QuantBloke

@QuantBloke

Quant trader, opera buff, and CrossFit regular. Analyzing markets by day, contemporary opera by night—usually over good wine. Data-driven, globally curious.

قد يعجبك

Algorithms for Decision Making - 700+ page 2022 #ebook algorithmsbook.com/files/dm.pdf

A good intro to the intersection of GPUs, Deep Learning and Limit order Book (#LoB #HFT) Modeling - video Mathematics Seminar: Deep LOB Trading: Half a second please! youtube.com/watch?v=0QJJ5l… Alas, Paper & alt video requires Nvidia sign-up nvidia.com/en-us/on-deman…

youtube.com

YouTube

Mathematics Seminar: Deep LOB Trading: Half a second please! | Wong...

Paper - new empirical analysis of equity market fragmentation in Europe static1.squarespace.com/static/6310c0b…

The MacGuffin is the object of desire. It is the thing around which the plot of the story revolves. Here is the story arc of SBF and FTX, and the MacGuffin that anchored it all - the Magical Money Machine. epsilontheory.com/the-macguffin-…

Excellent thread

🧵below on why Silvergate $SI may be in a whole heap of KYC/AML trouble with the FTX collapse

This Day One Declaration is an incredible read

Genesis: contagion, etc. a very insightful thread.

If this is really the end for Genesis, this could be more impactful than FTX. FTX hurt liquid funds and consumers. Genesis impacts nearly every company in crypto. Let's dig in.

A credible and compelling writeup.

If this is really the end for Genesis, this could be more impactful than FTX. FTX hurt liquid funds and consumers. Genesis impacts nearly every company in crypto. Let's dig in.

Incredible that the most complete and internally consistent account of what happened at FTX/Alameda to date is not the NYT or WSJ or the FT but the blog “milky eggs dot com” written by user “fbi femboy”

If this is really the end for Genesis, this could be more impactful than FTX. FTX hurt liquid funds and consumers. Genesis impacts nearly every company in crypto. Let's dig in.

For anyone interested in #trendfollowing #CTAs, and market developments in 2022, this conversation with @TopTradersLive @investingidiocy and Nick Baltas is a must listen: toptradersunplugged.com/podcast/ttu121…

5/ Here's what I think happened: - Alameda blew up in Q2 along with 3AC+ others. - It ONLY survived because it was able to secure funding from FTX using as "collateral" the 172M FTT that was guaranteed to vest 4 months later. Once vested, all tokens were sent back as repayment.

The FTX thing We trusted another centralised company and got rugged. Again. My opinion on what happened:

StockBot - LSTM, YFinance and Google Trends provided data to automate predictions for the unitiatiated (of course, not to trade) Paper: arxiv.org/pdf/2207.06605… Python GitLab Code: gitlab.com/cs230_stock_an…

Very late to the party, but my new MacBook Pro 14 with the M1 Max processor is a very smooth experience indeed. #Mac #M1Max #64GB

Currently recording with @TopTradersLive Here is a graph I mentioned (Jorda et al “The rate of return on everything” QJE 2019)

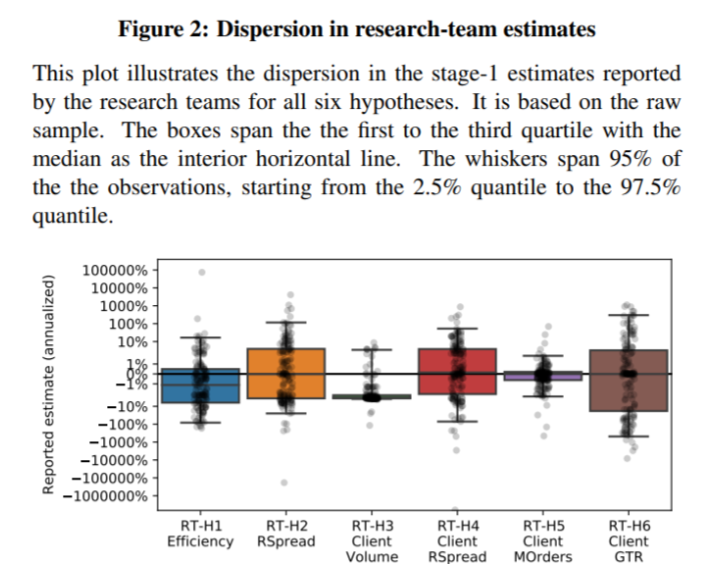

An astounding paper: “Non-standard Errors”. Huge dispersion in results, with experienced researchers and the same dataset. papers.ssrn.com/sol3/papers.cf… #quantfinance #liquidity #factors

