Main St Macro

@MainStMacroEcon

@columbia_biz MBA. Business Economist

A Recession Is Brewing 🧵 1️⃣ The Inflation Fallacy 2️⃣ Jobs, Jobs, Jobs 3️⃣ Pop the Bubbly 4️⃣ Cracking Housing Foundation 5️⃣ Contagion Coming to America 6️⃣ All Bailed Out

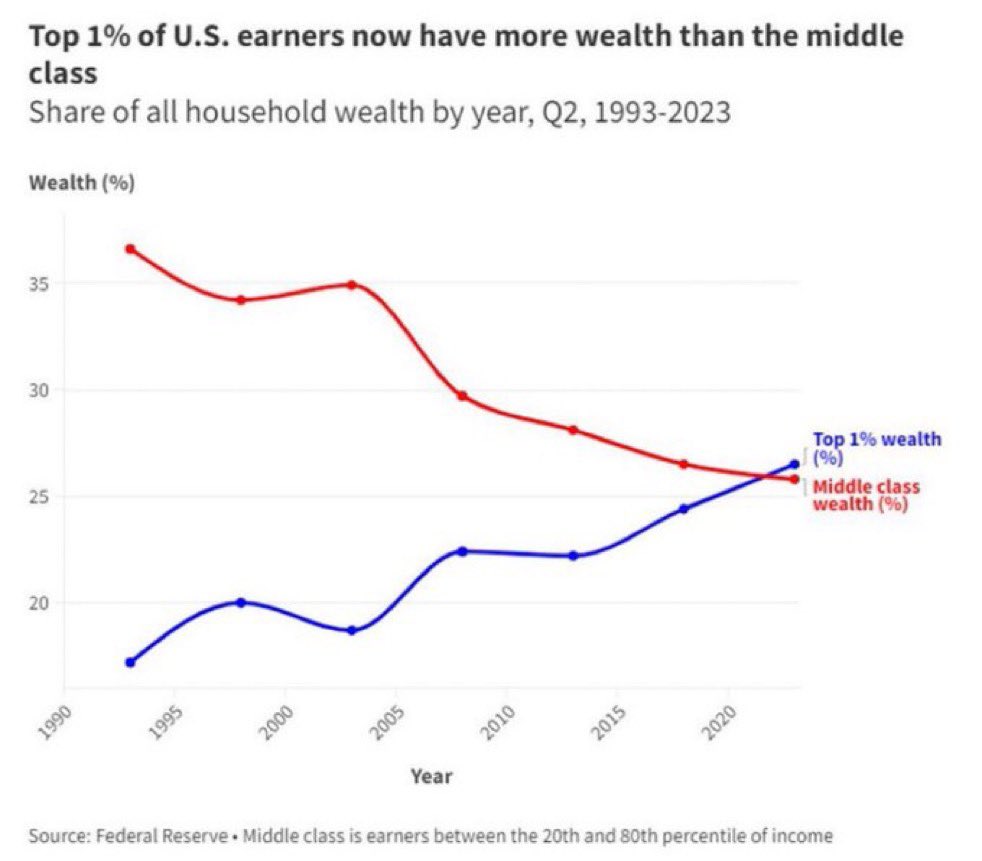

Biden fell for this in 2024. They think they can trick Americans into thinking the economy is good if the stock market is up. Main St didn’t buy it in 2024 and they’re not buying it now #NeverForget that one week in April when Main St was winning #MainStMacro

There’s a lot of talk about global inflation, but much of the developed world will quickly worry about growth over inflation

That is yoy. Here is the latest CPI MoM in August. Canada: -0.1% China: 0.0% Germany: +0.1% Japan: 0.0% Korea: -0.1% 4 out of 5 flat or deflating MoM Here is the latest PPI MoM in August. Canada: +0.5% China: 0.0% Germany: -0.5% Japan: -0.2% Korea: -0.1% 4 out of 5 flat or…

Historically, when the unemployment rate begins to rise, it tends to accelerate quickly, often coinciding with a recession. That’s why I disagree with the view that the Fed is overstating its concerns about the labor market. The downside risks to the labor market are significant

