ISABELNET

@ISABELNET_SA

Advanced Stock Market Forecast for Professionals & Individuals available on https://www.isabelnet.com • 95% Correlation since 1970 • R² = 0.90 • Tweets ≠ Advice

你可能會喜歡

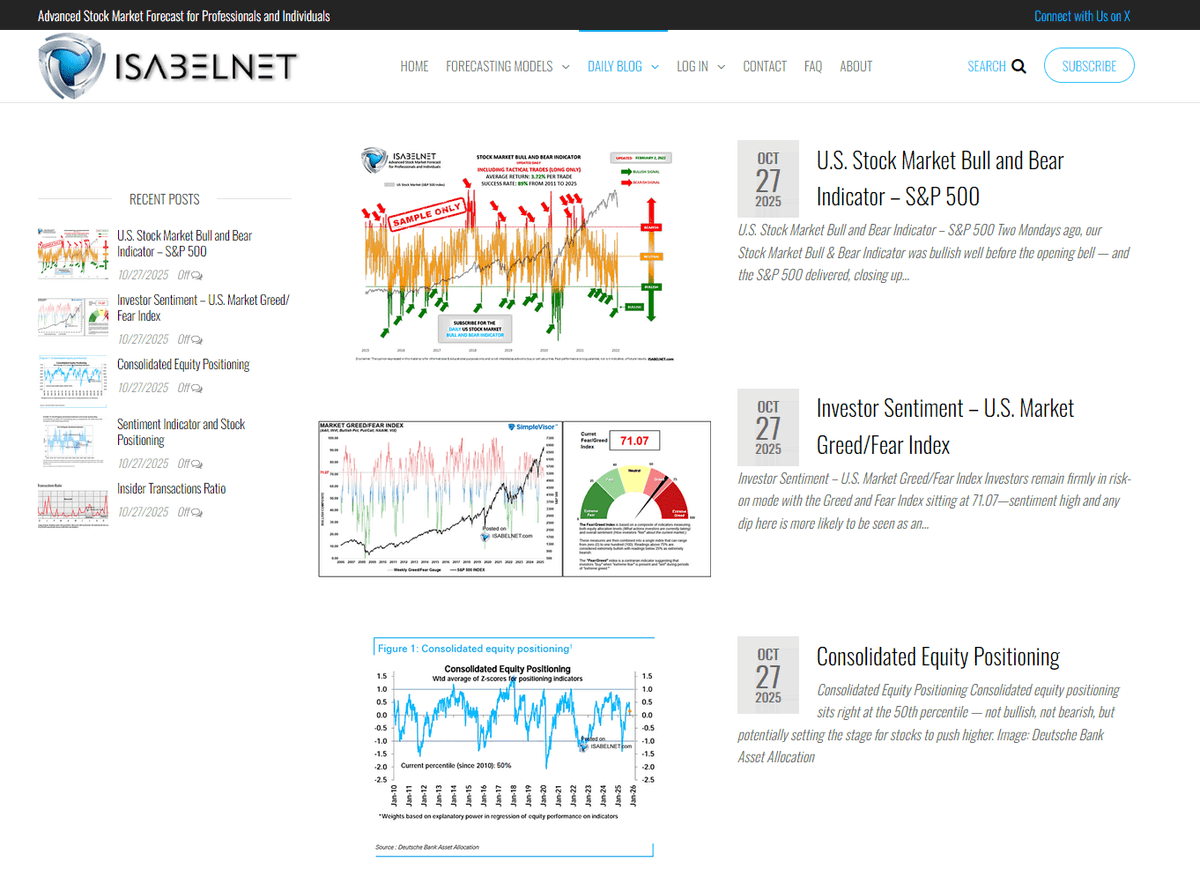

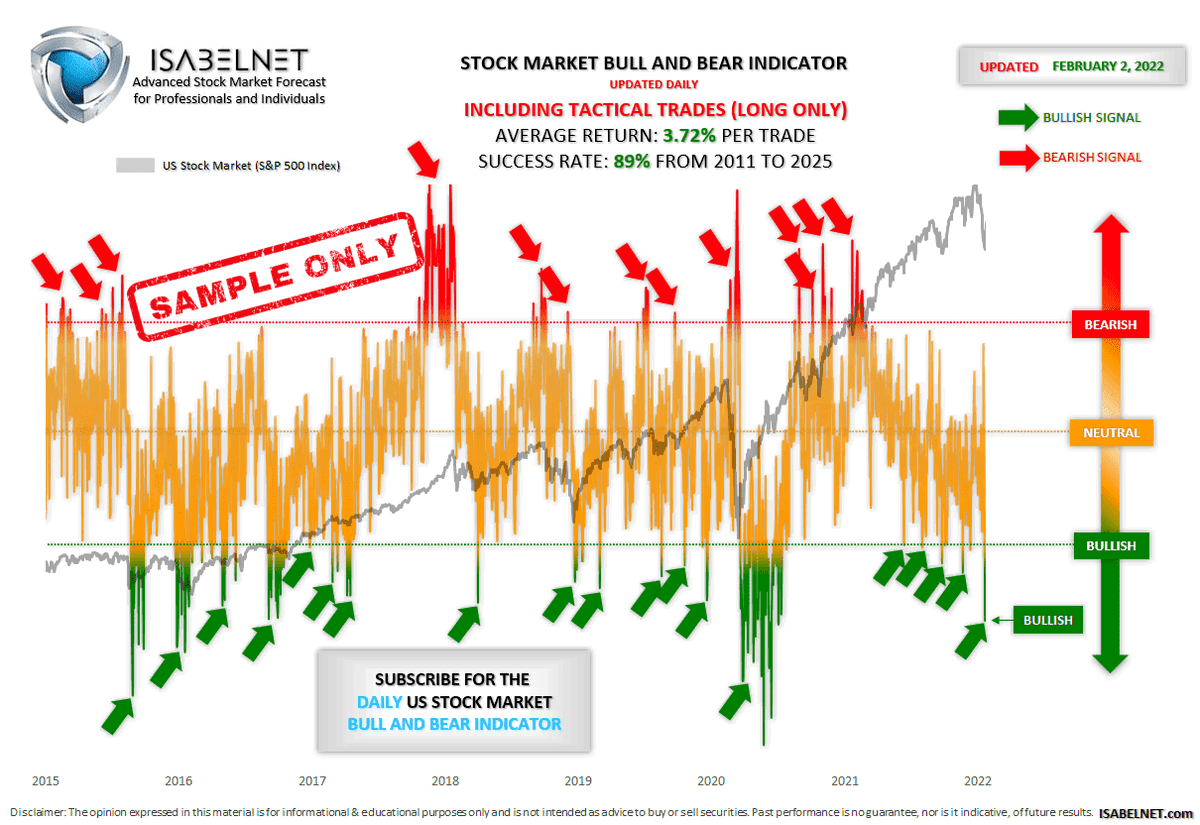

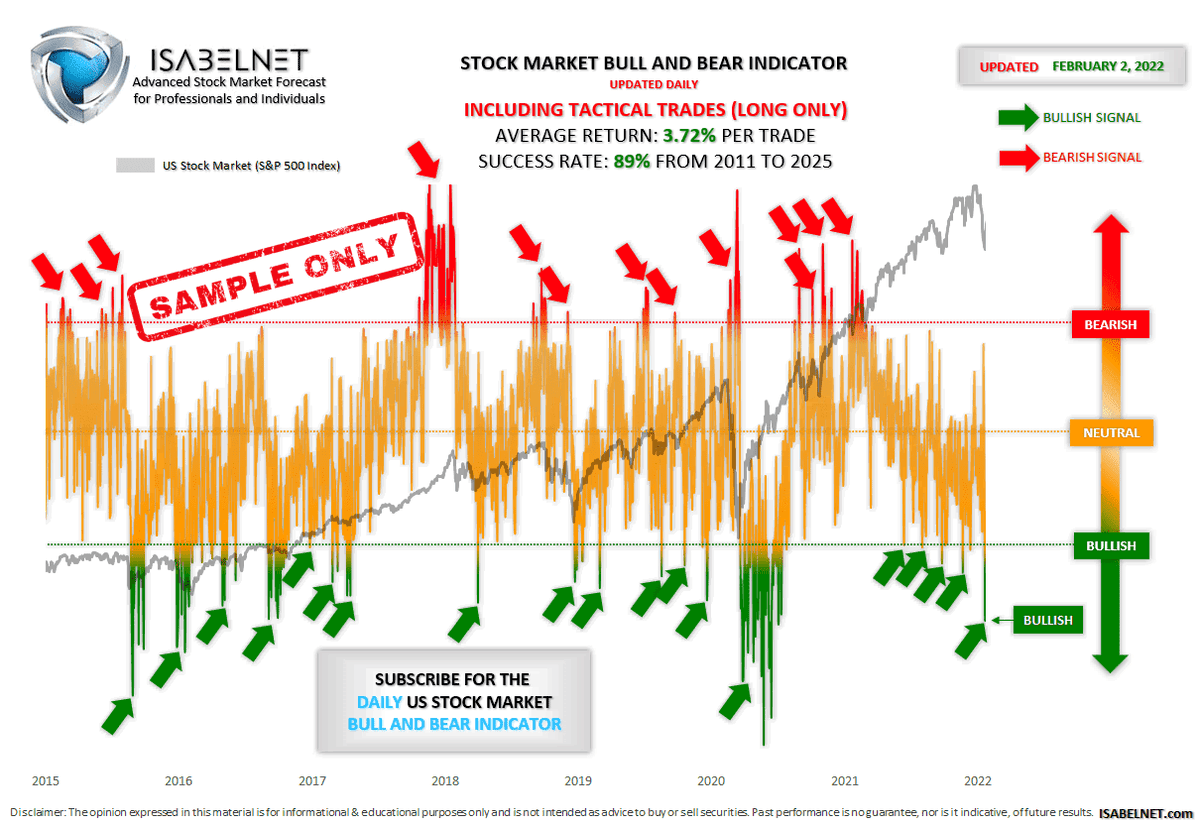

🇺🇸SPX Two Mondays ago, our Stock Market Bull & Bear Indicator was