Alex Barrow

@MacroOps

Triangulating markets through technicals, sentiment, & macro Founder of MO: Research & Community for traders seeking an uncommon edge https://macro-ops.com/

You might like

1/ Druckenmiller's first mentor, Speros Drelles, would often tell him that "60 million Frenchman can't be wrong." Here's a thread on what that means and how to know when you should listen to or ignore the "Frenchman" (market)...

Here is a full clip of my 45 min interview with NEC Director Kevin Hassett, current leading candidate for Fed chair. youtube.com/watch?v=HzyyOm…

youtube.com

YouTube

NEC Director Kevin Hassett Talks the Economy | Bloomberg Talks

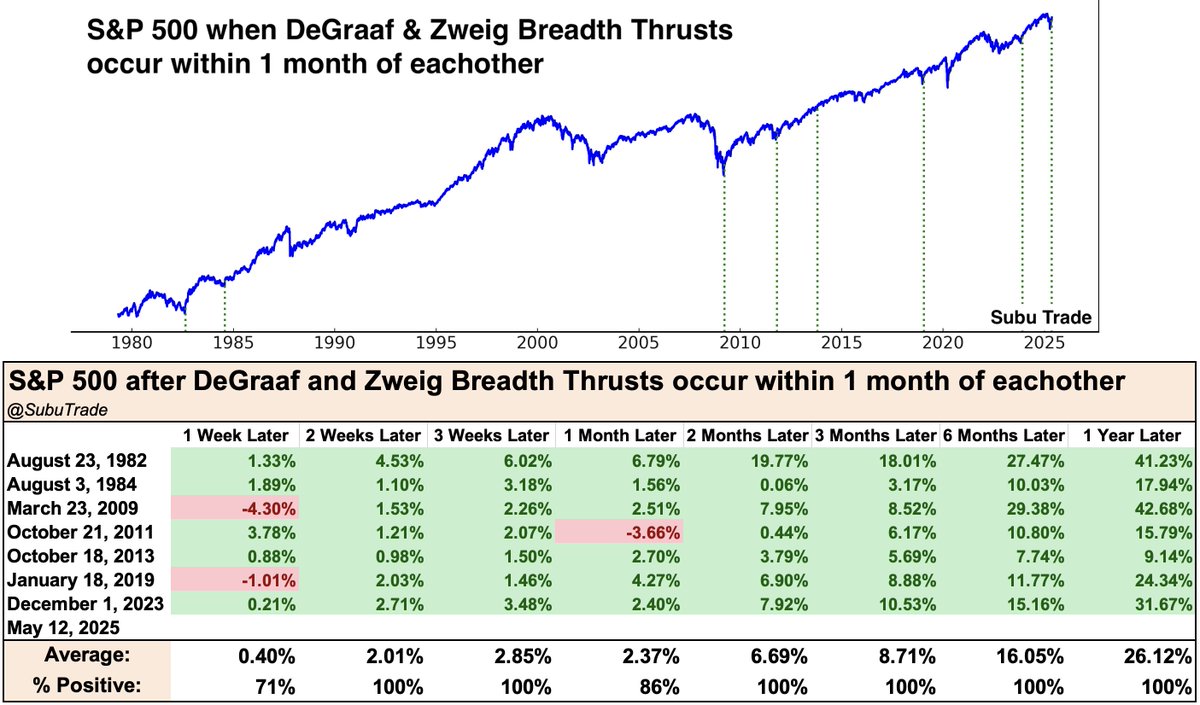

Yesterday saw a DeGraaf Breadth Thrust (55%+ of S&P 500 stocks hit a 20 day high). 3 weeks ago we got a Zweig Breadth Thrust. Here's what happens when we get both Thrusts within a month of each other:

