#aaar search results

GST payable on examination services provided to Gujarat Panchayat Service Selection Board clarified by AAAR. Big update for the sector! 📚💼 Read more: jurishour.in/gst/gst-payabl… #GST #TaxNews #AAAR #GujaratPanchayat #ExaminationServices #TaxUpdates #GSTNews #IndiaBusiness…

4 weeks till the next @Ravenscroft418 meeting. Better start writing the lecture on the 15th & 16th Degree. #AAAR #Freemasons

Big GST Ruling! The AAAR upholds that supplying pencil sharpeners along with pencils is a "Mixed Supply" under GST! 🚨 No relief for DOMS as appeal gets rejected! 🚫 What’s your take? Fair or unfair? 🤔 Read more:jurishour.in/gst/supply-of-… #GST #TaxUpdate #AAAR #DOMS…

⚖️ Central vs. State Face-Off in GST Dispute! ⚖️ AAAR rules in favor of the Centre Member’s opinion on GST applicability to Holiday Inn’s utility charges! ⚡ jurishour.in/gst/gst-holida… #GST #AAAR #TaxDispute #HospitalityTax #HolidayInn #TaxUpdates #FinanceNews

jurishour.in

GST On Holiday Inn’s Utility Charges: AAAR

In a significant ruling, the Telangana Authority for Advance Rulings (AAR) delivered a split verdict on the taxability of electricity and water charges collected by Holiday Inn along with license...

TR-6 Challans Not Valid for Availing GST ITC: AAAR jurishour.in/gst/tr-6-chall… #aaar #gstitc #challan #tr6 #news #breaking #gst The Tamil Nadu Appellate Authority for Advance Ruling (AAAR) has held that GST paid through TR-6 challans cannot be used to claim input tax credit (ITC)…

jurishour.in

TR-6 Challans Not Valid for Availing GST ITC: AAAR

The Tamil Nadu Appellate Authority for Advance Ruling (AAAR) has held that GST paid through TR-6 challans cannot be used to claim input tax credit (ITC) under the GST law.

AAR and AAAR Weekly Round Up #AAR #AAAR #Weekly #Taxscan #taxnews read more: taxscan.in/top-stories/aa…

Provide transport and delivery-related services? 50% off our listings through March when you use this link > itsonthemove.com/new_listing.as… #discount #AAAR

Subscription and Redemption of Mutual Fund Units amounts to Sale: AAAR on Zydus Lifesciences Ltd.’s Appeal [Read Order] #Subscription #AAAR #Redemption #taxscan #taxnews Read more: taxscan.in/top-stories/su…

We are excited to be part of the #AAAR Annual Conference. Come visit us at Booth 406 to explore the latest advances in source apportionment. We are looking forward to meeting you. #AAAR2024

ITC to be reversed in view of sale of alcoholic liquor for human consumption effected from business premises: AAAR #GST #AAAR #AARWestBengal #ITC #InputTaxCredit #Sale #AlcoholicLiquor #ReversalofITC

#Somalia this is not a President, this is a #OVNI : a Non Identified Flying Object ! He totally destroy the President function! Very Sad 4 somali people ! #Aaar #Farmaajo so ceshada !

Turkish Intelligence Chief Ibrahim Kalin told the corrupt hsm that Turkish drones would not no longer participate in the fight against Al-Shabaab after they were used incorrectly last month and more than 30 civilians lost their lives in the Lower Shabelle region. #Somalia

"Higher GST rate of 18% for open car parks sold to flat buyers." buff.ly/43hSuEQ #WestBengal #AAAR #AdvanceRulings #GST #CarPark #SeparateSupply #HigherRate #Homebuyers #CompositeSupply

AAR and AAAR Weekly Round Up #aar #aaar #aarandaaarweeklyroundup #weeklyroundup #taxscan #taxnews taxscan.in/top-stories/aa…

Taxes applicable to the supply of aluminium foil type winding inverter duty transformers and components: AAAR ➡️alcircle.com/news/taxes-app… #aluminiumfoil #AAAR #aluminium #GST #ShilcharTechnologies @AdaniGreen #alcirclenews #AlCircle

