CTC

@CacheThatCheque

Japanese shitco and tobacco stonk autist. Saizeriya lover. No investment advice.

You might like

America has Warren Buffett, but Japan's most famous investor is 71-year-old Kiritani, who has a portfolio of over 500 stocks totaling over 400 million yen. He does not own a car and rides around everywhere in his bicycle. He's also known for his love of shareholder perks. /1

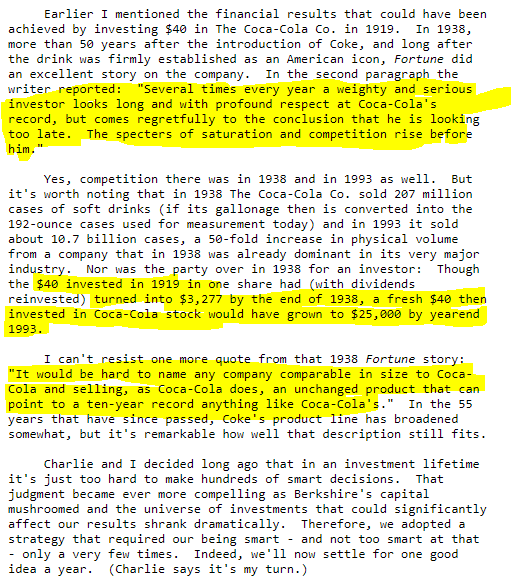

In 1938, an article at Fortune Magazine implied that it may be too late to invest in Coca-Cola $KO A fresh $40 then invested in Coca-Cola stock would have grown to $25,000 by year-end 1993, and almost $300,000 by 2025

It’s not just about the shitcos, it’s about the shitco friends we make along the way

