The strength in Alts during this last week has been unusual. $BTC even developed negative impulse on its decline from $105K to $90K… yet alts? $WIF is the clearest example of relative strength, refusing to drop more than BTC and essentially holding its ground.

We are getting close to an over extended Risk Off environment. Key here is to track DXY and Bonds which have not move in a way consistent with flight to safety. What we are seeing is more consistent with repositioning and rebalancing

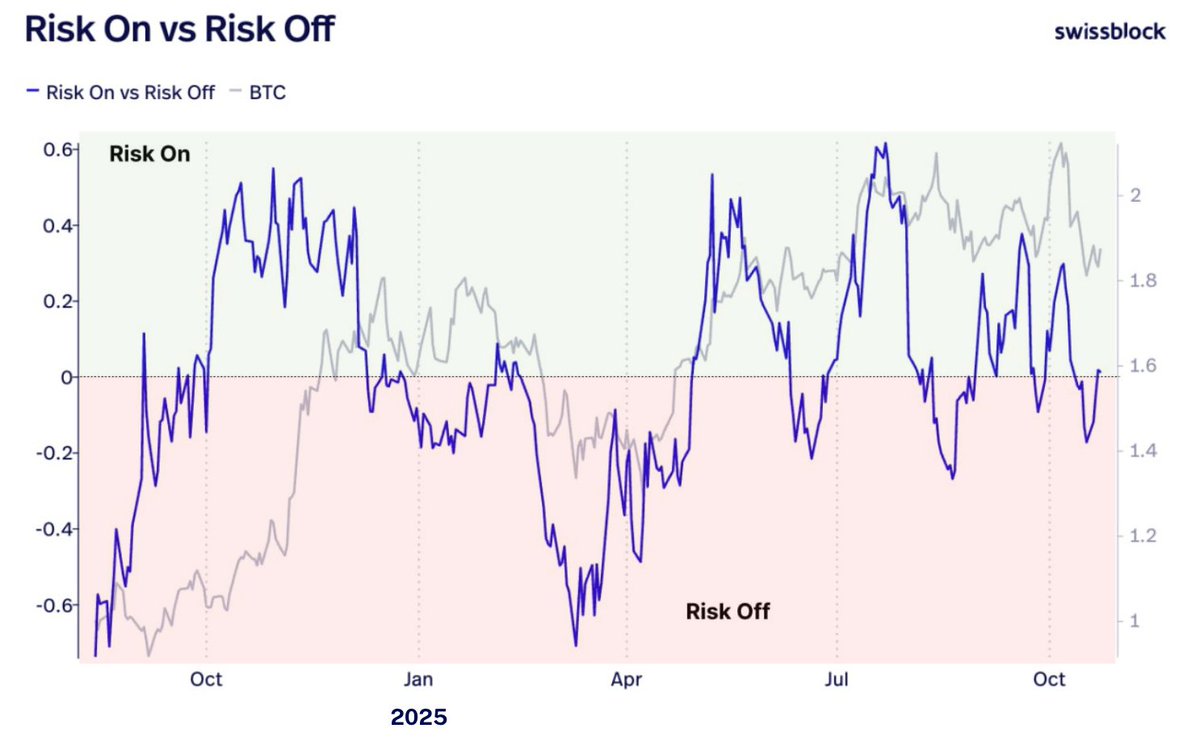

With the current level of pessimism and uncertainty in the market, it’s important to zoom out. When you step back, a clear pattern emerges: Bitcoin has been trading inside a dominant macro-sensitive regime, rotating between 🟢Risk On and 🔴Risk Off . This isn’t noise: it’s…

Bear Trap, Bull Run, or Blow Off Top? Where Is The Market Going Next w/ @Negentropic_ The Fed just ended QT and injected $50B into the repo market. Markets are melting up. But under the hood, the economy is cracking. Yann explains the signals in liquidity, credit cycles, and…

