Long Way

@LongWayCapital

Worked in SaaS for a decade, now investor. Nothing I say is advice. Do your own diligence.

You might like

Snack Bites #41: What's the Deal with Stock-Based Compensation - Why too much of a focus on SBC is suboptimal - How to evaluate the cost of SBC - Fallacy of point in time analysis Spurred by @LongWayCapital recent tweet from my pod with @BillBrewsterTBB shomik.substack.com/p/743dfcc4-d99…

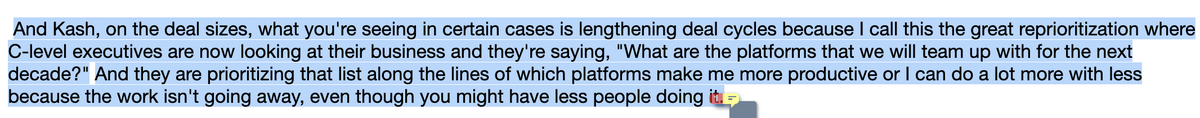

If what McDermott says here tracks + they have a view into the prioritization with their customers, wouldn't this be the ideal environment to make an acquisition at the right price? Getting acquired by $NOW would be a win for many co's right now IMO.

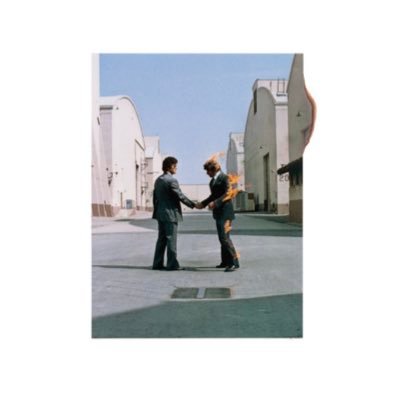

Coincidentally, @morganhousel just happened to write about the dude in my pfp and who inspired the name of my Twitter handle. Never talked about it b/c it's too personal, but this is worth reading and interesting on the off chance you're curious. collaborativefund.com/blog/lifestyle…

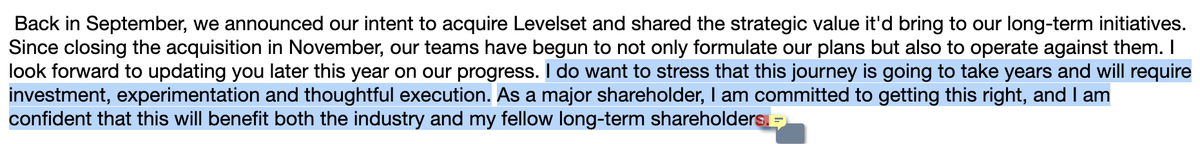

Taking a hard look at Procore and thought this bit from their Q4 call was interesting. It's rare a software company is this transparent about acquisitions. They're hard and success isn't assured even tho they might give an immediate bump to growth.

Any good write-ups or threads out there about Procore? Haven't come across any so far.

