#irsguidelines search results

“Maximizing your #refunds starts with knowing your credits.” Poll: “Do you claim education or #childtaxcredits? ✅ Yes / ❌ No” Tip: “Check #IRSguidelines each year—credits can reduce your #tax bill dollar for dollar.”

These beloved credits are gone for 2022 tax year back to Pre-Covid Amounts! #Taxupdates #irsguidelines

How to Register as a Non-Profit: Essential Steps and Guidelines #NonProfitRegistration #IRSGuidelines #NonProfitOrganization

Big Beautiful Bill: No Taxes On Tips #EmployeeTips #IRSguidelines #WageAndTips #CustomaryTips #BusinessFinance #PayrollTips #TaxLaw #EmploymentLaw #BusinessTips #FinancialPlanning

Use this guide to get ready for the cryptocurrency tax filing rules #CryptoCurrency #IRSGuidelines zurl.co/drSe

Independent Contractor vs Employee: Avoid Misclassification Problems! full video: ilchiro.org/do-you-have-in… #IndependentContractor #EmployeeClassification #IRSGuidelines #LaborLaw #ChiropracticPractice #BusinessCompliance #EmploymentLaw #HRManagement #LegalCompliance

Review the IRS guidelines on medical expenses and beware of misrepresentation. ow.ly/mmuT50R8Mha #IRSguidelines #MedicalExpenses #TaxTips

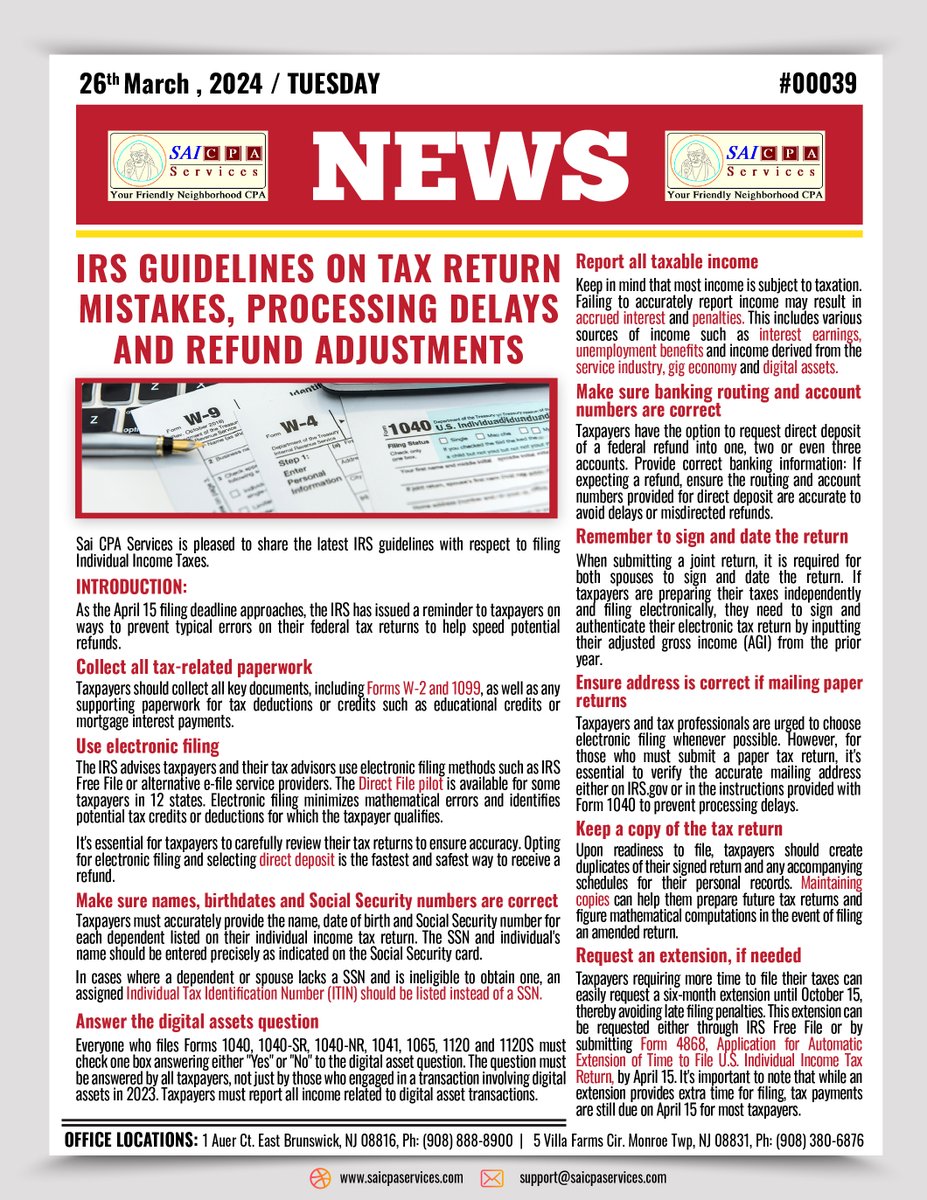

#saicpaservices_news IRS GUIDELINES ON TAX RETURN MISTAKES, PROCESSING DELAYS AND REFUND ADJUSTMENTS Contact Us: saicpaservices.com (908) 380-6876 #IRSGuidelines #TaxReturnMistakes #ProcessingDelays #RefundAdjustments #TaxRefunds #TaxSeasonTips #SaiCPAServices