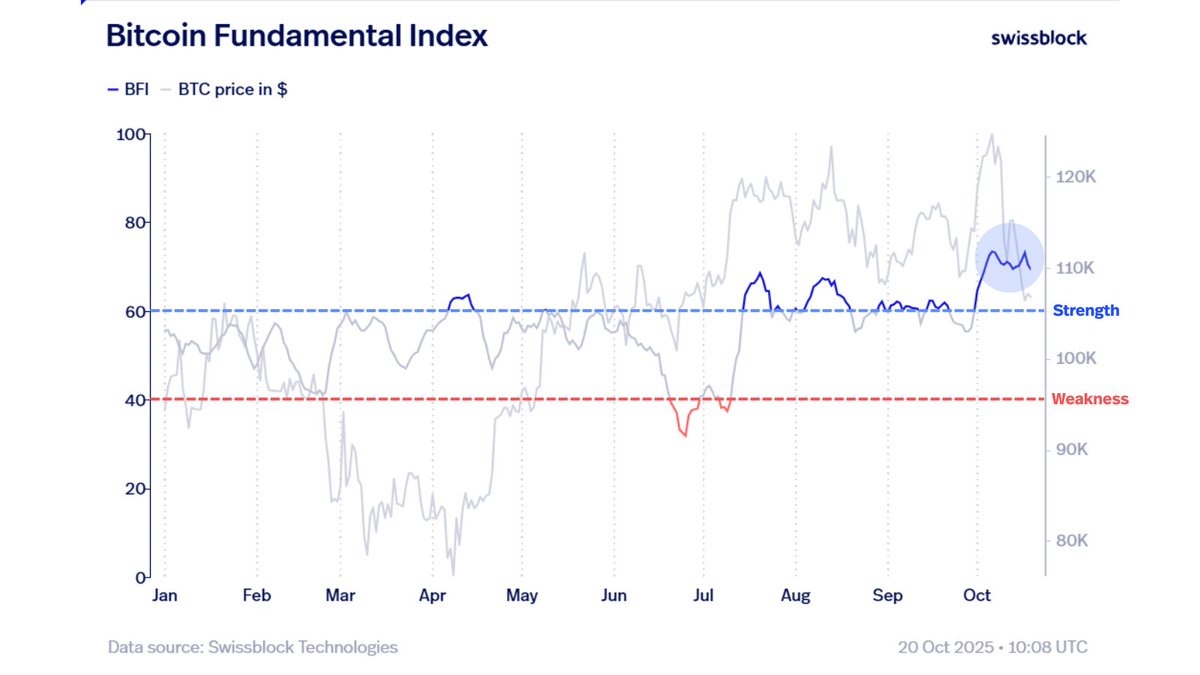

Let's put it this way: A bear shift doesn’t begin when fundamentals are strong, quite the opposite. A true end-of-cycle starts with declining liquidity, weakening network growth, and fading on-chain vitality. So, bear market and end of cycle? Not yet. Bitcoin’s fundamentals…

