DogsTradeToo

@DogsTradeToo

Trading Opinions and Options

You might like

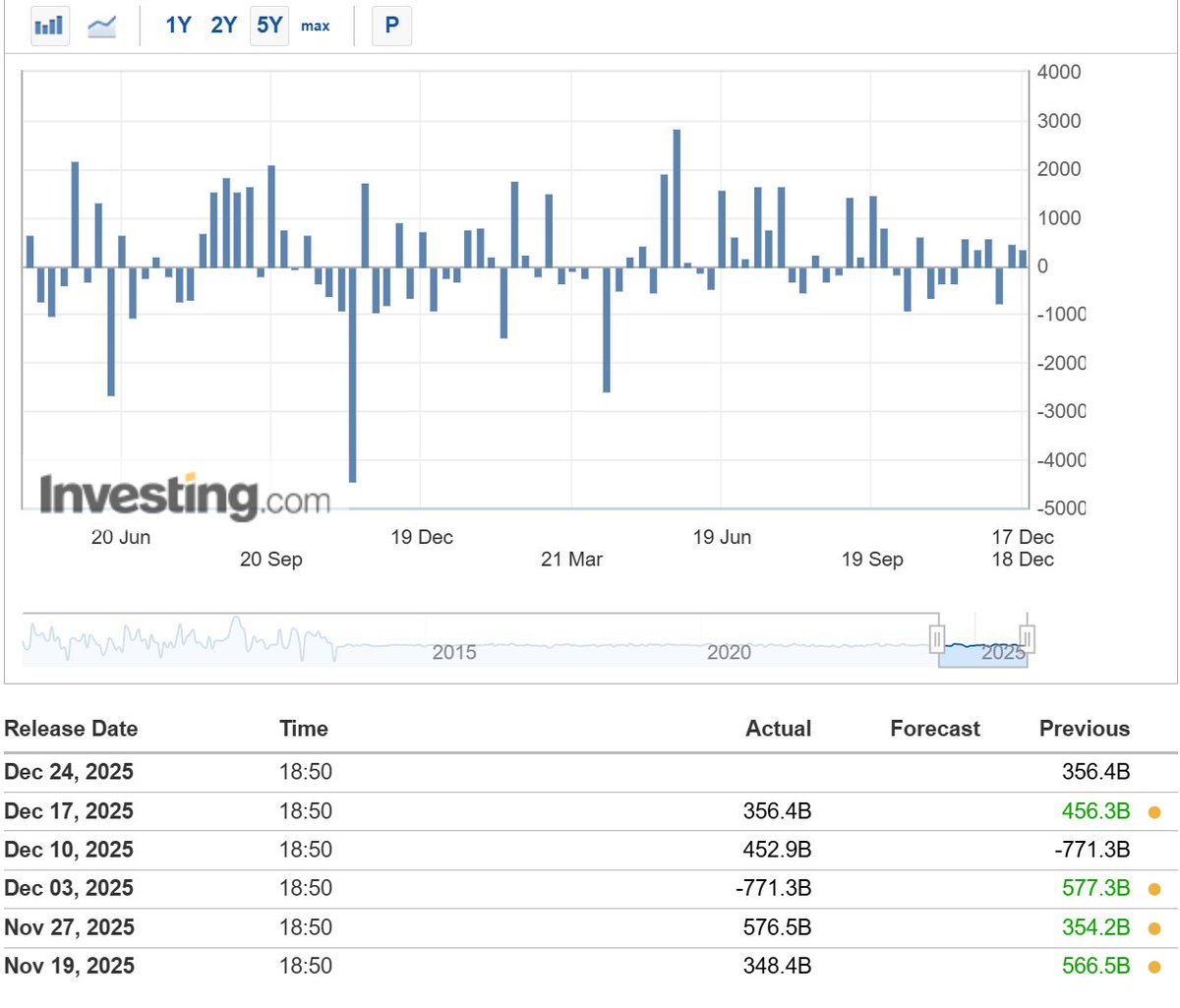

🚨ANNOUNCEMENT🚨 📉I am heavily shorting the UNITED STATES ECONOMY $SPY The date is Dec 26th 2026 Market is at ALL TIME HIGHS. Spy 691 YOU HAVE BEEN LIED TO ABOUT OUR ECONOMIC STABILITY!!! Position 1/30 expiration Puts I will explain my reasoning below. 👇

Possible topping pattern underway on gold for the range off the December 30 low. Needs a 4-hour close over 4616.4 to consider upside continuation. Will then need to find acceptance over previous high 4650.5. Another breakout targets 4719.2. If a pullback is underway, discount for…

