ISABELNET

@ISABELNET_SA

Advanced Stock Market Forecast for Professionals & Individuals available on https://www.isabelnet.com • 95% Correlation since 1970 • R² = 0.90 • Tweets ≠ Advice

You might like

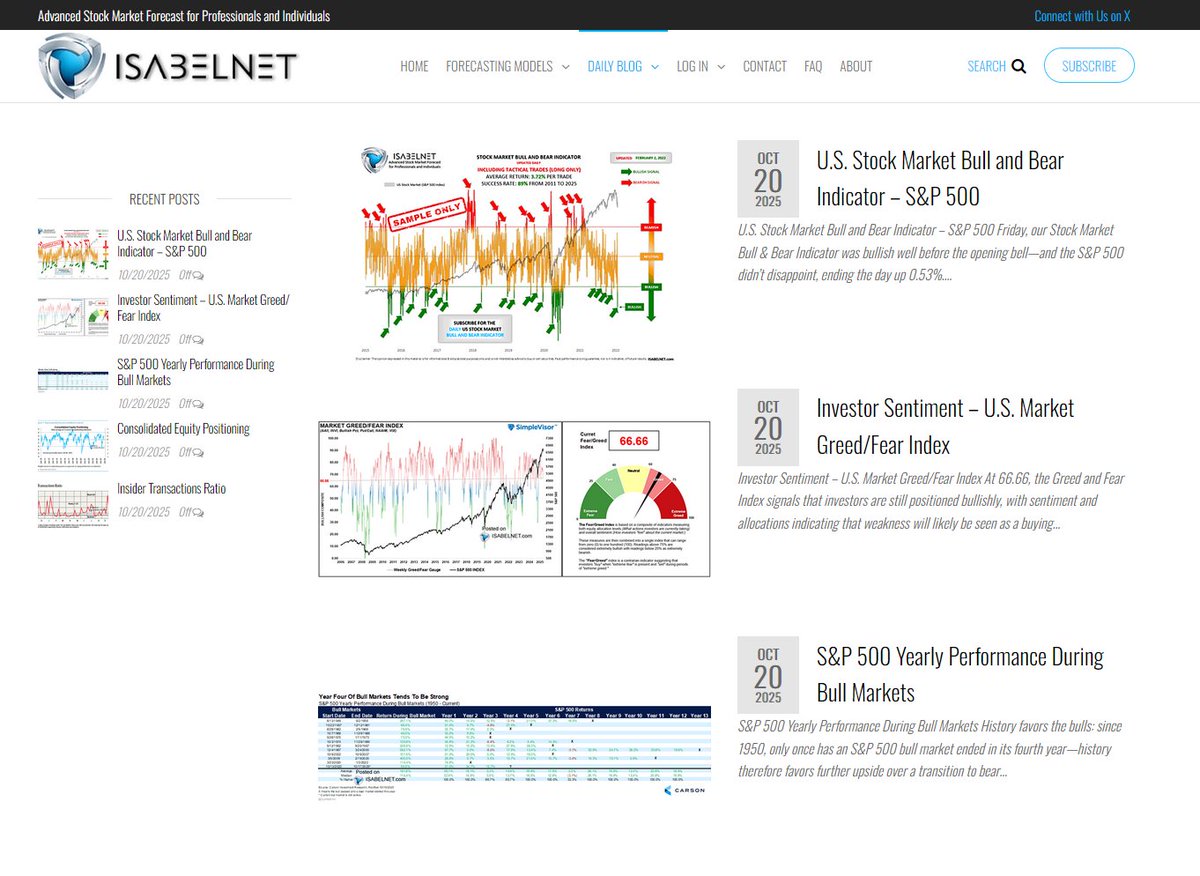

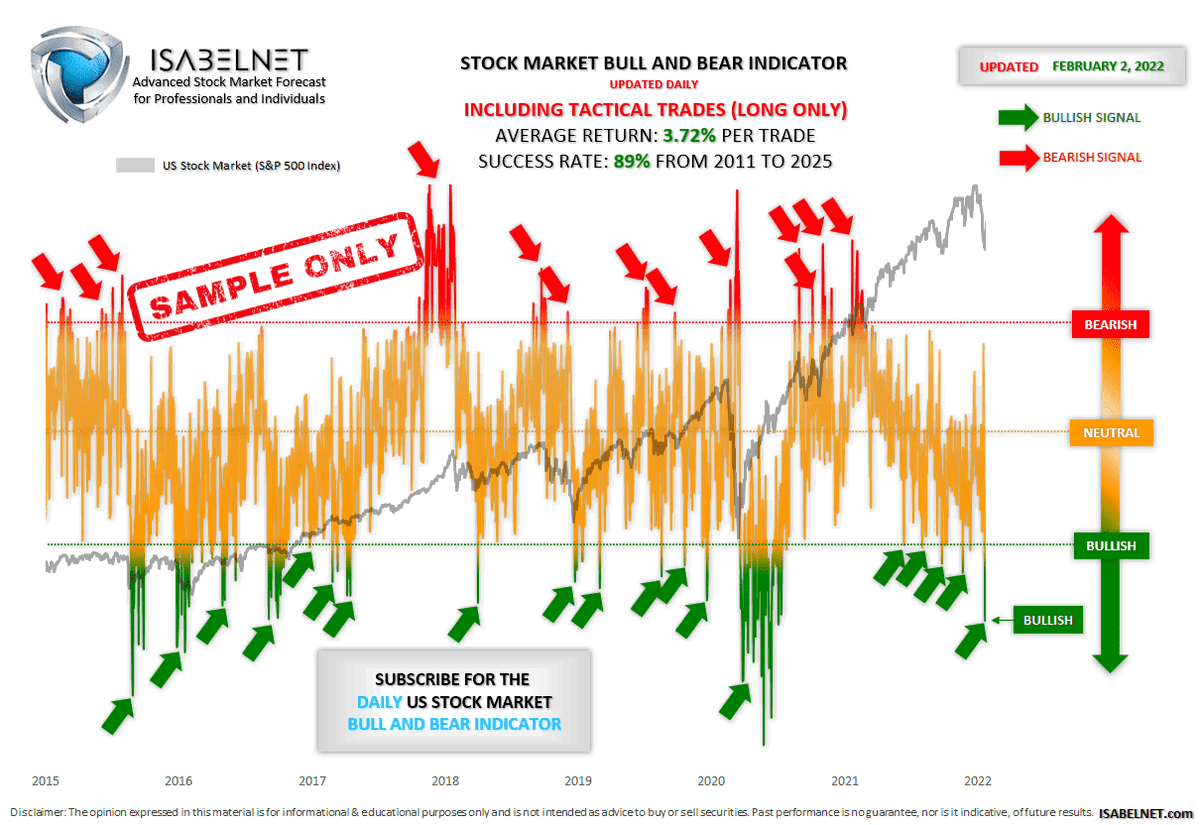

🇺🇸SPX Friday, our Stock Market Bull & Bear Indicator was bullish well before the opening bell—and the S&P 500 didn't disappoint, ending the day up 