bullish well before the opening bell — and the S&P 500 delivered, closing up 1.56% The model is designed to show which way the wind's blowing — bullish, bearish, or neutral More details 👉isabelnet.com

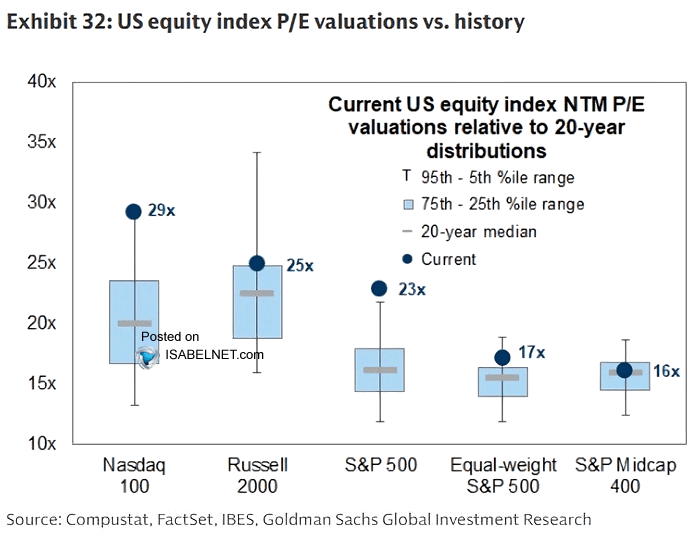

🇺🇸 Valuation Valuations are running hot. The S&P 500 and Nasdaq 100 remain well above historical norms, showing just how much faith investors have in the next leg of the earnings cycle, especially for tech and AI-driven leaders 👉 isabelnet.com/?s=valuation @GoldmanSachs $spx $qqq

🇺🇸 S&P 500 Short interest in the S&P 500 remains elevated. Risk appetite is holding up, but investors are keeping their guard up—using shorts more as a hedge than a sign of fear 👉 isabelnet.com/?s=S%26P+500 @GoldmanSachs $spx #spx #sp500 #equities #stocks