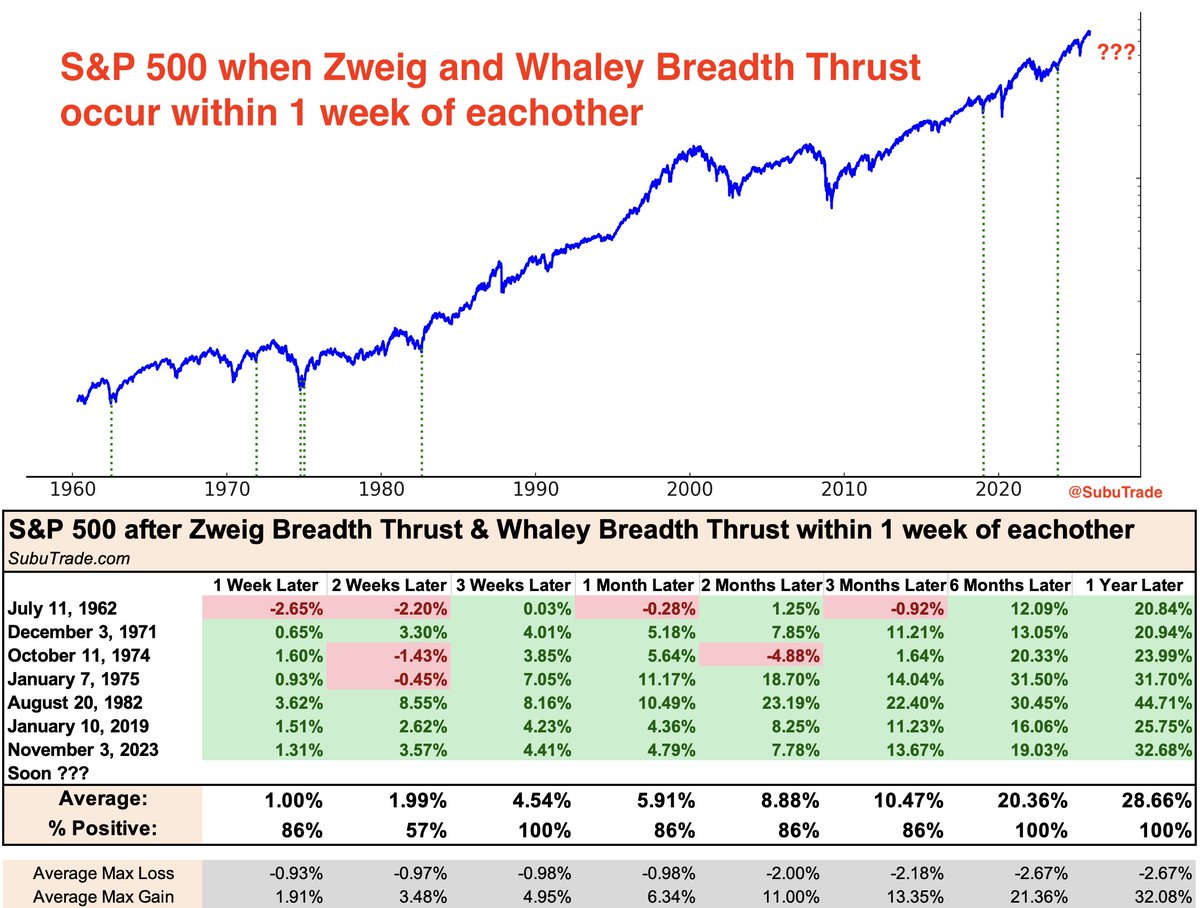

Just imagine..... If we got a Zweig Breadth Thrust & Whaley Breadth Thrust within 1 week of eachother. Could happen soon. Happy Thanksgiving!

Yes. You know. The posts are 347% bullish. +8% in 3 days and, well, you know. $IWM

Please tell me he’s not doing Xi’s dirty work now. This does not look good.

Japan’s Prime Minister Sanae Takaichi says she spoke with US President Donald Trump on a call at his request, and that he updated her on the latest situation between the US and China bloomberg.com/news/articles/…

Bad regime dynamics... deteriorating breadth, weakening liquidity, poor internals, & stubbornly bullish sentiment = continued chop & vol w/ increasing downside risk macro-ops.com/bad-regime-dyn…

Looks like a power play by Xi to use his leverage to prod Trump into pulling support for Japan in the current Beijing-Tokyo row. That would kill "strategic decoupling" in its tracks - the TACO to end all TACOs...

Breaking! During the phone call with President Trump tonight, President Xi said that the return of Taiwan to China is an important part of the post-war international order. China and America have been fighting militarism and fascism side by side. At present, it is even more…

Grateful to share my new piece in @nytimes. I write that there are moments in great-power politics when the tectonic plates seem to shift beneath us. The Busan Summit that froze the U.S.-China trade war was one of them. And if historians try to identify exactly when China…

Worth reading this again

1/ Druckenmiller's first mentor, Speros Drelles, would often tell him that "60 million Frenchman can't be wrong." Here's a thread on what that means and how to know when you should listen to or ignore the "Frenchman" (market)...