This actually makes me feel slightly better about Nvidia’s positioning. I’m bearish on Nvidia in the short term, but it’s always good to think out the bull case. ~3.65% of earnings for the sp500 is much higher than I would’ve thought. Bull case is that we’re still early in AI.…

Fun Fact: Based on 2024 FY Financials Nvidia only represented ~0.68% of the total annual revenue and ~3.65% of the total annual net earnings of all other S&P 500 companies combined

🚨July Redfin Results Are out and it's not just FL and TX...CA, CO and AZ say hello 👋 M3 Cities=85 cities I track

Trump canning the head of the BLS may work out for America. We won’t be able to trust the NFP report anymore, and we’ll likely have to start relying on the ADP report, which is a better view of private/productive jobs

Liberation day tariffs were 25%. That means it’s a 40% discount including a 550B investment. For countries that can’t invest a half T, does their reciprocal tariff rate only drop by 20%? More than in would’ve thought

How soon until Japan's next real prime minister - Ishiba is just a lame duck now - renegs on this deal?

Personally, I don’t know if inflation will shoot higher or remain muted, but gut says recent retail sales numbers tell you what you need to know about consumer spending. As earnings ramp up, it will be interesting if this trend continues

Looking at transcripts of S&P 500 companies, mentions of inflation—as of June—were at their lowest since January 2021 per @Bloomberg

You do not want your interest rates at 4.25% when your economy is slowing. Payrolls FELL by >100k in May. GDP is contracting. UK is in for some pain and a global slowdown is on the horizon. Yet stocks at ATH 🧐 These global trends will not just impact foreign countries…

The last time ADP was negative (March 2023), the NFP ultimately printed just +85k (revised down from a +236k first look) @tEconomics

What this obbb piece of trash legislation is telling me is that the main difference between this administration and the previous administration is that this administration has less DEI, more crypto, and a more secure border. That’s about it. Spending is still out of control

Amazon, a very reliable client in America, is your tenant. And you still default. Probably fine

A corporate entity tied to Fortress warned investors that it will likely miss a key deadline to refinance about $2 billion of bonds backed by warehouses leased to Amazon bloomberg.com/news/articles/…

Before the end of the year, the the labor market is going to collapse and the housing/debt bubble is coming crashing down with it

Representative Rashida Tlaib just said: “There are too many war mongers in Congress. Many profit financially sending our children to wars. Many are drooling at the opportunity to help defense contractors.”

In the coming weeks, please keep in mind that Iran is a nation of 90 million people — many of whom hate this regime as much as anyone — full of kids like this:

This is so cool. This travel vlogger met a young Iranian boy who basically speaks perfect English all because he watches YouTube

The Top 1% of U.S. earners now have more wealth than the entire middle class

The reason Core CPI is still elevated is because of Shelter, but Shelter is coming down fast. New Tenant Rent Index turned negative in Q1 Once the lagging Shelter CPI number catches up with the real time rent numbers, CPI will be low The @federalreserve is behind the ball

Today, I am introducing my Progressive Deficit Reduction Plan to lower deficits by over $12 trillion. Every member should have a calculator & show their plan. Mine calls for modernizing the military, eliminating Medicare Advantage upcoding, ending fossil fuel subsidies, taxing…

United States Trends

- 1. #SmackDown 26.6K posts

- 2. Caleb Wilson 3,116 posts

- 3. Lash Legend 2,516 posts

- 4. #TheLastDriveIn 1,068 posts

- 5. Giulia 8,850 posts

- 6. #OPLive N/A

- 7. Darryn Peterson 1,849 posts

- 8. Kansas 22.8K posts

- 9. Chelsea Green 3,443 posts

- 10. Nia Jax 2,173 posts

- 11. #MutantFam N/A

- 12. Tiller 4,123 posts

- 13. Georgetown 3,104 posts

- 14. Dizzy 12.3K posts

- 15. Reed Sheppard N/A

- 16. #NYCFC N/A

- 17. Tar Heels N/A

- 18. Vesia 6,328 posts

- 19. Rockets 17.1K posts

- 20. End of 1st 1,844 posts

Something went wrong.

Something went wrong.