The Addled Angler

@AddledAngler

Not investment advice - just personal views.

These #SPDR to $SPX ratios can of course move two ways, the nice way and the nasty way.. With the top 10 stocks being so dominant and not distributed amongst the components, it could very well be by SP500 falling with many of these..

The economically sensitive $SPX internals are starting to look good. Strong candles this week on banks, industrials and materials ratio charts. $XLF $XLI $XLB Medium-term momentums turning positive vs the $SPY or getting close to it. After several months down these could go.

$XLP vs $SPX trading close to all time lows. Have the staples been left for dead due to #MAHA, #Ozempic and other weight-loss drugs? The oscillators look promising. #MACD has turned decisively and #RSI has recovered neutral after double dip to oversold. It broke the multi-year…

With the #Fed cut and #NotQE-#QE announcement, both monetary and fiscal look supportive looking forward to 2026. Powell's term is coming up and there's gonna be a new chair next spring. We don't know who it's gonna be or how accommodative to the administration's wishes he or…

The economically sensitive $SPX internals are starting to look good. Strong candles this week on banks, industrials and materials ratio charts. $XLF $XLI $XLB Medium-term momentums turning positive vs the $SPY or getting close to it. After several months down these could go.

The economically sensitive $SPX internals are starting to look good. Strong candles this week on banks, industrials and materials ratio charts. $XLF $XLI $XLB Medium-term momentums turning positive vs the $SPY or getting close to it. After several months down these could go.

