#factoryorders search results

US Factory Orders Surge by 8.2% in May globaltrademag.com/us-factory-ord… #FactoryOrders #USEconomy #BusinessTrends #SupplyChain #EconomicGrowth

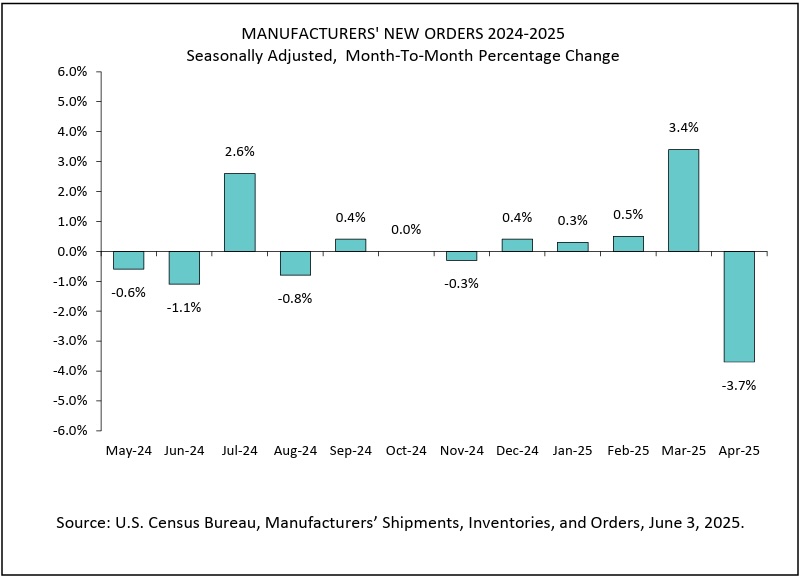

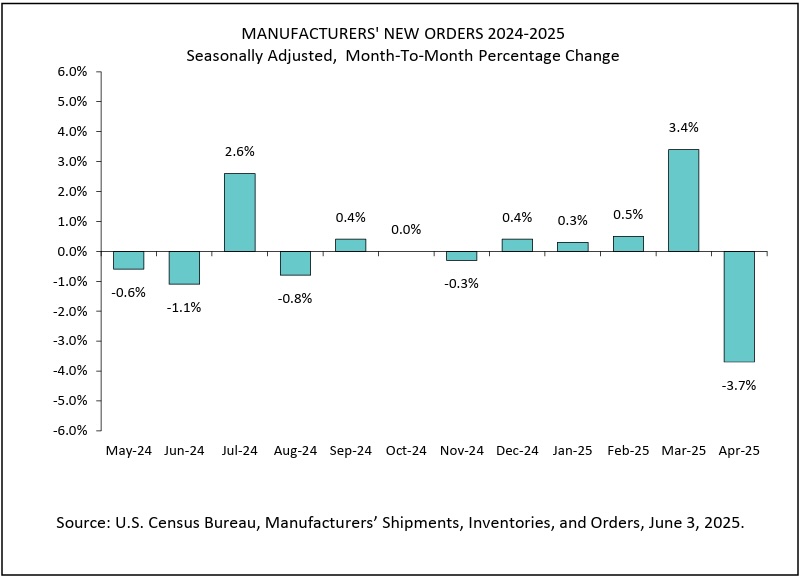

Factory orders fell 3.7% in April, hinting at a shift from goods buying to services. A sign of recalibration, not retreat. Manufacturing steadies as consumer priorities evolve. #FactoryOrders #EconomicUpdate