जादू ना टोना , भूत होवे ना प्रेत ! मन में भय जिनके बसे , भक्ति करे अनेक !! #Aaar

Myntra not eligible for ITC on gift vouchers sourced from third party: AAR Read more at: studycafe.in/myntra-not-eli… #GST #AAAR #Studycafe #Myntra

AAR and AAAR Weekly Round Up #AAR #AAAR #Weekly #Taxscan #taxnews read more: taxscan.in/top-stories/aa…

AAAR Tamil Nadu Rules: TR-6 Challan Not a Valid Document for Availing Import IGST Credit #Judgement #AAAR #AAARtamilnadu #TR6challan #IGSTCredit #igst taxationnote.com/aaar-tamil-nad…

taxationnote.com

AAAR Tamil Nadu Rules: TR-6 Challan Not a Valid Document for Availing Import IGST Credit - Taxation...

Becton Dickinson India Private Limited faced differential import IGST liabilities due to true-up adjustments under its distributorship. The AAR ruled that ITC on import IGST could only be claimed...

TR-6 Challans Not Valid for Availing GST ITC: AAAR jurishour.in/gst/tr-6-chall… #aaar #gstitc #challan #tr6 #news #breaking #gst The Tamil Nadu Appellate Authority for Advance Ruling (AAAR) has held that GST paid through TR-6 challans cannot be used to claim input tax credit (ITC)…

jurishour.in

TR-6 Challans Not Valid for Availing GST ITC: AAAR

The Tamil Nadu Appellate Authority for Advance Ruling (AAAR) has held that GST paid through TR-6 challans cannot be used to claim input tax credit (ITC) under the GST law.

AAR and AAAR Weekly Round Up taxscan.in/top-stories/aa… #AAR #AAAR #WeeklyRoundUp #taxscan #taxnews

taxscan.in

AAR and AAAR Weekly Round Up

Read on to know the recent AAR and AAAR matters covered at taxscan.in.

Subscription and Redemption of Mutual Fund Units amounts to Sale: AAAR on Zydus Lifesciences Ltd.’s Appeal [Read Order] #Subscription #AAAR #Redemption #taxscan #taxnews Read more: taxscan.in/top-stories/su…

AAR and AAAR Weekly Round Up #aar #aaar #aarandaaarweeklyroundup #weeklyroundup #taxscan #taxnews taxscan.in/top-stories/aa…

taxscan.in

AAR and AAAR Weekly Round Up

Read on to know the recent AAR and AAAR matters covered at taxscan.in

AAR and AAAR Weekly Round Up #AAR #AAAR #weeklyroundup #taxscan #taxnews Read more: taxscan.in/top-stories/aa…

Hesitant To Reappear - Tupac #AAAR Y'all Praise That Man & Diss Me ? Y'all Bipolar , Go Seek Help Before I Hurt Y'all .