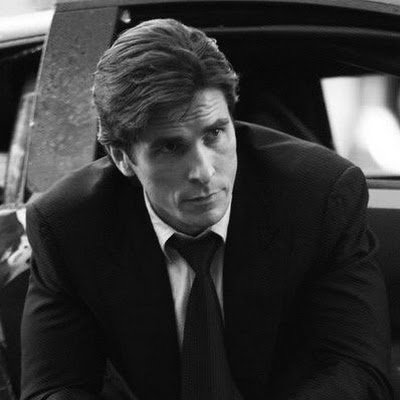

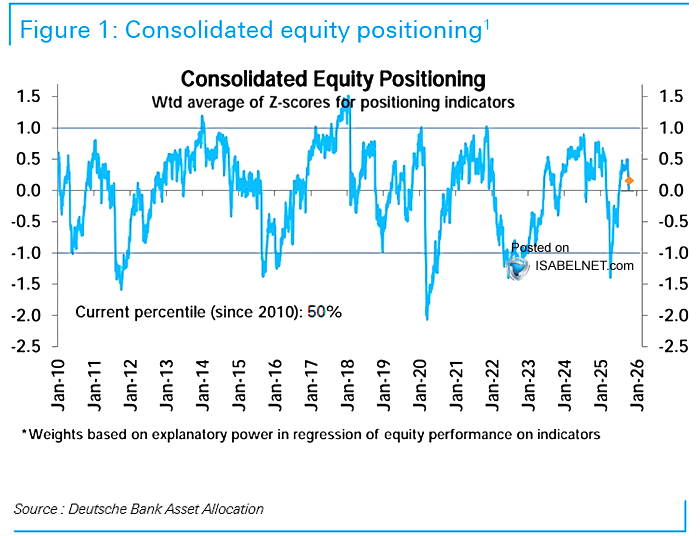

📌 Equity Consolidated equity positioning sits right at the 50th percentile — not bullish, not bearish, but potentially setting the stage for stocks to push higher 👉 isabelnet.com/?s=equity h/t @DeutscheBank $spx #spx #sp500 #equities #stocks

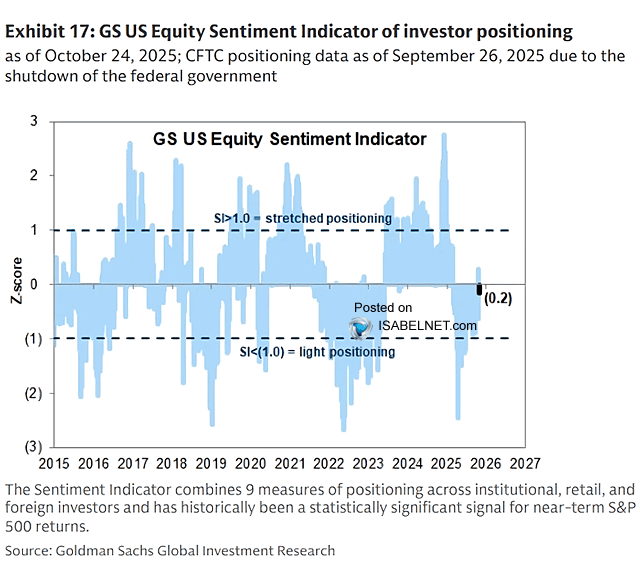

🇺🇸 Sentiment At -0.2, Goldman Sachs' US Equity Sentiment Indicator is flashing mild caution — but past readings like this have more often marked the calm before an S&P 500 bounce in the coming month 👉 isabelnet.com/?s=sentiment @GoldmanSachs $spx #spx #sp500 #stocks #stockmarket

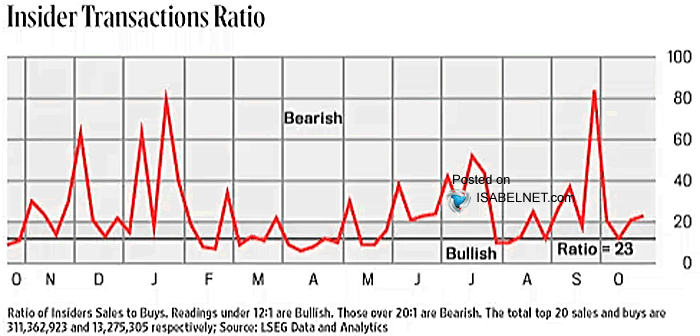

📌 Insiders With the Insider Transactions Ratio tilting slightly bearish, corporate insiders aren't exactly rushing to buy 👉 isabelnet.com/blog/ #insider $ndx $spx #spx #stocks #stockmarket

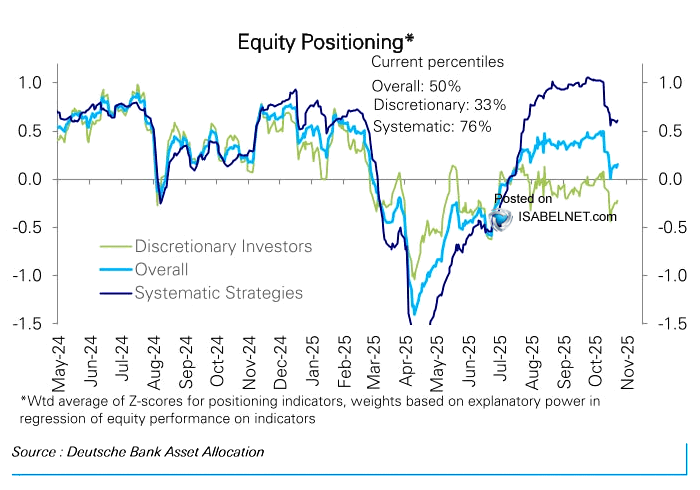

📌 Equity Equity positioning remains broadly neutral, with discretionary investors slightly increasing exposure but still underweight, while systematic strategies maintain a moderate overweight stance 👉 isabelnet.com/?s=equity h/t @DeutscheBank $spx #spx #equity #stocks