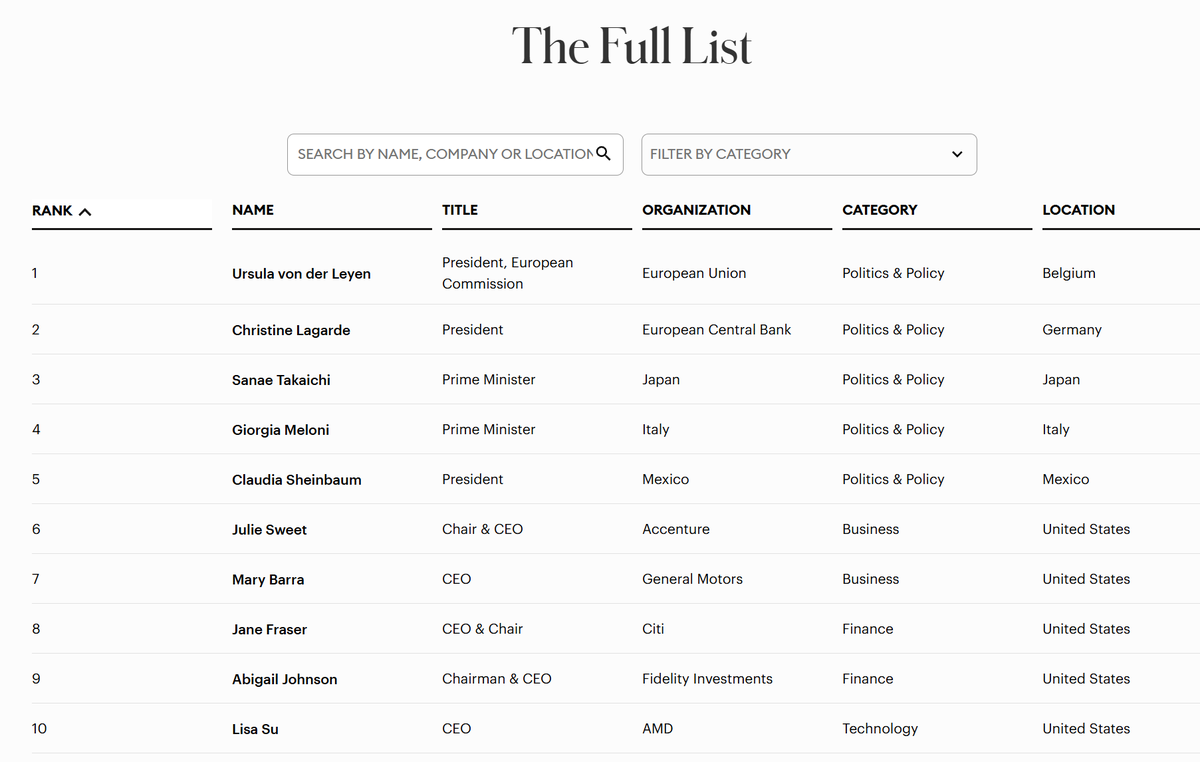

Japanese Prime Minister Sanae Takaichi rockets to number 3 on the Forbes World's Most Powerful Women list, behind Christine Lagarde and Ursula von der Leyen forbes.com/lists/power-wo…

Used to own it but sold out of it a few years ago only to break even. Unfortunately, very common story: 1. Poor management 2. Poor balance sheet 3. Poor dividend record, and dividend cuts #3 is especially unforgivable for Japanese investors who treat dividends as sacrosanct

@CacheThatCheque just a quick question, what‘s the issue with Mitsubishi Chemical? They own Nippon Sanson, and NS rocked the last couple years. So why did Mitsubishi Chemical so poorly at the market?