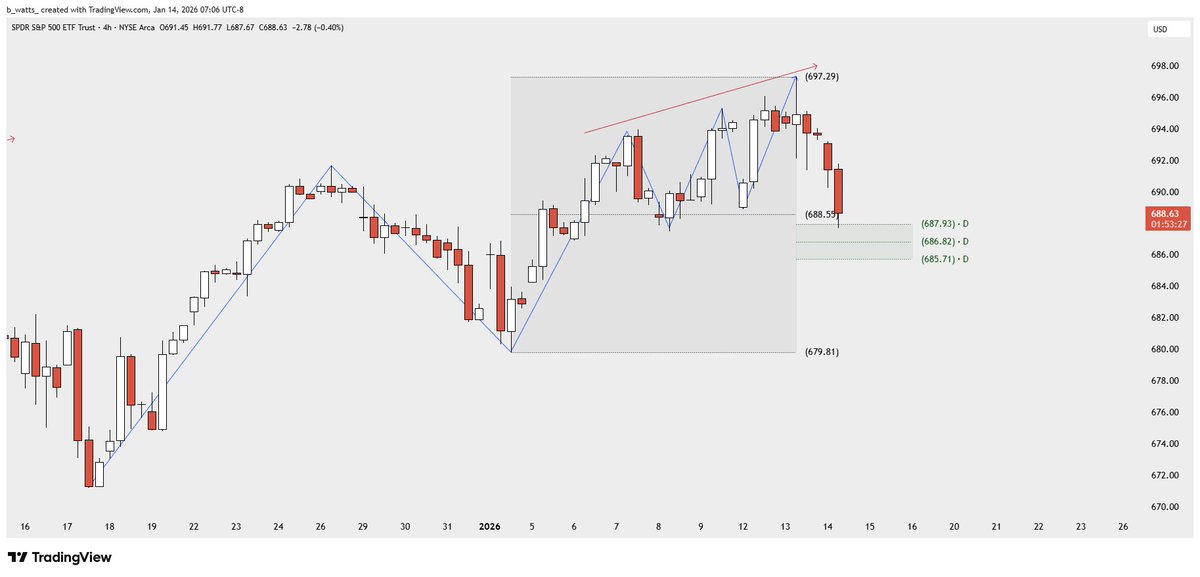

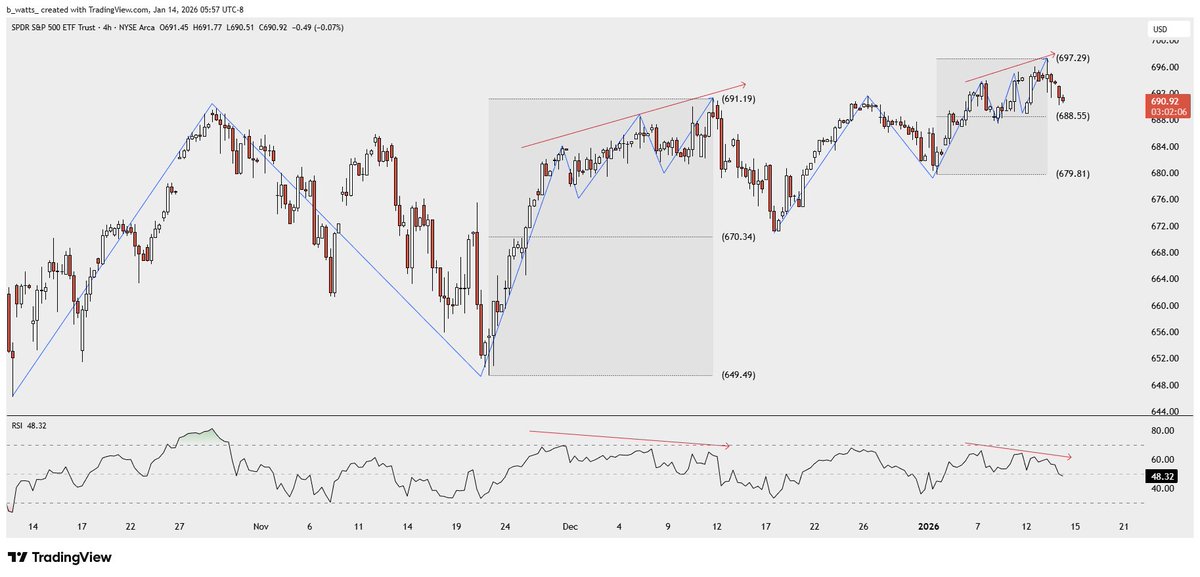

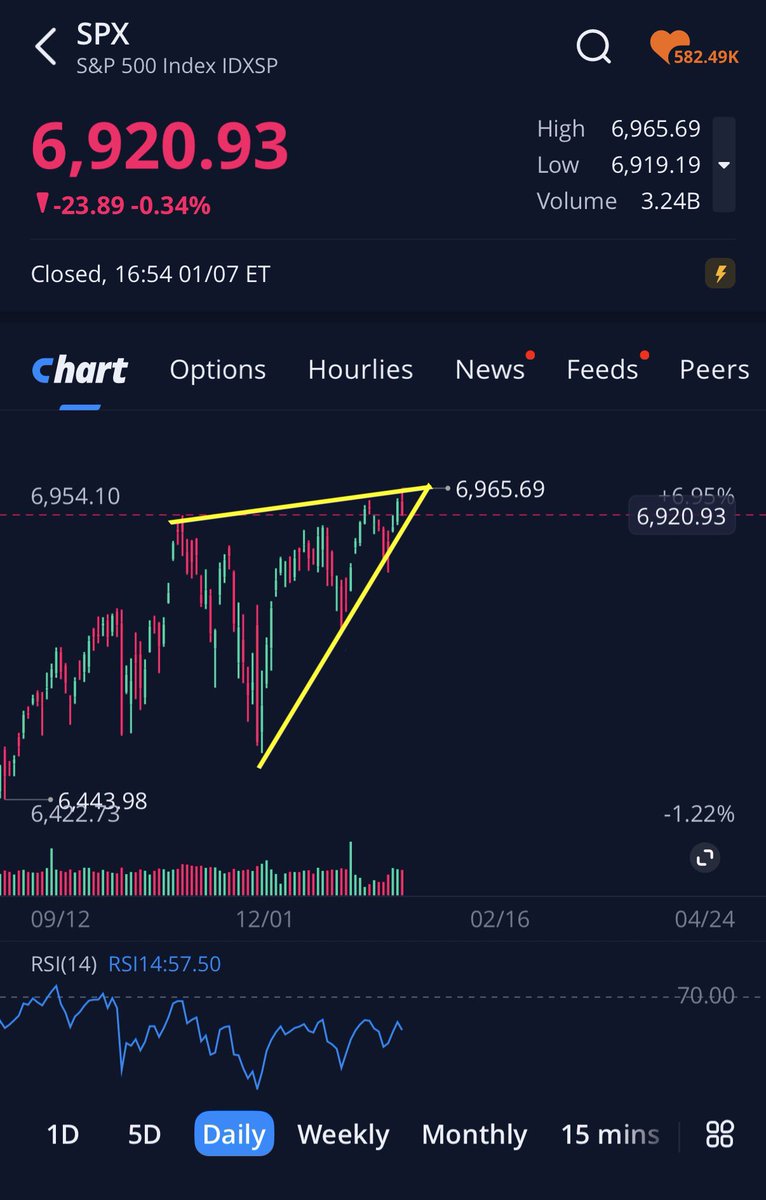

$SPX Currently a rising wedge breakdown. Can always turn into a fake out. Stay nimble. Downside levels for the three ranges off the 11/21 low: Currently working through the upper range from the 1/2 low. Sitting at discount + daily support and testing the daily volume…