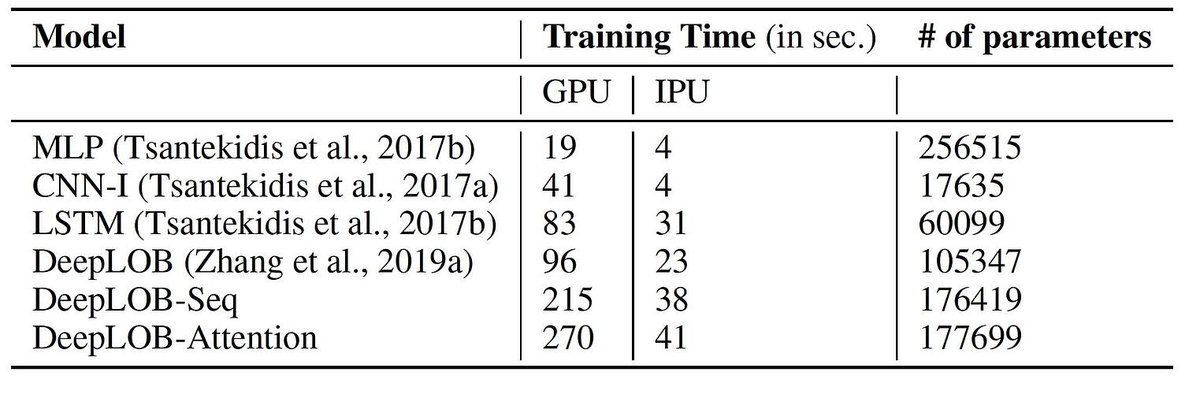

Multi-Horizon Limit Order Book Modeling by Oxford-Man Quants using Intelligent Processing Units, GPUs with a public FI-2010 dataset. #Graphcore #Attention #LOB Paper: arxiv.org/abs/2105.10430 Blog and video: graphcore.ai/posts/graphcor… Python GitHub: github.com/zcakhaa/Multi-…

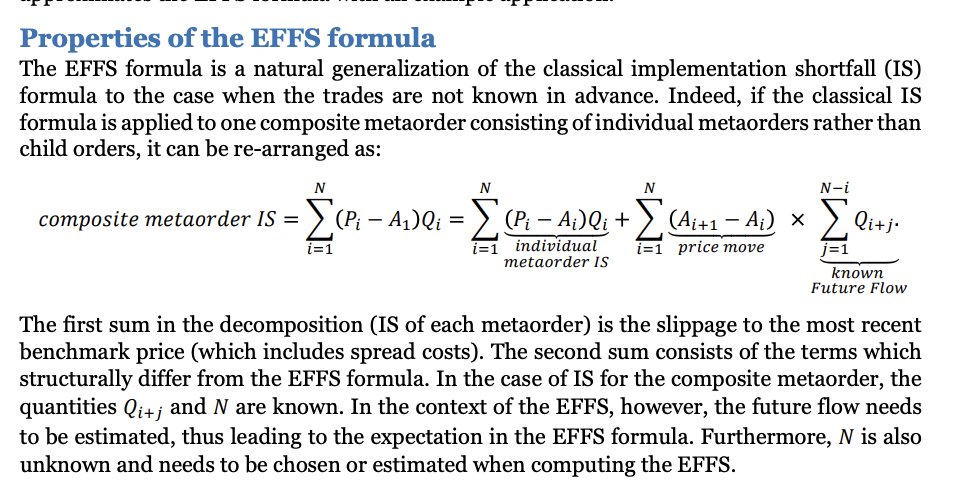

Expected Future Flow Shortfall (EFFS) as an alternative to traditional market impact - #TCA paper by Campbell Harvey and others... papers.ssrn.com/sol3/Delivery.…

United States الاتجاهات

- 1. Thanksgiving 146K posts

- 2. #IDontWantToOverreactBUT 1,314 posts

- 3. #GEAT_NEWS 1,420 posts

- 4. Jimmy Cliff 24.2K posts

- 5. #WooSoxWishList 2,232 posts

- 6. #MondayMotivation 13.5K posts

- 7. #NutramentHolidayPromotion N/A

- 8. DOGE 233K posts

- 9. $ENLV 18.8K posts

- 10. Victory Monday 4,385 posts

- 11. TOP CALL 5,006 posts

- 12. Monad 173K posts

- 13. Good Monday 52.2K posts

- 14. Justin Tucker N/A

- 15. Feast Week 1,996 posts

- 16. The Harder They Come 3,664 posts

- 17. $GEAT 1,316 posts

- 18. $MON 34K posts

- 19. AI Alert 3,070 posts

- 20. Soles 101K posts

Something went wrong.

Something went wrong.