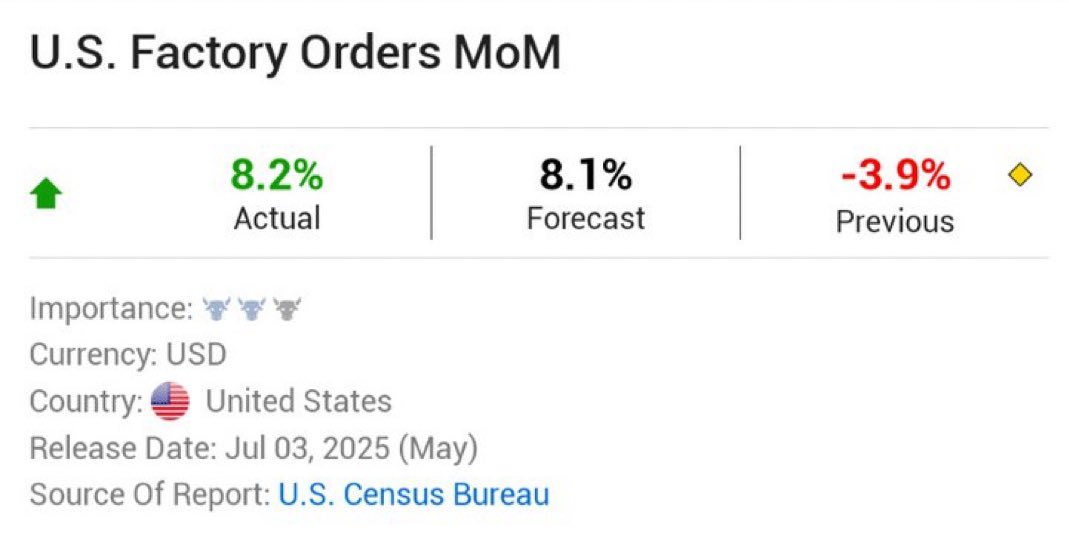

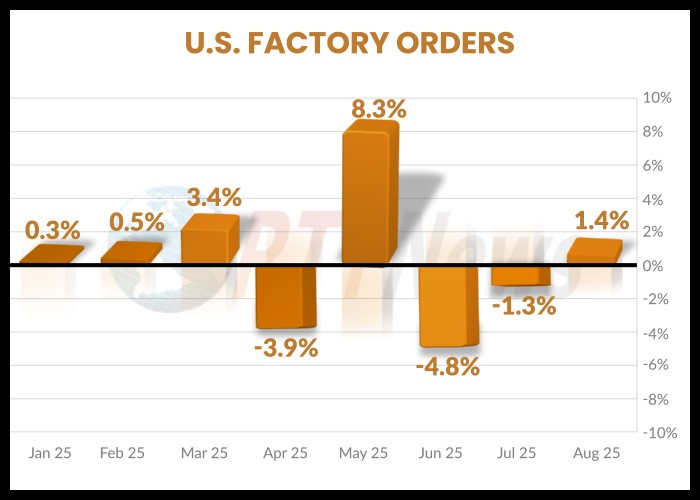

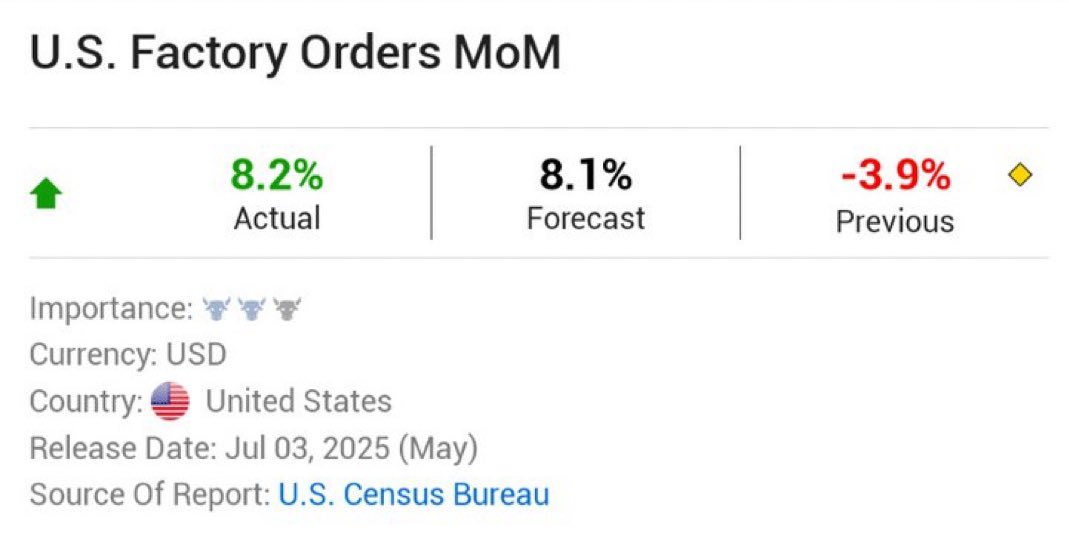

⚠️ BREAKING: 🇺🇸 U.S. factory orders surged 8.2% in May month-over-month, beating expectations of 8.1% and rebounding from a -3.9% decline in April. #US #FactoryOrders #Economy #Markets

📊 U.S. Economic Data This Week 🇺🇸 • Factory Orders - Monday • Trade Balance - Tuesday • ISM Services PMI - Tuesday • Jobless Claims - Thursday • Wholesale Inventories - Thursday • Consumer Credit - Thursday #USEconomy #FactoryOrders #TradeBalance #ISMServices…

Decline in U.S. Factory Orders Reflects Economic Slowdown globaltrademag.com/decline-in-u-s… #FactoryOrders #USEconomy #EconomicSlowdown #EconomicTrends #SupplyChain #IndustryTrends

📉 US Manufacturing Weakens US factory orders fell 0.5% in September, with durable goods down 0.7% and non-durables down 0.2%. with majority of 2024 seeing declines. Is the sector slowing for good or can we see a Q4 recovery? #Manufacturing #Economy #FactoryOrders

US ISM Services #PMI, #FactoryOrders bolstered bearish bias about #USDollar & Treasury bond yields. With this, #Gold marked a record high daily close near $2,140 while #USDINR stays pressured toward 82.80-75 support zone. US ADP Employment, #Fed Chair Powell’s #Testimony eyed.

July Services PMI: 52.7% Forecast 53% Previous 53.9% prior. Business Activity Index at 57.1%. 59.2% previous New Orders Index 55% Previous 55.5% Supplier Deliveries Index at 48.1% vs. 47.6% previous #ISM #PMI #Factoryorders

Another weekly gain in the books! Will the Federal Reserve Bank deliver more gains or bring the pain? Read on in this week's Market Thoughts at ffsinv.com/mt0527/. #jobs #factoryorders #frb

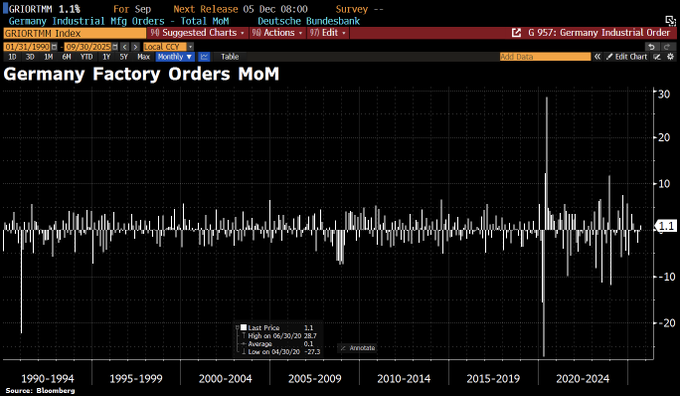

German Factory Orders Rebound In September dlvr.it/TP4qcm #Germany #FactoryOrders #EconomicGrowth #Manufacturing #AutoIndustry

🔹US ISM PMI: 50.3 (Prev. 51.9) 🔹US Factory Orders M/M: 0.4% 🔹ISM Services Employment: 49.2 (Prev. 50.8) #PMI #Factoryorders #economy #USecon hubs.ly/Q01SgFyS0

