This is a major push towards utility and mass adoption. Important pillars for becoming a true independent macro asset

1/ Three major narratives are quietly converging in crypto right now. * Privacy * Quantum resistance * The failure of airdrops & token games And there’s one opportunity that sits right at the intersection of all three: @NeptuneCash Let’s break it down

1/ Three major narratives are quietly converging in crypto right now. * Privacy * Quantum resistance * The failure of airdrops & token games And there’s one opportunity that sits right at the intersection of all three: @NeptuneCash Let’s break it down

$SUI is still in early-stage compression, liquidity coiling under $4.

For those of you looking for well balance macro context, to understand what is going on: a must watch 👇👇

🚨 Replay is live! Bull Market in Risk Assets… for now! 🚨 @HenrikZeberg breaks down: 🔹Titanic analogy: damage is done, but ship not under yet 🔹Why this isn’t 1998 — it’s 2007 🔹Dollar squeeze ahead 🔹Altseason already unfolding (BTC → ETH → SOL → alts) 👉 Watch here:…

Bitcoin isa macro asset, watch and see it catch up to gold asap

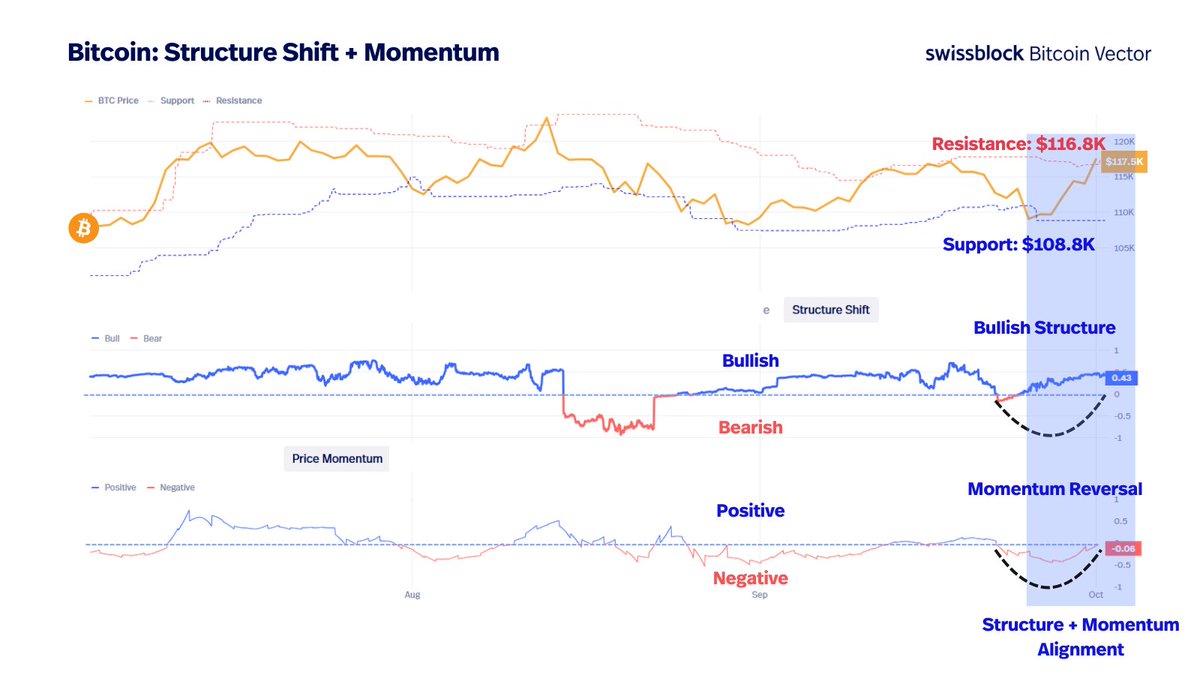

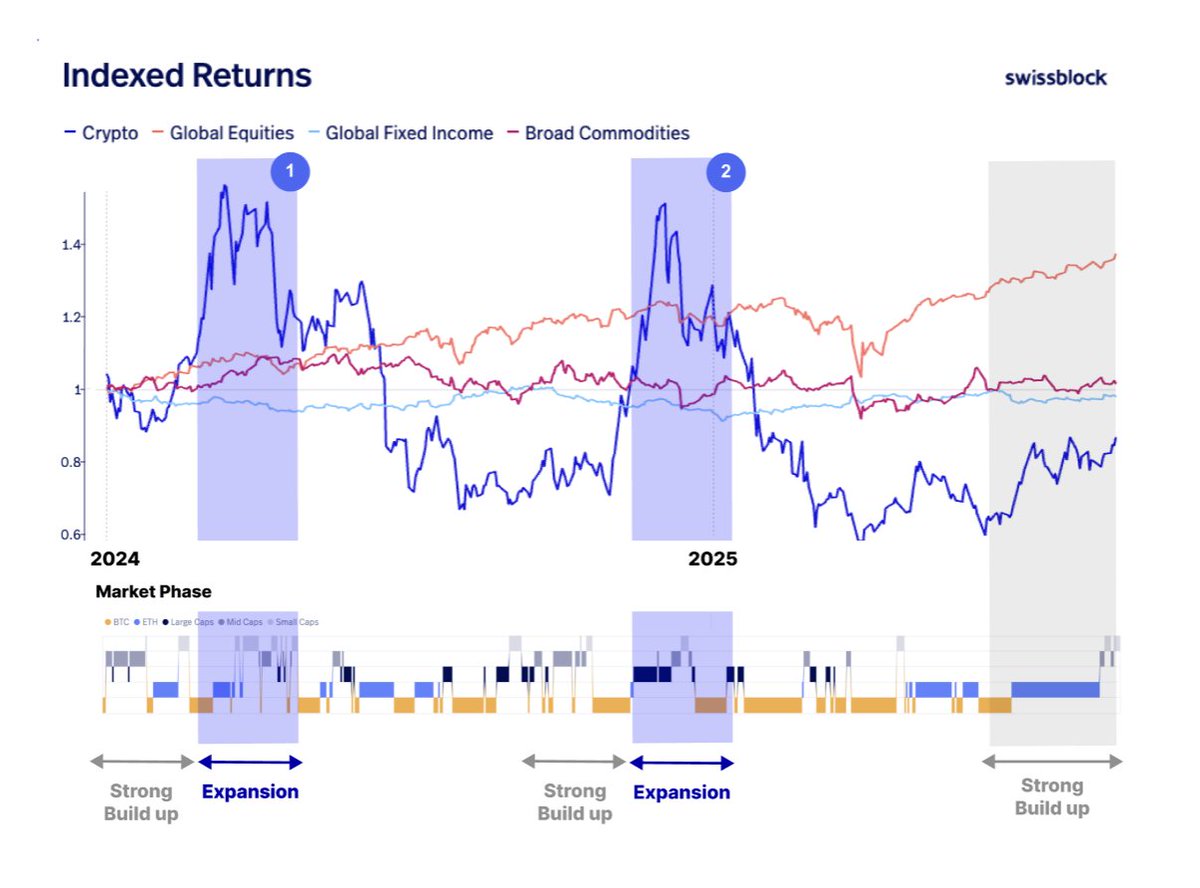

Our favorite setup for Bitcoin breakouts is when Structure Shift + Price Momentum align. In bull markets, this alignment drives price to rip through resistance, step by step.

There’s been a lot of FUD around insider equity selling. Let’s set the record straight: September spikes are normal. Execs sell after Q3 earnings and ahead of Q4 blackout periods, plus tax deadlines and year-end rebalancing. Seasonal. Mechanical. Recurring.

