Douglas

@MMTmacrotrader

Macro Trading, Flow Following, Deep Learning Model Building. CEO Modern Macro Technologies http://youtube.com/@mmtmacrotrader

You might like

The MMT Macro Trader Starter Pack - Data Driven Applied MMT Analysis Videos: Trading youtu.be/WTK1liv6Og4 Employment youtu.be/RlXhr8QOYcU Inflation youtu.be/lzpDXNE1CZ8 Rates youtu.be/75d6-zoDLE4 Tweets/🧵 Unemployment Inflation…

The Goal: Build a deep learning neural network using only sectoral balances to predict the unemployment rate. Why? To see if core MMT data can explain unemployment and validate a deep learning architecture for further macro & market analysis. An MMT Research 🧵 1/11

Few might remember this but we had a president once shut down the global economy, crash markets, and then hand out thousand dollar stimmys to everyone.

TRUMP SAYS HE IS CONSIDERING TAXPAYER REBATES OF $1,000 TO $2,000 USING TARIFF MONEY

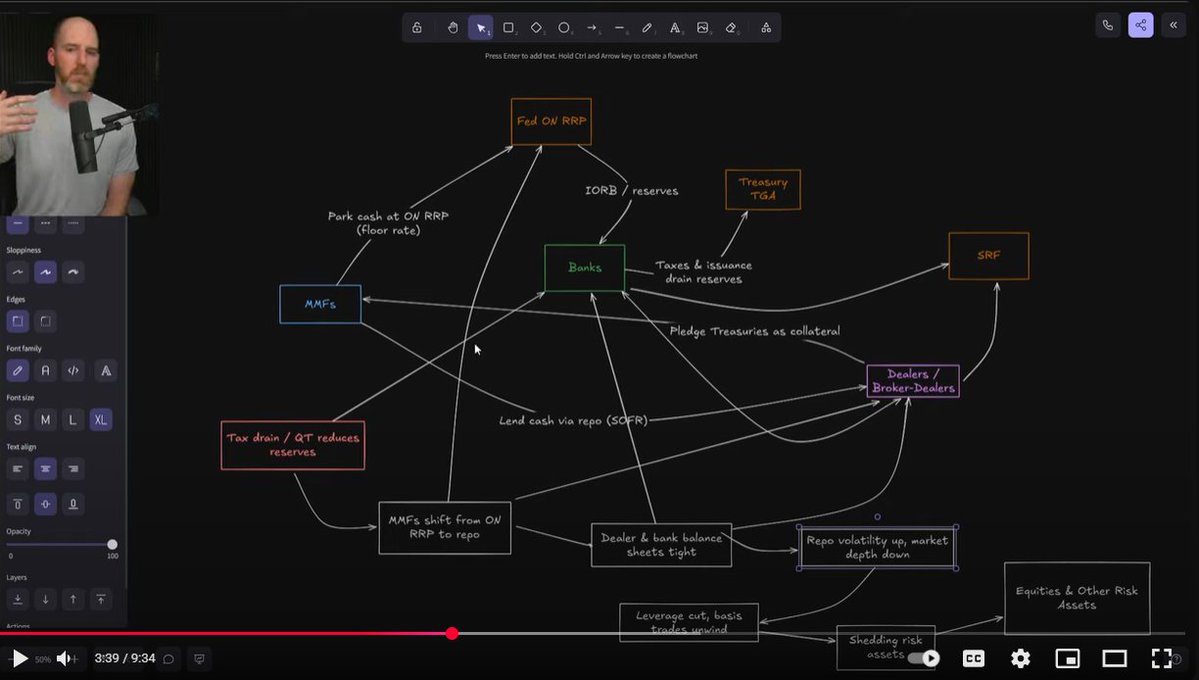

Very few guys on here have an actual understanding of the plumbing. @MMTmacrotrader is one of them. Watch: youtube.com/watch?v=3ynl-g…

The 18 month divergence between Tax Receipt Acceleration and Bank Credit is starting to get concerning. The implication here is that little of the credit expansion were seeing is going to productive growth. Means we're probably quite a ways up the Minsky curve at this point.