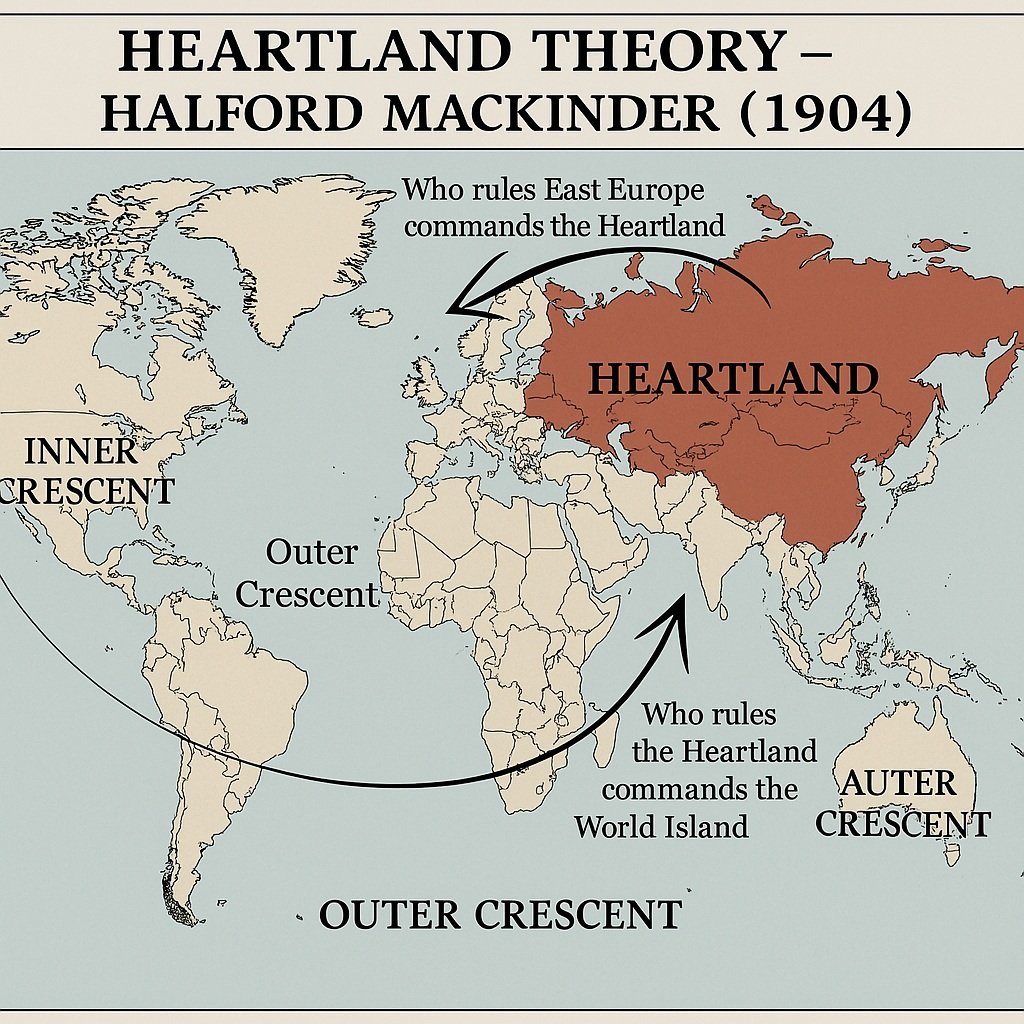

Magnificent! I just spent time reading the National Security Strategy of the United States of America. And it is a gem. The Trans-Atlantic crowd in Europe must be panicking. So much to highlight, but basically when i comes to US-NATO-EU; it is over. 🔸The strategy emphasizes…

47 sentences that'll make you kore money than a 4 year business degree:

There is an interesting, slow-burning realisation, both economically and socially, that we are — as if — living with the after-effects of having lost a war without even realising we were in one. With no bombs even dropped... — Our industrial capacity has been eviscerated. —…

#OOTT Moves like this will increase demand for and hasten the inevitability of multi-currency settlement for #oil and other commodities. ...eternal interests and so forth. Will that also include #gold? If multi-currency settlement happens, more liquidity would be chasing the…

#Crude prices jumped after the U.S. imposed sanctions on Russia’s two largest oil producers—a dramatic policy shift aimed at pressuring Moscow by choking revenue from two of the Kremlin’s key cash generators. Refineries in China and India will now be forced to seek alternative…

Hartnett’s point is that the traditional investing playbook doesn’t work in the environment we’re in, every major asset class is priced for perfection, but the fundamentals underneath them are stretched to the limit. Normally you’d hide in Treasuries when growth slows or stocks…

"Do I buy Treasuries when government owes $38tn, corporate bonds with spreads at 20-year lows, stocks trading on a 40x CAPE, or gold that’s just gone vertical? Tricky." - Michael Hartnett

$ABXX On a @ttmygh podcast David Fergusson, CEO of Atlas Consolidated, said the following about MAS: "- - if you want to set out to start a global business, you want to start up with the lowest common denominator. And while the MAS are strict ... And it’s good that it’s strict…

The Fourth Turning and America’s Hemispheric Play The Fourth Turning lens suggests every 80–90 years, the U.S. reaches a crisis climax where the old institutional and monetary order can no longer hold. The Civil War, the Depression and WWII, the Cold War and Bretton Woods each…

