CortexDAO

@CortexDAO

Instant portfolio diversification for the @curvefinance and @convexfinance ecosystem.

Może Ci się spodobać

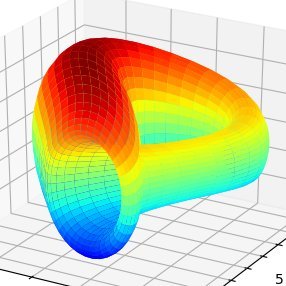

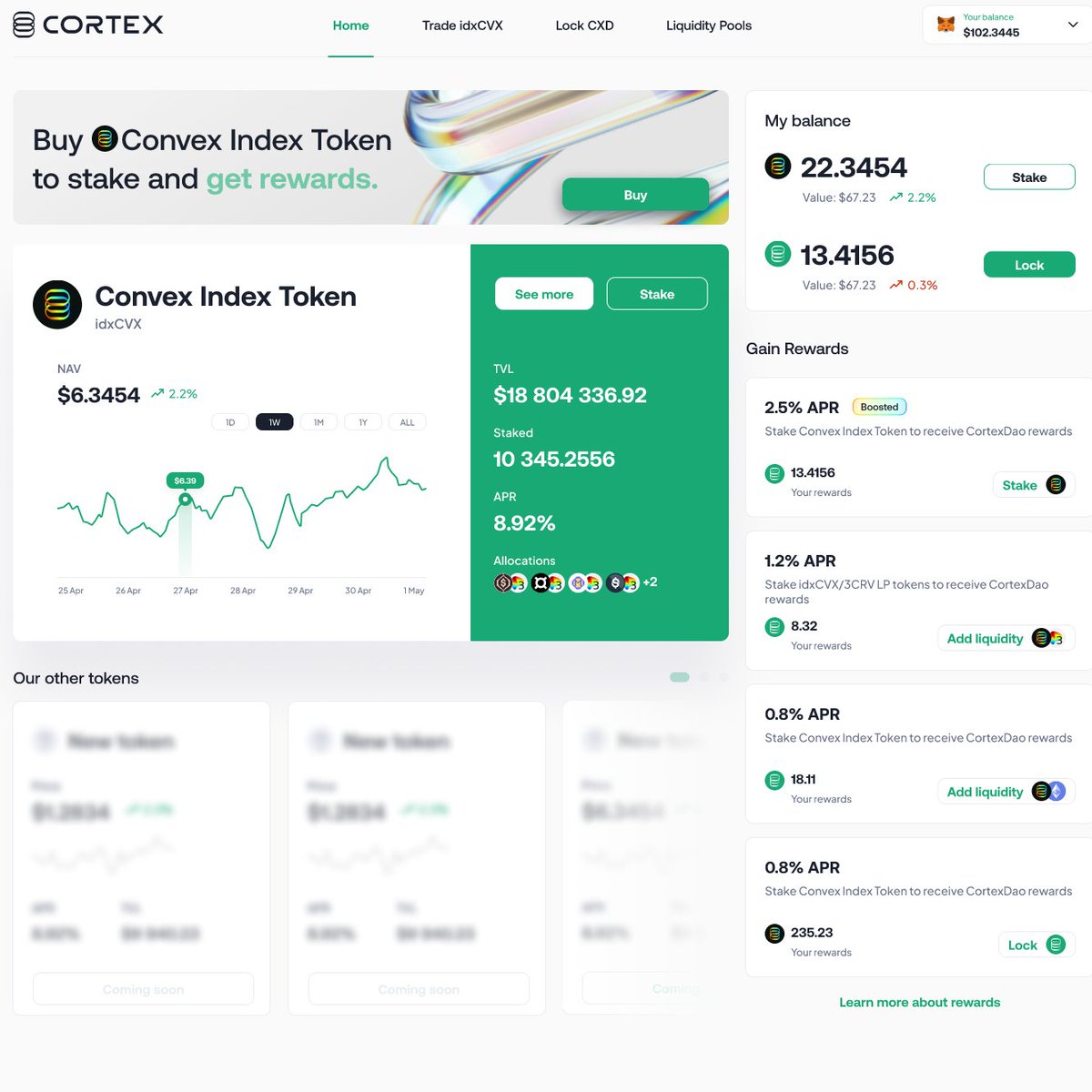

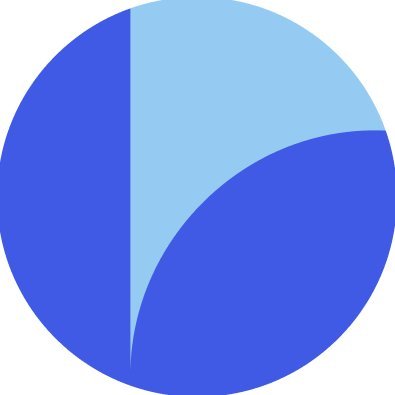

End your week with a preview of the upcoming CortexDAO UI. CortexDAO's Convex Index is primed to bridge the gap between @CurveFinance, @ConvexFinance, and institutions.