Planning to claim tax credits under the FFCRA? Sarah Wixson explains what you need to know. bit.ly/2R6uQbv #IRSguidelines #taxcredit

IRS guidance on renewable tax credit transferability, direct-pay provisions of IRA, garners mixed reviews. ow.ly/TACh50OTSws #IRSguidelines #renewables #cleanenergy #taxcredits

Accurate mileage tracking can significantly reduce your business tax burden. By following IRS guidelines and maintaining detailed records, you can claim vehicle expenses with confidence. Call us now at businesstaxesandmore.com/business-tax-c… #taxburden #irsguidelines #claimvehicleexpenses

⏳ IRS Delay Initially set for 2024, the IRS has postponed this change to 2026. This gives everyone more time to prepare and adjust their retirement strategies. #IRSGuidelines

As a #nonprofit, you must ensure your traveling volunteers follow the #IRSguidelines when dealing with things like #mileage and meals. Here's everything you need to know to stay compliant with the #IRS and nonprofit expense guidelines: bit.ly/2s2kP5H

🌐 Social Advocacy & Trade Orgs: Essential in society, aim to influence policy or support industries. 💼🤝 #SocialAdvocacy #TradeOrgs 📜 IRS Guidelines: To be tax-deductible, orgs must meet specific criteria. Let's explore! 📝 #IRSGuidelines #TaxDeductible

Many in the nonprofit community are concerned about what they can and cannot do under IRS guidelines with respect to political candidates and issues. Learn more here. ow.ly/YKb230kv5x8 #elections #nonprofit #IRSguidelines #politics #community #nonprofitpolitics

How the phishing and email scams will increase rapidly with the new IRS rule? Read for more details. businessupside.com/2022/05/25/phi… #phishingscams #IRSguidelines #IRSscams #newIRSrules

In Response to the COVID-19 Pandemic, the IRS Releases Temporary Guidance to State and Local Issuers of Tax-Exempt #IRSguidelines #UStaxlaw #breakingtaxnews Bonds bit.ly/2YSKJar photo: WUSA

🚨IRS UPDATE🚨 The IRS announces 2023 retirement plan dollar limits and thresholds. Read our latest article explaining the figures! #IRS #IRSGuidelines #retirement Link: bit.ly/3FzLuu8

Learn how to prevent incorrect Employee Retention Credit claims! Get insight on new IRS guidelines for high and low-risk claims and discover how to guarantee accurate processing of your claims. okt.to/PbryYq #ERC #IRSGuidelines #ERCClaims

Big Beautiful Bill: No Taxes On Tips #EmployeeTips #IRSguidelines #WageAndTips #CustomaryTips #BusinessFinance #PayrollTips #TaxLaw #EmploymentLaw #BusinessTips #FinancialPlanning

Big Beautiful Bill: No Taxes On Tips #EmployeeTips #IRSguidelines #WageAndTips #CustomaryTips #BusinessFinance #PayrollTips #TaxLaw #EmploymentLaw #BusinessTips #FinancialPlanning

Independent Contractor vs Employee: Avoid Misclassification Problems! full video: ilchiro.org/do-you-have-in… #IndependentContractor #EmployeeClassification #IRSGuidelines #LaborLaw #ChiropracticPractice #BusinessCompliance #EmploymentLaw #HRManagement #LegalCompliance

🚨 Alert: Own crypto, Bitcoin, or NFTs? You may need to report them on your tax return. Know the IRS rules on capital gains and income tax, and use tools like CoinLedger to simplify reporting. #CryptoTax #IRSGuidelines

Learn how to prevent incorrect Employee Retention Credit claims! Get insight on new IRS guidelines for high and low-risk claims and discover how to guarantee accurate processing of your claims. okt.to/yvCDWa #ERC #IRSGuidelines #ERCClaims

Accurate mileage tracking can significantly reduce your business tax burden. By following IRS guidelines and maintaining detailed records, you can claim vehicle expenses with confidence. Call us now at businesstaxesandmore.com/business-tax-c… #taxburden #irsguidelines #claimvehicleexpenses

Learn how to prevent incorrect Employee Retention Credit claims! Get insight on new IRS guidelines for high and low-risk claims and discover how to guarantee accurate processing of your claims. okt.to/ujo6Pi #ERC #IRSGuidelines #ERCClaims

Learn how to prevent incorrect Employee Retention Credit claims! Get insight on new IRS guidelines for high and low-risk claims and discover how to guarantee accurate processing of your claims. okt.to/bQ9fx5 #ERC #IRSGuidelines #ERCClaims

Student #CANCELED #DEBT. Under #IRSGUIDELINES Canceled debt turns into income for the person getting the debt cancelled and taxes are paid on the amount cancelled. Al the people who have cancelled debt should have to pay taxes on that debt cancelled. Have #BIDENHARIS ever…