It's too bad my account is suppressed on this platform. I will be sharing much less going forward. Good luck out there.

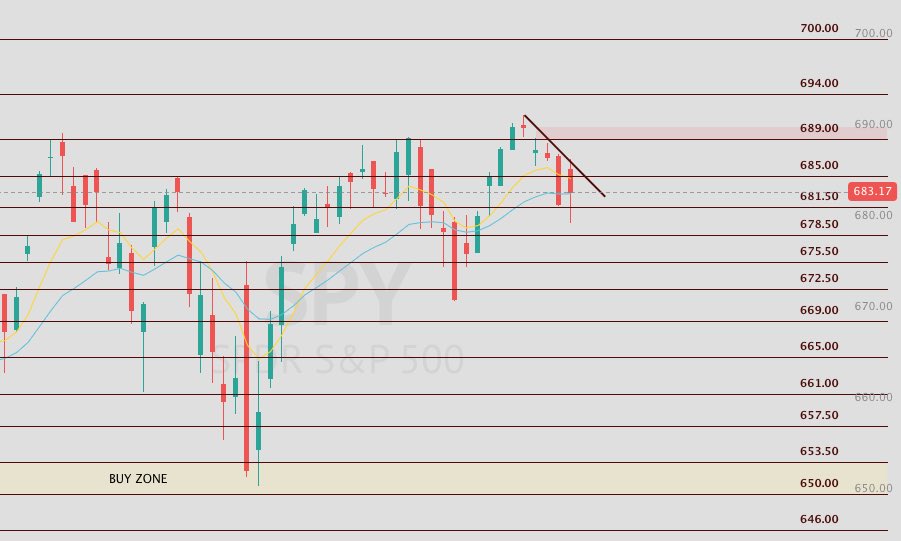

$SPY nice follow through here. Discount for that small range landed at 688.55. Can use levels from this chart to navigate from here x.com/_bwatts_/statu…