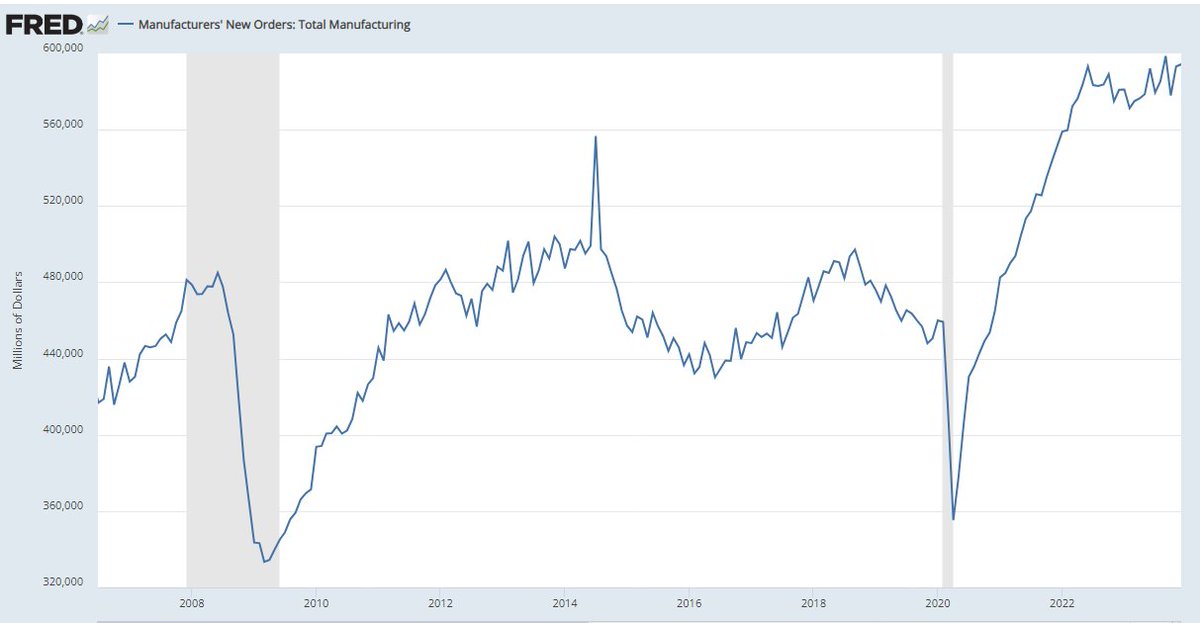

New orders manufactured goods in May ⬆️ by $1.6B or 0.3% to reach $578.0B. Shipments ⬆️by $1.6B or 0.3% to $572.6B Unfilled orders ⬆️ $10.5B or 0.8% to $1,301.9B. Inventories decreased by $1.7B or 0.2% to $853.8B. #Manufacturing #factoryorders hubs.ly/Q01WKYg-0

paradigmfutures.net

US Economic News Today | Paradigm Futures

See easy-to-read summaries and data visualizations for U.S. economy news and reports that you need to succeed in commodity futures trading.

German factory orders surged 3.9% in June, marking the first growth this year! Could this signal a rebound for the German economy and a potential end to the recession? #GermanEconomy #FactoryOrders #EconomicRecover

Week in the #Market #News Jan 6: #FactoryOrders Jan 7: #TradeDeficit Jan 7: #JOLTS Jan 8: #FOMCMinutes Jan 8: #ConsumerCredit Jan 9: #JoblessClaims Jan 9: #WholesaleInventories Jan 10: #Unemployment Jan 10: #ConsumerSentiment #YouTubeChannel YouTube.com/@lasvegastrader

Week in the #Market #News Dec 4: #FactoryOrders Dec 5: #JOLTS Dec 6: #USTradeDeficit Dec 7: #JoblessClaims Dec 7: #WholesaleInventories Dec 7: #ConsumerCredit Dec 8: #Unemployment Dec 8: #ConsumerSentiment YouTube.com/@lasvegastrader #Trading #Traders #DayTrading #DayTrader #Stocks

#EconomicCalendar: At 10:00am ET we get the monthly #FactoryOrders report; At 10:30am ET we have the weekly #CrudeOilInventories report; At 11:30am ET we have a $60 billion 4-month #TreasuryBillAuction; And at 4:00pm ET President @DonaldTrump is due to announce #RecipricalTariffs…

