Pierce O'Reilly

@PierceOReilly

Senior Economist & Head of Business & International Taxes Unit in the Tax Policy Division of @OECDtax. Formerly @Columbia. Usual disclaimers apply.

You might like

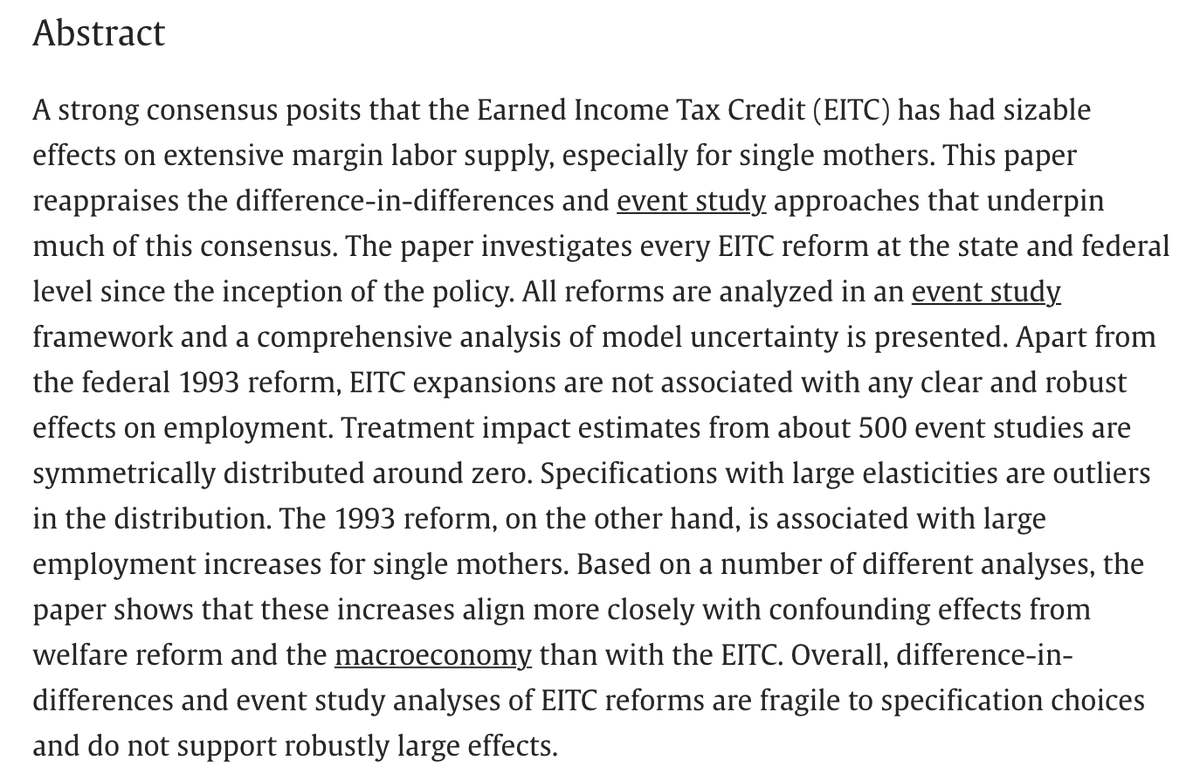

Just published in @JPubEcon: "The EITC and the extensive margin: A reappraisal" By Henrik Kleven (@PrincetonEcon) sciencedirect.com/science/articl…

The discussions of unrealized capital gains for the very rich (ie those with wealth exceeding $100M) are often missing a key fact - two thirds of unrealized gains at the very top is from gains in private businesses (From SCF data eml.berkeley.edu/~yagan/Capital…) @jasonfurman @MargRev

[OUT NOW] Corporate Tax Statistics 2024 Explore new Country-by-Country Reporting data, new data on IP regimes & indicators on #BEPS activity. 🧵 Some key #Stats from the report ⤵️ oecd.org/en/data/datase…

![OECDtax's tweet image. [OUT NOW] Corporate Tax Statistics 2024

Explore new Country-by-Country Reporting data, new data on IP regimes & indicators on #BEPS activity.