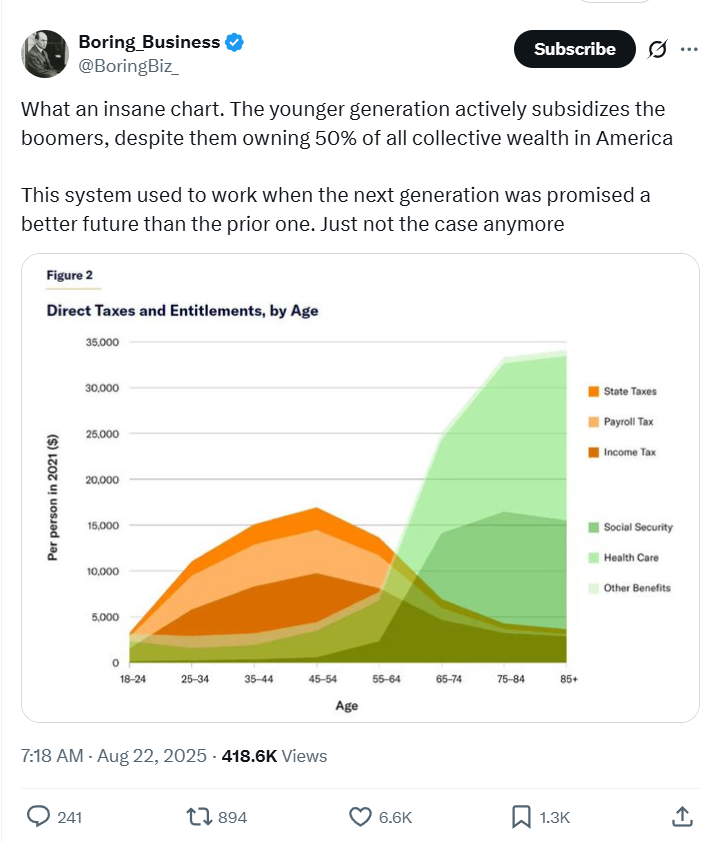

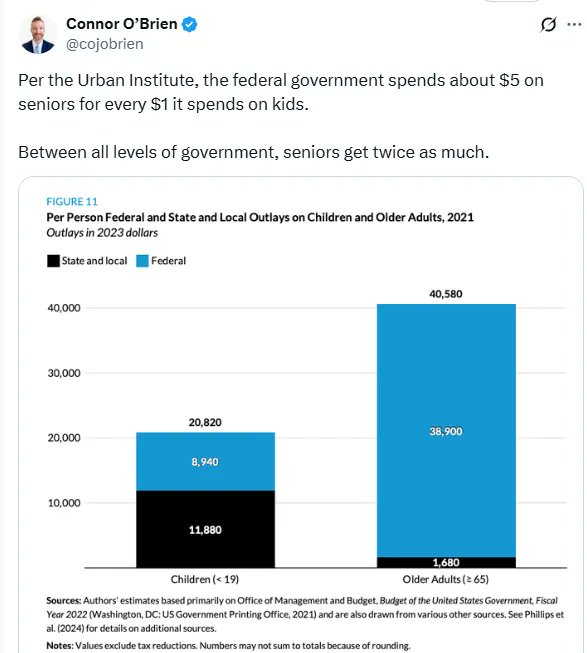

Boomers are never going to listen to "evidence" because the status quo extracts wealth from the young and gives it to geriatrics. Asset inflation enriches old people at the expense of the young. It's more convenient to believe the young are lazy and morally inferior.

How do we let boomers like this know that things have changed and engineering degrees no longer hold the premium they do due to companies using visa holder to undercut American labor? What was the best piece of evidence that convinced you?

I became successful at the age of 32. The lessons I learned on the way are more valuable than any millions I earned. Here are 8 essential lessons every hustler should know by 25: // Don't miss this thread // 🧵

You want to be a liquidity provider, when Mr. Market needs it, like April. You want to do the opposite, when Mr. Market doesn't need it. Although looking at this tidbit by GIR, the coming weeks and months will require discipline and may be mentally taxing.

As Charlie Munger said it's easier to avoid stupidity than seek brilliance. Politicians don't always agree. As a principled investor protecting your capital from inflation, taxation and bad decisions is a simple but important starting point.

EUROPEAN CITIZENS TO PAY GLOBAL TAXES 🇫🇷 France approved an amendment to tax its citizens on global income if they move to a region with tax 50% lower than France's. 🇳🇱 The Netherlands proposed a new exit tax for citizens who leave the country to pay income (and presumably…

United States Trends

- 1. Christmas 3.77M posts

- 2. #AEWDynamite 8,195 posts

- 3. Santa 1.27M posts

- 4. Feliz Navidad 553K posts

- 5. Happy Holidays 576K posts

- 6. Groq 4,871 posts

- 7. Bandido 16.3K posts

- 8. Merry Xmas 218K posts

- 9. Pebble 7,019 posts

- 10. Mike Preston 1,741 posts

- 11. Hawaii 14.5K posts

- 12. Die Hard 12.8K posts

- 13. Marty Supreme 13.5K posts

- 14. Gabe Kidd N/A

- 15. Stephen Colbert 23.3K posts

- 16. Baylor 2,850 posts

- 17. SDNY 17K posts

- 18. Tumblr 19.7K posts

- 19. Controversial 17.4K posts

- 20. Rudolph 21.7K posts

Something went wrong.

Something went wrong.