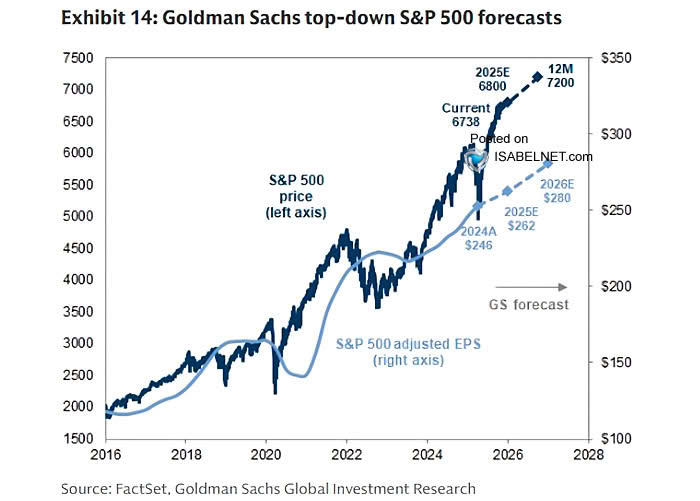

🇺🇸 S&P 500 A friendlier Fed and resilient large caps have Goldman Sachs keeping faith in the bull run—targeting 6,800 on the S&P 500 by end-2025 and 7,200 by end-2026 👉 isabelnet.com/?s=S%26P+500 h/t @GoldmanSachs $spx #spx #sp500 #equity #stocks

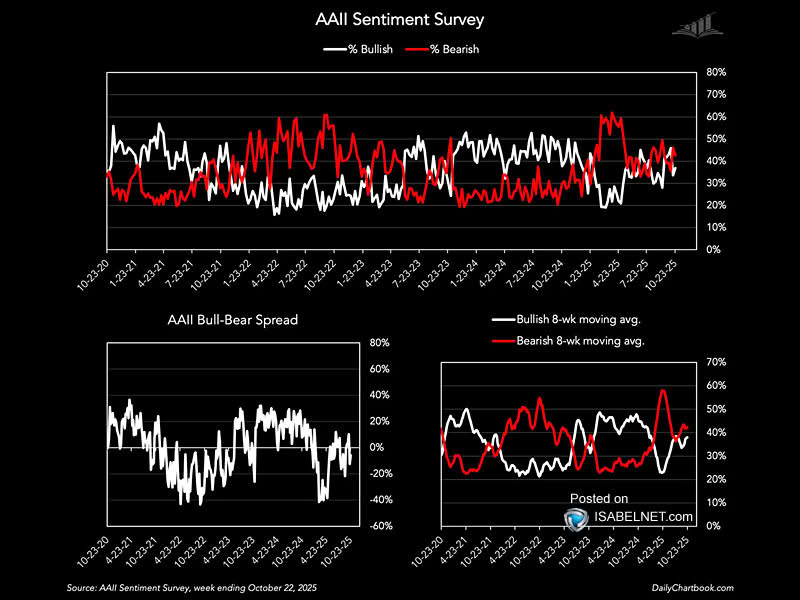

🇺🇸 Sentiment The modestly negative AAII bull‑bear spread isn't euphoria—it's hesitation. Markets have tended to bounce from that mood, not break down 👉 isabelnet.com/blog/ h/t @dailychartbook $spx #spx #AAII

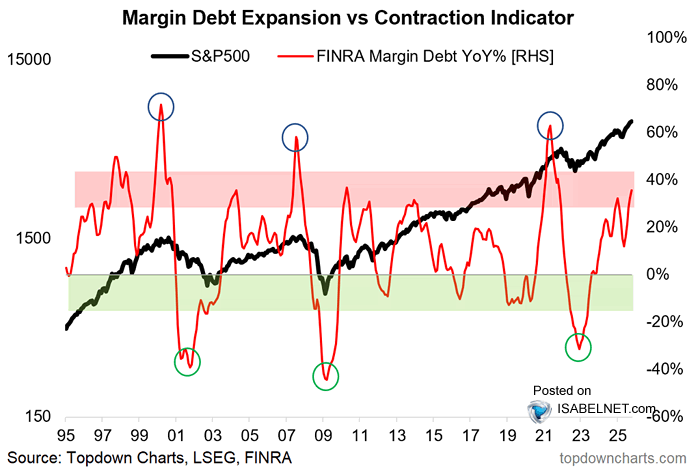

🇺🇸 Margin Debt Margin debt is soaring to levels that make some investors uneasy, flirting with the "danger zone." For now, momentum still points higher—but a reversal would be the real red flag 👉 isabelnet.com/?s=S%26P+500 h/t @Callum_Thomas #spx $spx

