Greg Ip

@greg_ip

Chief economics commentator for The Wall Street Journal. A fox, not a hedgehog. Read my articles here: https://www.wsj.com/news/author/greg-ip

You might like

New Japan PM's pressure on BOJ shows gold's rally is not just about eroding trust in the dollar, but all fiat currencies. With debts near or above 100% of GDP worldwide & growing, the pressure on CB's to inflate it away will grow. My column: /1 wsj.com/economy/centra…

Let me guess, she thinks NYC is too big and powerful and will work to make it smaller

If you don’t know Lina Khan, now is a great time to know about her. She’s now on Zohran Mamdani’s transition team. She’s also the former FTC Chair, only 36, & committed to leveling the playing field for everyday Americans. She is an absolute star. This is what hope feels like.

Of 3 key winners Tuesday, Mamdani is hogging all the attention. But I'd argue Spanberger and Sherrill tell us more about voter priorities: they won by bigger margins, over Republicans, not fellow Democrats, and will govern more people with more power (governors >> mayors).

More than tariffs were at stake at the Supreme Court this week: so is the separation of powers, which Trump has bulldozed by tariffing, hitting up companies for $, and withholding appropriated spending. The court seems ready to say, "enough." My column: wsj.com/politics/polic…

Exactly. Trump's argument is that Presidential declarations of an emergency can't be reviewed by the courts. So presumably he thinks a court couldn't review a future President's determination of a climate emergency, regardless of whether there is, in fact, such an emergency.

As @petereharrell has elsewhere argued, and I have written, if SCOTUS says "regulate" imports under IEEPA' includes tariffs, it would include any kind tax. A future president could declare a climate emergency originating abroad and impose a carbon tax under IEEPA.…

What I’ll be watching for at Wednesday’s blockbuster Supreme Court hearing on Trump’s IEEPA tariffs, beyond the obvious vote counting: (Brief case recap at the bottom of the post). 1. FIRST KEY ISSUE: Do (m)any Justices look for a compromise position? My view remains that…

Most countries promote, even subsidize, exports. Argentina does the opposite. Agricultural producers are clamoring for Milei to scrap the export tax. With @SFrydlewsky, I delve into the origins, effects and outlook of the world's weirdest tax. (Bonus ostrich photo)…

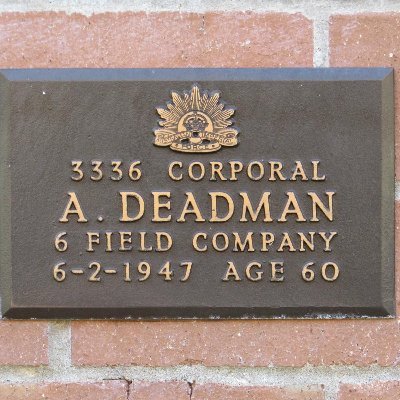

Al Broaddus, president of the Richmond Fed from 1993 to 2004, has died. I got to know Al while covering the Fed back then and profiled his journey from hawk to dove in a 2002 feature. Besides being an intellectually honest and dedicated public servant, Al was funny, decent and…

This is the craziest stat of the World Series: Trey Yesavage, the Blue Jays starting pitcher who makes $57K a year, started the game by striking out Shohei Ohtani, who makes $47M - that's 824x his salary.

Chair Powell's downplaying of the supercore seems odd. Yes, it slowed earlier this yr, esp in CPI, but that was airfares related and was, imo, very obviously going to bounce.

Powell’s deliberate effort to cast doubt on a December cut (“if we do wind up resuming rate cuts at some point”) reflected deepening divisions over how to interpret an economy where consumer spending been OK but hiring had slowed before the data drought wsj.com/economy/centra…

The logic makes sense, but market-based core PCE services ex. housing still looks tenacious & in an above-2019 holding pattern (the imputations should be much less important on the goods side).

Powell's statement is interesting since 1) core services ex housing inflation (where tariffs have very little impact) is still running hot; 2) core goods prices (where tariffs primarily pinch) are also accelerating; 3) PCE housing is cooling but that's been widely expected.

"non-tariff inflation is not so far from 2% now." This seems more important than FOMC is giving credit for and in tension with the assessment that inflation risks are to the upside.

Can it be true that AI spending is a bubble based on overoptimism about adoption and payoff, and that AI is already wiping out massive swaths of jobs? I guess, technically, both these things could be true but it seems a stretch, and the second feels less plausible to me.

I'm open to the possibility that AI is having a nonzero effect on the labor market. But the varied mix of firms announcing layoffs strikes me as more consistent with the main driver here being a correction from over-hiring in the wake of the pandemic. wsj.com/economy/jobs/w…

Trump allies plan to host a party on the sidelines of America Fest to promote the idea of the president possibly running for a third term. Trump admitted to reporters he's barred from a third term. The back and forth on the 22nd amendment👇 wsj.com/politics/elect…

United States Trends

- 1. Grammy 187K posts

- 2. Clipse 11.3K posts

- 3. Kendrick 46.1K posts

- 4. addison rae 16.1K posts

- 5. olivia dean 9,851 posts

- 6. Dizzy 8,083 posts

- 7. #FanCashDropPromotion 3,164 posts

- 8. gaga 81.4K posts

- 9. Katseye 89.4K posts

- 10. Leon Thomas 12.3K posts

- 11. Kehlani 27.5K posts

- 12. AOTY 14.8K posts

- 13. ravyn lenae 1,678 posts

- 14. lorde 9,784 posts

- 15. Album of the Year 47.2K posts

- 16. #FridayVibes 6,344 posts

- 17. Durand 3,849 posts

- 18. Luther 20.2K posts

- 19. Benito 6,086 posts

- 20. Alfredo 2 N/A

You might like

-

Martin Wolf

Martin Wolf

@martinwolf_ -

Nouriel Roubini

Nouriel Roubini

@Nouriel -

Austan Goolsbee

Austan Goolsbee

@Austan_Goolsbee -

Ian Shepherdson

Ian Shepherdson

@IanShepherdson -

Jason Furman

Jason Furman

@jasonfurman -

Adam Posen

Adam Posen

@AdamPosen -

ChicagoFed

ChicagoFed

@ChicagoFed -

Hyun Song Shin

Hyun Song Shin

@HyunSongShin -

FT Alphaville

FT Alphaville

@FTAlphaville -

Tracy Alloway

Tracy Alloway

@tracyalloway -

Stabls Support

Stabls Support

@MarkusEconomist -

David Wessel

David Wessel

@davidmwessel -

Neil Irwin

Neil Irwin

@Neil_Irwin

Something went wrong.

Something went wrong.