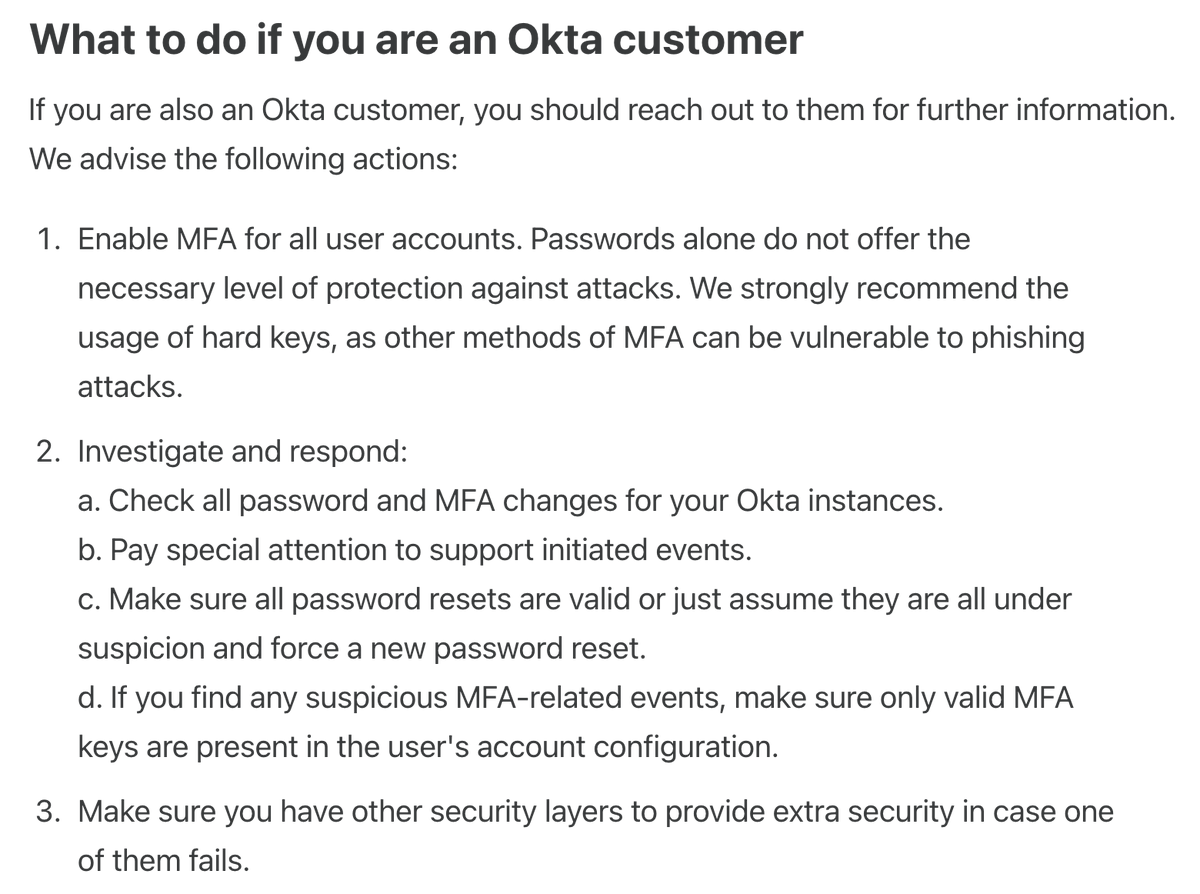

Cloudflare literally doing Okta's job in this blog post. blog.cloudflare.com/cloudflare-inv…

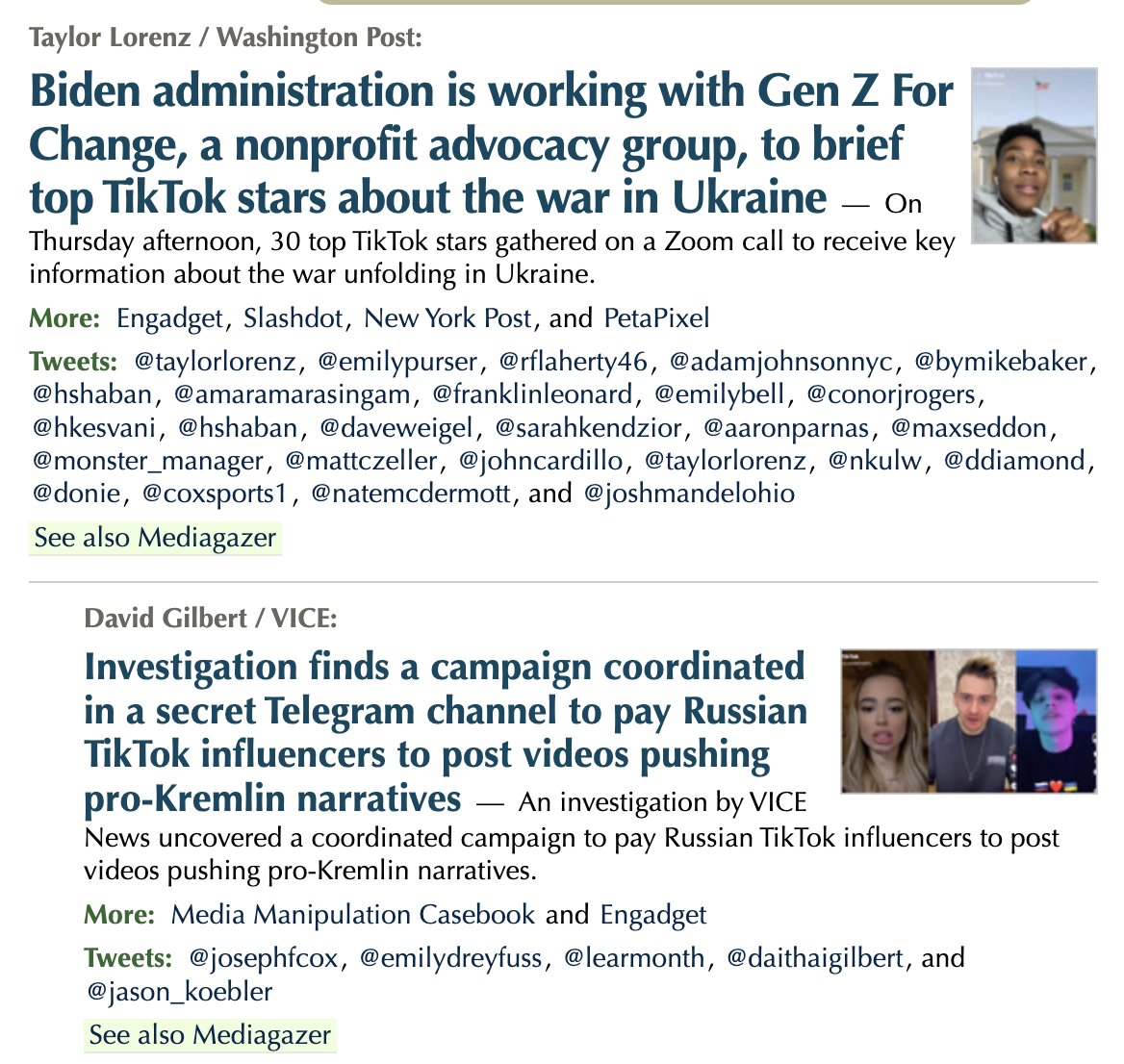

Can't believe this is where we're at, but here we are. "Amusing Ourselves To Death" gets more relevant every year and I wish Neal Postman was here to give us his perspective.