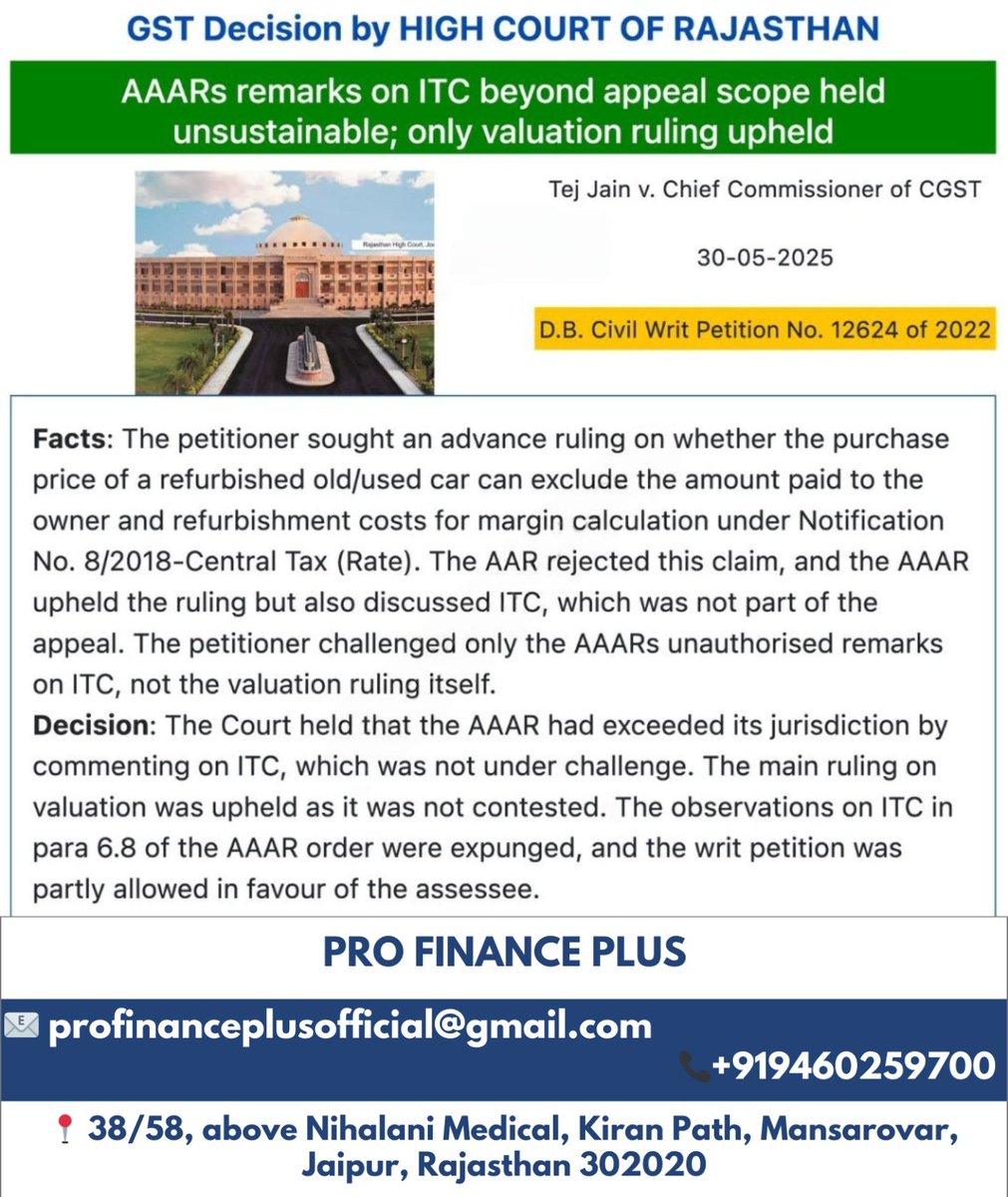

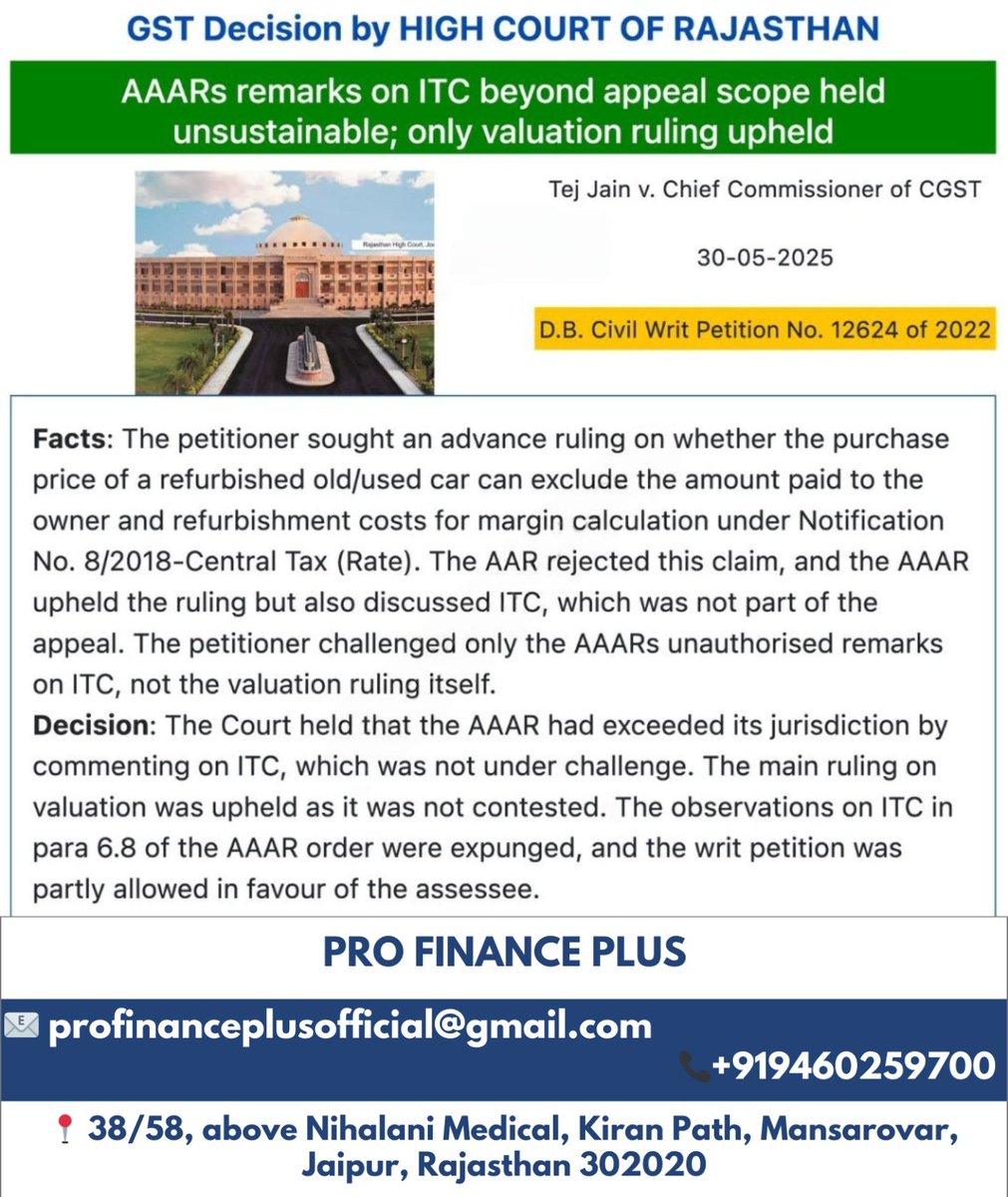

AAAR Cannot Exceed Appeal Limits: Rajasthan HC Expunges ITC Views on Valuation of Refurbished Used Cars under GST Notification [Read Order] CITATION : 2025 TAXSCAN (HC) 1507 #AAAR #AppealLimits #RajasthanHC #GSTNotification #taxscan #taxnews Read more: taxscan.in/top-stories/aa…

taxscan.in

AAAR Cannot Exceed Appeal Limits: Rajasthan HC Expunges ITC Views on Valuation of Refurbished Used...

The court agreed with the petitioner’s contention, observing that an appellate authority cannot expand the scope of an appeal or decide questions not raised before it

HC: AAAR Can't Overstep! Remarks beyond appeal scope on ITC struck down—valuation ruling stays valid. #GSTUpdate #HighCourtJudgment #AAAR #AdvanceRuling #ITCDispute #TaxLitigation #RajasthanHighCourt #GSTLaw #IndirectTax #TaxNews #InputTaxCredit #CAIndia

For school transportation services where payments are made directly by parents, no #GST exemption is available, the #TamilNadu State Appellate Authority for Advance Ruling (#AAAR) has held. blog.saginfotech.com/tn-aaar-gst-ex…

blog.saginfotech.com

TN AAAR: GST Exemption Not Available on School Transport if Parents Pay Directly

For school transportation services where payments are made directly by parents, no Goods and Services Tax (GST) exemption is available, the Tamil Nadu State Appellate Authority for Advance Ruling...

GST payable on examination services provided to Gujarat Panchayat Service Selection Board clarified by AAAR. Big update for the sector! 📚💼 Read more: jurishour.in/gst/gst-payabl… #GST #TaxNews #AAAR #GujaratPanchayat #ExaminationServices #TaxUpdates #GSTNews #IndiaBusiness…

4 weeks till the next @Ravenscroft418 meeting. Better start writing the lecture on the 15th & 16th Degree. #AAAR #Freemasons

HC: AAAR Can't Overstep! Remarks beyond appeal scope on ITC struck down—valuation ruling stays valid. #GSTUpdate #HighCourtJudgment #AAAR #AdvanceRuling #ITCDispute #TaxLitigation #RajasthanHighCourt #GSTLaw #IndirectTax #TaxNews #InputTaxCredit #CAIndia