0.53% The model gauges if the market is leaning bullish, bearish or neutral More details on our website: 👉isabelnet.com

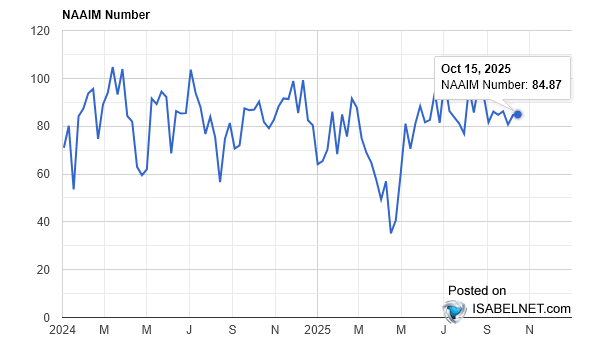

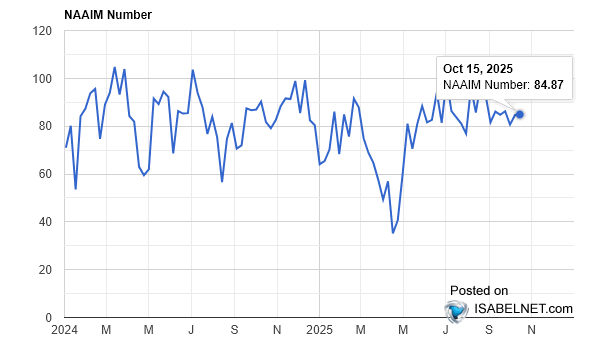

🇺🇸 NAAIM At 84.87, the NAAIM Exposure Index paints a clear picture: active managers are still all-in on US equities, their conviction unshaken 👉 isabelnet.com/?s=sentiment #NAAIM $spx #spx #sp500 #stocks #equities #stockmarket