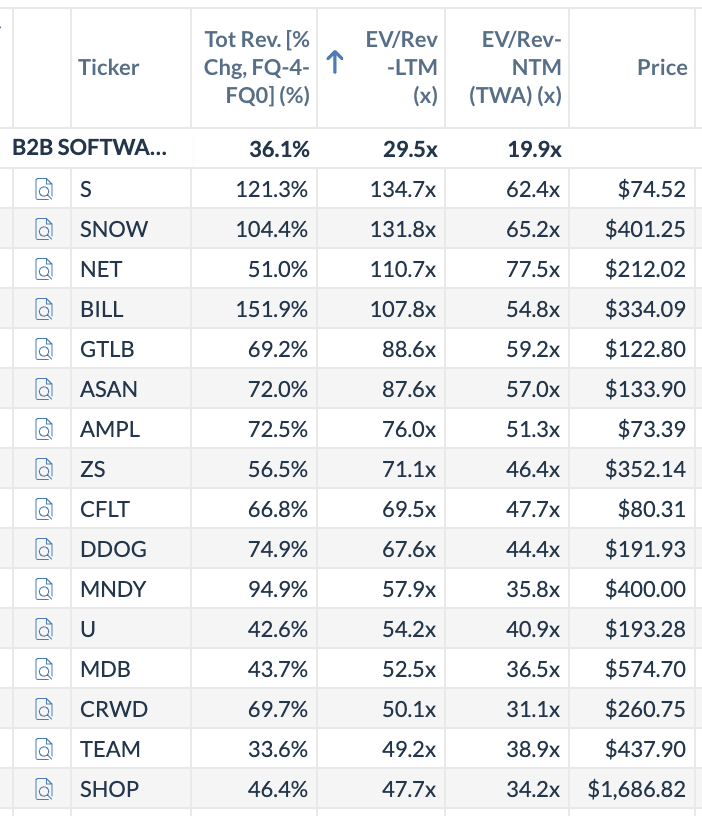

Everyday I wake up, look at this, and I still find it surreal. That there are this many B2B software companies trading >=50x trailing sales, and even more-so that Asana and Monday are among them. 2016 me's head would explode.

A third of Basecamp employees leaving shouldn’t be surprising. When you use mediocre project management and email software to export and sell your work culture, what kind of people wanna spend their time and energy working on that?

The consensus belief that SaaS companies will outperform is the primary driver of multiple expansion these past 4-5 years IMO.

I always enjoy reading Bessemer's annual State of the Cloud report. One of my favorite slides below. The takeaway? Leading cloud companies don't decelerate growth nearly as quickly as they're expected to. Why? Cloud markets are almost always much bigger than anticipated

Note the investors here. @Alex_Danco called this and it’s happening. Best in class software companies are shifting to debt to fuel growth. Possible solutions for mitigating dilution + stock based comp. Using this model of funding will be a sign of strength/quality.

United States Trends

- 1. Dabo N/A

- 2. #ZuffaBoxing01 N/A

- 3. Clemson N/A

- 4. Blades Brown N/A

- 5. Pete Golding N/A

- 6. Royce Keys N/A

- 7. #LightningStrikes N/A

- 8. Wendy N/A

- 9. Antarctica N/A

- 10. Notre Dame N/A

- 11. #sramhr N/A

- 12. Lobo N/A

- 13. Rivers N/A

- 14. John Brodie N/A

- 15. Ryan Wedding N/A

- 16. Jassi N/A

- 17. Southern Hemisphere N/A

- 18. #ICEOUT N/A

- 19. Deion N/A

- 20. Penguins N/A

You might like

-

Biggie Capital (fka Hem, fka LFG)

Biggie Capital (fka Hem, fka LFG)

@lfg_cap -

Jake Haberman

Jake Haberman

@VPCapital100 -

Joey Brookhart

Joey Brookhart

@SaasquatchC -

MrRatable

MrRatable

@MRatable -

Art Capital

Art Capital

@crazyjoedavola_ -

Buyside Bogey

Buyside Bogey

@buysidebogey -

TMT Jack

TMT Jack

@TMT_Jack_ -

SouthernValue

SouthernValue

@SouthernValue95 -

TBall Coach Black Sails

TBall Coach Black Sails

@BlackSailsRsch -

Andy 🍕🏔️

Andy 🍕🏔️

@bizalmanac -

Value Trap Capital™

Value Trap Capital™

@ValueTrapCapLP -

Southpaw Cap

Southpaw Cap

@SouthpawCapital -

FLinvestor

FLinvestor

@FLinvestor_ -

Analysis Paralysis

Analysis Paralysis

@MDD_IRR -

dalibali

dalibali

@dalibali2

Something went wrong.

Something went wrong.