Notification: E-Way Bill Exemption aaermlawassociates.com/eway-bill-waiv… #TataMotors #EwayBillWaiver #GSTNotification #MaharashtraGST #VehicleTesting #MGSTRules

Gst alert Gstr-3b for the September month tax period extended up to 25 Oct 2025. Enjoy happy dhanteras and diwali it is a gift from the government to professionals. #GSTR3B #gstupdates2025 #GSTnotification #gstindia

🚨 GST Return Due Date Extended! CBIC's Notification Central Tax 17/2025 extends the GSTR-3B due date for September 2025 to 25th Oct 2025. 🗓 Applies to both monthly & quarterly filers. #IndiaTaxNews #TaxUpdates #GSTNotification #GSTReturn #GSTR3B #GSTUpdates #CBIC #GSTNews

Gst Alert for Taxpayers Gst-9 and 9C enable on the gst portal now you can file up to 31st Dec 2025. #gstupdates2025 #GSTnotification #GSTR9 #gstr9c

No GST Payable On Execution Of JDA; Bombay High Court Calls Dept. To Refund 7 Crores Succumbed On Threats Of Attaching Bank A/c Read More Here- thebarbulletin.com/bombay-high-co… #BombayHighCourt #GSTLaw #GSTNotification #GSTRefund #IndianJudiciary #IndirectTax #JointDevelopmentAgreement…

Notification of order based Refunds in Gst. If any taxpayer is eligible for refund in gst by demand or order then taxpayer can claim gst refund from the department irrespective of the demand ID status. #GSTnotification #gstupdates #gstrefund #Klath05 #Klath24 #dekhoaccountant

Maharashtra GST Notification: E-Way Bill Exemption aaermlawassociates.com/eway-bill-waiv… #TataMotors #EwayBillWaiver #GSTNotification #MaharashtraGST #VehicleTesting #MGSTRules

Delhi HC sets aside Order u/s 73 of CGST Act as the Challenge on GST Notification yet to be Adjudicated by Supreme Court [Read Order] #delhihighcourt #cgstact #gstnotification #supremecourt #taxnews #taxscan Read More: taxscan.in/delhi-hc-sets-…

taxscan.in

Delhi HC sets aside Order u/s 73 of CGST Act as the Challenge on GST Notification yet to be...

Since there is a challenge to the impugned notifications, which is still to be adjudicated by the Supreme Court as well as the Court, the Court allowed an opportunity to the Petitioner to contest...

Challenge to GST Notifications u/s 168A Pending in SC: Delhi HC Orders Fresh Adjudication, Directs Reconsideration of Taxpayer’s Reply [Read Order] #gstnotification #section168a #pendinginsc #delhihighcourt #taxnews #taxscan Read More: taxscan.in/challenge-to-g…

taxscan.in

Challenge to GST Notifications u/s 168A Pending in SC: Delhi HC Orders Fresh Adjudication, Directs...

The Delhi High Court has set aside a GST order and directed fresh adjudication with reconsideration of the petitioner’s reply. The High Court kept the challenge to GST notifications under Section...

Validity of GST Notification upheld without personal hearing of assessee: Delhi HC Sets aside Order [Read Order] #GSTnotification #personalhearing #delhihighcourt #taxnews #taxscan Read More: taxscan.in/validity-of-gs…

taxscan.in

Validity of GST Notification upheld without personal hearing of assessee: Delhi HC Sets aside Order...

The bench found that the Petitioner had then applied for rectification through an application raising various grounds, which were rejected without considering any of the raised grounds

GST Notifications, Circulars, and Advisories – April 2025 Compilation #GSTnotification #circulars #advisories #taxscan #taxnews Read More: taxscan.in/gst-notificati…

taxscan.in

GST Notifications, Circulars, and Advisories – April 2025 Compilation

A monthly round-up of key GST Notifications, Circulars, and Advisories issued in April 2025, highlighting major procedural reforms and system updates.