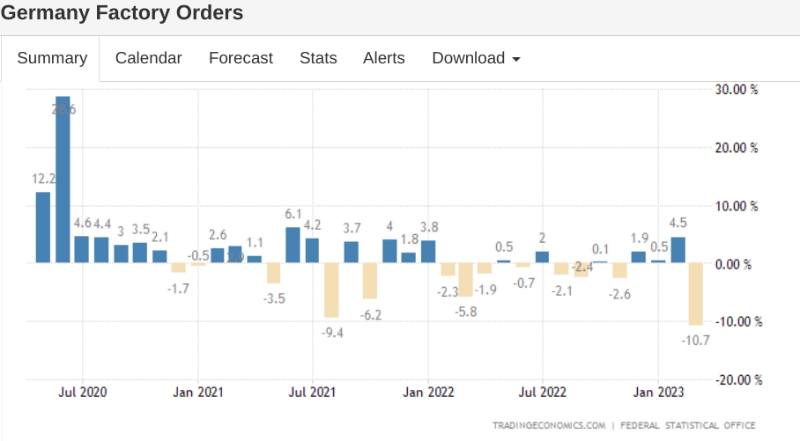

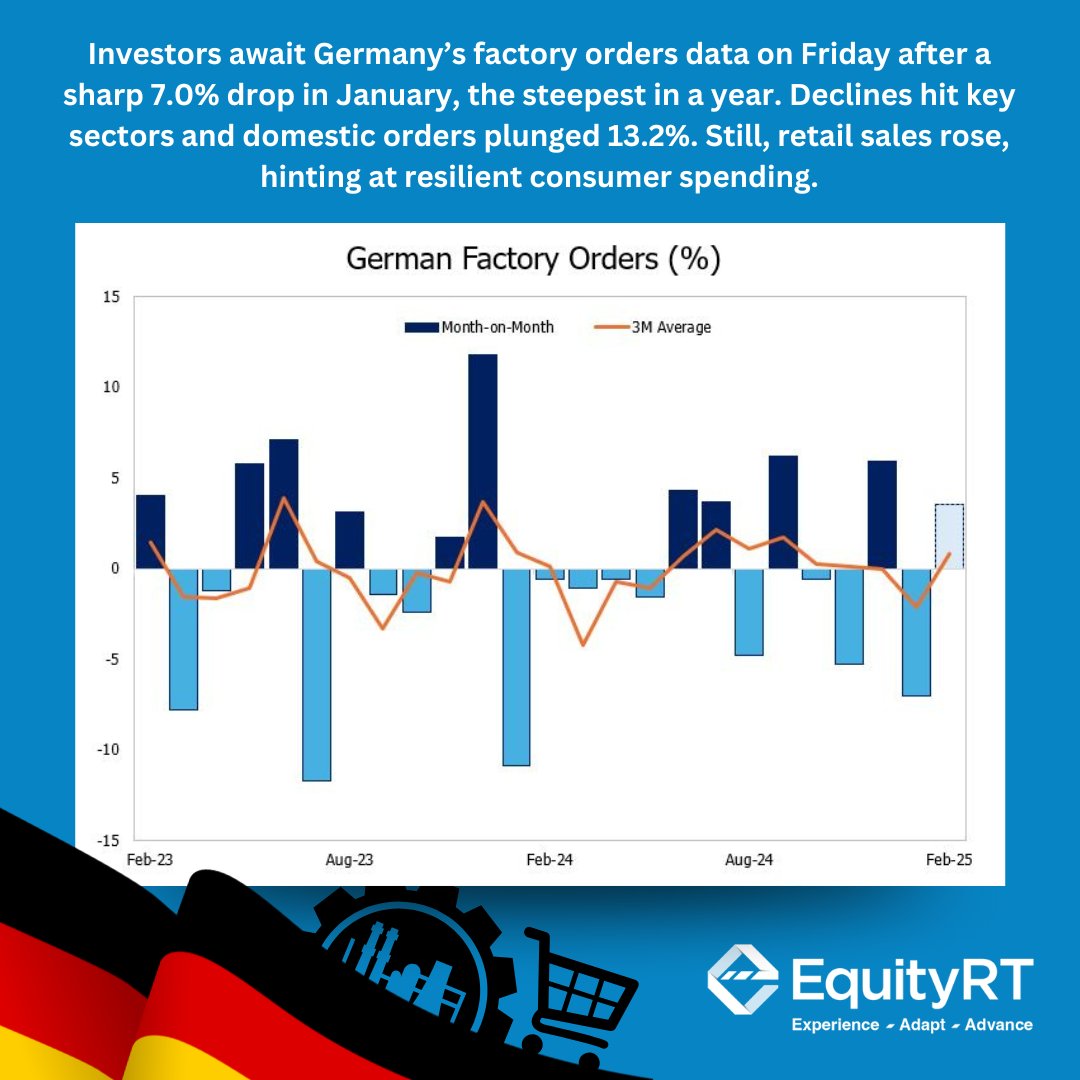

Investors will be watching Germany’s factory order data closely set for release this Friday. Need more data like this? Request a free trial: equityrt.com/free-trial/ #EquityRT #Germany #FactoryOrders #IndustrialSector #EconomicData #Manufacturing #MarketTrends #GermanyEconomy

Week in the #Market #News Mar 5: #FactoryOrders Mar 6: #WholesaleInventories Mar 6: #JOLTS Mar: 6: #BeigeBook Mar 7: #JoblessClaims Mar 7: #USProductivity Mar 7: #TradeBalance Mar 7: #ConsumerCredit Mar 8: #Unemployment Mar 8: #ConsumerSentiment YouTube.com/@lasvegastrader

US Durable Goods (Revised) at 1% (Forecast: 0.9%, Previous: 0.9%) US Factory Orders MoM at 0.6% (Forecast: 0.5%, Previous: 1.7%) US Core Durable Goods (Revised) at 0.7% (Forecast: 0.7%, Previous: 0.7%) #USDurableGoods #FactoryOrders #USEconomy #EconomicData #Markets…

#FactoryOrders Data Show Rebound In August | ZeroHedge #Manufacturing zerohedge.com/economics/fact…

U.S. Factory Orders Rebound In Line With Estimates In August dlvr.it/TPKxvj #FactoryOrders #Manufacturing #EconomicNews #USEconomy #BusinessGrowth

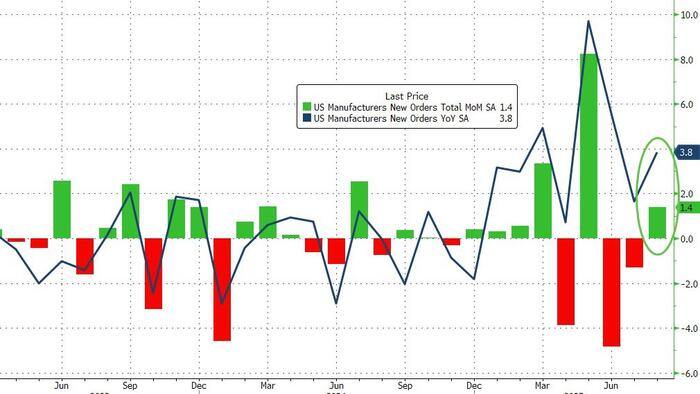

USD Factory Orders (MoM) for August met expectations at 1.4%, signaling no surprise for markets. Limited impact on USD pairs and Fed policy anticipated. Find out more at onemilliontrade.com #USD #FactoryOrders #EconomicData #Manufacturing #MarketAn...

Good morning from Germany! Factory orders up 1.1% in Sep—first rise in 5 months, led by autos & electrical gear. Ex one-offs, +1.9% MoM, clawing back Aug plunge. But no sustained rebound yet; Commerzbank: True turnaround waits for 2026 fiscal boost #GermanEconomy #FactoryOrders

German Factory Orders Rebound In September dlvr.it/TP4qcm #Germany #FactoryOrders #EconomicGrowth #Manufacturing #AutoIndustry

European Economic News Preview: German Factory Orders Data Due dlvr.it/TP4m8s #GermanEconomy #FactoryOrders #EconomicNews #EuroArea #PMI

German Factory Orders significantly beat forecasts, signaling robust industrial activity and potentially strengthening the EUR. This may reduce expectations for immediate ECB dovish action. Find out more at onemilliontrade.com #EUR #FactoryOrders #...

