Ben

@PatternProfits

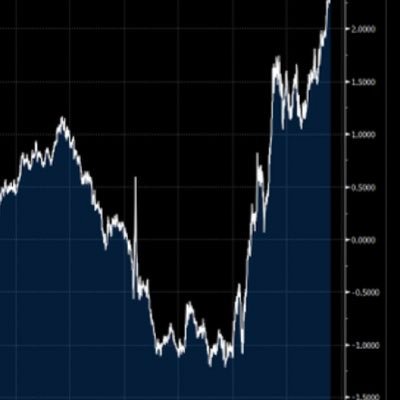

$NQ $ES 📈📉 Trading Futures & Selling Premium. Much like playing poker, I bet when probabilities are favorable. Time Based Liquidity, ORB/IBB, FVG, VWAP, 0DTE

I'm currently of the opinion that there are 3 drivers of daily market movements... 1) Liquidity 2) 0DTE 3) Trump Headlines 💣 Nothing more. Nothing less. 😊

$NQ Pattern 4 this morning sees 73% probability of taking the London low during the NY session, as long as the London high isn't taken first (drops to 43%). 66% probability of taking the London high in the NY session, as long as the London low isn't taken first (drops to 41%).…

Are you currently refining your process, seeking profitability? I put together "The Day Traders Blueprint" as a way to help reset people back to the fundamentals, the things that matter. Its a 5 part series designed to equip traders with the essential foundations for consistent…

Dear girls, marry a trader. He’ll be so busy from 9:15 to 3:30 that whatever you ask, he’ll just say “yes.” Should I go shopping? - Yes. Can I use your credit card? - Yes. Can we go out for dinner today? - Yes. Plus, he’ll be home most of the time, so you’ll get plenty of…

$ES In addition to the call wall (6864) clear BF now on 5 min, too. Would take $ES back down to the lower end of the chop zone. tradingview.com/x/Xtw8F6Yy/

$ES tapping into the call wall ahead of $NQ. Call wall doing what call walls do... rejecting price on first tap. 🛑

$NQ IB close in the upper half with the low printing first. 🟢 $ES IB close in the lower half with the high printing first. 🔴 Mixed messages there this morning. Tech showing RS in the early going.

$ES $NQ 1st FVGs after 10am print green. Turning attention to IB.

$NQ takes the London high. ALN has validated.

Good morning. $NQ Pattern 1 this morning (London session engulfing the Asia range) sees 98% probability of the NY session breaking at least one side of the London range. If London high is taken first, London low is taken 44% of the time. If London low is taken first, London high…

Good morning. $NQ Pattern 1 this morning (London session engulfing the Asia range) sees 98% probability of the NY session breaking at least one side of the London range. If London high is taken first, London low is taken 44% of the time. If London low is taken first, London high…

$NQ Rare pattern 2 this morning sees Asia engulf the London range. This only happens roughly 7% of the time. 95% of the time, the London high or low will be broken in the NY session. 91% of the time, the Asia high or low will be broken in the NY session. tradingview.com/x/5WjNnPRz/

United States Tendances

- 1. #SpotifyWrapped 17.1K posts

- 2. Chris Paul 15.8K posts

- 3. Clippers 24.5K posts

- 4. Good Wednesday 28.3K posts

- 5. #NSD26 4,881 posts

- 6. #WednesdayMotivation 3,297 posts

- 7. Happy Hump 6,278 posts

- 8. Hump Day 9,545 posts

- 9. National Signing Day 2,934 posts

- 10. FELIX LV VISIONARY SEOUL 26.1K posts

- 11. TOP CALL 10.2K posts

- 12. #FELIXxLouisVuitton 29.4K posts

- 13. Nashville 31.1K posts

- 14. #Wednesdayvibe 1,858 posts

- 15. jungkook 263K posts

- 16. Somalians 86.8K posts

- 17. Elden Campbell N/A

- 18. The BIGGЕST 298K posts

- 19. Somalis 100K posts

- 20. Market Focus 4,648 posts

Something went wrong.

Something went wrong.