10 Questions to ask while reading a #GST Order. taxonation.com/show-detail-ar… #gstupdate #gstnotification #finance

🚨 GST Return Due Date Extended! CBIC's Notification Central Tax 17/2025 extends the GSTR-3B due date for September 2025 to 25th Oct 2025. 🗓 Applies to both monthly & quarterly filers. #IndiaTaxNews #TaxUpdates #GSTNotification #GSTReturn #GSTR3B #GSTUpdates #CBIC #GSTNews

Gst Alert for Taxpayers Gst-9 and 9C enable on the gst portal now you can file up to 31st Dec 2025. #gstupdates2025 #GSTnotification #GSTR9 #gstr9c

Gst alert Gstr-3b for the September month tax period extended up to 25 Oct 2025. Enjoy happy dhanteras and diwali it is a gift from the government to professionals. #GSTR3B #gstupdates2025 #GSTnotification #gstindia

GST Update E-invoice limit reduced from 10 crore to 5 crore w.e.f. August 01, 2023 Notification No. 10/2023 – Central Tax dated May 10, 2023 #gst #gstupdate #gstnotification #E_invoice #taxguidenilesh #nileshujjainkar @Taxguidenilesh

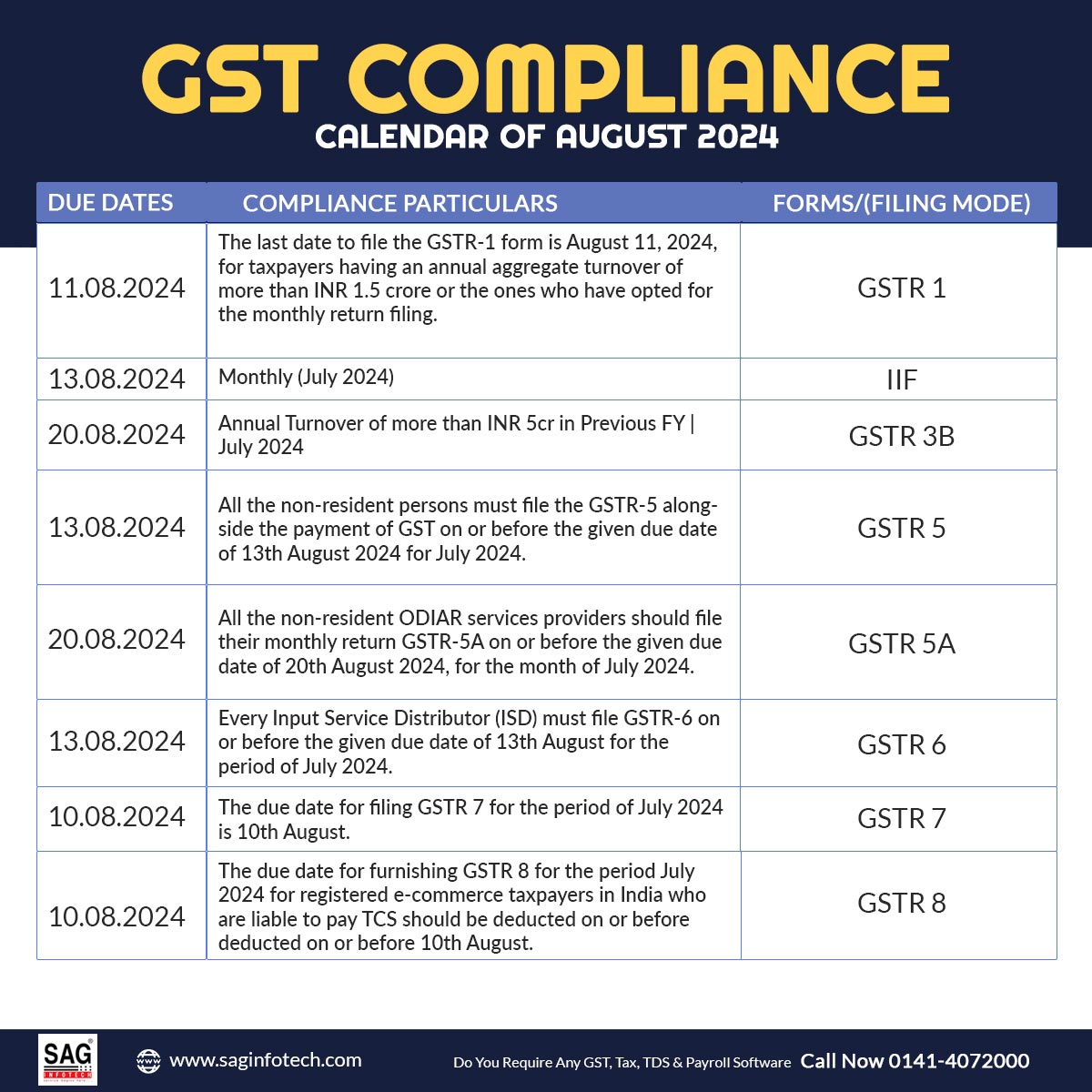

Check out the August 2024 #compliancecalendar for #GST with brief details. Also, we attached the latest #GSTnotification. Get more:bit.ly/3PKHomD

Amnesty Scheme for GSTR-10 Notification No 08/2023- Central Tax dt. 31/03/2023 #gst #gstnews #gstnotification #gstupdates

Read more at: studycafe.in/no-igst-on-oce… #GST #GSTNotification #IGSTACT #IGSTNOTIFICAIONS #IGSTRATENOTIFICAIONS #OceanFreight