🧵 Some key #Stats from the report ⤵️

oecd.org/en/data/datase…](https://pbs.twimg.com/media/GSM2znIWwAAtL4D.jpg)

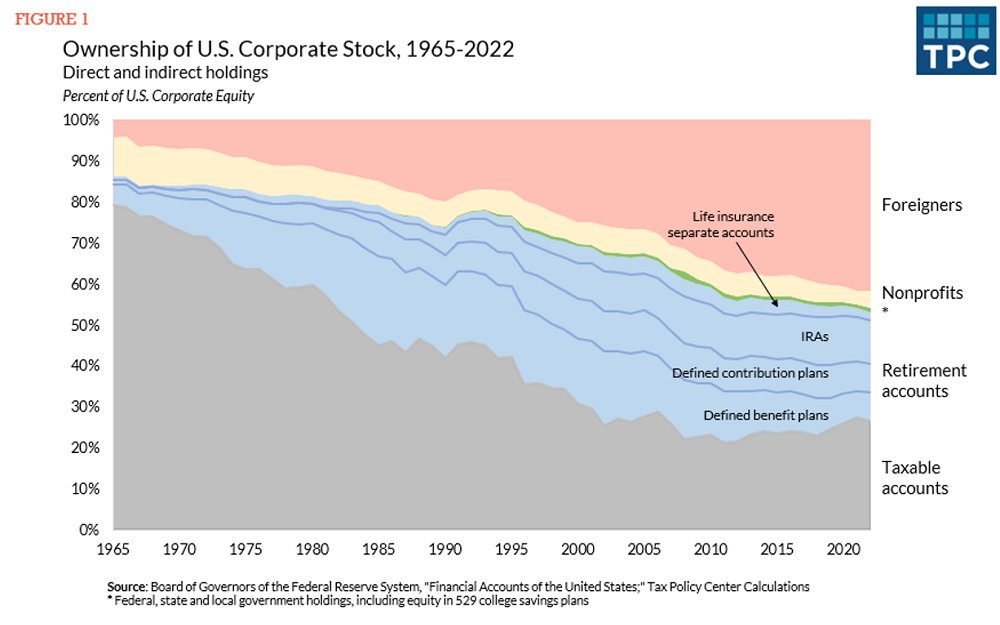

Efforts to raise taxes corporate profits and shareholders need to consider that a growing percentage of shares are held by different types of tax-exempt entities. tpc.io/3VKt1Dr

Come work with us! We do lots of work on business tax, environmental tax, investment, tax incentives, capacity building, and of course the international tax negotiations.

[JOB VACANCY] We’re hiring economists for quantitative economic analysis in environmental, corporate, and international taxation. 🗓️ Apply by 14 July 2024 (23:59 CEST) ➡️ smrtr.io/kZLhJ #OECDjobs #taxjobs #envjobs

![OECDtax's tweet image. [JOB VACANCY] We’re hiring economists for quantitative economic analysis in environmental, corporate, and international taxation.

🗓️ Apply by 14 July 2024 (23:59 CEST)

➡️ smrtr.io/kZLhJ

#OECDjobs #taxjobs #envjobs](https://pbs.twimg.com/media/GQhgaeIWgAAH3EK.jpg)

[JOB VACANCY] We’re hiring economists for quantitative economic analysis in environmental, corporate, and international taxation. 🗓️ Apply by 14 July 2024 (23:59 CEST) ➡️ smrtr.io/kZLhJ #OECDjobs #taxjobs #envjobs

![OECDtax's tweet image. [JOB VACANCY] We’re hiring economists for quantitative economic analysis in environmental, corporate, and international taxation.

🗓️ Apply by 14 July 2024 (23:59 CEST)

➡️ smrtr.io/kZLhJ

#OECDjobs #taxjobs #envjobs](https://pbs.twimg.com/media/GQhgaeIWgAAH3EK.jpg)

United States Trends

- 1. Jack Smith N/A

- 2. Sinners N/A

- 3. Oscar N/A

- 4. harry styles N/A

- 5. He-Man N/A

- 6. Don Lemon N/A

- 7. MetLife N/A

- 8. #BTSWorldTour N/A

- 9. FINALLY DID IT N/A

- 10. Ticketmaster N/A

- 11. William Kelly N/A

- 12. Jared Leto N/A

- 13. Christian Parker N/A

- 14. Forza Horizon 6 N/A

- 15. Best Picture N/A

- 16. #XboxDeveloperDirect N/A

- 17. Jim Jordan N/A

- 18. #MountainOfBusch N/A

- 19. Maul N/A

- 20. Fable N/A

Something went wrong.

Something went wrong.