Tal vez te guste

Remember that FTX was illegally using **customer money** to lend to his affiliated hedge fund Alameda Research, to make illiquid venture bets, and to make political donations. And that when the customers asked for their money back, he couldn’t return it. THAT is why the…

[SBF says:] I don't quite agree with every point—but, yeah, this is basically what happened. I'm not saying FTX's solvency or the Debtors' mismanagement are the reasons I'm innocent (although it's a piece of the story!). But the Debtors are still withholding funds—see, e.g.,…

ICE hikes Brent Crude Oil futures margin by 24%.

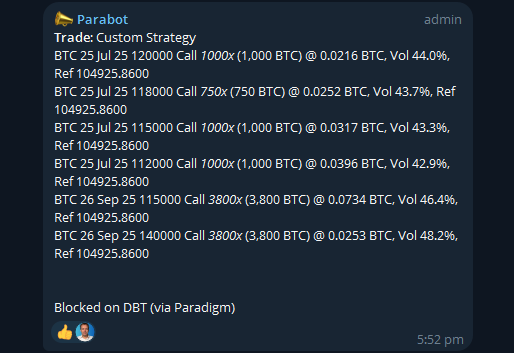

Interestingly this trade adds to the transparency risk argument opened earlier in the week. Large notional trade, actually $7.5m spent (not 50m), client sells all the July and buys a Sep Call spread. Net small delta (200btc); no issue with hedge. The client gets a chunk done at…

Largest single trade on @tradeparadigm to date🔥🔥 Someone just printed our largest trade ever: ~ $1.2 billion in notional for a $50 million premium, filled via RFQ in a single shot with zero impact on the public order book!

Intuitive understanding to options You might have heard that options represent the full distribution of the market and are thus the real underlying. Sure you can argue, in the English sense of the word, that they are not underlying, but that viewpoint is useless for making money,

Life Through a Volatility Lens with @KrisAbdelmessih (S7E10) My guest in this episode is Kris Abdelmessih, co-founder of moontower.ai. Kris began his career at SIG, where he worked as a market maker in several different option pits, before moving to Parallax where he…

They called it .net bubble, the crypto bubble, now calling it an ai bubble. Guess I love bubbles and bubbles pay very well.

*Money Printing* A seemingly simple, yet confusing topic. I mean, why even sell bonds to the public, when the Fed can just print more dollars and pay for whatever the government wants to spend? The answer is simple but requires a little critical thinking. Time for a Fed 🧵👇

Alpha on silver spoon!

A Demonstration of VRP Normalizing One of moontower.ai's "top of funnel" charts is a scatterplot of VRP (volatility risk premium) vs realized vol percentile We are going to hindsight the chart to show how BTC vols anticipated the last month's moves...

Seeing trad-fi traders in bad mood cuz of %6 pull back is priceless.

One of the lessons we were taught at SIG was that finding edge was the lifeblood. "If you can find real edge we'll find a way to lay it off." It is downstream of the idea that edge stacks linearly and risk scales sublinearly.