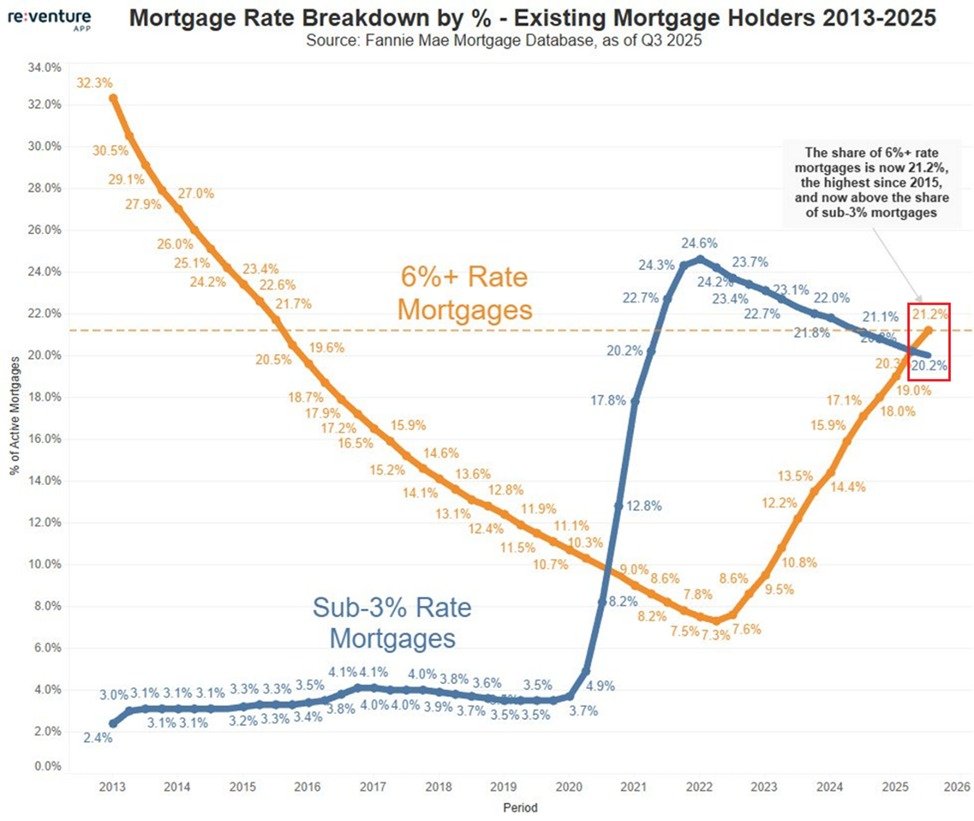

US housing market dynamics are changing: Mortgages with rates of 6%+ are up to 21.2% of all loans, the highest since 2015, per Reventure. This percentage has almost TRIPLED since 2022. Over the same period, sub-3% rate mortgages have declined -4.4 percentage points to 20.2%,…