UPDATE: Key US economic reports, including September Factory Orders and JOLTS job openings, have been delayed due to the ongoing government shutdown. #Trump #EconomicGrowth #FactoryOrders #JOLTS #GovernmentShutdown

UPDATE: As of November 4, 2025, leveraged positions worth approximately $1.3 - 1.37 billion were liquidated across major exchanges like Binance, Bybit, and OKX, primarily driven by Bitcoin's drop below $104,000. #CryptoMarket #CryptoLiquidation #Bitcoin #Binance #OKX #ByBit

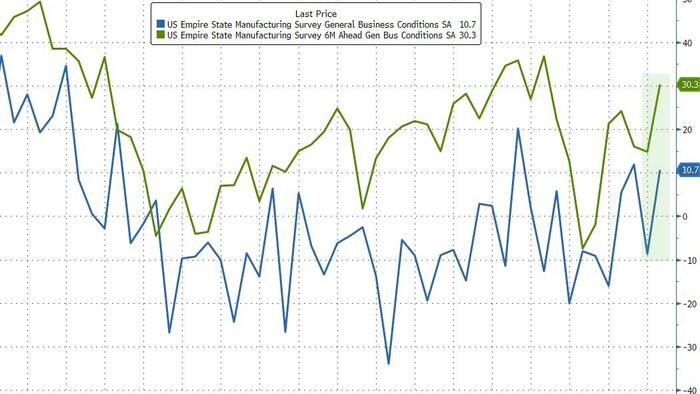

New York Factory Activity Surged In October, Jobs & Orders Jump | ZeroHedge #FactoryOrders zerohedge.com/economics/new-…

German Factory Orders Log Unexpected Decline dlvr.it/TNX7lt #Germany #FactoryOrders #EconomicDecline #Manufacturing #Economy

European Shares Subdued As German Factory Orders Fall Again dlvr.it/TNWn6V #EuropeanMarkets #GermanStocks #FactoryOrders #PoliticalCrisis #Investing

🏭 Factory Orders MoM – 10:00 AM 📍Previsión: +1.4% ⚠️ Una sorpresa negativa podría renovar presiones bajistas. ✅ Buen dato puede impulsar industriales y manufactura. #Manufacturing #FactoryOrders #SP500 #DayTrading

US #FactoryOrders Dropped Again In July As #Tariff Front-Running Hangover Lingers | ZeroHedge #Tariffs zerohedge.com/economics/us-f…

zerohedge.com

US Factory Orders Dropped Again In July As Tariff Front-Running Hangover Lingers

...but Core orders (ex-Transports) rose 0.6% MoM (the third monthly rise in a row)

US Factory Orders (MoM) – July ✅ Actual: -1.3% ✅ Previous: -4.8% ✅ Estimate: -1.3% 📊 Key Takeaway: Contraction in factory orders slows matching expectations signaling a potential stabilization in manufacturing #USMarkets #FactoryOrders #Economy #Manufacturing #MacroUpdate

U.S. Factory Orders Slump Roughly In Line With Estimates In July dlvr.it/TMrsR3 #FactoryOrders #USEconomy #Manufacturing #EconomicReport #CommerceDepartment

US Factory Orders Surge by 8.2% in May globaltrademag.com/us-factory-ord… #FactoryOrders #USEconomy #BusinessTrends #SupplyChain #EconomicGrowth