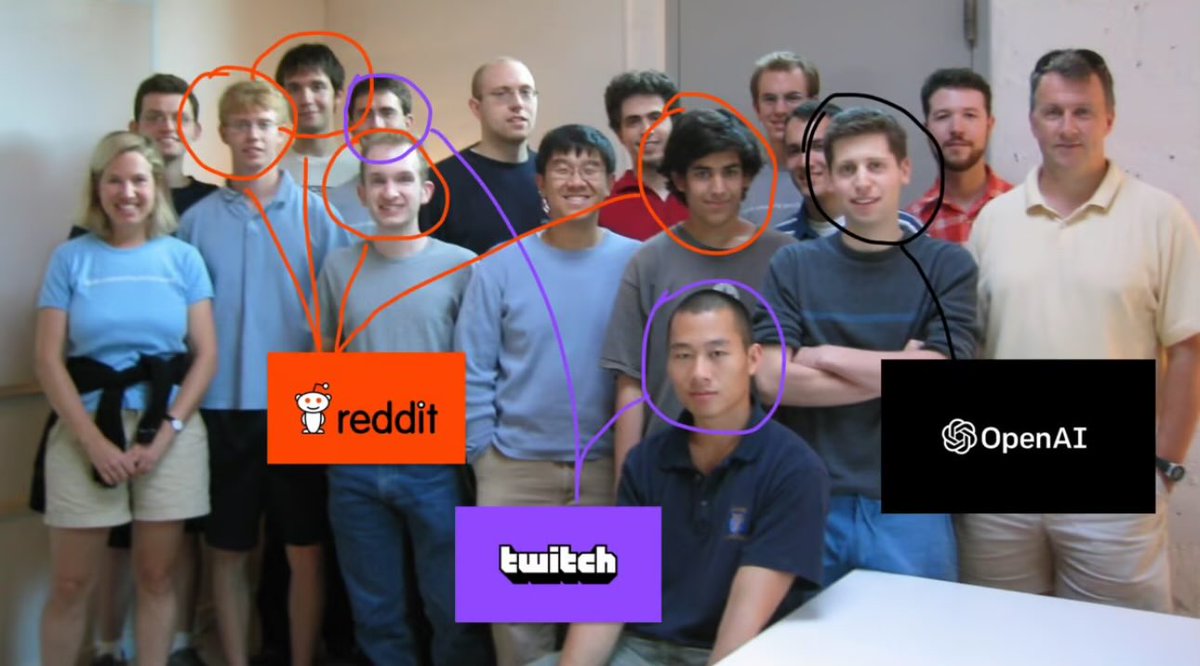

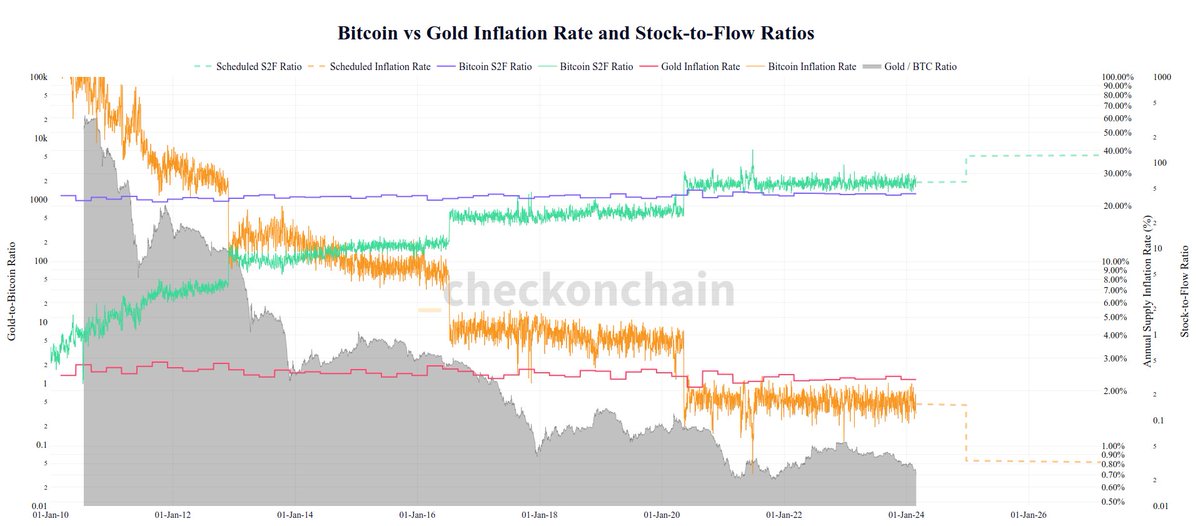

Lest we forget that one founder of Reddit

The world is not ready for the #Bitcoin halving event in April. $BTC already has a lower annual inflation rate (~1.60%) compared to gold (~2.25%), but post halving, this falls to 0.8%. It would take 119 years of mining at the 3.125 $BTC/block rate to recreate the current…

A trader thinking about economics is like a dog thinking about quantum physics: unlikely to be right and completely irrelevant to their lives.

Everything is priced in. Don't even ask the question. The answer is yes, it's priced in. Think Amazon will beat the next earnings? That's already been priced in. You work at the drive thru for Mickey D's and found out that the burgers are made of human meat? Priced in. You think…

14 year-old Wall Street intern

Things you prob don't do if you going to deny or delay. Hearing similar btw, and why why when we see updated (final) 19b-4s roll in that is sign approval imminent as SEC has been doing back and forth w issuers offline to perfect their 19b-4s vs doing numerous refilings a la S-1s

"This business was perfect for me. It's a real test on your own character. Because the greed & the stardom & all that bs that goes with the money, eats a lot of people up." - Mike Walsh Feel like this guy would fit in well on crypto twitter.

United States Tendencias

- 1. #StrangerThings5 59.4K posts

- 2. Thanksgiving 566K posts

- 3. Afghan 159K posts

- 4. #AEWDynamite 16.5K posts

- 5. National Guard 499K posts

- 6. #Survivor49 2,223 posts

- 7. Kevin Knight 1,944 posts

- 8. Rahmanullah Lakanwal 64.5K posts

- 9. holly 24.3K posts

- 10. dustin 84.1K posts

- 11. Cease 27.3K posts

- 12. Doris Burke N/A

- 13. Celtics 14K posts

- 14. Rizo 2,062 posts

- 15. robin 47.6K posts

- 16. Blood 253K posts

- 17. Savannah 5,127 posts

- 18. #TheChallenge41 N/A

- 19. Operation Allies Welcome 21.1K posts

- 20. #SistasOnBET N/A

Tal vez te guste

Something went wrong.

Something went wrong.

![SBF_FTX's tweet card. [SBF says:] I’ve heard that some people in the replies are asking: Where did the money go? The ans...](https://pbs.twimg.com/card_img/1993319023291809792/yT5nBv9N?format=jpg&name=orig)