Variant Perception

@VrntPerception

Quantitative discipline rooted in timeless economic principles. In search of repeatable Variant Perception.

你可能會喜歡

Here's our solution:

China growth leading indicator is turning over after strong improvement this year. Both the Fourth Plenum and the Trump-Xi meeting turned out to be underwhelming in terms of additional stimulus/relief measures. More stimulus will be needed to renew economic momentum despite the…

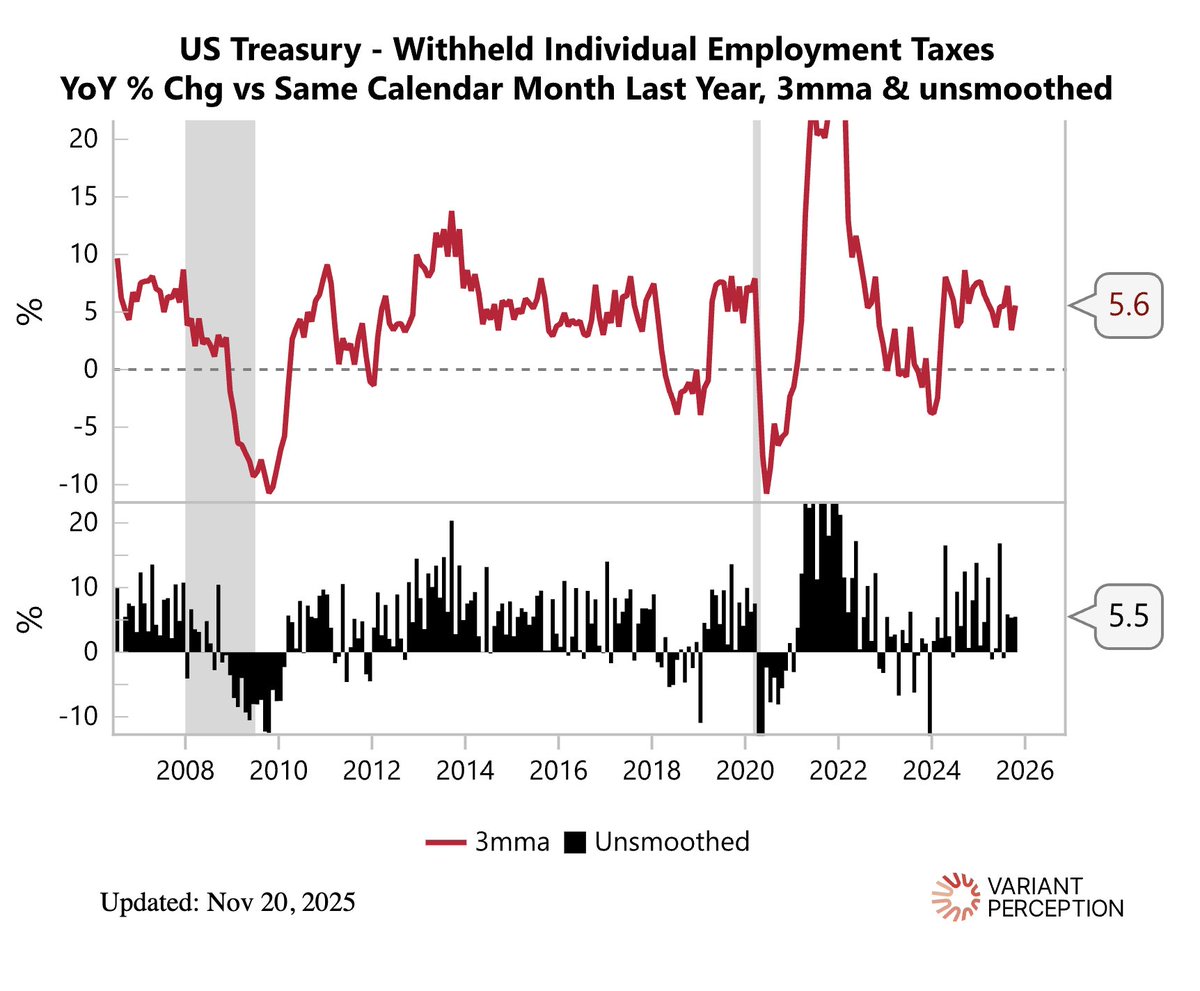

The US Treasury data on withheld income taxes shows nominal incomes taxes still growing at >5%