Airdrops are more than just free tokens. They're an integral part of the blockchain ecosystem. Learn how to find new airdrops and keep your funds secure while participating. Read: cortexdao.substack.com/p/airdrops

This week's edition of The Cortex Connection highlights the news of the month covering a flurry of crypto and defi bills, a controversial digital ID system, and an interesting wave of animal-based gambling dApps. Read: cortexdao.substack.com/p/whats-news-w…

'The Cortex Connection' brings you another curated selection of informative YouTube content. Get insights on the Bitcoin Halving 2024, discussions surrounding the Ripple v SEC lawsuit, and some exciting announcements from around the industry. Read: cortexdao.substack.com/p/knowledge-is…

Dig into fabled 'Ethereum Killer', Solana, in this week's Cortex Connection. Read: cortexdao.substack.com/p/explore-the-…

1/ What's the most innovative new DEX? You might think it's Uniswap v4, but there are a few lesser-known, innovative DEXes that could surprise you. Here the top 5 DEXes you should try out right now: 🧵

Dive into Arbitrum, how it compares to other Layer 2 solutions, and🔑projects. Read: cortexdao.substack.com/p/cortex-insig…

This week's edition of The Cortex Connection highlights the news of the month ranging from illicit crypto finance reports, Michael Saylor buying Bitcoin (again), and some big regulatory progress updates. Read more: cortexdao.substack.com/p/whats-news-w…

This week’s edition of ‘The Cortex Connection’ continues our foray into the content creator space, presenting a curated selection of YouTube interviews and other thought-provoking discussions surrounding crypto, blockchain development, and DeFi. Read: cortexdao.substack.com/p/knowledge-is…

Uncover the leading projects shaping the future of decentralized finance. From @Uniswap and @compoundfinance to @AaveAave and @MakerDAO, explore the innovative platforms revolutionizing the way we interact with financial services. cortexdao.substack.com/p/explain-like…

Say goodbye to siloed blockchains and say hello to seamless interconnectivity and collaboration made possible by blockchain bridges in the latest edition of The Cortex Connection. Read more: cortexdao.substack.com/p/bridging-the…

This week's edition of The Cortex Connection highlights notable news covering: 📰Protocol governance 📰US and EU regulatory clarity 📰Developments in the crypto world Read more: cortexdao.substack.com/p/whats-news-w…

🧠Unravel the intricacies of blockchain layers. From the physical infrastructure to user-facing applications, join us on the journey through the blockchain stack! The Cortex Connection #008: cortexdao.substack.com/p/peeling-back…

So, how does @CurveFinance earn fees from $crvUSD? It's through another essential mechanism after LLAMMA: PegKeeper. If you're familiar with @fraxfinance, you can think of it as an AMO. Basically, when the crvUSD price is above $1, PegKeeper can mint new crvUSD ... (26/n)

The way your tweets are ranked has changed dramatically Twitter just released the latest algorithm I've been reading through the code for the past 10 hours and have some big takeaways Here is every change I found so far and what you need to do to rank higher (live thread):

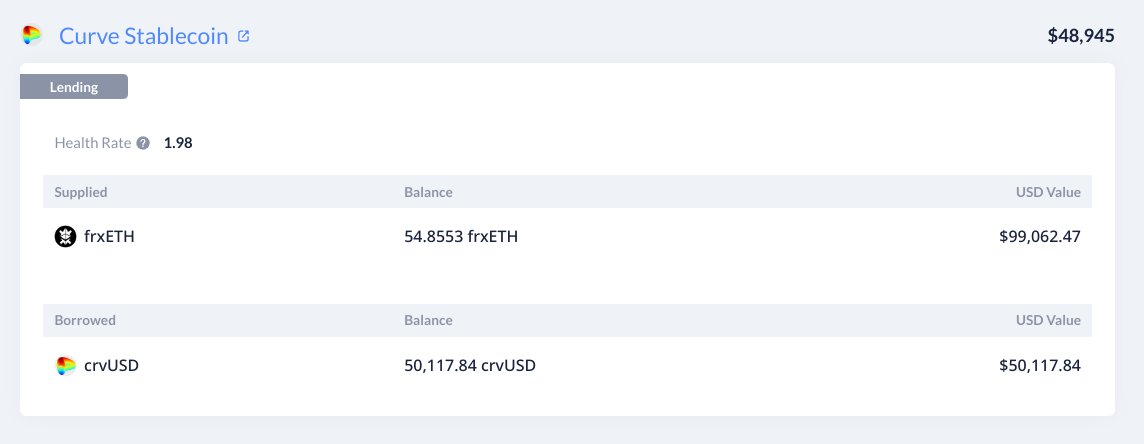

Loving how @DeBankDeFi already integrated crvUSD. Thanks guys - you are so fast, integrating all the DeFi you see around!

🧠 Discover a curated selection of insightful interviews in this latest edition of 'The Cortex Connection'. Stay informed, think critically, and expand your knowledge in this ever-evolving industry. The Cortex Connection #007: cortexdao.substack.com/p/knowledge-is…

Yesterday I freaked out about the revelation that @Ledger could spit out your private key with a firmware update. Yet I noticed the smartest people were not freaking out. Was I missing something? I spent the evening educating myself, and now I'm in the "nvm it's fine" camp.