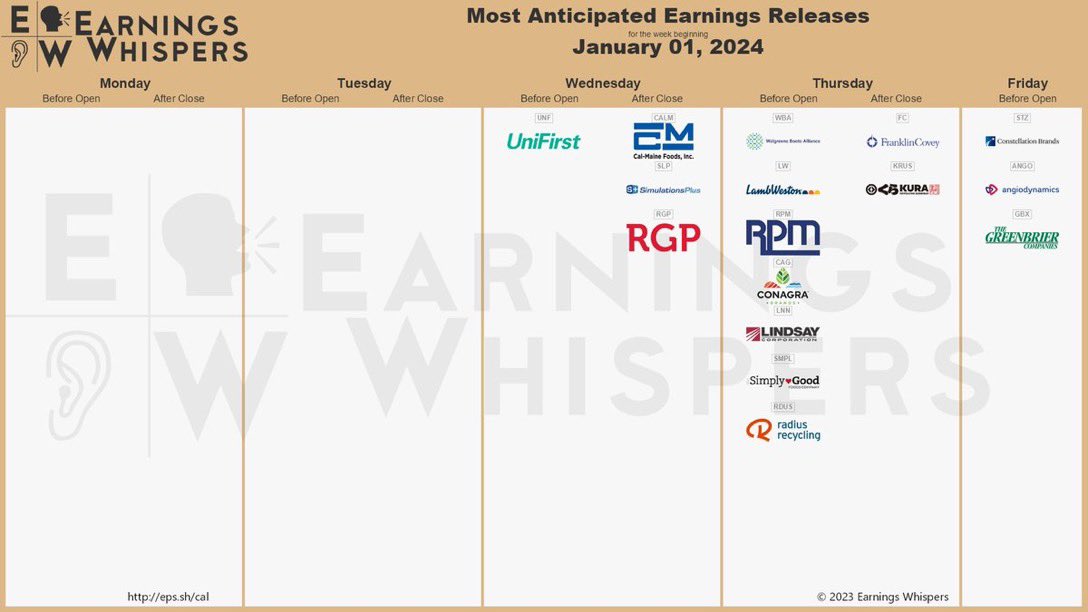

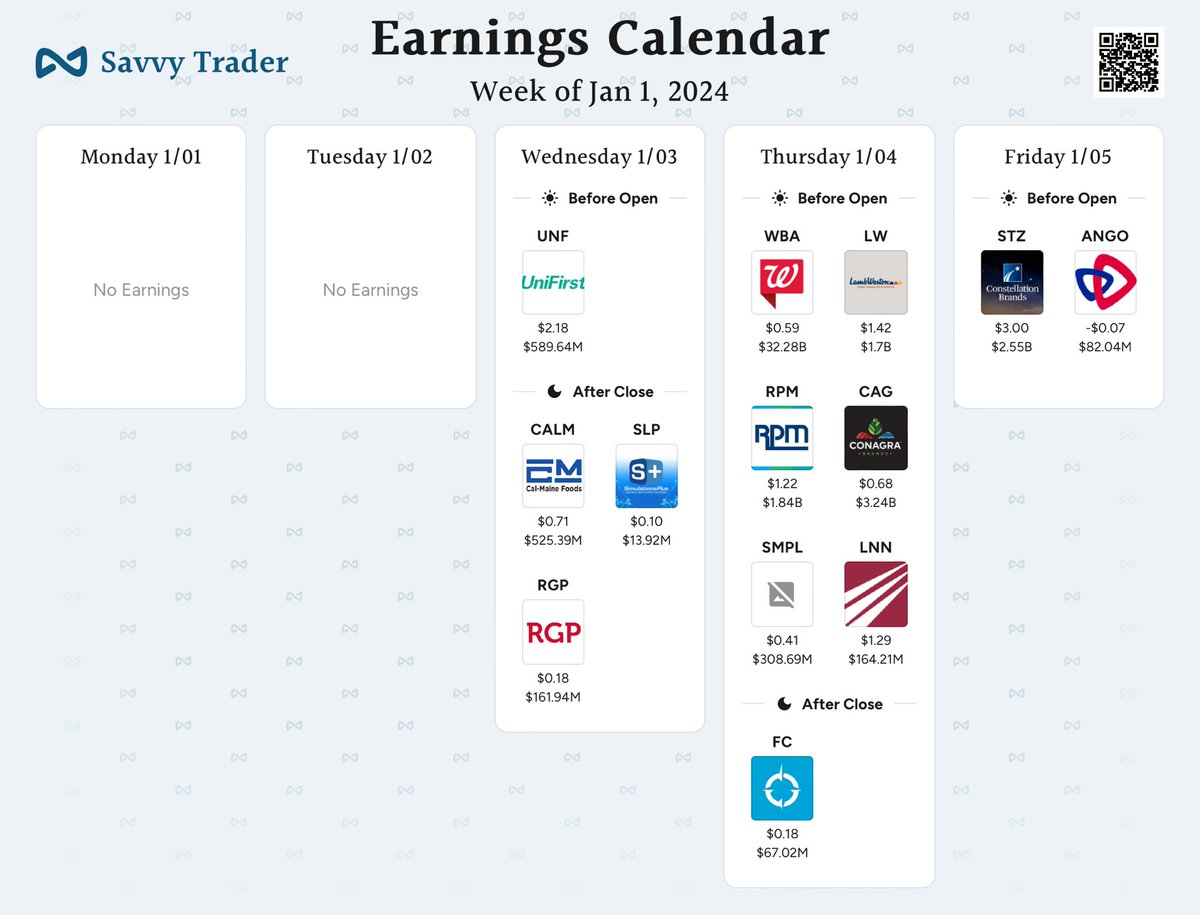

#FederalReserve Jan 5 #Employment #FactoryOrders #ISM #ThomasBarkin #Earnings Jan 4 #AMC $KRUS $FC Jan 5 #BMO $STZ $GBX $ANGO

Decline in U.S. Factory Orders Reflects Economic Slowdown globaltrademag.com/decline-in-u-s… #FactoryOrders #USEconomy #EconomicSlowdown #EconomicTrends #SupplyChain #IndustryTrends

European Data Slips Further into Contraction - Part 4 with @markfny primaryvision.co/youtube-videos… #EuropeanEconomy #RetailSales #FactoryOrders #InflationTrends #ECBRates #EurozoneCrisis #EconomicContraction

1/ Detailed tweet on #FactoryOrders New orders for manufactured goods in the US increased by 0.3% in May 2023 compared to the previous month, maintaining the same pace as the previous period. However, this growth fell short of market expectations for a 0.8% advance. #economy

#FactoryOrders were better than expected. The #economic #calendar is also pretty light this week and odds are that the upcoming #Inflation (#CPI, #PPI) data will be better than expected. So, markets go up in the meantime?