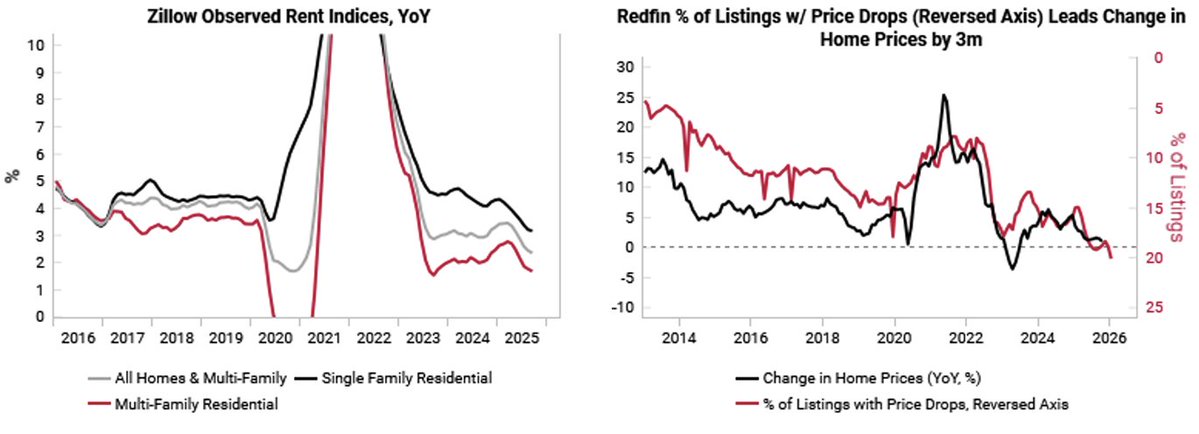

US housing remains a source of disinflation for the next 6 months. Rents continue to slow while more home listing are now seeing price drops than at any point over the past 10 years...