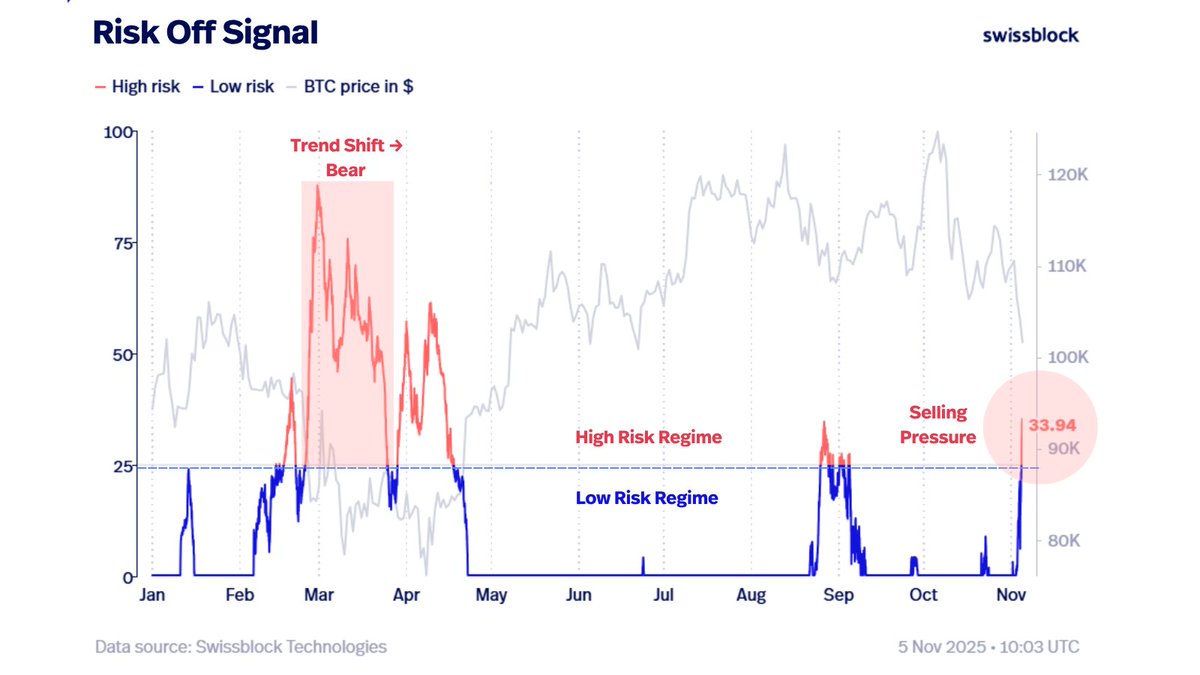

The Risk-Off Signal has entered a High-Risk Regime, indicating not only rising selling pressure but also that we’re standing at the threshold of a bear shift. A simple transition into high risk isn’t enough to confirm that BTC is being dragged into bear territory; what matters…

We are at a major 🔴 Risk Off to 🟢Risk On shift across all major assets. Below you have an index that tracks capital flows between all major asset classes. Here we bench mark against $btc, the canary in the coal mine for risk on liquidity flows.

We are about to see a major next leg up like we saw exactly one year ago.

Has Bitcoin bottomed? Bitcoin is preparing to retake the $110K zone, a key battleground that could decide whether a bottom is forming, or just another trap on the road. The bottoming process is never linear, it’s a path filled with retests and shakeouts that test conviction 🧵

$ETH has been rebuilding its structure. Spot volume is rising, open interest keeps falling. That’s real demand replacing leverage: fewer traders, stronger hands. Not the bottom yet, but the recovery is taking shape.

The SOFR–EFFR spread is quietly flashing one of the biggest structural warnings since 2019. Liquidity is tightening fast. Banks are running low on reserves. And the system is one shock away from breaking again. This isn’t noise — it’s a regime change. 🧵 to explain:

Bitcoin, what is the plan? $BTC faces a decisive week. On-chain strength is at its best shape of the year: liquidity rising, holders steady. Solid Fundamentals The target: reclaim $113.4K–$115.4K with strength and volume for a full bullish reversal. You don’t get a bear market…

Bitcoin Liquidity is showing the shift in macro tides

BTC Liquidity is rising again for the first time since July. Capital is re-entering the system — and it’s flowing into Bitcoin. Historically, this setup has preceded both major breakouts and the onset of Alt-season. Short at your own discretion.

BTC Liquidity is rising again for the first time since July. Capital is re-entering the system — and it’s flowing into Bitcoin. Historically, this setup has preceded both major breakouts and the onset of Alt-season. Short at your own discretion.

We’ve had countless people reach out over the past few weeks asking about the macro picture — and how to navigate it. It’s hard to overstate just how crucial a solid grasp of macro will be in the months ahead.

See Macro does not seem to matter - until the moment it is the ONLY THING that matters. And we are moving closer to that point. See our Macro Services here: 1. SEM - if you want to have weekly updates: swissblock.net/products/sem 2. Zeberg Letter - if you are OK with Monthly…

This is a major push towards utility and mass adoption. Important pillars for becoming a true independent macro asset

1/ Three major narratives are quietly converging in crypto right now. * Privacy * Quantum resistance * The failure of airdrops & token games And there’s one opportunity that sits right at the intersection of all three: @NeptuneCash Let’s break it down

1/ Three major narratives are quietly converging in crypto right now. * Privacy * Quantum resistance * The failure of airdrops & token games And there’s one opportunity that sits right at the intersection of all three: @NeptuneCash Let’s break it down

United States 趨勢

- 1. $NVDA 58.9K posts

- 2. #ใครในกระจกEP5 9,341 posts

- 3. #happybdayTYGA N/A

- 4. GeForce Season 4,505 posts

- 5. Peggy 36.6K posts

- 6. Jensen 17.9K posts

- 7. Sumrall 1,757 posts

- 8. Saba 10.8K posts

- 9. Martha 18.4K posts

- 10. Sonic 06 3,476 posts

- 11. Poverty 50.7K posts

- 12. Comey 52.8K posts

- 13. Jason Crow 1,719 posts

- 14. Halligan 24K posts

- 15. Stargate 5,643 posts

- 16. MLB TV 2,113 posts

- 17. NASA 49.6K posts

- 18. The Fugitive 2,774 posts

- 19. Sunday Night Baseball N/A

- 20. #ComunaONada 5,301 posts

Something went wrong.

Something went wrong.