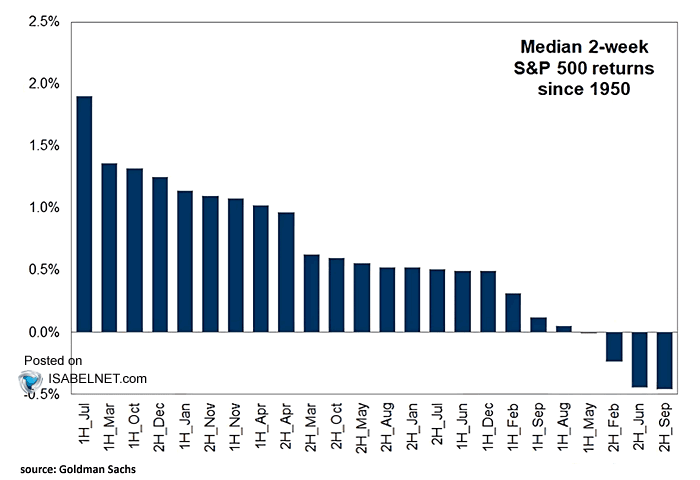

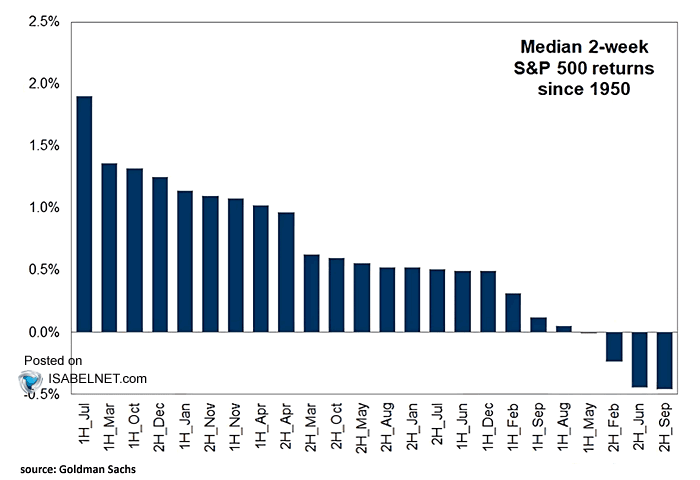

🇺🇸 S&P 500 The S&P 500 tends to shine in early October, but history shows its momentum often cools in the back half of the month 👉 isabelnet.com/?s=S%26P+500 h/t @GoldmanSachs $spx #spx #sp500 #stocks #equities