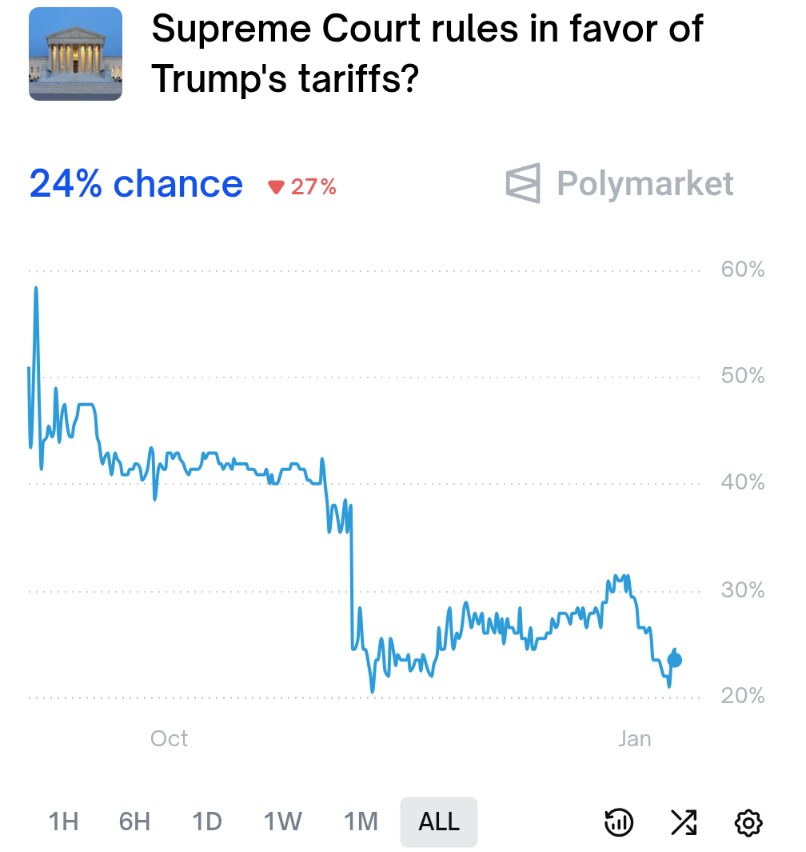

🚨BREAKING: Polymarket shows a 76% probability that Trump’s tariffs will be ruled illegal. The Supreme Court is expected to issue its decision on Friday. If the Supreme Court rules against the tariffs, there are 2 big issues. FIRST: REFUNDS. Tariffs already collected may have…

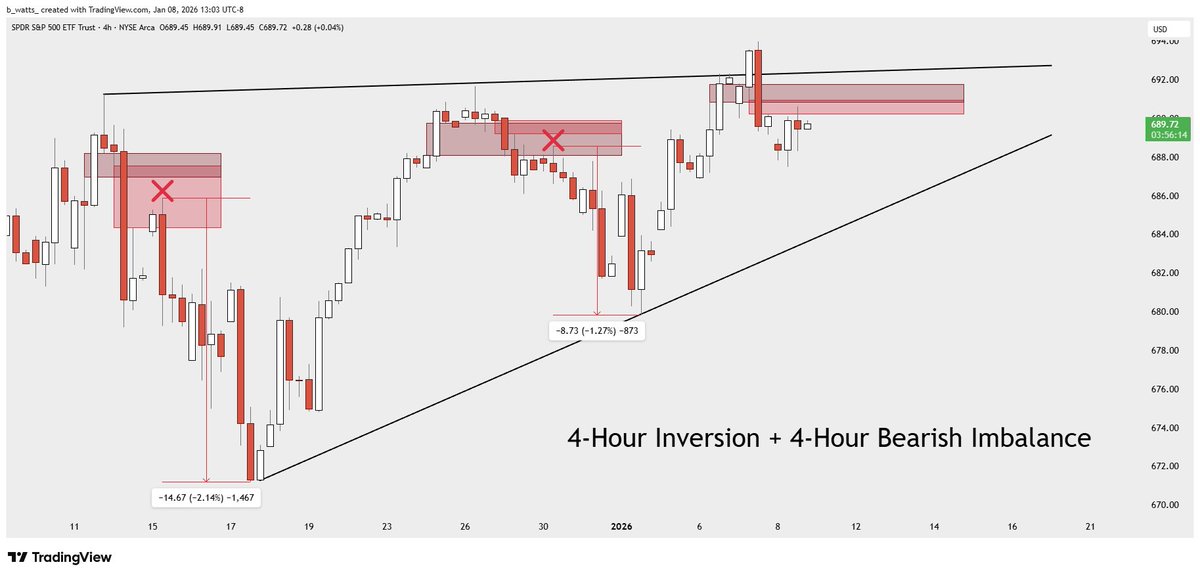

$SPY 4-Hour Inversion + 4-Hour Bearish Imbalance. Previous two setups have followed up with solid pullbacks. Will this time be different?

A couple bear scenarios for 2026 (not a prediction). The setup is the same as the 2022 top and the 2025 top so worth looking at. $SPY $SPX $ES

