#pwcdeals نتائج البحث

Congrats to PwC Deals is the Global #1 M&A Advisor by Volume for 2024! ranked by Mergermarket, LSEG, Bloomberg & Dealogic—retaining our top spot from 2023! 🎉 🌟 #PwCDeals #M&A

We’re proud to have served as exclusive financial advisors to Goyaz Jewellery for their Series A investment from Norwest. We’re grateful for our client’s trust in PwC India and proud to support the next phase of growth for this dynamic brand. #PwCDeals

PwC Belfast Deals — One Firm One Day! Launched into helping coach primary schools in 🤺 🤺 🤺 !! The things I do 😜@PwC_UK #ofod #giveback #PwCDeals

Taiba Investments acquires Dur Hospitality shares through a swap securities transaction supported by @PwC Middle East One of the most high profile share transactions in the region, this is a step forward in support of the Kingdom’s #Vision2030. #PwCdeals

We recently launched the ‘Deals at a Glance’ report highlighting the robust momentum in India’s Private Equity (PE) activity in Q3 CY25. Download the report: lnkd.in/g7NWDdxf #PwCDeals

TMT dealmakers face a shifting landscape shaped by AI, geopolitics & strategic realignment. Investors are doubling down on AI-adjacent bets & resilient supply chains. Explore insights shaping tomorrow’s deals: pwc.to/4fZFFVu #PwCDeals

Congratulations to our @PwC Deals and Corporate Finance team for being named the Global #1 M&A Advisor by Volume for 2023 by Thomson Reuters, Bloomberg and Dealogic. This is a credit to our global network of teams bringing value to our clients. #PwCDeals #PwCCorporateFinance

Caution's still the name of the game for consumer markets dealmakers in a not-so-quiet environment. In our midyear M&A outlook we highlight why investors are taking a measured approach to deals, but remain open to opportunity: pwc.to/4aj6HpM. #PwCIndonesia #PwCDeals…

Our corporate finance team has been ranked the global number one M&A Advisor by Volume for H1 2025 according to Mergermarket, LSEG and Bloomberg. 🎉 #PwCDeals #PwCCorporateFinance

We are #PwCProud to act as the financial advisor to Satiya Nutraceuticals for its majority stake sale to Marico. We would like to thank our client for trusting us with this transaction and congratulate the team who worked on the deal for their relentless efforts. #PwCDeals

What should we watch out for in the M&A market? 📈 Sector dynamics are evolving fast. Find out what dealmakers will be looking out for—and how to maximize the opportunities that arise. #PwCDeals #IndustryTrends

We’re proud to have advised Wipro Enterprises (Aerospace) on its proposed majority acquisition of Lauak Group, a French aircraft parts maker. The deal underscores India’s growing aerospace role and the impact of global strategic partnerships in advanced manufacturing. #PwCDeals

We are #PwCProud to act as financial advisor to The Souled Store – a leading D2C lifestyle brand in India – in their capital raise from Xponentia Capital and their existing investors. We would like to thank our client for reposing their trust on us. #PwCDeals

We acted as the exclusive financial advisor to Goals101 for its acquisition by M2P Fintech. We would like to thank our client for their trust in us and congratulate the team who worked on this deal. #PwCDeals #ValueCreationInDeals

Huge congratulations to our exceptional PwC Deals and Corporate Finance team for securing the top spot as the Asia Pacific #1 M&A Advisor by Volume for 2021, 2022 and 2023, as recognized by Thomson Reuters, Mergermarket, Bloomberg, and Dealogic! #PwCDeals #PwCCorporateFinance

Today we launch the 10th edition of our PwC Africa Valuation Methodology Survey. Download or update your existing app to explore the latest insights into general #valuation practice in the African market: ow.ly/KjaI50NaENZ #PwCValuation #PwCDeals #DigitalIntelligence

We began 2025 with cautious optimism about M&A growth but also warned of some wild cards that could spoil the party. Those cards turned out to be wilder than we imagined. Explore our Global M&A #IndustryTrends 2025 mid-year outlook: pwc.to/4amJRNL #PwCDeals

Our research shows that UK Businesses are investing in external partnerships to acquire tech skills and capabilities to transform their businesses. Find out more pwc.to/3Dexyny #PwCDeals #ValueCreation