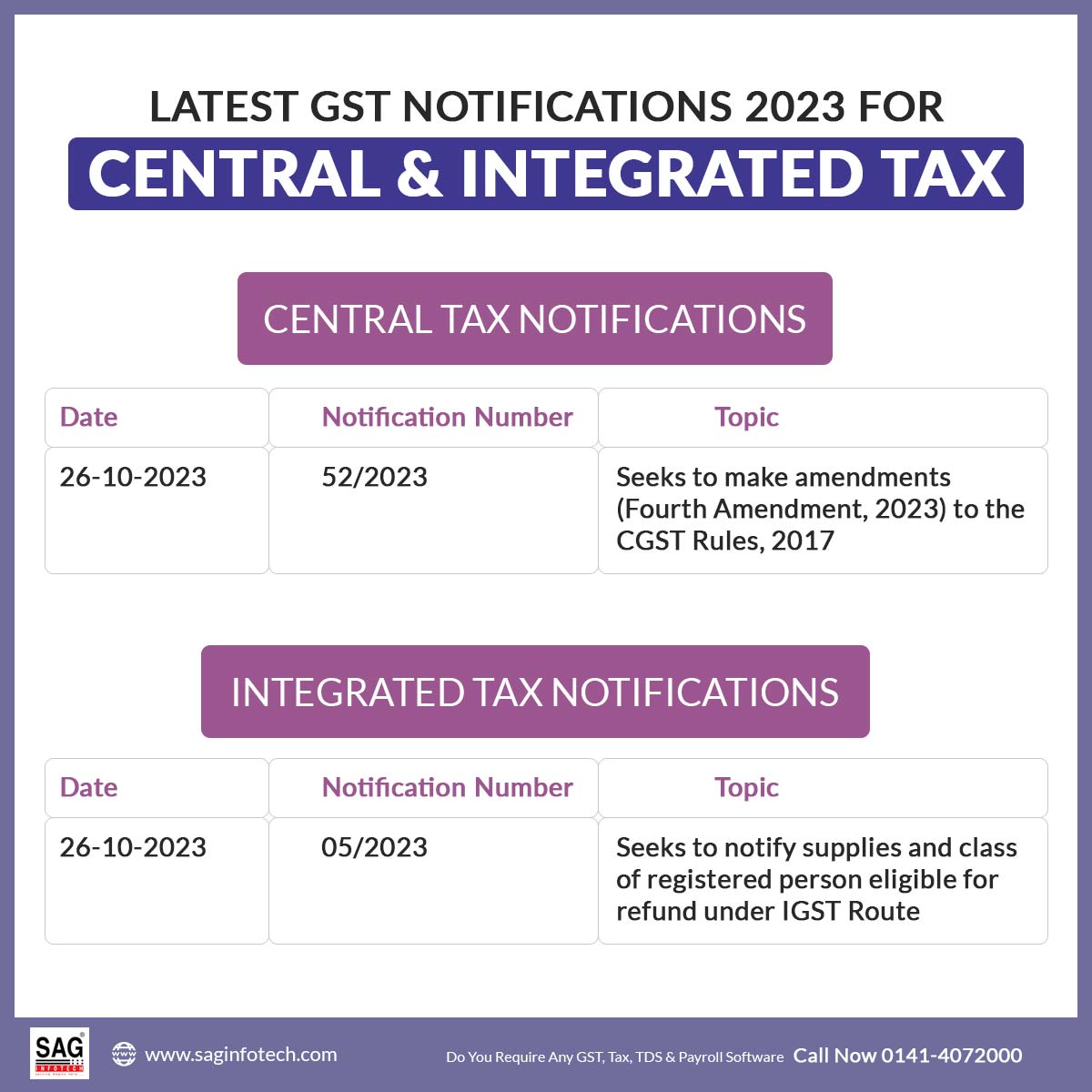

Get the latest GST Notification 2023 for Central Tax. Check Details: bit.ly/3OJ6K3N #GSTNotification #Tax #CentralTax #GSTUpdates

CBIC extends Due Date of Amnesty Scheme for GSTR-9 Non-Filers #GST #CBIC #GSTNotification #GSTR9 #NonFilers #amnesty #AmnestyScheme #DueDateExtension

CBIC extend due date for filing FORM GSTR-1 for period April to June 2023 #GST #CBIC #GSTNotification #GSTR1 #FormGSTR1 #Duedateextension #GSTRDueDate

Common Reason for issuing Gst notice #gst #gstnotification #gstnotice #notice #issuing #commonreason #gstupdates

CBIC extends Form GSTR-3B filing due date for QRMP and Non QRMP Taxpayers #GST #CBIC #GSTNotification #GSTR3B #FormGSTR3B #QRMPTaxpayers #NonQRMPTaxpayers #duedateextension #GSTReturnDueDate

10 Questions to ask while reading a #GST Order. taxonation.com/show-detail-ar… #gstupdate #gstnotification #finance

CBIC Notifies exemption from GST Annual Return Filing for taxpayers having Aggregate ATO upto Rs.2 Crore #GST #GSTNotification #GSTAnnualReturn #GSTExemption #AggregateAnnualTurnover