How to Register as a Non-Profit: Essential Steps and Guidelines #NonProfitRegistration #IRSGuidelines #NonProfitOrganization

Learn how to prevent incorrect Employee Retention Credit claims! Get insight on new IRS guidelines for high and low-risk claims and discover how to guarantee accurate processing of your claims. okt.to/IgkUye #ERC #IRSGuidelines #ERCClaims

Learn how to prevent incorrect Employee Retention Credit claims! Get insight on new IRS guidelines for high and low-risk claims and discover how to guarantee accurate processing of your claims. okt.to/36vmZa #ERC #IRSGuidelines #ERCClaims

Learn how to prevent incorrect Employee Retention Credit claims! Get insight on new IRS guidelines for high and low-risk claims and discover how to guarantee accurate processing of your claims. okt.to/PbryYq #ERC #IRSGuidelines #ERCClaims

Learn how to prevent incorrect Employee Retention Credit claims! Get insight on new IRS guidelines for high and low-risk claims and discover how to guarantee accurate processing of your claims. okt.to/OY8q94 #ERC #IRSGuidelines #ERCClaims

⏳ IRS Delay Initially set for 2024, the IRS has postponed this change to 2026. This gives everyone more time to prepare and adjust their retirement strategies. #IRSGuidelines

💸 Crypto Tax Basics: As crypto gains mainstream attention, it's crucial to understand the tax implications of buying, selling, and trading digital assets. Stay informed to avoid surprises come tax season. #CryptoTax #Taxation #IRSGuidelines

Review the IRS guidelines on medical expenses and beware of misrepresentation. ow.ly/mmuT50R8Mha #IRSguidelines #MedicalExpenses #TaxTips

These beloved credits are gone for 2022 tax year back to Pre-Covid Amounts! #Taxupdates #irsguidelines

Review the IRS guidelines on medical expenses and beware of misrepresentation. ow.ly/mmuT50R8Mha #IRSguidelines #MedicalExpenses #TaxTips

Use this guide to get ready for the cryptocurrency tax filing rules #CryptoCurrency #IRSGuidelines zurl.co/drSe

#saicpaservices_news IRS GUIDELINES ON TAX RETURN MISTAKES, PROCESSING DELAYS AND REFUND ADJUSTMENTS Contact Us: saicpaservices.com (908) 380-6876 #IRSGuidelines #TaxReturnMistakes #ProcessingDelays #RefundAdjustments #TaxRefunds #TaxSeasonTips #SaiCPAServices

IRS guidance on renewable tax credit transferability, direct-pay provisions of IRA, garners mixed reviews. ow.ly/TACh50OTSws #IRSguidelines #renewables #cleanenergy #taxcredits

Planning to claim tax credits under the FFCRA? Sarah Wixson explains what you need to know. bit.ly/2R6uQbv #IRSguidelines #taxcredit

As a #nonprofit, you must ensure your traveling volunteers follow the #IRSguidelines when dealing with things like #mileage and meals. Here's everything you need to know to stay compliant with the #IRS and nonprofit expense guidelines: bit.ly/2s2kP5H

Accurate mileage tracking can significantly reduce your business tax burden. By following IRS guidelines and maintaining detailed records, you can claim vehicle expenses with confidence. Call us now at businesstaxesandmore.com/business-tax-c… #taxburden #irsguidelines #claimvehicleexpenses

How the phishing and email scams will increase rapidly with the new IRS rule? Read for more details. businessupside.com/2022/05/25/phi… #phishingscams #IRSguidelines #IRSscams #newIRSrules

Many in the nonprofit community are concerned about what they can and cannot do under IRS guidelines with respect to political candidates and issues. Learn more here. ow.ly/YKb230kv5x8 #elections #nonprofit #IRSguidelines #politics #community #nonprofitpolitics

🚨IRS UPDATE🚨 The IRS announces 2023 retirement plan dollar limits and thresholds. Read our latest article explaining the figures! #IRS #IRSGuidelines #retirement Link: bit.ly/3FzLuu8

In Response to the COVID-19 Pandemic, the IRS Releases Temporary Guidance to State and Local Issuers of Tax-Exempt #IRSguidelines #UStaxlaw #breakingtaxnews Bonds bit.ly/2YSKJar photo: WUSA

Something went wrong.

Something went wrong.

United States Trends

- 1. Ferran 18.5K posts

- 2. Sonny Gray 7,869 posts

- 3. Chelsea 342K posts

- 4. Rush Hour 4 12.2K posts

- 5. Godzilla 21.5K posts

- 6. Barca 123K posts

- 7. Red Sox 7,579 posts

- 8. Raising Arizona 1,101 posts

- 9. Happy Thanksgiving 22K posts

- 10. Dick Fitts N/A

- 11. National Treasure 5,884 posts

- 12. 50 Cent 5,276 posts

- 13. Gone in 60 2,177 posts

- 14. Muriel Bowser N/A

- 15. Giolito N/A

- 16. Dirty Diana 1,089 posts

- 17. Brett Ratner 3,707 posts

- 18. Man in the Mirror 1,431 posts

- 19. Clarke 6,585 posts

- 20. Leaving Las Vegas N/A