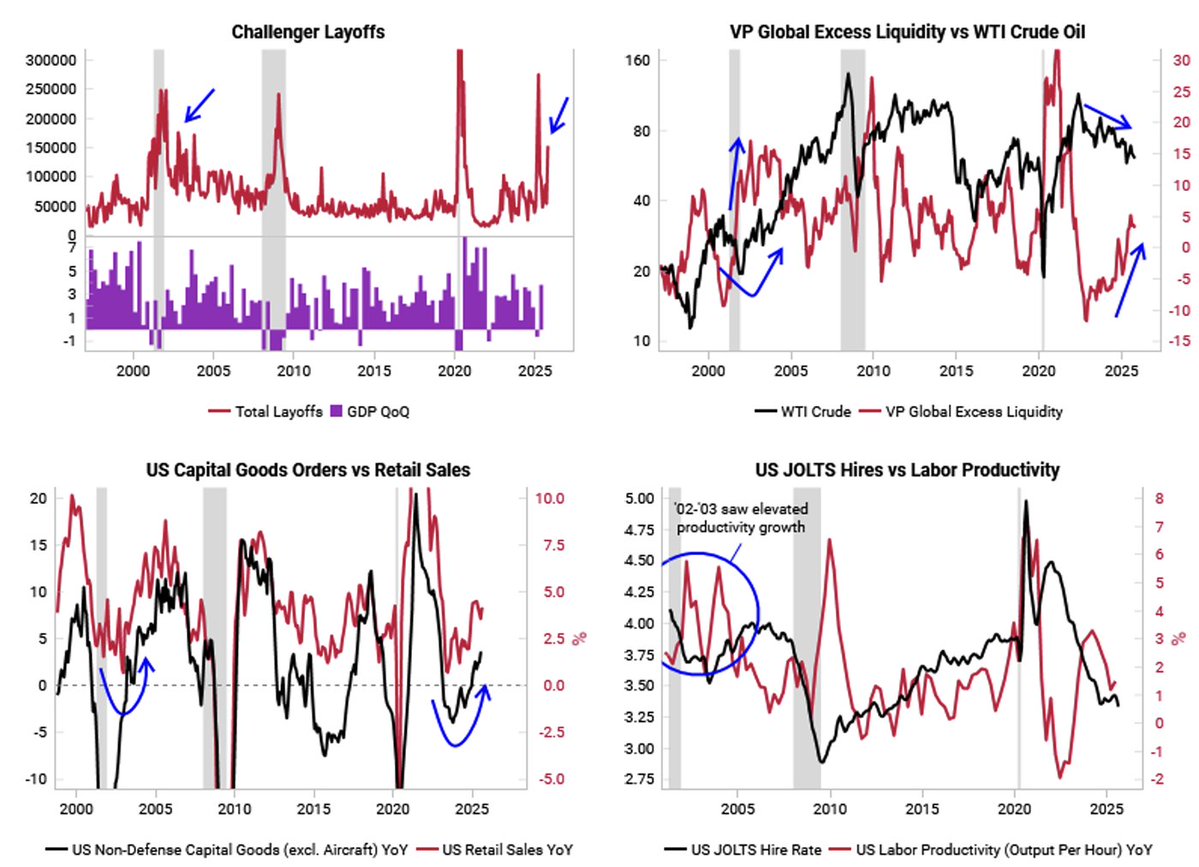

This month we've been talking about 2002-2003 "jobless" growth analogy: Fed kept monetary policy easy while clusters of layoffs were announced, meanwhile we saw elevated excess liquidity after a drawdown in oil prices and recovering capital goods orders and retail sales .…