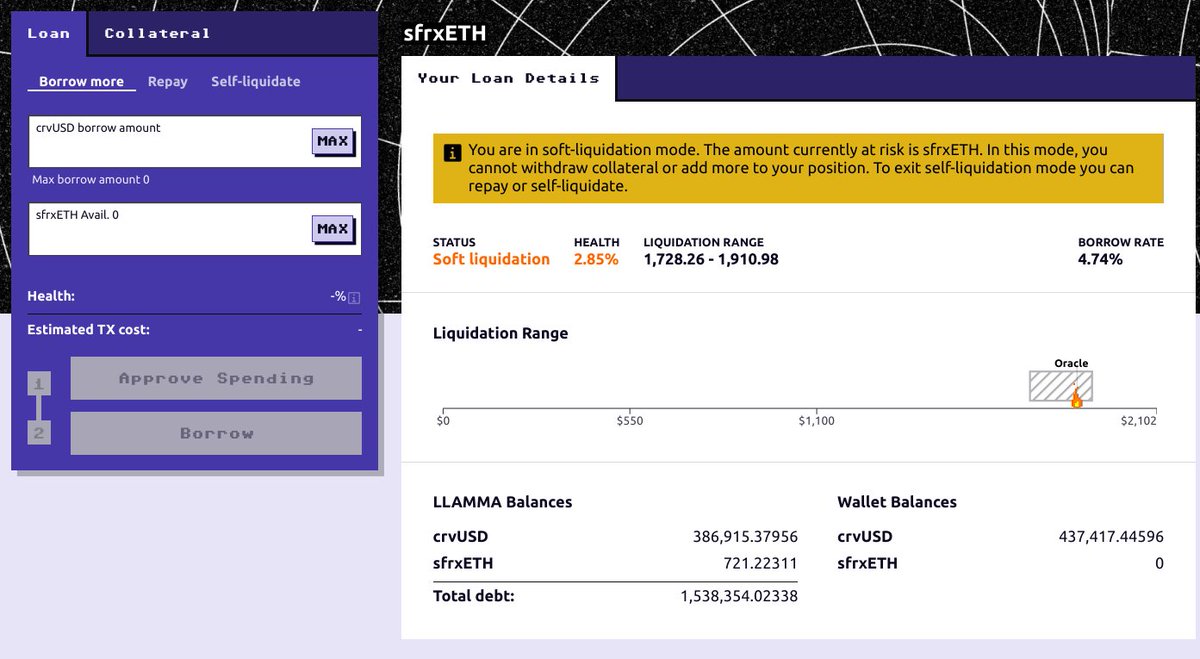

Unlike traditional borrowing, you can be in liquidation and back if price of collateral goes up. For example, here a position with 1.5M crvUSD loan was in "soft liquidation" for around 3 days and lost 0.5% of the collateral value due to that (this position is live now btw)

What an insane day in the world of AI. We got huge announcements from Google, HuggingFace, Scale AI, and Synthesia. Here's the rundown on everything you need to know:

United States Trendy

- 1. Luka 91.8K posts

- 2. Dodgers 121K posts

- 3. Blue Jays 79.8K posts

- 4. #WorldSeries 103K posts

- 5. #LakeShow 3,270 posts

- 6. Mavs 13K posts

- 7. Snell 14.3K posts

- 8. Marcus Smart 3,338 posts

- 9. #TheLastDriveIn 4,271 posts

- 10. #SmackDown 33.4K posts

- 11. Vando 2,533 posts

- 12. Kyshawn George 4,021 posts

- 13. Halo 160K posts

- 14. Addison Barger 17.4K posts

- 15. #BostonBlue 5,458 posts

- 16. Nico Harrison 2,367 posts

- 17. Blazers 10.9K posts

- 18. Reaves 8,758 posts

- 19. Wizards 10.3K posts

- 20. Wolves 23.2K posts

Może Ci się spodobać

-

Cream Finance 🍦

Cream Finance 🍦

@CreamdotFinance -

Pareto

Pareto

@paretocredit -

Synthetix ⚔️

Synthetix ⚔️

@synthetix -

0x (mainnet arc)

0x (mainnet arc)

@0xProject -

₿adger 🦡

₿adger 🦡

@BadgerDAO -

mStable

mStable

@mstable_ -

Harvest

Harvest

@harvest_finance -

Nexus Mutual

Nexus Mutual

@NexusMutual -

Velora (formerly ParaSwap)

Velora (formerly ParaSwap)

@VeloraDEX -

Liquity

Liquity

@LiquityProtocol -

DeFi Saver

DeFi Saver

@DeFiSaver -

Reflexer

Reflexer

@reflexerfinance -

Zane

Zane

@CryptoVandalism -

devops199fan 🔪📜😅 ⌐◨-◨

devops199fan 🔪📜😅 ⌐◨-◨

@devops199fan -

Fernando | Balancer 🦇🔊

Fernando | Balancer 🦇🔊

@fcmartinelli

Something went wrong.

Something went wrong.