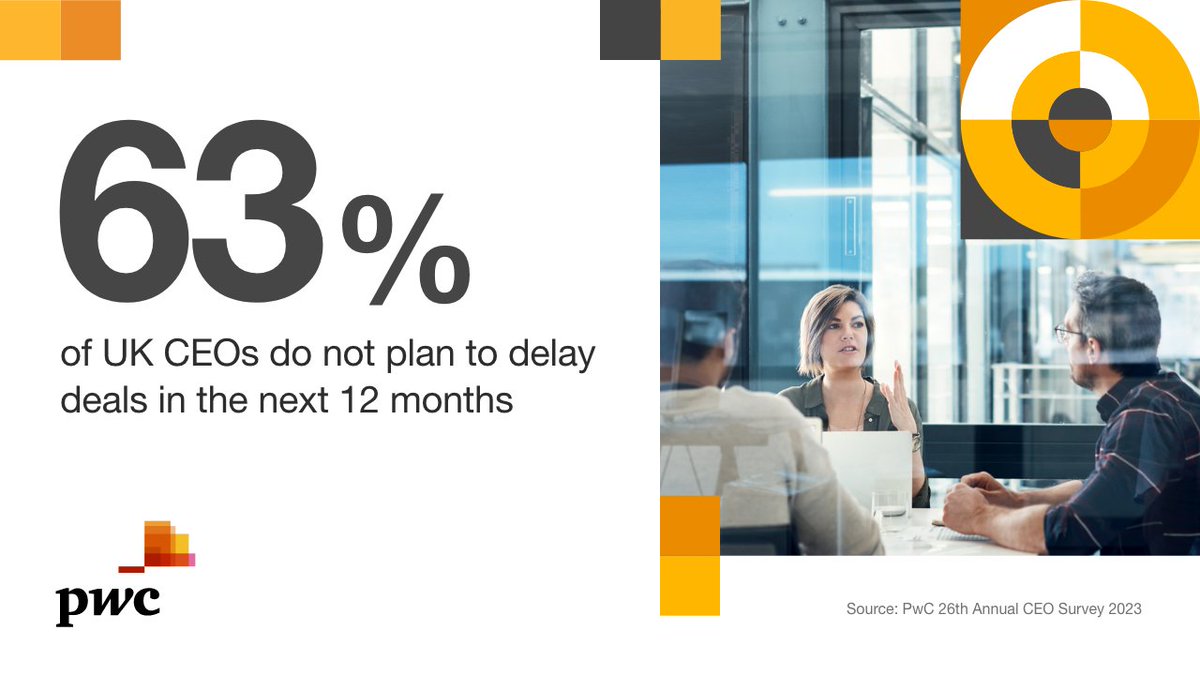

UK deals activity is down compared to last year, however investors are showing confidence in sector-specific deals. Read our mid-year M&A trends review to learn more. bit.ly/3q06wwE #ValueCreation #PwCDeals

We recently launched the ‘Deals at a Glance’ report highlighting the robust momentum in India’s Private Equity (PE) activity in Q3 CY25. Download the report: lnkd.in/g7NWDdxf #PwCDeals

Insurance M&A is gaining pace, driven by consolidation, geographic expansion, and the need for new capabilities. Insurance brokerages are seeing strong deal flow—including megadeals. Read more: pwc.to/3E7n7W0. #PwCIndonesia #PwCDeals #Insurance #Broker

We’re proud to have served as exclusive financial advisors to Goyaz Jewellery for their Series A investment from Norwest. We’re grateful for our client’s trust in PwC India and proud to support the next phase of growth for this dynamic brand. #PwCDeals

In 2025, automakers are realigning fast—divesting non-core assets to focus on electrification and digital transformation. Efficiency and focus are setting the tone for M&A in the months ahead. Read more: pwc.to/4g1MSnW. #PwCIndonesia #PwCDeals #Automotive

Tech meets health: Companies outside the sector are reshaping care delivery with wearables and remote solutions, aiming for a more integrated, efficient system. Read our midyear outlook: pwc.to/4amJRxf. #PwCIndonesia #PwCDeals #IndustryTrends #HealthTech

Strategic M&A in energy, utilities and resources is unlocking #ValueinMotion—driven by rising demand, resilience plays, and AI-fueled infrastructure deals. Read more: pwc.to/4amKSp5. #PwCIndonsia #PwCDeals #IndustryTrends #energy #infrastructure

Capital is on the move. Real estate investors are pivoting globally—towards hands-on strategies, high-growth markets, and asset classes with strong fundamentals. Read more in our midyear outlook: pwc.to/4aiCwie. #PwCIndonesia #PwCDeals #IndustryTrends #RealEstate…