Big GST Ruling! The AAAR upholds that supplying pencil sharpeners along with pencils is a "Mixed Supply" under GST! 🚨 No relief for DOMS as appeal gets rejected! 🚫 What’s your take? Fair or unfair? 🤔 Read more:jurishour.in/gst/supply-of-… #GST #TaxUpdate #AAAR #DOMS…

Last but not least on our summer event plan is the #AAAR aerosol conference in Portland, Oct 2-6. Come and join us for a talk, poster, instrument showcase presentation and meet with us at our booth #302 aaar.org/2023/ Now, enjoy the summer time!

We are excited to be part of the #AAAR Annual Conference. Come visit us at Booth 406 to explore the latest advances in source apportionment. We are looking forward to meeting you. #AAAR2024

AAR and AAAR Weekly Round Up #AAR #AAAR #Weekly #Taxscan #taxnews read more: taxscan.in/top-stories/aa…

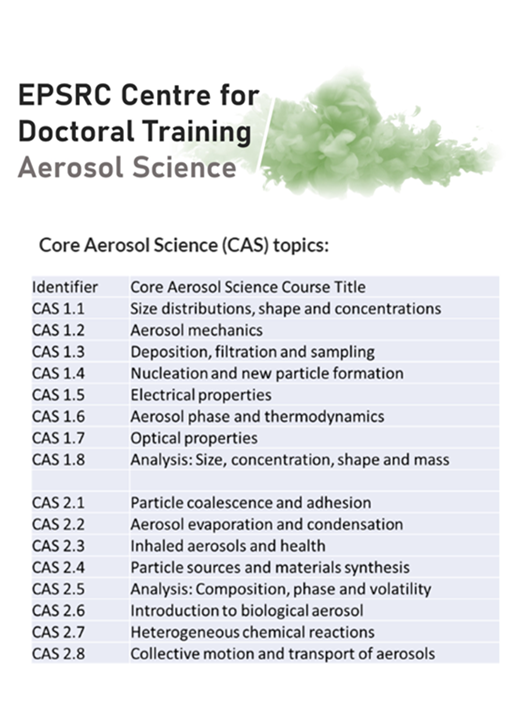

#AAAR is supporting access to a new resource! The EPSRC Center for Doctoral Training in Aerosol Science has developed a web platform for #aerosol training. Students can register on the AAAR website under resources: bit.ly/3MQH3gJ

Provide transport and delivery-related services? 50% off our listings through March when you use this link > itsonthemove.com/new_listing.as… #discount #AAAR

"Higher GST rate of 18% for open car parks sold to flat buyers." buff.ly/43hSuEQ #WestBengal #AAAR #AdvanceRulings #GST #CarPark #SeparateSupply #HigherRate #Homebuyers #CompositeSupply

Myntra not eligible for ITC on gift vouchers sourced from third party: AAR Read more at: studycafe.in/myntra-not-eli… #GST #AAAR #Studycafe #Myntra

planning to attend #AAAR annual conference in #Oct23, consider submitting to this special symposia aaar.org/2023/special-s… led by @JingqiuMao @NASA_HAQAST @AerosolWatch @SanGasso @Carbon2C @BzGEO @blefer @NASAEarthData @NASAARSET

Something went wrong.

Something went wrong.

United States Trends

- 1. Thanksgiving 359K posts

- 2. Trumplican 1,888 posts

- 3. Fani Willis 4,260 posts

- 4. Golesh 1,007 posts

- 5. Hong Kong 69.4K posts

- 6. #wednesdaymotivation 5,999 posts

- 7. #Wednesdayvibe 3,110 posts

- 8. Good Wednesday 34.2K posts

- 9. Mora 22.7K posts

- 10. Ruth 14K posts

- 11. Gretzky N/A

- 12. Karoline Leavitt 27.6K posts

- 13. #puebloenbatallayvictoria 2,914 posts

- 14. #StrangerThings5 19K posts

- 15. #BurnoutSyndromeSeriesEP1 251K posts

- 16. Colorado State 3,881 posts

- 17. Nuns 9,489 posts

- 18. Ribs 11.5K posts

- 19. Elijah Moore N/A

- 20. BYOB N/A