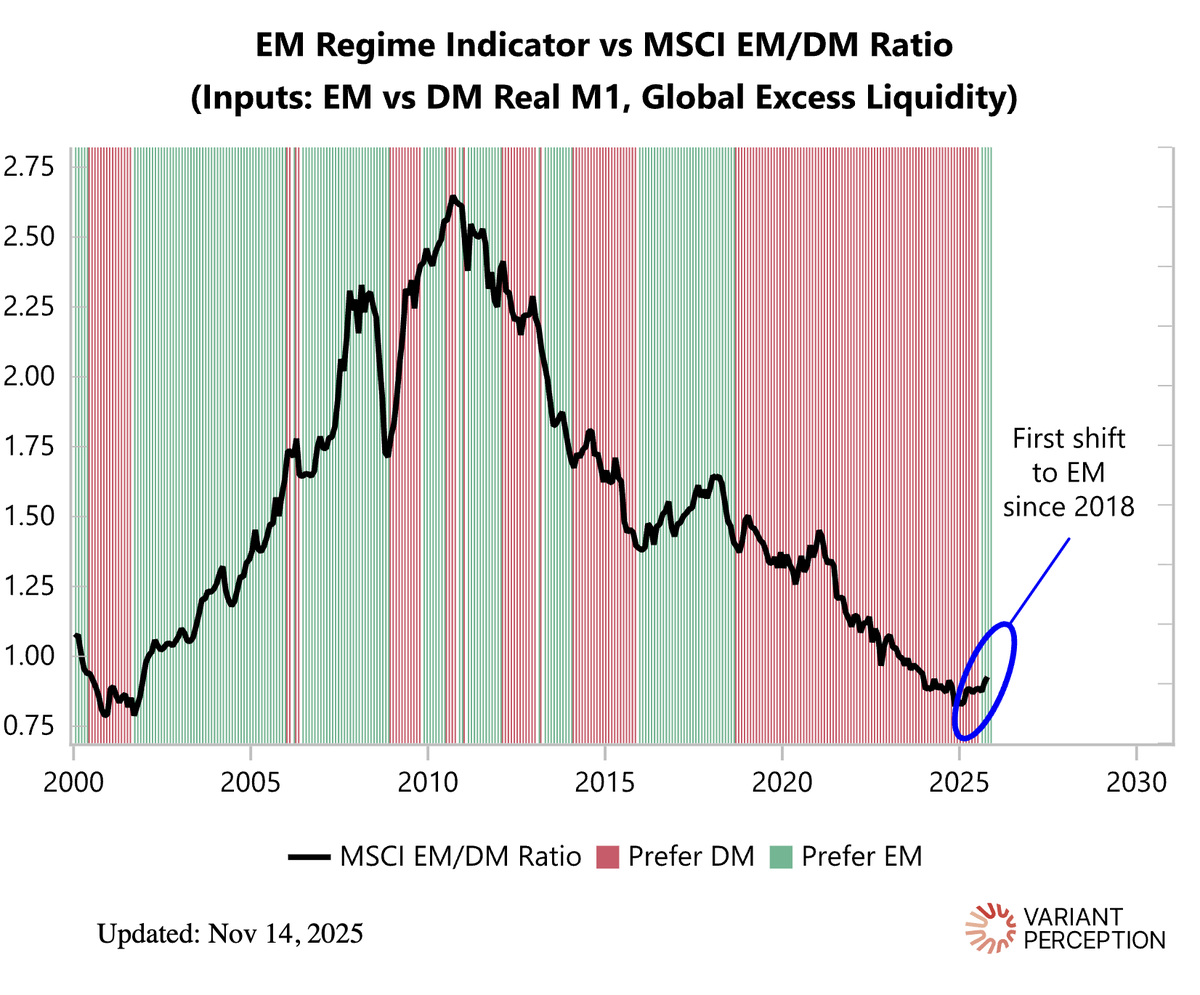

We view emerging market assets as a high beta play on the global liquidity cycle. Therefore, the best environments to own EM assets are when a) global excess liquidity is positive b) EM real money is growing faster than DM. This is a sign that excess liquidity is flowing into…