Equities are really pressing their luck here, dipping below their lows from two Fridays ago and relying on $RUT/ $IWM small caps, $BKX banks, and $NFLX to try to hold things together. That's a heavy lift when $SOX/ $SMH semis and all the other mega caps are red. VOLs are wide…

Lackluster liquidity, weak short-term breadth, internals, and elevated sentiment point to continued chop & vol in markets, while strong buybacks, seasonality, and longer-term momentum suggest downside is capped... macro-ops.com/lackluster-liq…

BIG OIL STRATEGY: Chevron updates and extends its business plan to 2030, expecting to buyback $10-$20 billion per year over the next five years. The company is tightening its belt, reducing capex guidance by $1 billion a year to prioritise returns over growth. $CVX #OOTT

The S&P 500 was recently extended 13% above its 200-day moving average. The median maximum annual drawdown was a muted -2.32%. The average one-year gain was +13.60%. Both figures are indicative of a strong uptrend. Click image to enlarge. $SPX $SPY $QQQ

When 52-week highs/lows are roughly equal near all-time $SPX highs - It's rare. We dug into the data to see what's happened historically when breadth looked like this. - Times it has occurred are marked below - interesting Full discussion on this week's pod (drops in 2hrs)

My former pinned tweet hard at work.

UMich Corrent Economic Conditions Index just fell to its lowest reading on record.