Gst notification no 03/2023 Relief for revocation of cancelled registration #gstnotification #gstupdates #revocation #registration #49thgstcouncilmeeting

Common Reason for issuing Gst notice #gst #gstnotification #gstnotice #notice #issuing #commonreason #gstupdates

No GST Payable On Execution Of JDA; Bombay High Court Calls Dept. To Refund 7 Crores Succumbed On Threats Of Attaching Bank A/c Read More Here- thebarbulletin.com/bombay-high-co… #BombayHighCourt #GSTLaw #GSTNotification #GSTRefund #IndianJudiciary #IndirectTax #JointDevelopmentAgreement…

Something went wrong.

Something went wrong.

United States Trends

- 1. Thanksgiving 2.4M posts

- 2. Packers 64.8K posts

- 3. Dan Campbell 7,158 posts

- 4. #GoPackGo 10.9K posts

- 5. Wicks 11.2K posts

- 6. Jordan Love 16.5K posts

- 7. Micah Parsons 11.7K posts

- 8. Goff 11.3K posts

- 9. Jack White 9,596 posts

- 10. Kenneth Murray N/A

- 11. McDuffie 2,935 posts

- 12. #ChiefsKingdom 3,890 posts

- 13. Kelce 11.9K posts

- 14. Watson 15.8K posts

- 15. Tony Romo N/A

- 16. Turkey 308K posts

- 17. Caleb Wilson 1,177 posts

- 18. #KCvsDAL 3,072 posts

- 19. Jamo 5,316 posts

- 20. Thankful 495K posts