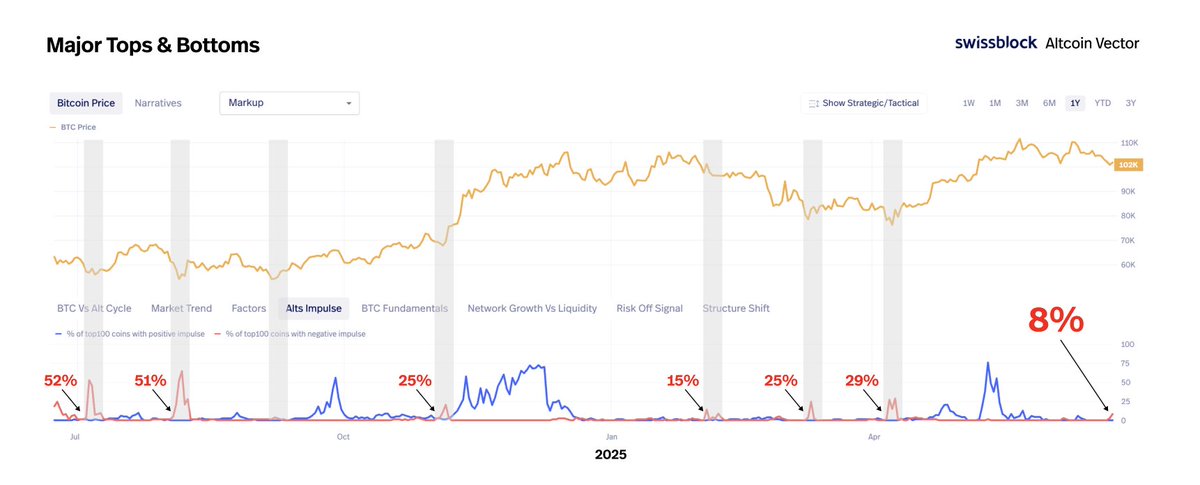

We’re in the reset phase. The last 7 times this signal triggered since 2024, it marked a major bottom. What happened next? 🔵 BTC rallied +20–30% 🔵 Altcoins surged +50–150% We track this with the most accurate tops & bottoms signal in the market: Aggregated Impulse, by…

We’re in the bottoming phase. The last time this signal triggered was April 7. It took 3 days to play out. - What happened next? 🔹 BTC rallied +30% over 3 weeks 🔹 Major altcoins surged +50–120% We track this using the most accurate tops & bottoms signal in the market:…

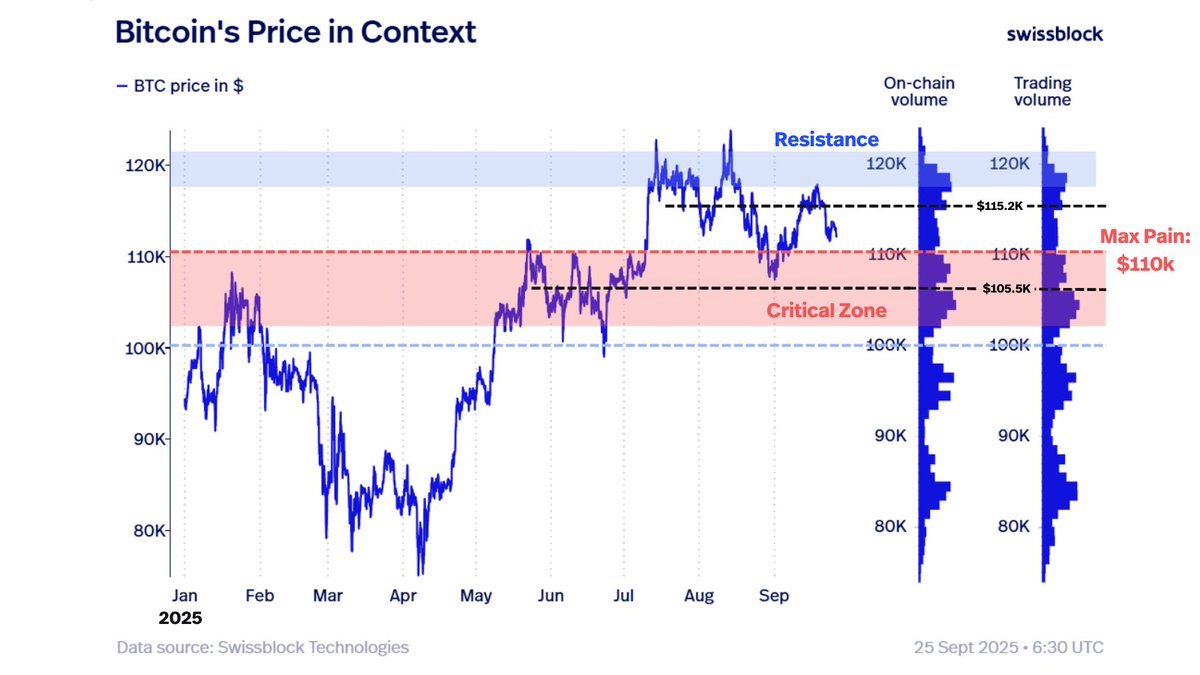

No bear market with strong fundamentals. $BTC can’t turn bearish mid-term if on-chain stays strong. The warning comes when price rips higher while fundamentals degrade, signaling weakness. BTC on-chain is still strong.

Bitcoin lost $113K and hovers under $112K: a retest of $110K looks imminent. $BTC sits in a delicate balance: Above $115.2K → opens $120K. Below $110K → exposes $105.5K–$100K. $110K = max pain. Likely to be touched, leaving Friday’s options worthless.

Strong Macro data release today. All eye in PCE tomorrow. If number comes in at or below expectations it will signal a strong economic recovery.