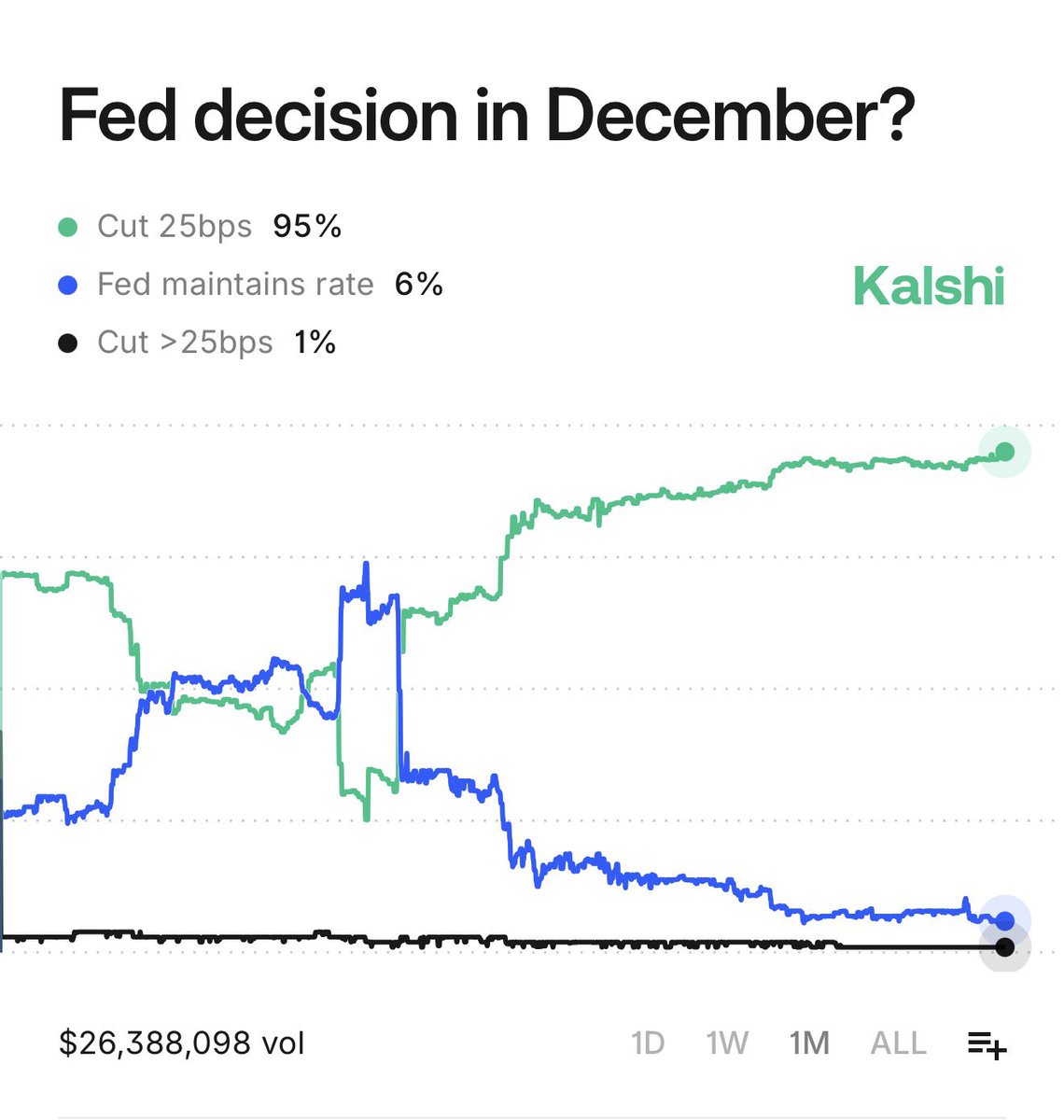

Every six weeks the whole macro world stops whatever they’re doing to watch the Fed and be like

Japan really does everything better

microplastics are bad until it’s time to put on the Uniqlo Heattech Ultra Warm

Nothing stops this train.

Realizing that Trump hasn’t even installed his own dovish Fed chair yet

the year 2100 will be another samurai golden age followed by a huge wave of Japanophile weeb migrants who arrive to study the samurai and go native lmao

Wild thinking about how the population of Japan in 2100 could be the same as during the Last Samurai era

Yet another reason why we’ll always have oil stonks

This movie still stands the test of time. Unironically, one of the funniest and darkest critiques of white collar office work