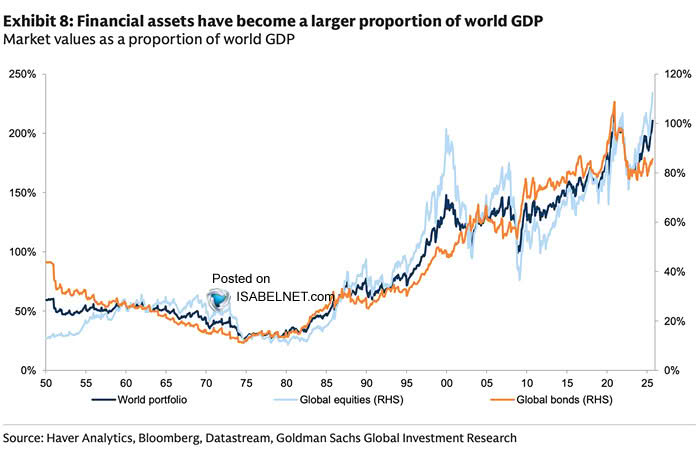

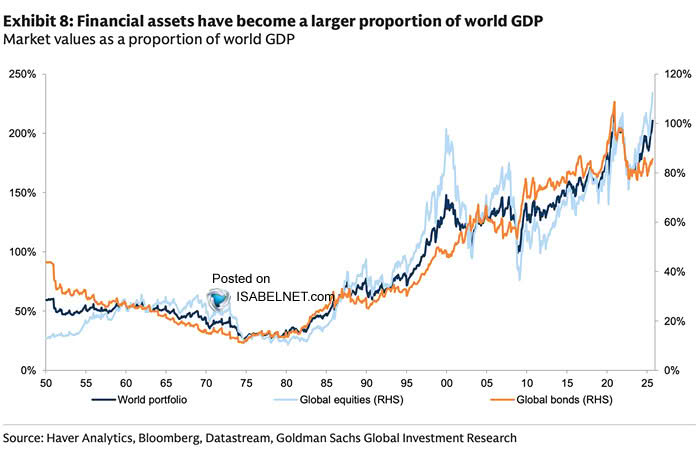

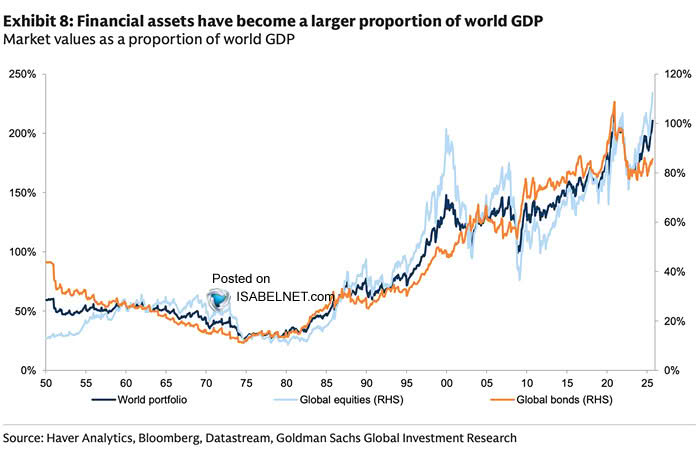

📌 Valuations Global equities have tripled their weight since the 1990s, jumping from 75% to above 200% of world GDP—an expansion that screams just how far valuations have run. Honestly, what could go wrong? 👉 isabelnet.com/?s=valuation h/t @GoldmanSachs $spx #spx #stocks #bonds

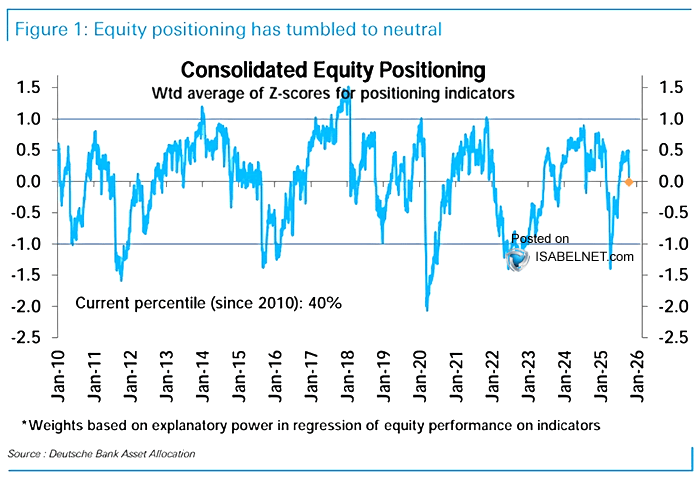

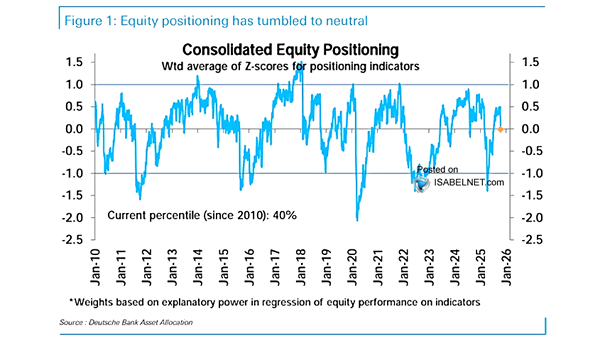

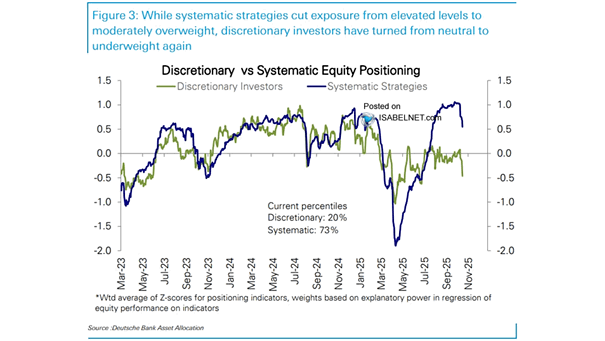

📌 Equity Consolidated equity positioning sits at the 40th percentile—neutral for now, but with room to lean risk-on if market momentum builds 👉 isabelnet.com/?s=equity h/t @DeutscheBank $spx #spx #sp500 #equities #stocks