AI is reshaping #PrivateEquity—from portfolio ops to deal execution. Learn how leading firms are leveraging emerging tech to drive more value in our latest M&A outlook: pwc.to/4jTUWZQ. #PwCIndonesia #PwCDeals #IndustryTrends #PE

From ESG pressures to rising commodity costs, value chains are being reconfigured across the food and beverage sector. Consumer preferences are changing fast—and dealmakers are adapting. Read more: pwc.to/4aj6HpM. #PwCIndonesia #PwCDeals #CPG

Strong margins and tech-led growth are drawing buyers to oilfield services. But with oil prices softening, risk premiums and valuation gaps may temper deal activity. Explore more: pwc.to/4amKSp5. #PwCIndonesia #PwCDeals #OilandGas #OilfieldServices #OFS

Energy, utilities and resources are transforming rapidly. Strategic M&A is unlocking “value in motion” as demand rises and transition accelerates. Discover key trends in our 2025 mid-year outlook: pwc.to/4amKSp5 #PwCDeals

Favourable consumer trends and a fragmented brand landscape are fueling deal activity in personal care. We expect strong M&A momentum to continue over the second half of 2025. pwc.to/4aj6HpM. #PwCIndonesia #PwCDeals #PersonalCare #IndustryTrends

From active portfolio management to international plays, real estate investors are rethinking their #growth strategies. Dive into the trends in our M&A outlook: pwc.to/4aiCwie. #PwCIndonesia #PwCDeals #IndustryTrends #RealEstate #RealAssets

We’re proud to have advised the shareholders of Comfort Click on its sale to Zydus Wellness. This deal highlights PwC Corporate Finance’s strong track record in consumer health and the global network’s ability to deliver complex cross-border M&A. #PwCDeals

Caution's still the name of the game for consumer markets dealmakers in a not-so-quiet environment. In our midyear M&A outlook we highlight why investors are taking a measured approach to deals, but remain open to opportunity: pwc.to/4aj6HpM. #PwCIndonesia #PwCDeals…

Energy demand is surging—and #infrastructure is racing to keep up. See how dealmakers are stepping up in our midyear M&A outlook: pwc.to/4amKSp5. #PwCIndonesia #PwCDeals #IndustryTrends #energy

IBC Amendment Bill 2025 introduces targeted reforms across insolvency, regulation, technology, and cross-border cooperation. It aims to build a more agile, transparent, and investor-friendly regime. #PwCDeals #IBC

Private equity is moving into retail. With eyes on the retirement market as a new source of AuM, expect to see more #MnA and strategic alliances ahead. Read our midyear M&A outlook: pwc.to/4jTUWZQ. #PwCIndonesia #PwCDeals #IndustryTrends #PE #PrivateEquity

Economies of scale and digital #transformation are fueling consolidation in financial services. See how M&A is reshaping the competitive landscape in our midyear outlook: pwc.to/3E7n7W0. #PwCIndonesia #PwCDeals #FS #MnA #IndustryTrends

Back to the core, forward with tech. Portfolio realignment is reshaping M&A in industrials and services. See what’s ahead in our 2025 midyear outlook: pwc.to/4g1MSnW. #PwCIndonesia #PwCDeals #IndustryTrends #PortfolioOptimisation

Congratulations to our @PwC #Deals and #CorporateFinance team for being named the Global #1 M&A Advisor by Volume for 2022 by @ThomsonReuters, @Bloomberg and @Dealogic. #PwCDeals #PwCCorporateFinance

Caution's still the name of the game for consumer markets dealmakers in a not-so-quiet environment. In our midyear M&A outlook we highlight why investors are taking a measured approach to deals, but remain open to opportunity: pwc.to/4aj6HpM. #PwCIndonesia #PwCDeals…

PwC Belfast Deals — One Firm One Day! Launched into helping coach primary schools in 🤺 🤺 🤺 !! The things I do 😜@PwC_UK #ofod #giveback #PwCDeals

Our corporate finance team has been ranked the global number one M&A Advisor by Volume for H1 2025 according to Mergermarket, LSEG and Bloomberg. 🎉 #PwCDeals #PwCCorporateFinance

Congratulations to our @PwC Deals and Corporate Finance team for being named the Global #1 M&A Advisor by Volume for 2023 by Thomson Reuters, Bloomberg and Dealogic. This is a credit to our global network of teams bringing value to our clients. #PwCDeals #PwCCorporateFinance