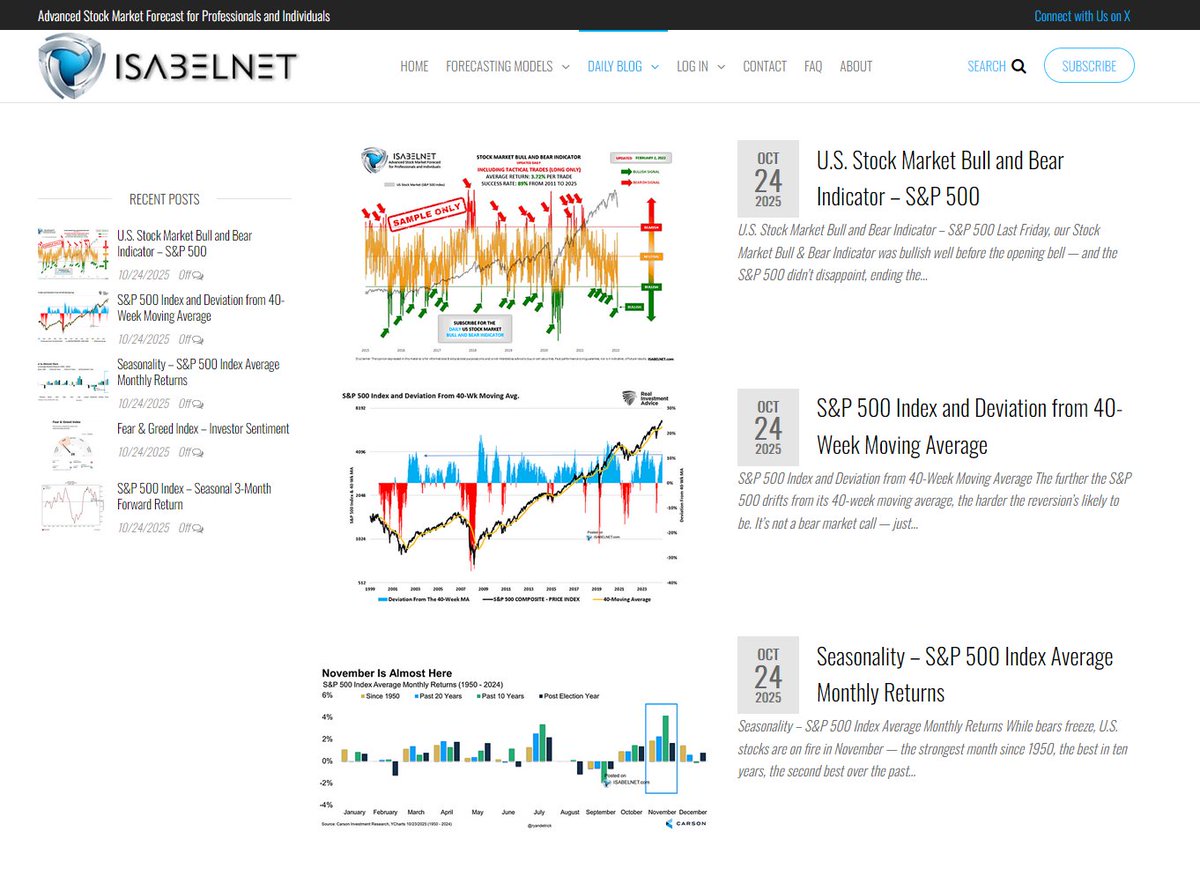

🇺🇸 Sentiment Investors remain firmly in risk-on mode with the Greed and Fear Index sitting at 71.07—sentiment high and any dip here is more likely to be seen as an excuse to buy than a reason to sell 👉 isabelnet.com/?s=sentiment h/t @LanceRoberts $spx #spx #equity #stocks

📌Subscriber Access The #stockmarket bull and bear indicator, the short- & long-term forecasts, the #valuation & ERP charts have been updated on 👉isabelnet.com #valuations #markets #investing #assetallocation #sp500 #nasdaq #dow #dowjones $djia $spx #spx $spy #stocks