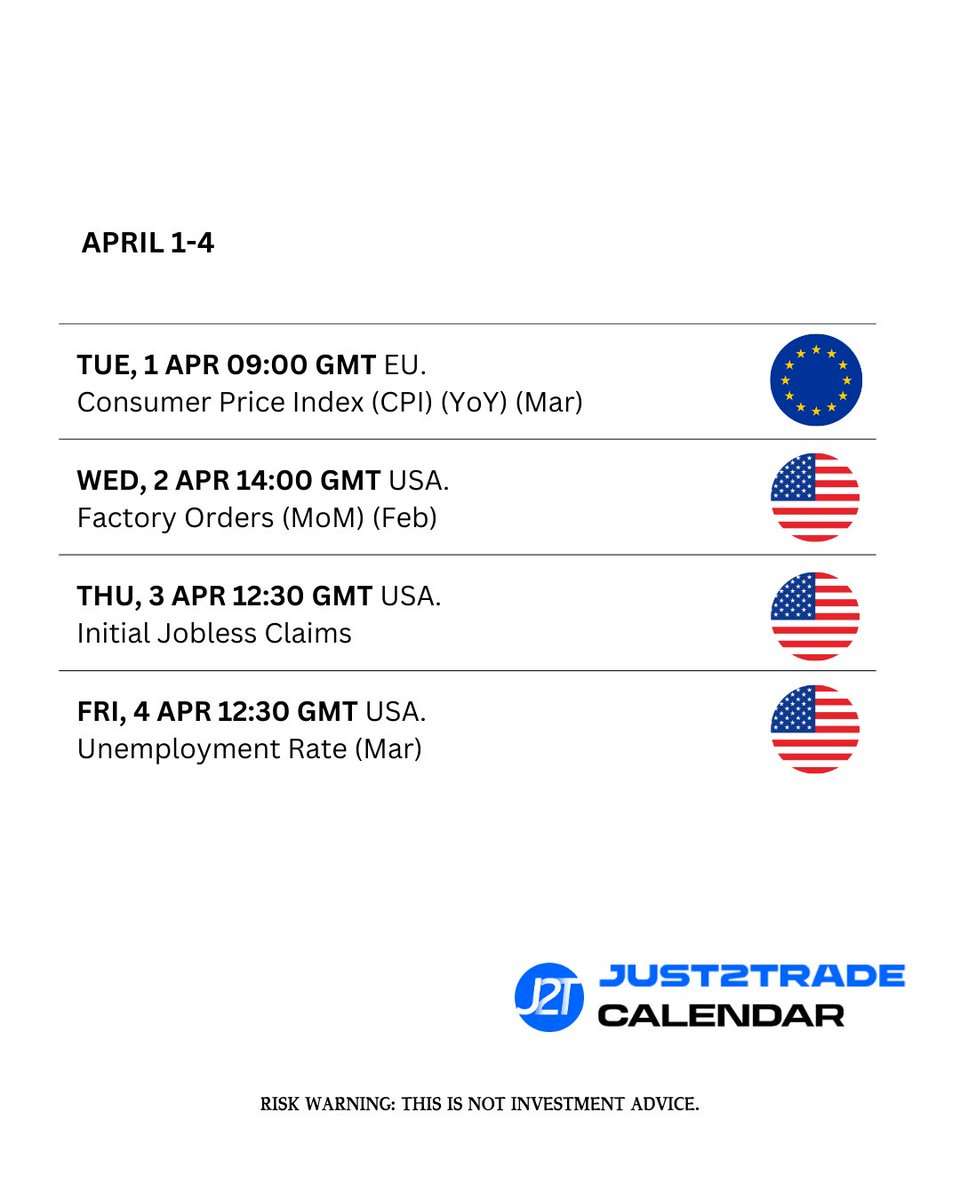

🗓️Weekly economic calendar April 1-4 Get ready for this week’s major news events that could influence your trades. Click the link in our bio for the full economic calendar🔗 ⚠️ This is not investment advice. LIME TRADING (CY) LTD / CySEC License 281/15 #CPI #FactoryOrders…

US ISM Services #PMI, ADP #Employment Change & #FactoryOrders drowned #USDollar before #USHoliday. #USDINR pokes bullish triangle’s resistance of 83.52, well above 200-SMA support of 83.38, while #Gold hovers between $2,368-69 hurdle & monthly resistance-turned-support of $2,353.

#Germany January factory orders fall 7% M/M, worse than the expected -2.5%. Y/Y, factory orders decline 2.6%, missing the forecast of +2.6%. #Economy #FactoryOrders #Germany #MarketNews #Manufacturing #EconomicData #GermanyEconomy #BBG

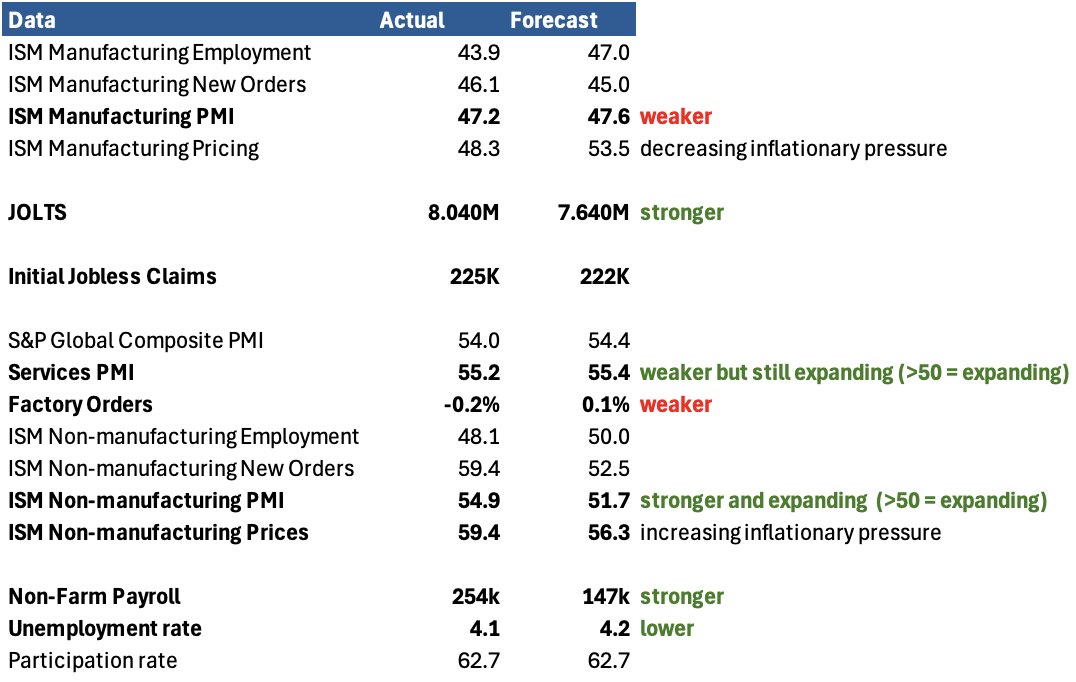

Big week in economic data. #Manufacturing and #factoryorders continue to be weak. #services continue to be strong. #Employment #jobmarket is strengthening -> #JOLTS and #NFP (254k vs 147K expected!) Some thoughts: - Economy is in ok shape. No #hardlanding in sight - Lows in…

#Germany's factory orders surged 3.9% in June 2024, beating forecasts and reversing May's 1.7% decline. Driven by strong demand for aircraft, ships, trains, and cars. Domestic orders soared 9.1%. #Otet #FactoryOrders

Factory orders fell 3.7% in April, hinting at a shift from goods buying to services. A sign of recalibration, not retreat. Manufacturing steadies as consumer priorities evolve. #FactoryOrders #EconomicUpdate

US ISM Services #PMI, #FactoryOrders bolstered bearish bias about #USDollar & Treasury bond yields. With this, #Gold marked a record high daily close near $2,140 while #USDINR stays pressured toward 82.80-75 support zone. US ADP Employment, #Fed Chair Powell’s #Testimony eyed.