Congrats to PwC Deals is the Global #1 M&A Advisor by Volume for 2024! ranked by Mergermarket, LSEG, Bloomberg & Dealogic—retaining our top spot from 2023! 🎉 🌟 #PwCDeals #M&A

We’re proud to have served as exclusive financial advisors to Goyaz Jewellery for their Series A investment from Norwest. We’re grateful for our client’s trust in PwC India and proud to support the next phase of growth for this dynamic brand. #PwCDeals

Telecom operators are sharpening their focus—exiting some markets while doubling down in others. Portfolio reviews are driving bold, market-specific moves. Read our M&A outlook: pwc.to/4fZFFVu. #PwCIndonesia #PwCDeals #Telecoms

🎉😊#PwCProud of all of us that form our Corporate Finance team for being recognised as the Global 🌍 #1 M&A Advisor by Volume for 2022 by Thomson Reuters, Bloomberg and Dealogic. #PwCDeals #teamwork #internationalworking

What should we watch out for in the M&A market? 📈 Sector dynamics are evolving fast. Find out what dealmakers will be looking out for—and how to maximize the opportunities that arise. #PwCDeals #IndustryTrends

We are #PwCProud to announce that PwC Nigeria has been recognised as the ‘Best Advisory Services: Corporate Finance’ at the 2024 @AfricaGlobFunds Service Providers Awards. Congratulations to our Deals Team on winning this award! #CorporateFinance #PwCDeals #DealsAdvisory

TMT dealmakers face a shifting landscape shaped by AI, geopolitics & strategic realignment. Investors are doubling down on AI-adjacent bets & resilient supply chains. Explore insights shaping tomorrow’s deals: pwc.to/4fZFFVu #PwCDeals

We are #PwCProud to act as the financial advisor to Satiya Nutraceuticals for its majority stake sale to Marico. We would like to thank our client for trusting us with this transaction and congratulate the team who worked on the deal for their relentless efforts. #PwCDeals

Huge congratulations to our exceptional PwC Deals and Corporate Finance team for securing the top spot as the Asia Pacific #1 M&A Advisor by Volume for 2021, 2022 and 2023, as recognized by Thomson Reuters, Mergermarket, Bloomberg, and Dealogic! #PwCDeals #PwCCorporateFinance

Despite the complex and sometimes contradictory trends in the M&A market, deals are still getting done. What strategies are dealmakers adopting through these turbulent times? #PwCDeals #IndustryTrends #MnA

We are #PwCProud to act as financial advisor to The Souled Store – a leading D2C lifestyle brand in India – in their capital raise from Xponentia Capital and their existing investors. We would like to thank our client for reposing their trust on us. #PwCDeals

We acted as the exclusive financial advisor to Goals101 for its acquisition by M2P Fintech. We would like to thank our client for their trust in us and congratulate the team who worked on this deal. #PwCDeals #ValueCreationInDeals

🏆Achieving sustained excellence in M&A advisory ⭐ We are proud to announce that PwC has once again claimed the top spot as the #1 Asia Pacific M&A Advisor for the first half of 2024. #PwCDeals #PwCProud #MnA

We are #PwCProud to announce that we have been ranked as the Global #1 M&A Advisor by volume of deals for 2023 – 10 years in a row! We hope to continue to make valuable contributions to our clients' growth and success. #PwCDeals #ValueCreationInDeals

Something went wrong.

Something went wrong.

United States Trends

- 1. #socideveloper_com N/A

- 2. #lip_bomb_RESCENE N/A

- 3. ARMY Protect The 8thDaesang 38.5K posts

- 4. #DaesangForJin 38.3K posts

- 5. #ENHYPEN 109K posts

- 6. #2025MAMAVOTE 60.7K posts

- 7. ilya 18.6K posts

- 8. Ravens 59.5K posts

- 9. Shane 22.6K posts

- 10. Black Friday 275K posts

- 11. Lamar 47K posts

- 12. Bengals 53.1K posts

- 13. Mnet 154K posts

- 14. Joe Burrow 21.6K posts

- 15. Connor 15.3K posts

- 16. Sarah Beckstrom 233K posts

- 17. BNB Chain 8,053 posts

- 18. Third World Countries 31.6K posts

- 19. Zay Flowers 4,272 posts

- 20. Hudson 12.1K posts