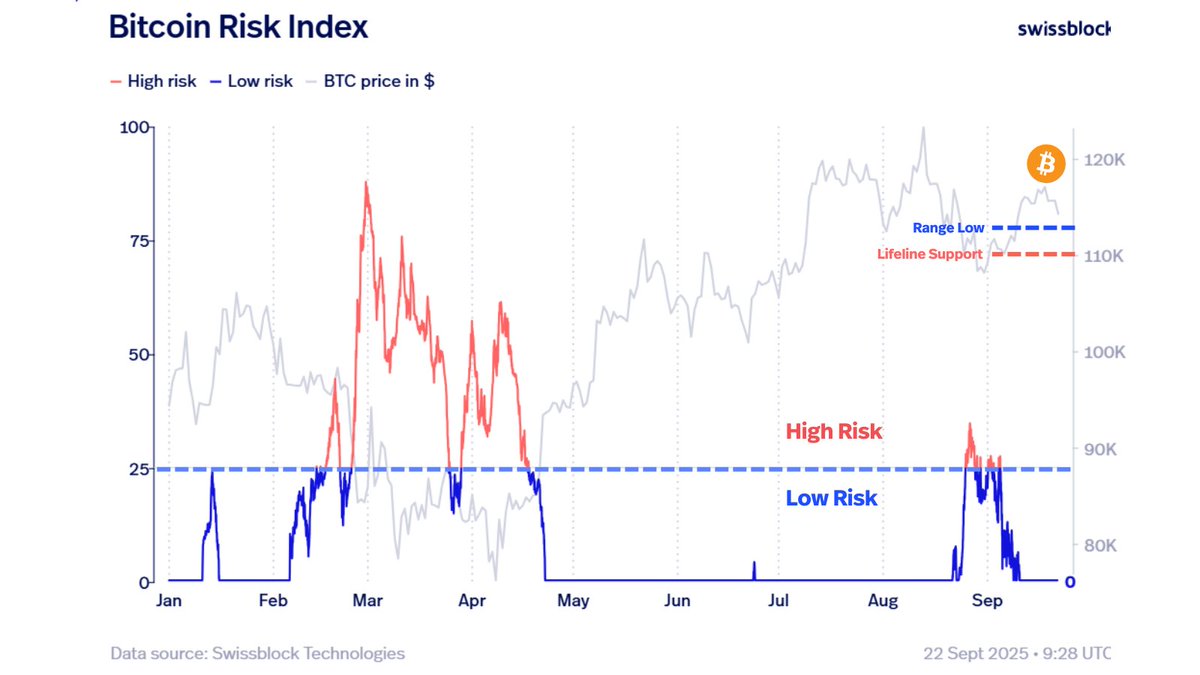

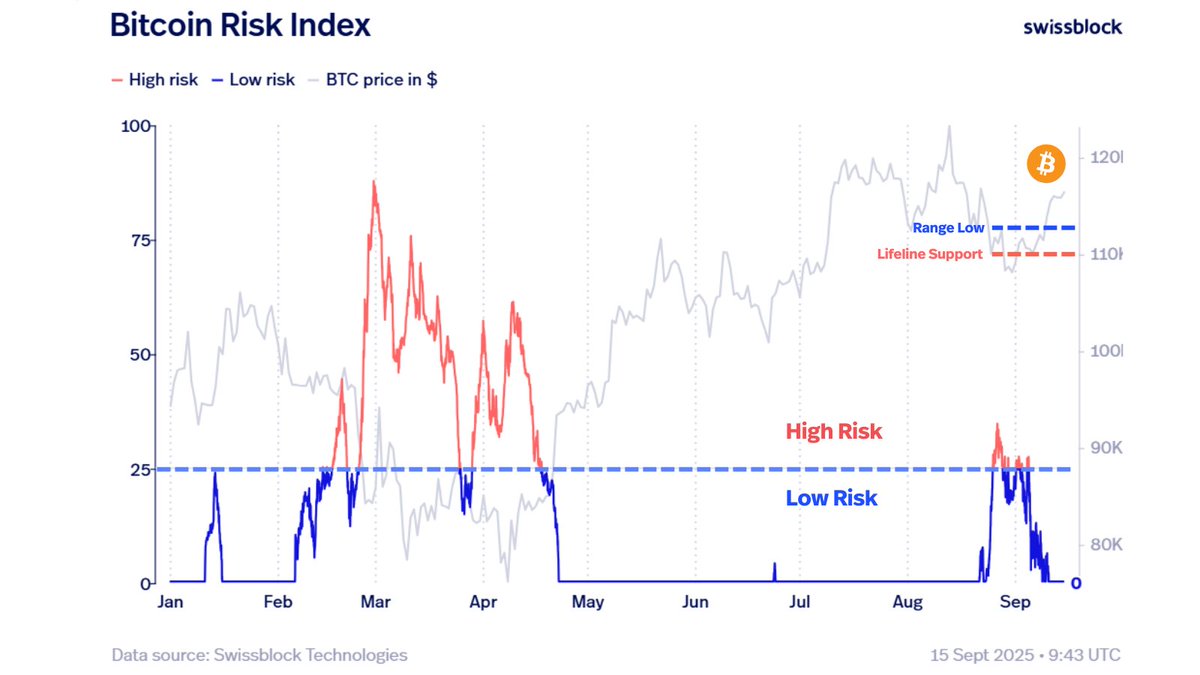

Bitcoin, what is the Plan? $BTC is in correction while alts lose supports. As long as $112K holds and the Risk stays stable, BTC can rebuild strength — $110K remains lifeline support.

Short-term volatility = repricing risk, not breakdown. Testing the bottom end of the price range is within volatility expectations. We’re in the final downside move before the next leg higher. 📊 Liquidity rising + strong Network Growth = classic BTC advance setup. Looking at…

Its all about liquidity, $btc is the canary in the coal-mine, as a macro asset, its key to understand what its telling us about global liquidity, and as a consequence risk on assets.

Keep your eyes on the fundamentals. Short-term volatility can obfuscate what’s really happening. 🔵 Liquidity turns up first → BTC price follows 1–3 weeks later 🔴 Network Growth confirms → the move sustains Last times this aligned: 1️⃣ Feb ’24 → BTC +35% in 2w 2️⃣ Nov ’24…

Keep your eyes on the fundamentals. Short-term volatility can obfuscate what’s really happening. 🔵 Liquidity turns up first → BTC price follows 1–3 weeks later 🔴 Network Growth confirms → the move sustains Last times this aligned: 1️⃣ Feb ’24 → BTC +35% in 2w 2️⃣ Nov ’24…

BITCOIN IS FOLLOWING THE ACCUMULATION BLUEPRINT. Market Trend Indicator by @bitcoinvector is flashing the same noisy “bottom formation” signals we saw in March–April. Noise isn’t weakness. It’s the shakeout before the move. Bottoms are built in chaos, not calm. This is where…