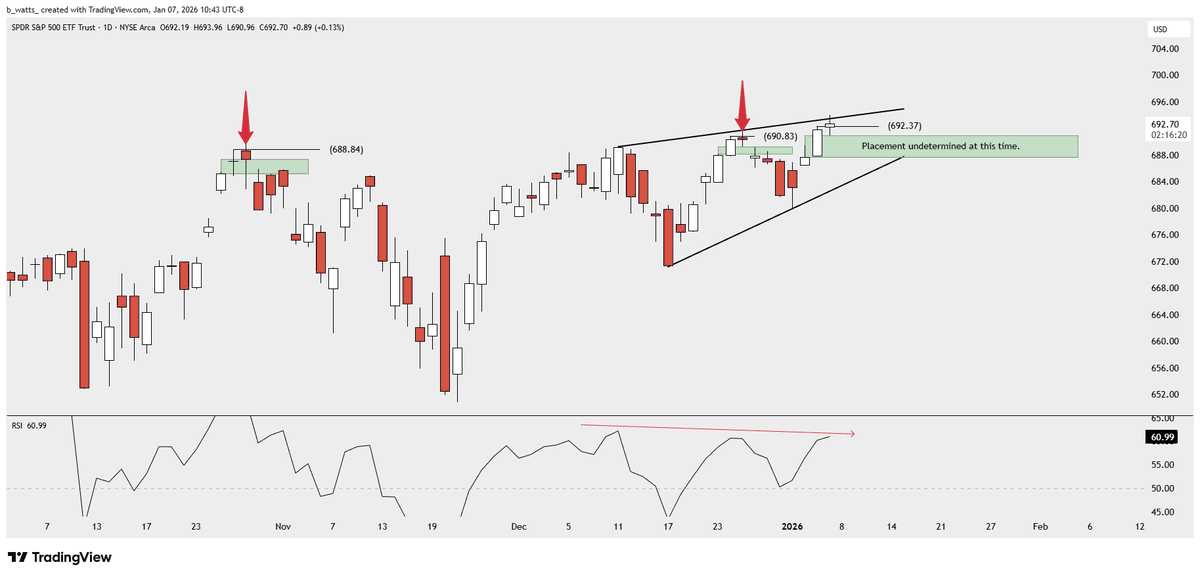

Something to keep an eye on if $SPY closes today below 692.26. See previous two examples of this setup (red arrows). Daily timeframe. Also, currently a rising wedge with bearish divergence.