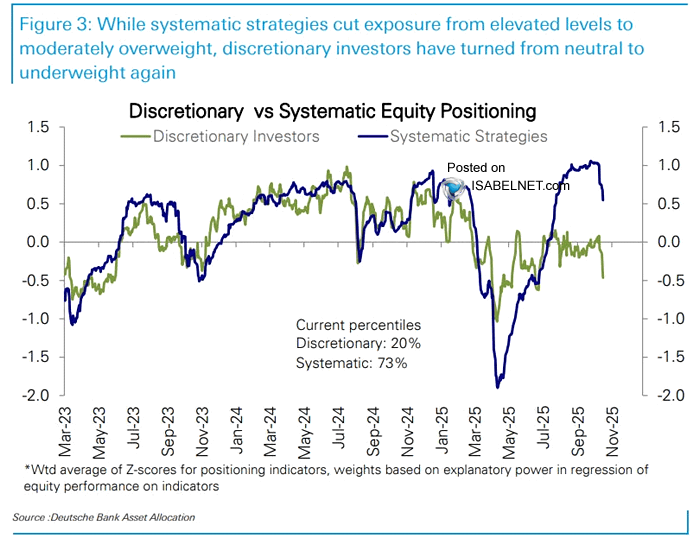

📌 Equity Systematic strategies have rolled back exposure after months of buildup to a mild overweight, while discretionary investors, still risk-averse, have moved decisively underweight—a setup that, paradoxically, tilts bullish 👉 isabelnet.com/?s=equity @DeutscheBank $spx

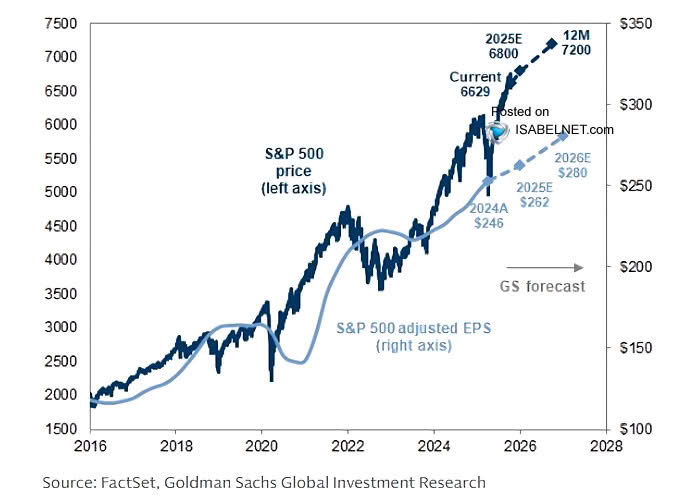

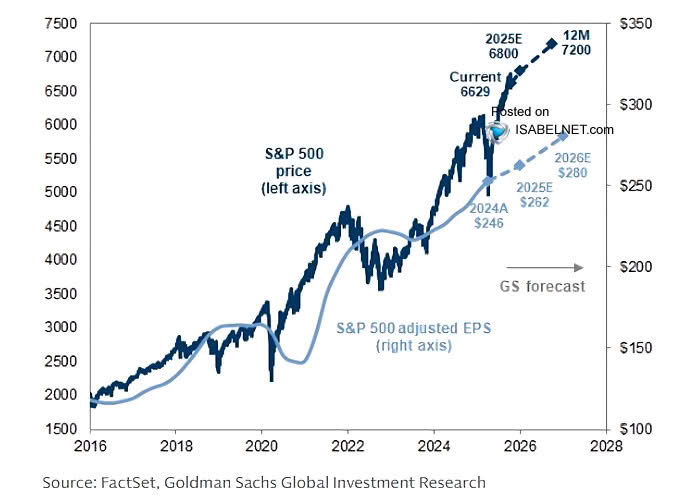

🇺🇸 S&P 500 With the Fed turning more accommodative and large caps holding their ground, Goldman Sachs still sees the S&P 500 finishing 2025 at 6,800 and pushing toward 7,200 by the end of 2026 👉 isabelnet.com/?s=S%26P+500 h/t @GoldmanSachs $spx #spx #equities #stocks