🇺🇸SPX Last Friday, our Stock Market Bull & Bear Indicator was bullish well before the opening bell — and the S&P 500 didn't disappoint, ending the day up 0.53%. The model gauges if the market is leaning bullish, bearish or neutral. Visit our website: 👉 isabelnet.com

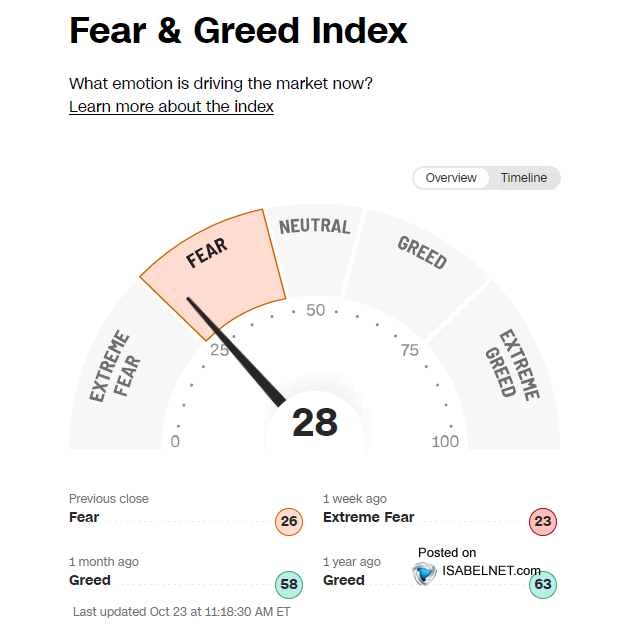

🇺🇸 Sentiment With the Fear & Greed Index down at 28, one thing's clear: market participants aren't in the mood for risk 👉 isabelnet.com/?s=sentiment @CNNBusiness $spx #spx #equities #stocks #stockmarket

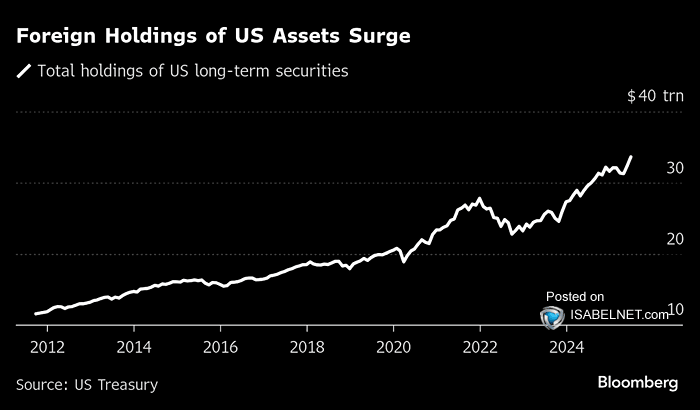

🇺🇸 Assets Record foreign holdings of US assets in 2025 point to lasting investor confidence, even in the face of global economic and geopolitical risks 👉 isabelnet.com/blog/ h/t @markets $spx #spx #stocks #treasuries #bonds #equities

🇺🇸 NAAIM At 90.35, the NAAIM Exposure Index leaves little doub — active managers are still all-in on US stocks 👉 isabelnet.com/?s=sentiment #NAAIM $spx #spx #sp500 #stocks #equities #stockmarket