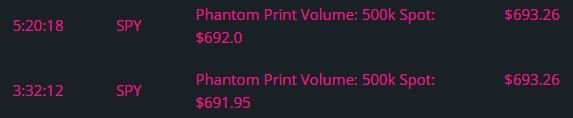

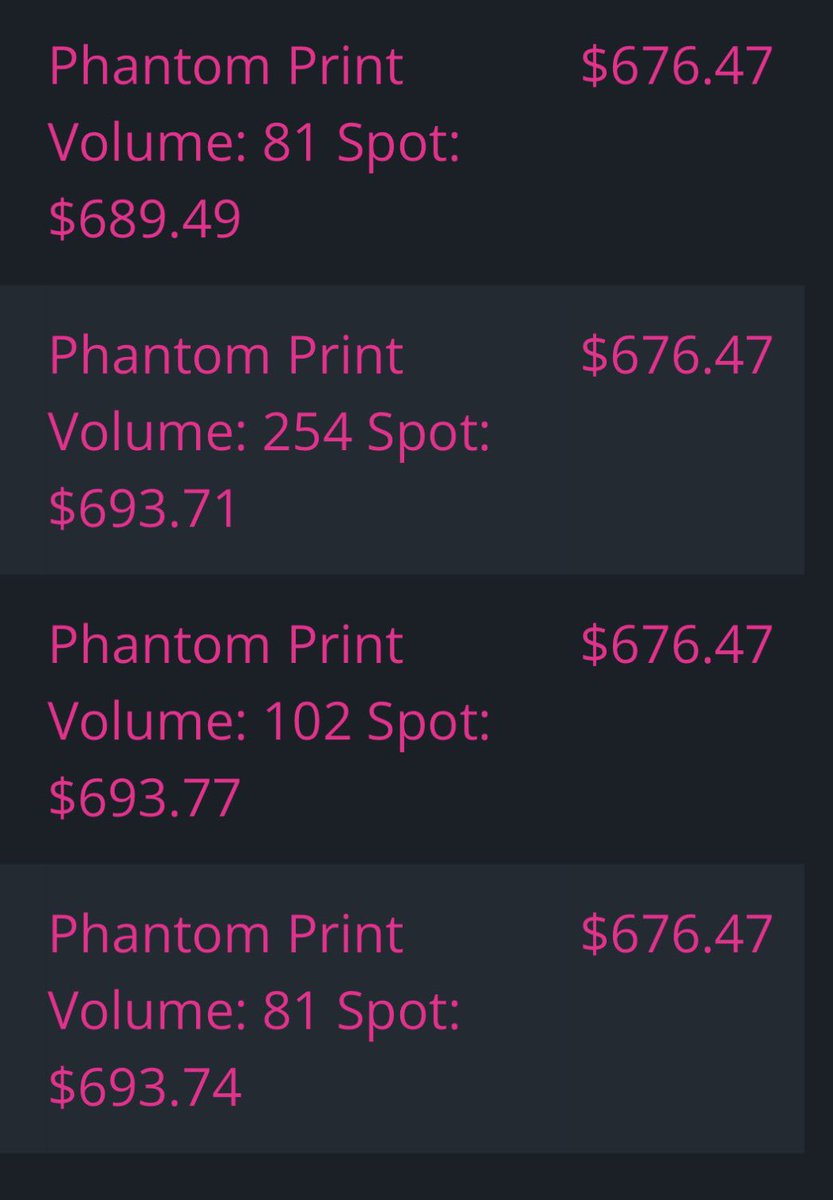

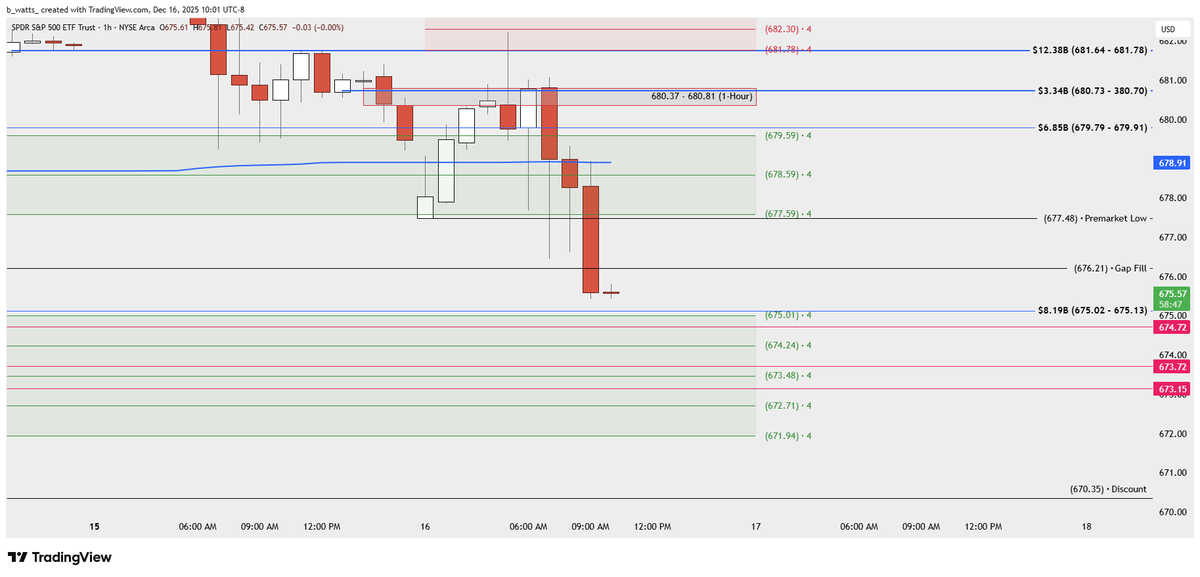

$SPY Phantom Prints Price: $676.47 / VOL: 510 / $350k Notional Value Nothing comparable to the 1,000,000 shares that came in yesterday at $693.26 but with a notional value of $350k could be worth adding to the chart.

Things that make you go hmmm 🤔 with millions in $VIX 👑 calls open 🍿 $NDX $SPX $SPY $DJI $QQQ

$SPY - The Bear gap is giving the Bears Oxygen currently and bulls have to capture it before it becomes a problem and probably bringing the market down another 10%. - looking at this trendline drawn here, on the short term time frame if bulls can break that we have a clear move…

This doesn't look good. I'm now starting to think we may actually have a down week next week. Hanging man candles on the SPX and NDQ weekly charts, both are solid green topping signal candles as well. Solid green candles using hollow candles on the weekly for NDQ are extremely…

It's called a "Santa rally" because Santa isn't real and neither is the rally. I hope this helps

Almost to the 200k in $SPY phantom prints shared back on 11/28.

Most phantom prints come in very small in size and should be ignored. When they come in with this type of size and are relatively close to spot price, they should be acknowledged. 1.28% - 1.51% below afterhours closing price. > Each print is 500k in size > Prices: 674.72, 673.15…

You can't live a big life in a small environment. Stay in the wrong place too long, and you start to shrink. You talk like the people around you. You think like them. You want what they want. If no one around you is building something big, taking risks, or pushing further,…

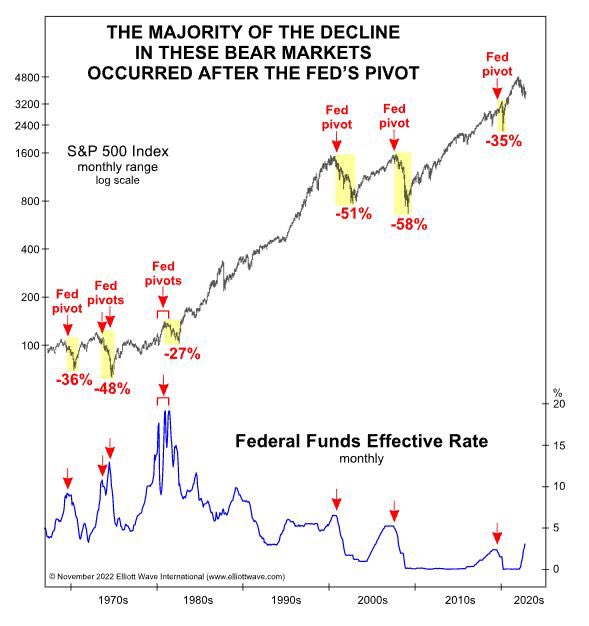

They’re LYING to you, rate cuts are actually BAD… Well, in the short term they are. The biggest crashes in history didn’t happen before the Fed pivot. They happened after it. 1970s? Fed cuts → stocks nuked. 2000 dot-com? Fed cuts → -51%. 2008? Fed cuts → -58%. Even the…