Throughout the worst of the selling DeepMMT remained bullish, seeing the selloff as a massive dislocation of price relative to flows. According to the model, the current rally has a ways to go until it gets back to where price is properly reflecting flows.

~$120B tax drain over 2 weeks, RRP empty, liquidity signaling tight and a possible govt shutdown. October shaping up to be a very volatile month. Keep an eye on the flows!

Going Live 🔴 at 5:00 pm et Discussing the impact of todays rate cuts and the implication on markets heading into next year. tldr: its not inflation risk, its a market crash risk. 🔗👇

If today does not mark a major reversal in the dollar then we are cooked. The dollar should rally here, under "normal" circumstances. A failure to rally means the rest of the world no longer cares to export to the U.S. In real terms, this is devastating for the America. To be…

Rate cuts, at this point in the cycle, just pull forward so many of the systemic risks that have been brewing underneath the surface for the past 5 years or so. The impact of higher interest income on both the macro economy and portfolios can not be understated.

📌 Bitcoin's price isn't driven by "Fed liquidity." It's fiscal flows. A thread, based on @MMTmacrotrader's work. 🧵1/14

Using MMT to Forecast Bitcoin [with data science] youtu.be/CPikXZPBLdw?si… via @YouTube

![ProfSteveKeen's tweet card. Using MMT to Forecast Bitcoin [with data science]](https://pbs.twimg.com/card_img/1975972820904525824/3GLJOTAW?format=jpg&name=orig)

youtube.com

YouTube

Using MMT to Forecast Bitcoin [with data science]

Retail sales booming and being carried by the top 10% of income earners. Keep telling yourself higher rates & the accompanying interest income don't impact growth because of MPC and the data will continue to prove your wrong.

United States Trends

- 1. Chiefs 108K posts

- 2. Branch 33.6K posts

- 3. Mahomes 33.2K posts

- 4. Red Cross 38.8K posts

- 5. #TNABoundForGlory 55.3K posts

- 6. Binance DEX 5,166 posts

- 7. #LaGranjaVIP 70.7K posts

- 8. #LoveCabin 1,194 posts

- 9. Rod Wave 1,314 posts

- 10. Bryce Miller 4,462 posts

- 11. Dan Campbell 3,870 posts

- 12. Goff 13.7K posts

- 13. LaPorta 10.8K posts

- 14. Kelce 16.7K posts

- 15. #OnePride 6,392 posts

- 16. Mariners 49.9K posts

- 17. #DETvsKC 4,984 posts

- 18. Butker 8,504 posts

- 19. Eitan Mor 8,001 posts

- 20. Omri Miran 8,326 posts

You might like

-

Warren B. Mosler

Warren B. Mosler

@wbmosler -

Thomas des Garets Geddes

Thomas des Garets Geddes

@thomasdggeddes -

Levy Institute

Levy Institute

@LevyEcon -

BizToc

BizToc

@biztoc -

John Harvey

John Harvey

@John_T_Harvey -

Options Johnny

Options Johnny

@OptionsJohnny -

Free Speech Ireland

Free Speech Ireland

@FreeSpeechIre -

Lumumba Amin 🇺🇬

Lumumba Amin 🇺🇬

@LumumbaAmin -

Modern Money Lab

Modern Money Lab

@modernmoneylab -

ANGTraders

ANGTraders

@ANGTraders -

OpenBB

OpenBB

@openbb_finance -

Relearning Economics

Relearning Economics

@RelearningEcon -

Fadhel Kaboub فاضل قابوب

Fadhel Kaboub فاضل قابوب

@FadhelKaboub -

Eric Tymoigne

Eric Tymoigne

@tymoignee -

Mike Bostic

Mike Bostic

@mbostic0

Something went wrong.

Something went wrong.