26 years later, this scene from 'Office Space' (1999) still hits home

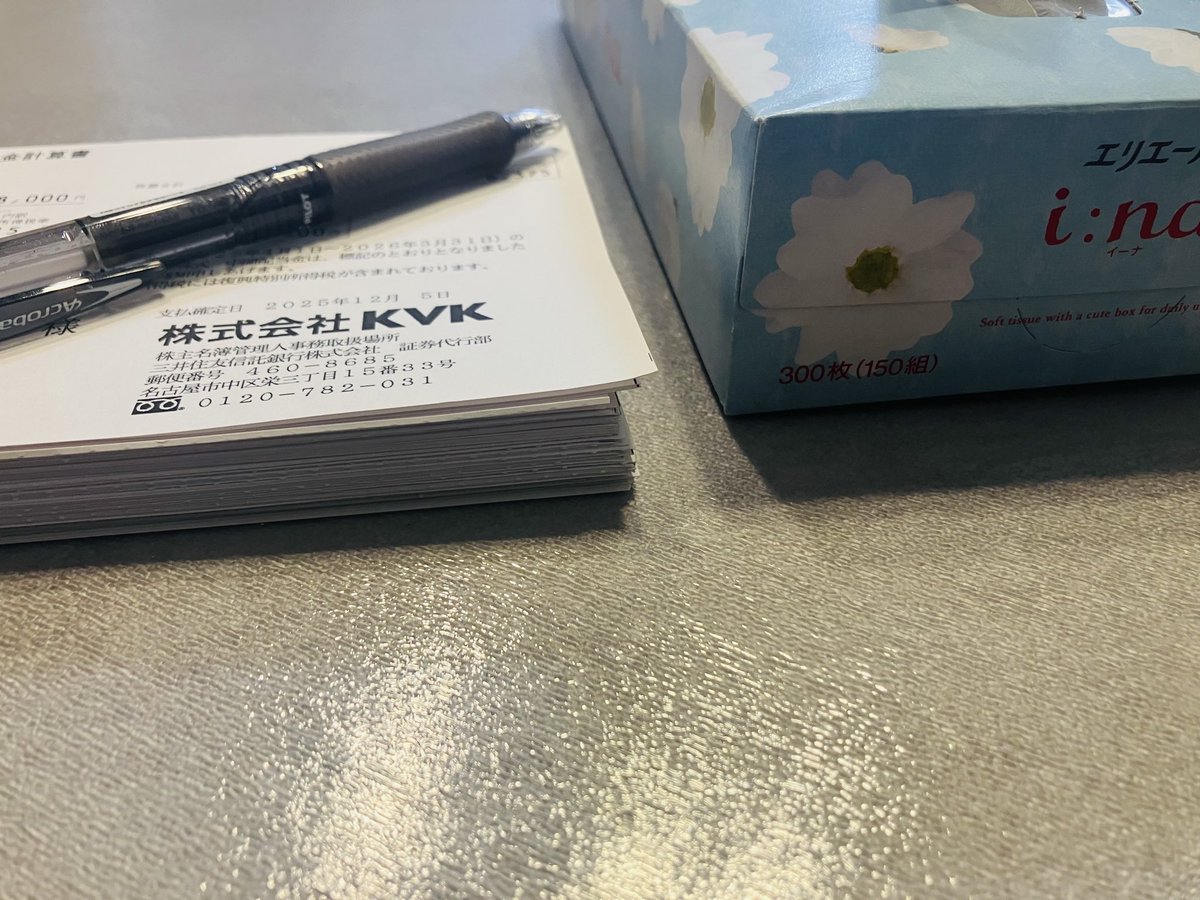

My stack of dividend checks so far for 2025. This year I will collect over 1.5m yen in dividends. Last year I collected 1.3m yen in dividends. Two years ago it was less than 1m yen. The dividend snowball effect is real. You just have to start and keep at it and keep buying.

Japanese stock market is heaven for small cap value investing

Bout triple for me on this one, and yes I wish I owned more too.

Another boring Japanese chemical company and one of my holdings that no one has ever heard of. Parker Corp: profitable, cash rich, below book value, up 95%ytd, and management has raised dividend per share over 3x since 2018. I’m up 2x on this position, wish I owned more

Accumulate assets or get left behind forever

United States Trends

- 1. Lakers 44K posts

- 2. Spurs 36.3K posts

- 3. Doug Dimmadome 8,883 posts

- 4. Godzilla 19.9K posts

- 5. Michigan 122K posts

- 6. Wemby 5,353 posts

- 7. Marcus Smart 2,144 posts

- 8. Sherrone Moore 62.9K posts

- 9. #Survivor49 5,134 posts

- 10. Dolly Parton 2,281 posts

- 11. #AEWDynamite 26.6K posts

- 12. Erika 176K posts

- 13. #PorVida 1,494 posts

- 14. Gabe Vincent 1,150 posts

- 15. Stephon Castle 3,640 posts

- 16. Jim Ward 9,223 posts

- 17. PETA 24.1K posts

- 18. Candace 218K posts

- 19. Gainax 3,615 posts

- 20. Vando 1,320 posts

You might like

-

Jamie Halse (Senjin Capital) 🇳🇿🇦🇺🇯🇵

Jamie Halse (Senjin Capital) 🇳🇿🇦🇺🇯🇵

@JamieHalse -

Ben Tan 笨蛋

Ben Tan 笨蛋

@bentan__ -

Steven Wood

Steven Wood

@GWInvestors -

In Practise

In Practise

@_inpractise -

𝗙𝗮𝗶𝗿𝗹𝗶𝗴𝗵𝘁 𝗖𝗮𝗽𝗶𝘁𝗮𝗹

𝗙𝗮𝗶𝗿𝗹𝗶𝗴𝗵𝘁 𝗖𝗮𝗽𝗶𝘁𝗮𝗹

@Fairlight_Cap -

Andrew Kuhn

Andrew Kuhn

@FocusedCompound -

Implied Expectations

Implied Expectations

@LongHillRoadCap -

Psyop Capital

Psyop Capital

@psyopcapital -

Andrew Walker

Andrew Walker

@AndrewRangeley -

Japan Deep Value

Japan Deep Value

@JapanDeepValue1 -

nipponNuggets

nipponNuggets

@JCVpartners -

Deep Sail Capital

Deep Sail Capital

@DeepSailCapital -

Travis Lundy 👹

Travis Lundy 👹

@travislundyasia -

Upper 20s St Capital

Upper 20s St Capital

@Upper20sStCap -

Will Thrower

Will Thrower

@WillThrower3

Something went wrong.

Something went wrong.