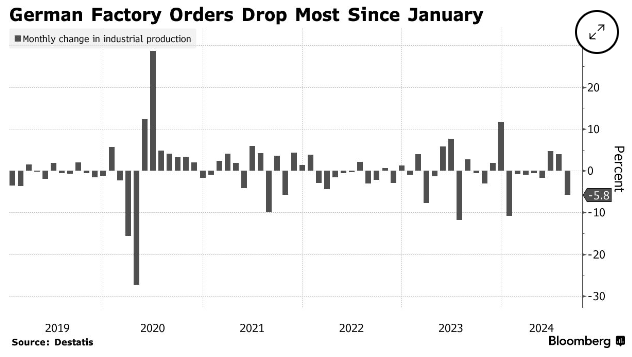

📉 Factory orders in Germany plummeted 5.8% in August, marking the biggest drop since January and disappointing economists' forecasts. Europe’s largest economy continues to struggle, missing the anticipated recovery. #Germany #Economy #FactoryOrders

⚠️ BREAKING: 🇺🇸 U.S. factory orders surged 8.2% in May month-over-month, beating expectations of 8.1% and rebounding from a -3.9% decline in April. #US #FactoryOrders #Economy #Markets

European #stocks opened higher and extended the rally on Wednesday despite the release of weak German #Factoryorders data. The bullish sentiment was also boosted by dovish comments from #ECB official #Schnabel. #Germany #eurusd #EuropeanUnion #StockMarket #dax30 #CAC40 #news

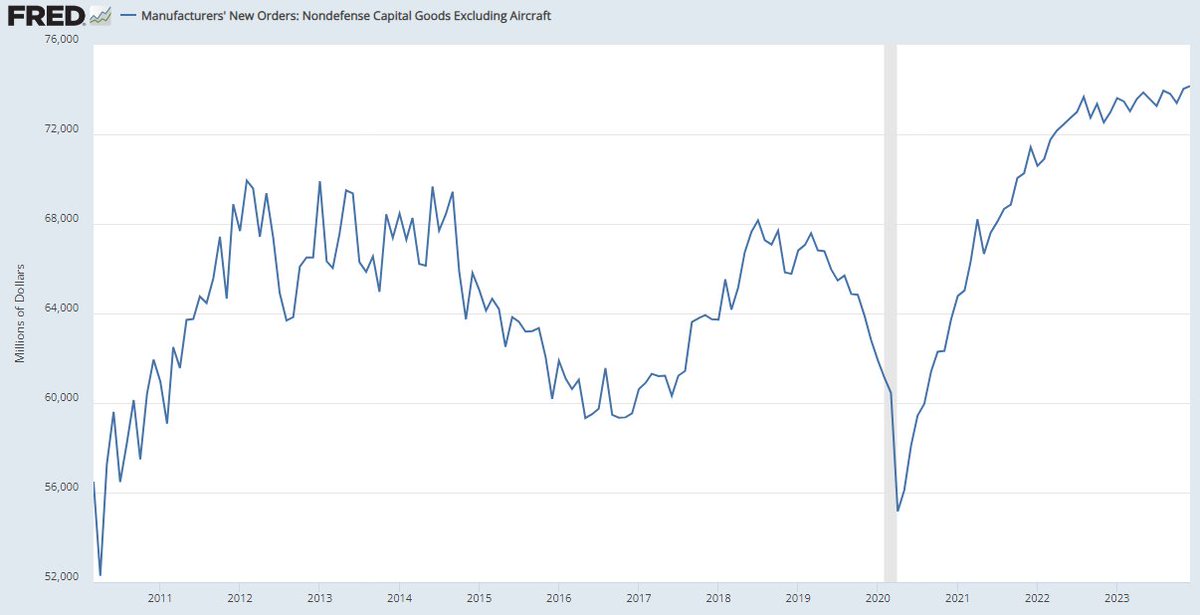

Core cap goods shipments rev’d a tenth lower to flat read so a drag to 4Q #GDP revision but remains just off ATH. Y/y #factoryorders +0.8%, -1.4% ex-transp, +5.2% incl backlogs. Core cap goods orders (biz spending) +1.7% y/y, shipments +3.1%.

Dec #factoryorders +0.2% m/m as exp’d after v strong +2.6% in Nov, as +15.3% incr in transp turned to -0.9% drag. Ex-transp though +0.4% vs +0.2% exp’d remaining in 2yr range. Non-durables (52% of factory orders) +0.4%. Core cap goods orders (biz cap ex) +0.2% to ATH, +1.7% y/y.

#USDollar traces a pullback in short-term yields despite upbeat US #FactoryOrders & JOLTS #Job Openings, as well as risk-off mood. With this, #Gold renews record top near $2,288 but #USDINR bounces off 83.30 support toward 83.40 resistance. US #PMI, ADP #Employment Change eyed.

Something went wrong.

Something went wrong.

United States Trends

- 1. #BaddiesUSA 61K posts

- 2. Rams 29.5K posts

- 3. #LAShortnSweet 21.8K posts

- 4. TOP CALL 3,350 posts

- 5. Scotty 9,862 posts

- 6. Cowboys 101K posts

- 7. Eagles 141K posts

- 8. Chip Kelly 8,736 posts

- 9. #ITWelcomeToDerry 15.7K posts

- 10. sabrina 61.7K posts

- 11. #centralwOrldXmasXFreenBecky 251K posts

- 12. Raiders 67.8K posts

- 13. SAROCHA REBECCA DISNEY AT CTW 272K posts

- 14. Stacey 24.4K posts

- 15. #RHOP 12.3K posts

- 16. Stafford 15.2K posts

- 17. Ahna 7,285 posts

- 18. Bucs 12.3K posts

- 19. billie 19.4K posts

- 20. Market Focus 2,209 posts