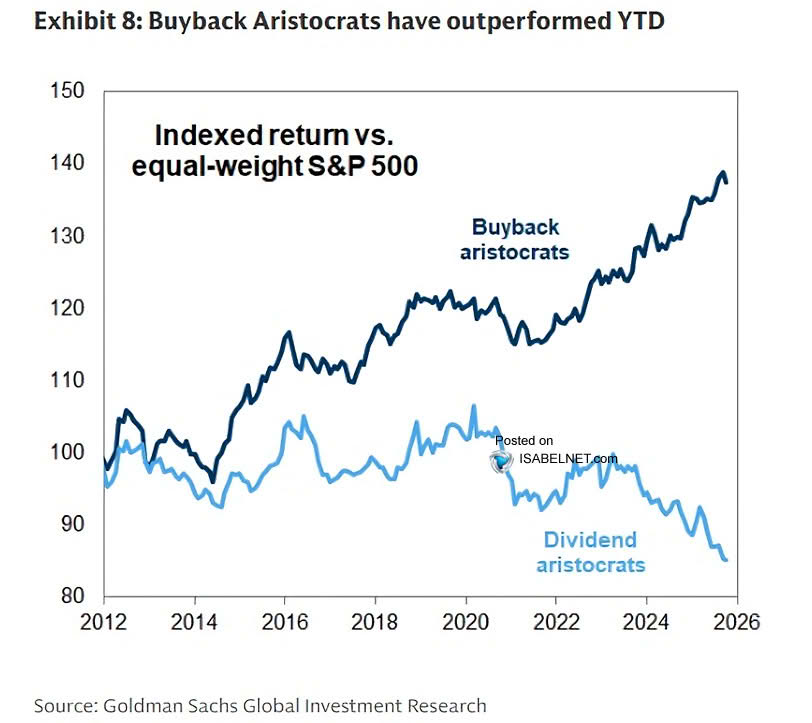

🇺🇸 Buyback Fueled by growth momentum and turbo‑charged buybacks, Buyback Aristocrats have left Dividend Aristocrats in the dust, as investors chase upside over income stability 👉 isabelnet.com/blog/ @GoldmanSachs #buybacks $spx #spx #stocks #equities

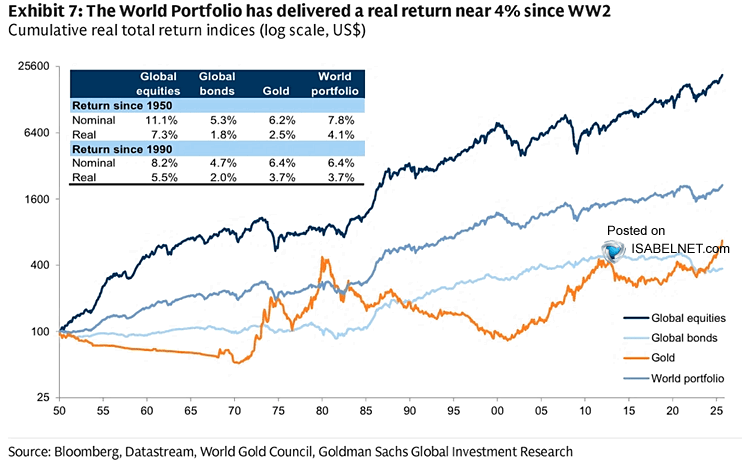

📌 Returns Since 1950, the world portfolio has earned a real 4.1% annual return — global equities led with 7.3%, gold lagged at 2.5%, and global bonds barely reached 1.8%. The long-run verdict is clear: equities have won 👉isabelnet.com/blog/ h/t @GoldmanSachs #stocks #gold

United States 趨勢

- 1. #WWERaw 29.5K posts

- 2. Chiefs 57.8K posts

- 3. Mariota 5,989 posts

- 4. Maxey 5,454 posts

- 5. Glasnow 5,140 posts

- 6. Kelce 9,473 posts

- 7. #RaiseHail 5,343 posts

- 8. Mahomes 16.9K posts

- 9. Sixers 10K posts

- 10. Edman 2,751 posts

- 11. Lattimore 2,620 posts

- 12. Deebo 4,903 posts

- 13. #WorldSeries 41.1K posts

- 14. Alejandro Kirk 5,160 posts

- 15. Scary Terry 1,172 posts

- 16. #Commanders 2,062 posts

- 17. Pistons 7,118 posts

- 18. Freddie 7,936 posts

- 19. #MondayNightFootball N/A

- 20. Ertz 2,730 posts

你可能會喜歡

-

Yardeni Research

Yardeni Research

@yardeni -

Holger Zschaepitz

Holger Zschaepitz

@Schuldensuehner -

Macro Charts

Macro Charts

@MacroCharts -

CrossBorder Capital/ GLIndexes

CrossBorder Capital/ GLIndexes

@crossbordercap -

Lisa Abramowicz

Lisa Abramowicz

@lisaabramowicz1 -

Kevin C. Smith, CFA

Kevin C. Smith, CFA

@crescatkevin -

Liz Ann Sonders

Liz Ann Sonders

@LizAnnSonders -

Otavio (Tavi) Costa

Otavio (Tavi) Costa

@TaviCosta -

Topdown Charts

Topdown Charts

@topdowncharts -

Christophe Barraud🛢🐳

Christophe Barraud🛢🐳

@C_Barraud -

John P. Hussman, Ph.D.

John P. Hussman, Ph.D.

@hussmanjp -

Jim Bianco

Jim Bianco

@biancoresearch -

Tom McClellan

Tom McClellan

@McClellanOsc -

Ian Harnett

Ian Harnett

@IanRHarnett -

3Fourteen Research

3Fourteen Research

@3F_Research

Something went wrong.

Something went wrong.