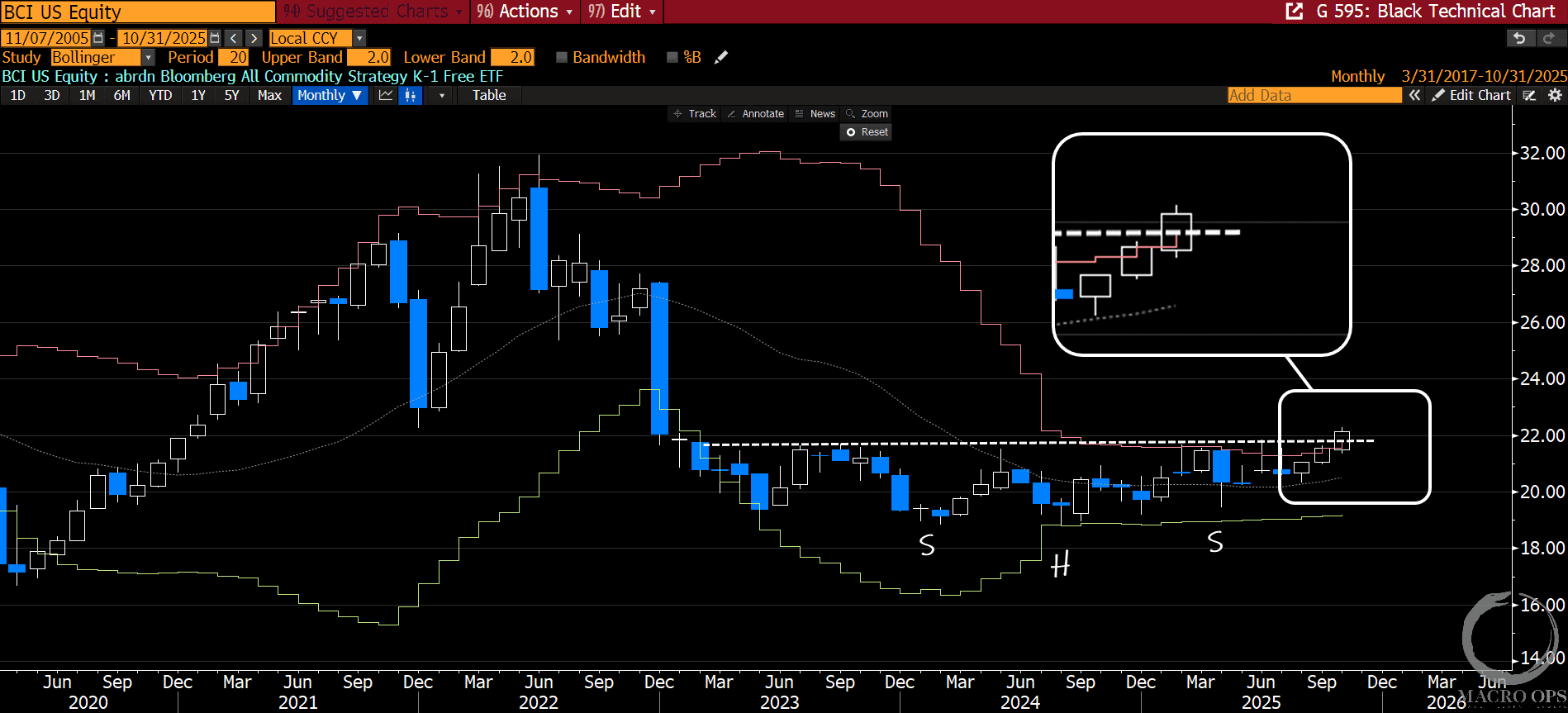

H/t to @MacroOps for his great weekly piece highlighting the opportunity. Not sure what you're doing if you're not subscribed and reading Alex's Monday Dozen each week. Best way to start the trading week. Read here: macro-ops.com/the-commodity-…

My body is ready for the rotation into agriculture. 🫛 Soybeans broke out last week (thank u Farmer, Bessent). 🥐 Wheat breaking out. But the most actionable setup today? Good ol' CORN 🌽 Textbook inverse H&S.

Goldman Sachs and Cboe are flagging a couple things that look like peak or near-peak optimism in options markets: -Mag 7 put/call skew inverted -share of S&P 100 stocks with inverted call skew sherwood.news/markets/option…

Companies have good reasons to blame AI for layoffs regardless of whether their layoffs have anything to do with AI.

As military action against Venezuela looms, the US just closed a swath of airspace off the coast of Puerto Rico, designating it "National Defense Airspace." The closure is adjacent to José Aponte de la Torre Airport, home to a significant deployment of forces.

United States Trends

- 1. Mariota 3,037 posts

- 2. Tomlin 21.5K posts

- 3. #RHOP 6,829 posts

- 4. Steelers 58.1K posts

- 5. #Married2Med 1,168 posts

- 6. Maxey 3,278 posts

- 7. Vikings 34.5K posts

- 8. #RaiseHail 2,164 posts

- 9. Jalen Johnson 2,447 posts

- 10. Bills 88.1K posts

- 11. Bo Nix 2,581 posts

- 12. Josh Allen 14.2K posts

- 13. #BroncosCountry 2,217 posts

- 14. Rodgers 14.7K posts

- 15. Ole Miss 114K posts

- 16. Bonitto N/A

- 17. Cavs 5,038 posts

- 18. Justin Jefferson 5,443 posts

- 19. #90DayFiance N/A

- 20. Chrisean 4,007 posts

You might like

-

Macro Charts

Macro Charts

@MacroCharts -

SentimenTrader

SentimenTrader

@sentimentrader -

Tom McClellan

Tom McClellan

@McClellanOsc -

MuddyWatersResearch

MuddyWatersResearch

@muddywatersre -

Jesse Felder

Jesse Felder

@jessefelder -

Hugh Hendry Acid Capitalist TV

Hugh Hendry Acid Capitalist TV

@hendry_hugh -

Julien Bittel, CFA

Julien Bittel, CFA

@BittelJulien -

Topdown Charts

Topdown Charts

@topdowncharts -

Jawad Mian

Jawad Mian

@jsmian -

Variant Perception

Variant Perception

@VrntPerception -

hedgopia

hedgopia

@hedgopia -

Nautilus Research

Nautilus Research

@NautilusCap -

Callum Thomas

Callum Thomas

@Callum_Thomas -

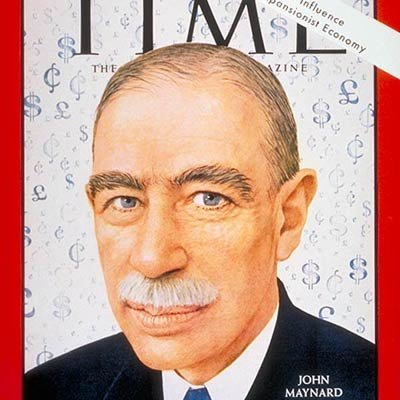

The Long View

The Long View

@HayekAndKeynes -

CrossBorder Capital/ GLIndexes

CrossBorder Capital/ GLIndexes

@crossbordercap

Something went wrong.

Something went wrong.