Capital Robotics Club

@CapitalRobotics

Robotics Club in the nation’s capital area

You might like

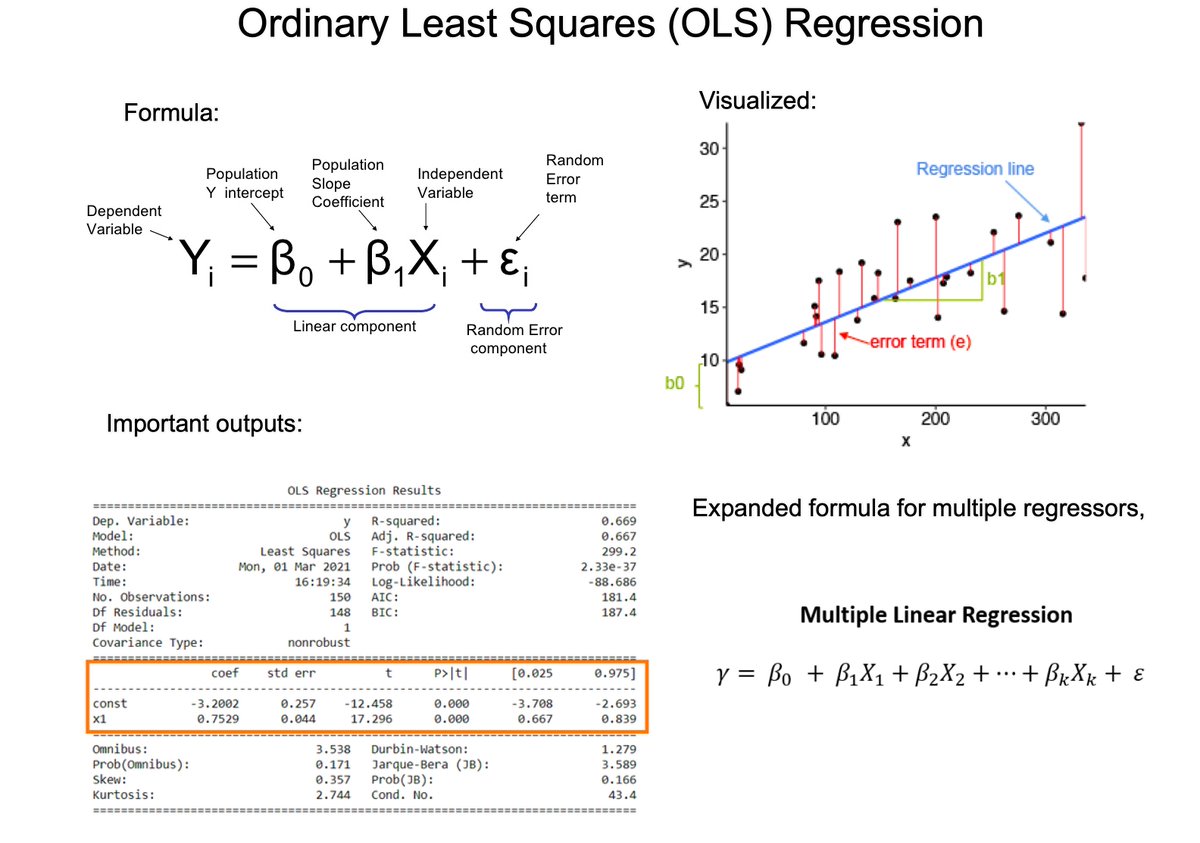

Linear Regression is one of the most important tools in a Data Scientist's toolbox. Here's everything you need to know in 3 minutes. 1. OLS regression aims to find the best-fitting linear equation that describes the relationship between the dependent variable (often denoted as…

17 Python GitHub repos for quant finance:

Last yr, I personally paid more in taxes than what I made (!!). I was completely shocked - I didn't think it was possible to *owe more* than you make. But it is. To be clear, this post isn't meant to ask for pity, but I think it can help a lot of ppl out. More >>

Interest rate yield curve analytics (in 2 minutes):

Finding (and understanding) implied volatility: A short thread 🧵 [1/N]

Critical thinking should be the first thing taught to kids

This is utterly brilliant. A student accuses @jk_rowling of being transphobic. This teacher skilfully dissects the claim and challenges it by asking questions. He teaches not what to think, but how to think critically. Watch until the end. You see the epiphany in real-time.