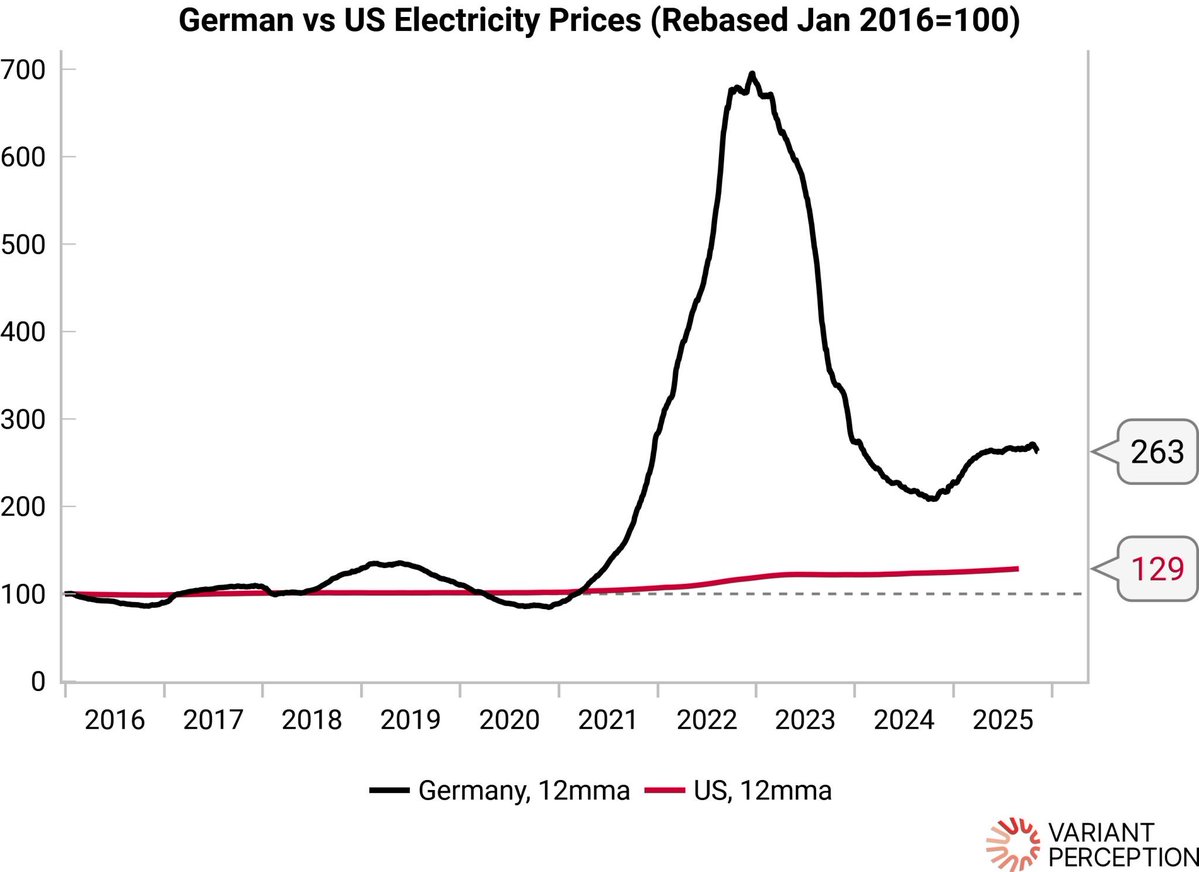

We are seeing continued improvements in leading indicators for the cyclical growth picture in Europe–– suggesting economic momentum in the coming months. Structurally, challenges remain. Notably, electricity prices in Germany are 2.5x higher than in 2016.

A break from regular posting to say Happy Veterans day from the team at Variant Perception–– thank you to our colleagues, clients, partners and all others who have served. We salute you.

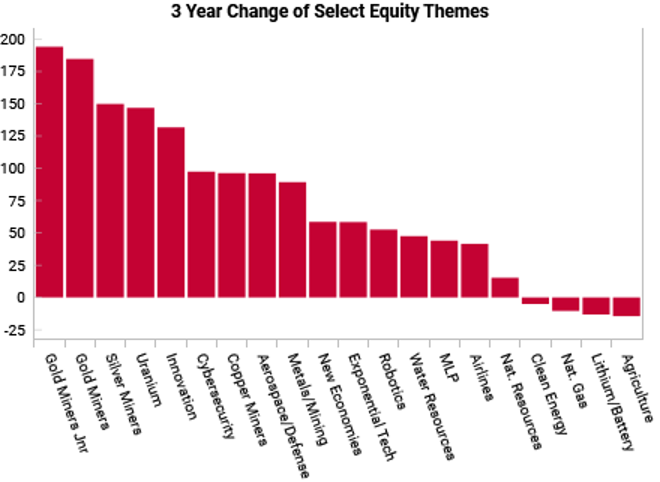

In our 2022 "Age of Scarcity Report" we wrote that it pays to invest alongside the USG... We've seen this play out in the past few years in chips, metals, defense, energy, and lately rare earth refining... still room to run in some other key areas... follow up report coming out…

United States 趨勢

- 1. Thanksgiving 2.13M posts

- 2. Packers 44.1K posts

- 3. Jack White 6,952 posts

- 4. Dan Campbell 2,745 posts

- 5. Jordan Love 8,955 posts

- 6. Goff 7,936 posts

- 7. #GoPackGo 6,997 posts

- 8. Wicks 5,724 posts

- 9. Watson 13.1K posts

- 10. #GBvsDET 3,821 posts

- 11. Gibbs 7,875 posts

- 12. Thankful 430K posts

- 13. #OnePride 6,307 posts

- 14. Turkey 276K posts

- 15. Green Bay 6,711 posts

- 16. Jameson Williams 1,893 posts

- 17. Jamo 3,601 posts

- 18. Tom Kennedy 1,108 posts

- 19. Amon Ra 2,862 posts

- 20. Seven Nation Army N/A

你可能會喜歡

-

(((The Daily Shot)))

(((The Daily Shot)))

@SoberLook -

Jesse Felder

Jesse Felder

@jessefelder -

CrossBorder Capital/ GLIndexes

CrossBorder Capital/ GLIndexes

@crossbordercap -

Kevin C. Smith, CFA

Kevin C. Smith, CFA

@crescatkevin -

fred hickey

fred hickey

@htsfhickey -

Jeffrey P. Snider

Jeffrey P. Snider

@JeffSnider_EDU -

Julian Brigden

Julian Brigden

@JulianMI2 -

Gavekal

Gavekal

@Gavekal -

MacroVoices Podcast

MacroVoices Podcast

@MacroVoices -

13D Research & Strategy

13D Research & Strategy

@WhatILearnedTW -

Jawad Mian

Jawad Mian

@jsmian -

Julien Bittel, CFA

Julien Bittel, CFA

@BittelJulien -

Juliette Declercq

Juliette Declercq

@JulietteJDI -

bill fleckenstein

bill fleckenstein

@fleckcap -

Grant Williams

Grant Williams

@ttmygh

Something went wrong.

Something went wrong.