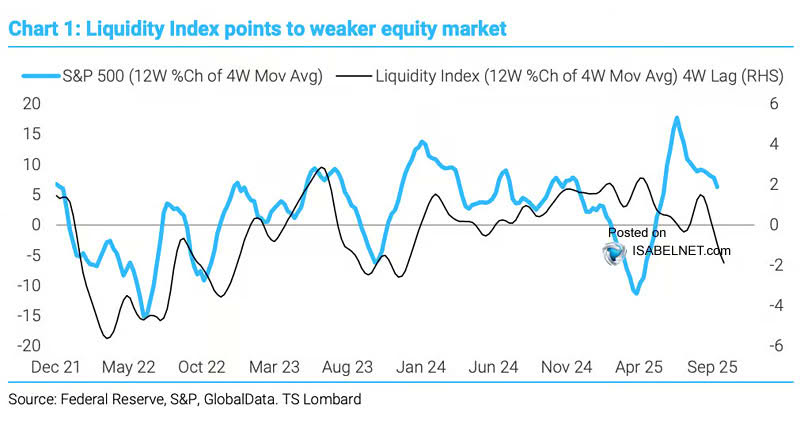

🇺🇸 S&P 500 Market liquidity has tightened in recent weeks, fueling bets that US equities could lose momentum as 2025 winds down 👉 isabelnet.com/?s=S%26P+500 h/t @dailychartbook @TS_Lombard $spx #spx

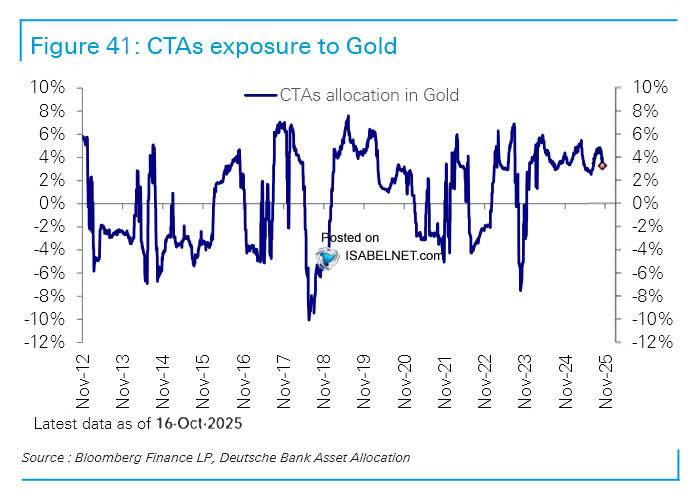

📌 Gold CTAs have slightly reduced their gold allocations but remain net long overall, which signals continued bullish sentiment for the metal 👉 isabelnet.com/?s=gold @DeutscheBank #markets $gld $gold #gold #gld $xau

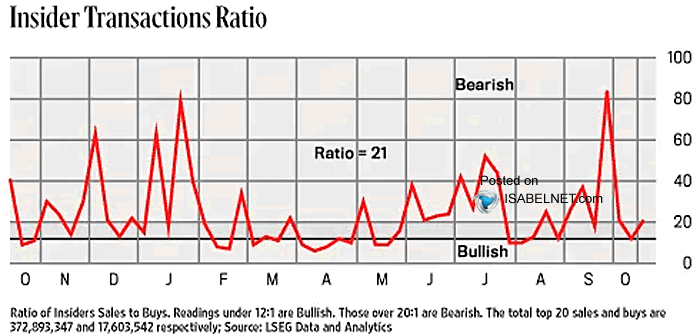

📌 Insiders Momentum among corporate insiders is waning, with the Insider Transactions Ratio leaning sligtly bearish 👉 isabelnet.com/blog/ #insider $ndx $spx #spx #stocks #stockmarket