This is an incredibly well written and insightful thread. In the end H4L is about a higher neutral rate than markets expect. Step back from the myopia of the artificial construct of a constant neutral rate. Well done.

The reason why I bring up the neutral rate is because I think the market is actively debating it without realizing it or explicitly saying so. Much of the consternation around Fed pricing right now is how many cuts is appropriate this year, but that implies that cuts themselves…

Finally had a chance to read the published version of this paper. The authors train a convolutional neural network using images of price and volume charts to predict the direction of the stock.

Intel's 386 processor (1985) was an important step toward today's computers, moving the x86 architecture to 32 bits. The chip came in a 132-pin ceramic package. There's more going on in this package than you'd expect. Let's take a look. 1/14

This is going to change how you use Jupyter Notebooks. I've always worked as part of a team, and collaborating on a notebook with somebody else is as painful as it gets. I remember building a file structure for my team to work on the same projects without touching each other's…

If FTX knew accounting as well as Enron, they could have been bigger and likely would still be around today. The reason Enron needed to use accounting and FTX didn't? Access to cash👇

Naive Bayes is an essential algorithm in the data scientist's toolbox. Here's 1 week of research in 1 minute. Let's go: 1. How it works: At its core, Naive Bayes uses Bayes' Theorem, which describes the probability of an event based on prior knowledge of conditions that might be…

The semiconductor industry is screaming at us that AI is all hype. Yes, lots of orders for H100 GPUs, but even an AI datacenter still needs CPUs, memory, and HDs. Then you have AI implementation, such as in computer vision and controls, robotics, etc, which require specialized…

If you're new to the real estate community on X this is a must-read. A thread on how most real estate folks structure deals with outside investors. Most GPs utilize the "preferred equity" structure when they raise money from outside investors. They "syndicate" deals.…

4 minute masterclass on how to beat the market, And debunking the Efficient Market Hypothesis. By the billionaire hedge fund manager, Jim Simons.

Funds pretty much run our economy… But how do they work? and why do they have to be so complicated? Let’s solve both of those…

Finding optimal trading parameters is great - but they may not respond or adapt to market changes This is where ML may be able to help us! So let's take a step-by-step case study in this 🧵and use ML to try and predict the best trading parameters each day Enjoy!

In 2011, I committed my first code to GitHub. Since then, I've starred the best Python repos for quant finance on the internet. Here's the 9 best (*definitely* bookmark this):

When you are applying Bayes’ Theorem to try to reason under conditional information, the quality of your conclusions is no better than the quality of your priors. If your priors are made up and based on vibes, then your conclusions are basically made up and based on vibes too.

There is no linear algebra without vectors. Now I will explain them with some basic code. Let's start. 🧵

United States Trends

- 1. Daniel Jones 5,869 posts

- 2. Falcons 16.8K posts

- 3. Penix 4,150 posts

- 4. Max B 15.1K posts

- 5. Drake London 2,845 posts

- 6. #Colts 3,297 posts

- 7. Kyle Pitts 1,453 posts

- 8. Bijan 3,096 posts

- 9. Raheem Morris 1,160 posts

- 10. $SENS $0.70 Senseonics CGM N/A

- 11. Zac Robinson N/A

- 12. Alec Pierce 2,198 posts

- 13. $LMT $450.50 Lockheed F-35 N/A

- 14. #Talus_Labs N/A

- 15. $APDN $0.20 Applied DNA N/A

- 16. Konate 6,328 posts

- 17. Jonathan Taylor 1,685 posts

- 18. #ForTheShoe 1,826 posts

- 19. Steichen 1,077 posts

- 20. #AskFFT N/A

You might like

-

MOADEfy

MOADEfy

@moadefy -

ZIIU

ZIIU

@ziiubg -

The GreyRhino newsletter RoundUp by iMB.Solutions

The GreyRhino newsletter RoundUp by iMB.Solutions

@imb_solutions -

Pramila

Pramila

@prmilajangid -

Cryptinish

Cryptinish

@Cryptinish -

satoji (ง'-')ง

satoji (ง'-')ง

@koifishfarmer -

MediBilling Experts

MediBilling Experts

@MediBillExperts -

PremPrasad Mirthinti

PremPrasad Mirthinti

@premmirth -

David Hughes

David Hughes

@DH_PlantVillage -

Makers Mind

Makers Mind

@makersminds1 -

Tom Safe Prep

Tom Safe Prep

@allmarkupnews

Something went wrong.

Something went wrong.