Bitcoin, what is the plan? Markets are locked on the FOMC Wednesday, with a 25 bps cut priced in and Powell’s stance under the spotlight for hints. Volatility is guaranteed: the Risk will guide whether BTC’s bullish structure holds or if a sell-off looms on the horizon.

Too many skewed bullish takes into tomorrow’s FOMC. Likely path is higher mid-term, but with more volatility as expectations get repriced for a more neutral Fed. Base case: 25bp cut, but neutral guidance vs. the very dovish tone most expect.

The 2025 Fed dots don’t need to move much. 🔹 Markets split between 50bp vs 75bp cuts 🔹 BofA expects median to stick at 50bp (close call) 🔹 2026: another 50bp cut vs 25bp in June 🔹 Longer-run neutral ~3.0% Dots drift lower, but the story stays the same.

The 2025 Fed dots don’t need to move much. 🔹 Markets split between 50bp vs 75bp cuts 🔹 BofA expects median to stick at 50bp (close call) 🔹 2026: another 50bp cut vs 25bp in June 🔹 Longer-run neutral ~3.0% Dots drift lower, but the story stays the same.

Short an important Macro week ahead, stay tuned as we give you relevant color.

United States トレンド

- 1. Columbus 80.4K posts

- 2. #WWERaw 34.7K posts

- 3. #SwiftDay 9,008 posts

- 4. #IDontWantToOverreactBUT N/A

- 5. #IndigenousPeoplesDay 3,757 posts

- 6. Middle East 174K posts

- 7. Seth 30.6K posts

- 8. Marc 38.7K posts

- 9. Knesset 133K posts

- 10. Thanksgiving 45.9K posts

- 11. #MondayMotivation 13.5K posts

- 12. The Vision 87.2K posts

- 13. Victory Monday 2,111 posts

- 14. Flip 50.5K posts

- 15. Good Monday 42.8K posts

- 16. Bron Breakker 4,033 posts

- 17. Bronson 5,885 posts

- 18. Heyman 4,131 posts

- 19. Branch 50.3K posts

- 20. Egypt 168K posts

Something went wrong.

Something went wrong.