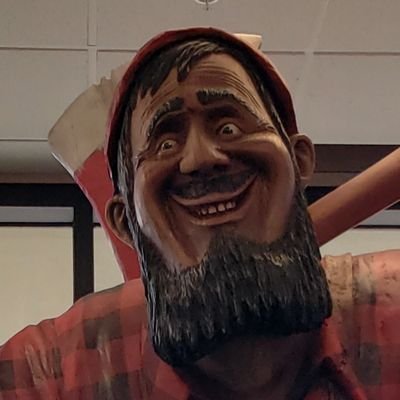

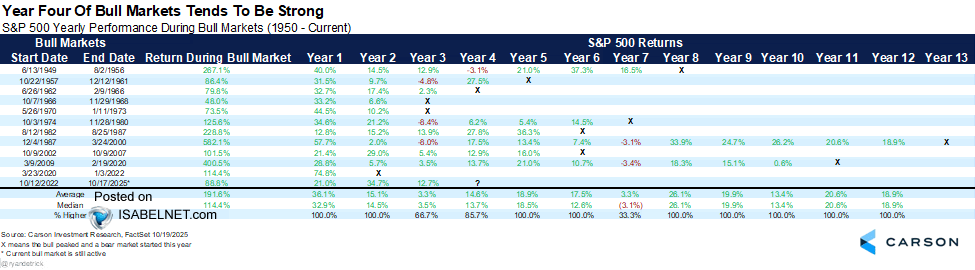

🇺🇸 S&P 500 History favors the bulls: since 1950, only once has an S&P 500 bull market ended in its fourth year—history therefore favors further upside over a transition to bear market 👉 isabelnet.com/?s=S%26P+500 h/t @RyanDetrick $spx #spx

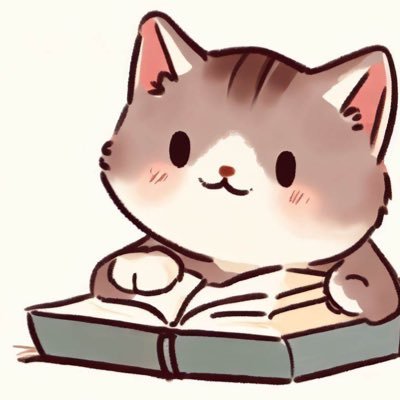

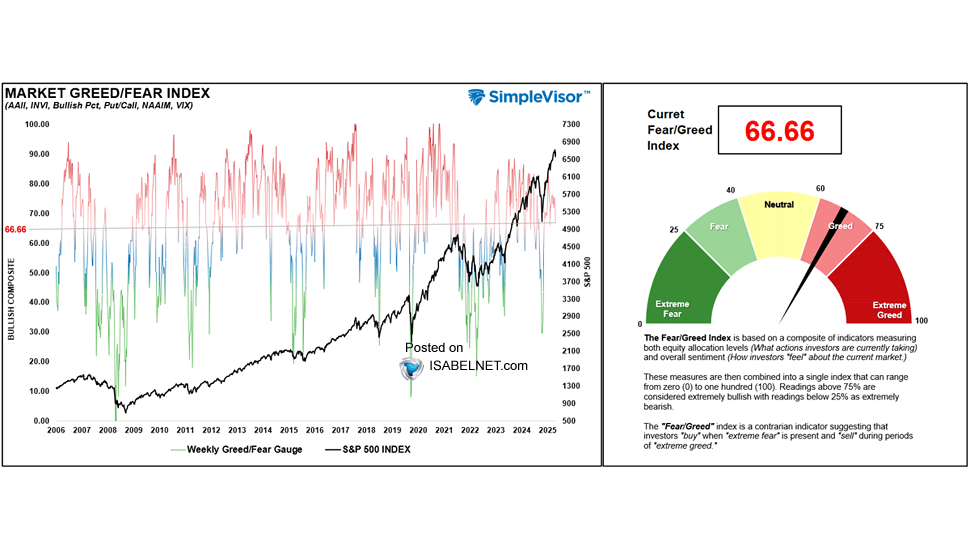

🇺🇸 Sentiment At 66.66, the Greed and Fear Index signals that investors are still positioned bullishly, with sentiment and allocations indicating that weakness will likely be seen as a buying opportunity 👉 isabelnet.com/?s=sentiment h/t @LanceRoberts $spx #spx #equities #stocks

最近数週間で市場の流動性が逼迫し、2025年が終わるにつれて米国株式市場が勢いを失う可能性があるとの見方が強まっています

🔍 El S&P 500 suele arrancar octubre con fuerza, pero su impulso se diluye en la segunda mitad del mes. Atentos a los giros de mercado. 📉📆🇺🇸 #Marketsbets #StockMarket

🇺🇸 S&P 500 The S&P 500 tends to shine in early October, but history shows its momentum often cools in the back half of the month 👉 isabelnet.com/?s=S%26P+500 h/t @GoldmanSachs $spx #spx #sp500 #stocks #equities

Since the Nixon shock, we’ve lived through the age of financialization—amplified by the Information Age. Fed-led central bank EZ money & globalization inflated capital markets, favoring the wealthy. Asset growth outpacing output signals overvaluation and systemic misallocation

📌 Valuations Global equities have tripled their weight since the 1990s, jumping from 75% to above 200% of world GDP—an expansion that screams just how far valuations have run. Honestly, what could go wrong? 👉 isabelnet.com/?s=valuation h/t @GoldmanSachs $spx #spx #stocks #bonds

