Christopher Cain

@PythonTrader

U.S. Quantitative Equity Strategist for @Bloomberg Intelligence👨🏻💻 | 2020 Dow Award Winner 🏆 | Lover of hip hop and ankle picks | #Bitcoin

Talvez você curta

Join us on Thursday, no need to be a terminal subscriber and the sign up is free

Join @PythonTrader and I for our US Equity Outlook webinar on 12/11 at 11am Eastern! I'll be addressing the AI/Tech "bubble", how a more aggressive Fed could help small caps break out, and possible implications of a possible court reversal on tariffs. bloomberg.zoom.us/webinar/regist…

In the latest episode of Inside Active, @PythonTrader and I spoke with @ChesapeakeCap's @rjpjr12 about $TFPN & his trend following plus nothing philosophy, why stocks belong in CTA portfolios, and the turtle experiment. @BBGIntelligence podcasts.apple.com/us/podcast/che…

In the latest episode of Inside Active, @PythonTrader & I spoke with @GQGPartners' Sid Jain about the firm’s focus on forward-looking quality, $GQEPX and why today’s market could prove worse than the dot-com bubble. @BBGIntelligence podcasts.apple.com/us/podcast/gqg…

The S&P 500 is on the verge of its fastest recovery from a 15%+ drawdown in 50 years... Past average: 490 days Tech bubble: 1,694 GFC: 1,480 If the market make a new ATH before June 30th ... it would break the previous shortest record of 83 days in 1982 & 84 days in 1998

This last month's rally has had a defensive tone .. but not today. Value finally working while low vol (factor star of 2025) and profitability are not. Momentum is also not working today, not surprising as momentum has really de-risked recently (as low vol becomes momentum)…

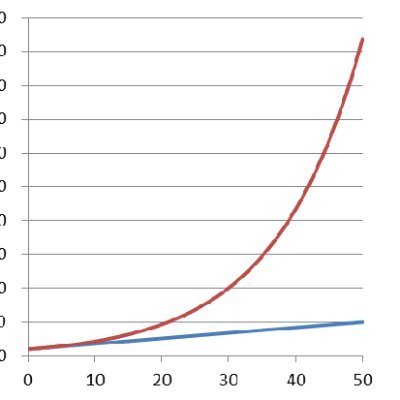

Something does seem different this time ... here is trailing 2-month (42 biz days) returns for SPX and DXY with todays result circled (DXY -8.2%, SPX -15.9% over last 2-months) This is actually the largest error (difference between dot and the line) using daily data back to…

United States Tendências

- 1. Bears 139K posts

- 2. Bears 139K posts

- 3. Caleb Williams 38.4K posts

- 4. DJ Moore 28.4K posts

- 5. Malik Willis 15.4K posts

- 6. #BearDown 4,656 posts

- 7. Nixon 12.5K posts

- 8. Ben Johnson 10.1K posts

- 9. Doubs 9,035 posts

- 10. Clippers 8,544 posts

- 11. Oregon 36.3K posts

- 12. WE LOVE YOU BTS 14K posts

- 13. Bowen 13.6K posts

- 14. Jordan Love 13.1K posts

- 15. #Toonami 2,475 posts

- 16. Cher 39K posts

- 17. #BlackClover 8,106 posts

- 18. Jahdae Walker 4,030 posts

- 19. GOOD BETTER BEST 3,793 posts

- 20. #GoPackGo 7,875 posts

Talvez você curta

-

HangukQuant

HangukQuant

@HangukQuant -

Systematic Microcaps ⚙️

Systematic Microcaps ⚙️

@systvest -

Pim van Vliet

Pim van Vliet

@paradoxinvestor -

Build Alpha

Build Alpha

@buildalpha -

Jack Forehand

Jack Forehand

@practicalquant -

Matthias Hanauer

Matthias Hanauer

@HanauerMatthias -

CMT Association

CMT Association

@CMTAssociation -

Journal of Financial and Quantitative Analysis

Journal of Financial and Quantitative Analysis

@JournalFQA -

Scott

Scott

@VolatilityWiz -

Corey Hoffstein 🏴☠️

Corey Hoffstein 🏴☠️

@choffstein -

Jay Soloff

Jay Soloff

@jsoloff -

Nicolas Rabener

Nicolas Rabener

@Finominally -

Jesse Cohen

Jesse Cohen

@JesseCohenInv -

Steven Strazza

Steven Strazza

@sstrazza -

Dave Nadig

Dave Nadig

@DaveNadig

Something went wrong.

Something went wrong.