Mark

@Mark_Graph

Interests: Data. Python. Economics. Social Policy. Politics. Australia. Caveats: Not financial advice. Opinions my own. Likes ≠ endorsement.

You might like

The Nationals' energy plan fails its own test. It promises affordability, reliability, and regional fairness - but nuclear's too expensive and slow, new coal can't get financed, and old coal is running out of time. Analysis: markthegraph.blogspot.com/2025/11/the-sl… #auspol #ausbiz #ausecon

If you feel like you're bad at your job and it's making you depressed, just consider that, as the investigation of the recent heist revealed, the password to access the Louvre's videosurveillance system was "Louvre".

The critical chart is RBA real wage growth expectations (maybe optimistic). I suspect the implicit NAIRU is 10 to 20 basis points too low. The only way we see a Q1 rate cut is if the Q4 CPI-TM comes in <= 0.7% q on q. #auspol #ausbiz #ausecon

RATES WERE NEVER GOING TO BE CUT. THE ONLY QUESTION WAS … … how grumpy the RBA would sound about the recent lift in inflation Would it see that as just a bump in the road, or as something more threatening? We now know that the RBA is talking tough – or at least tougher than…

RBA governor says there may still be a bit of excess demand in the economy. Interest rates cannot fall as long as the RBA thinks this.

The RBA should do its job, for sure. But fixing the gummed up housing supply system, with its web of regulatory barriers that push up house prices - that's a job for governments - state and Federal. 👇

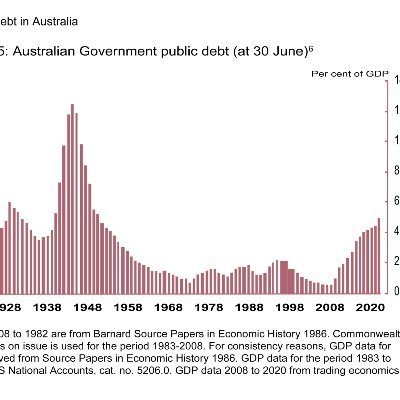

A cohort of economists says the RBA needs to take a tougher stance on inflation because the real interest rate in Australia is pushing house prices and equities to record levels. ebx.sh/NmWXlS

Tentative first post after family holiday in God's country (Melbourne feeling particularly cold today) "Sticky" inflation has remained above target after coming of its peak, but importantly for the RBA it is non-sticky inflation that has re-accelerated sharply, potentially…

I have been thinking about the Phillips Curve. Is it steepening? Is it moving up/to the right? Or are we just seeing the consequence of subsidies wash out? Possible issues: - productivity slump - changed inflation expectations (up from 2.5% to (say) 3%) - migration rebound -…

I think the real monthly household spending indicator growth for Q3 is flat - if we assume inflation is ~3%, and take off 0.75% for the quarter - are we looking at a possibly negative GDP for Q3? Yes, lots of other factors in GDP, but worth noting. #auspol #ausbiz #ausecon

United States Trends

- 1. Broncos 39.6K posts

- 2. Raiders 46.9K posts

- 3. Bo Nix 9,275 posts

- 4. Sean Payton 2,313 posts

- 5. Geno 9,186 posts

- 6. #911onABC 24K posts

- 7. Jeanty 5,115 posts

- 8. #TNFonPrime 2,926 posts

- 9. #WickedOneWonderfulNight 3,926 posts

- 10. Cynthia 41.7K posts

- 11. Chip Kelly N/A

- 12. GTA 6 87.9K posts

- 13. AJ Cole N/A

- 14. eddie 45.8K posts

- 15. Bradley Beal 1,521 posts

- 16. #RaiderNation 2,923 posts

- 17. Al Michaels N/A

- 18. ariana 124K posts

- 19. Thornton 2,691 posts

- 20. Tillman 3,612 posts

You might like

-

ANZ_Research

ANZ_Research

@ANZ_Research -

GhostWhoVotes

GhostWhoVotes

@GhostWhoVotes -

Matt Cowgill

Matt Cowgill

@MattCowgill -

Gaven Morris

Gaven Morris

@gavmorris -

casey briggs

casey briggs

@CaseyBriggs -

William Bowe

William Bowe

@PollBludger -

Bjorn Jarvis

Bjorn Jarvis

@Bjorn_Jarvis -

Michael Janda

Michael Janda

@mikejanda -

Gareth Hutchens

Gareth Hutchens

@grhutchens -

Jacob Greber

Jacob Greber

@jacobgreber -

Kevin Bonham

Kevin Bonham

@kevinbonham -

Shane Wright

Shane Wright

@swrighteconomy -

Australian Election Forecasts

Australian Election Forecasts

@aeforecasts -

Brendan Coates

Brendan Coates

@BrendanCoates -

Ben Phillips

Ben Phillips

@BenPhillips_ANU

Something went wrong.

Something went wrong.