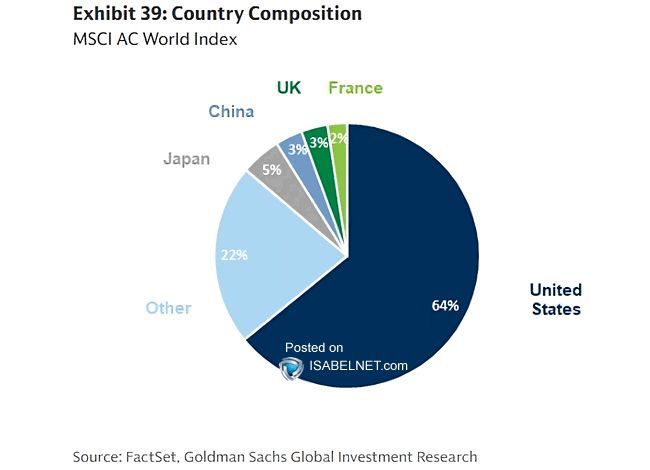

📊 The MSCI World Index is heavily weighted toward US stocks. So much for global diversification! 😅 #finance #stocks #globalmarkets Thanks @ISABELNET_SA!

In other words, $GS sees muted gains of 8% from current levels by year end 2026.

🇺🇸 S&P 500 With the Fed turning more accommodative and large caps holding their ground, Goldman Sachs still sees the S&P 500 finishing 2025 at 6,800 and pushing toward 7,200 by the end of 2026 👉 isabelnet.com/?s=S%26P+500 h/t @GoldmanSachs $spx #spx #equities #stocks

With global equities now valued at over 200% of world GDP, the scale of expansion is clear. This isn’t just elevated pricing it reflects deep reliance on liquidity, optimism, and momentum. In this environment, timing and disciplined risk management are more critical than ever.

📌 Valuations Global equities have tripled their weight since the 1990s, jumping from 75% to above 200% of world GDP—an expansion that screams just how far valuations have run. Honestly, what could go wrong? 👉 isabelnet.com/?s=valuation h/t @GoldmanSachs $spx #spx #stocks #bonds

#Equity #positioning in the #market remains elevated but reversed a bit last week. The back drop remains #bullish for equities as we start the two BIG weeks of #earnings reports. h/t @ISABELNET_SA

United States Trends

- 1. Texans 37.8K posts

- 2. World Series 112K posts

- 3. CJ Stroud 6,757 posts

- 4. Blue Jays 96.7K posts

- 5. Mariners 93.3K posts

- 6. Seahawks 36.7K posts

- 7. Springer 68K posts

- 8. Nick Caley 2,645 posts

- 9. White House 314K posts

- 10. Dan Wilson 4,332 posts

- 11. LA Knight 8,337 posts

- 12. Dodgers in 5 2,248 posts

- 13. Nico Collins 2,147 posts

- 14. Sam Darnold 4,335 posts

- 15. #WWERaw 61.6K posts

- 16. Kenneth Walker 2,584 posts

- 17. Bazardo 3,195 posts

- 18. Demeco 1,817 posts

- 19. Munoz 10.3K posts

- 20. Kendrick 17.1K posts

You might like

-

Yardeni Research

Yardeni Research

@yardeni -

Holger Zschaepitz

Holger Zschaepitz

@Schuldensuehner -

Macro Charts

Macro Charts

@MacroCharts -

CrossBorder Capital/ GLIndexes

CrossBorder Capital/ GLIndexes

@crossbordercap -

Lisa Abramowicz

Lisa Abramowicz

@lisaabramowicz1 -

Kevin C. Smith, CFA

Kevin C. Smith, CFA

@crescatkevin -

Liz Ann Sonders

Liz Ann Sonders

@LizAnnSonders -

Otavio (Tavi) Costa

Otavio (Tavi) Costa

@TaviCosta -

Topdown Charts

Topdown Charts

@topdowncharts -

Christophe Barraud🛢🐳

Christophe Barraud🛢🐳

@C_Barraud -

John P. Hussman, Ph.D.

John P. Hussman, Ph.D.

@hussmanjp -

Jim Bianco

Jim Bianco

@biancoresearch -

Tom McClellan

Tom McClellan

@McClellanOsc -

Ian Harnett

Ian Harnett

@IanRHarnett -

3Fourteen Research

3Fourteen Research

@3F_Research

Something went wrong.

Something went wrong.