Nasty work on $SPY... FOMC takes it higher to nearly ATH, next day they sell it off pre-market, just to rally it PAST ATH, just to dump it to nearly weekly lows. Thats trading for you. Pure manipulation. This is my levels and kill zones for next week. I am looking to short…

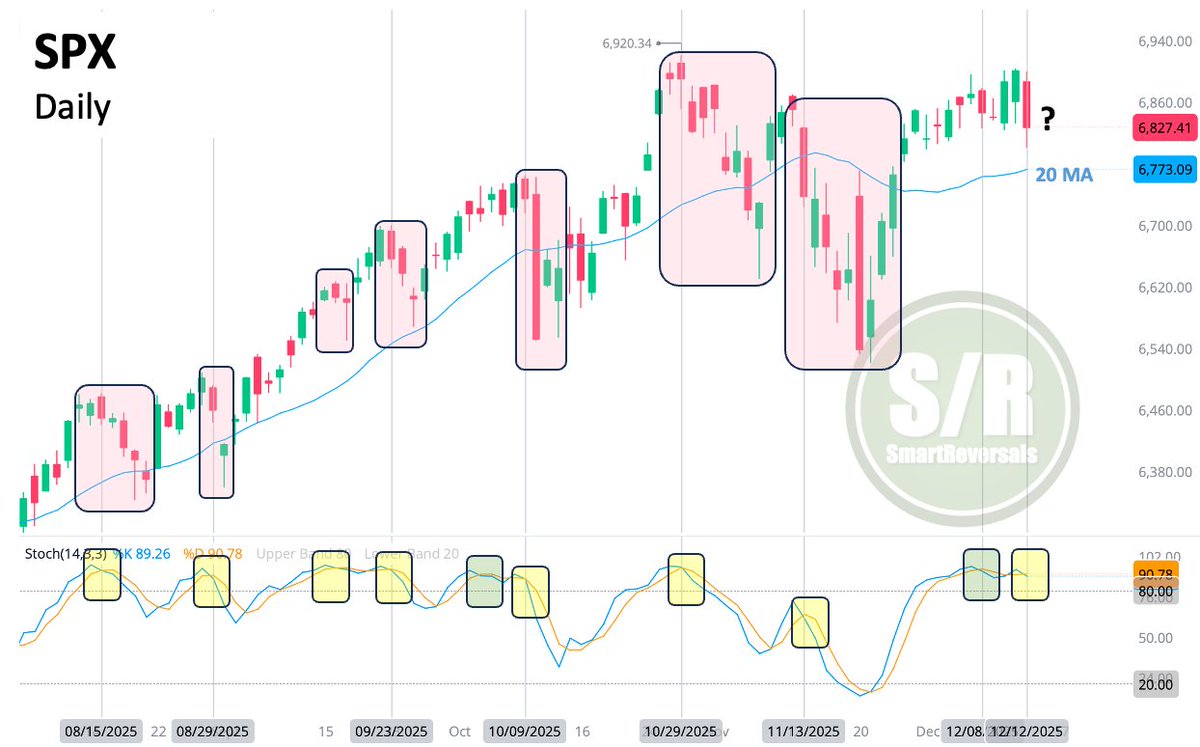

$SPX: 7 of the last 9 bearish crossovers have set the stage for further bearish continuation. One of the exceptions was an early warning signal. The other exception happened last week; if IT was also an early signal, red continuation is likely toward 20DMA.

I'm posting a series of FREE EMAILED articles on how to manage technical analysis. Receive my eBook when you subscribe to even the free plan at: smartreversals.com The first free article, studying the $NVDA case, was sent on Monday. Next will be the $SPX. Subscribe!

United States Trends

- 1. Zverev N/A

- 2. #AusOpen N/A

- 3. #AO26 N/A

- 4. #TheTraitorsUS N/A

- 5. #AustralianOpen N/A

- 6. Don Toliver N/A

- 7. Carlitos N/A

- 8. Cooper Flagg N/A

- 9. Colton N/A

- 10. Candiace N/A

- 11. Sinner N/A

- 12. #River N/A

- 13. Lisa N/A

- 14. Iron Lung N/A

- 15. OpenClaw N/A

- 16. Djokovic N/A

- 17. Warsh N/A

- 18. Hasan N/A

- 19. Sascha N/A

- 20. Benedict N/A

Something went wrong.

Something went wrong.