The Spread Thread

@SpreadThread1

Former head of credit strategy | Investor/Trader | Add your email at http://TheSpreadSite.com to receive our research to your inbox for no charge

你可能會喜歡

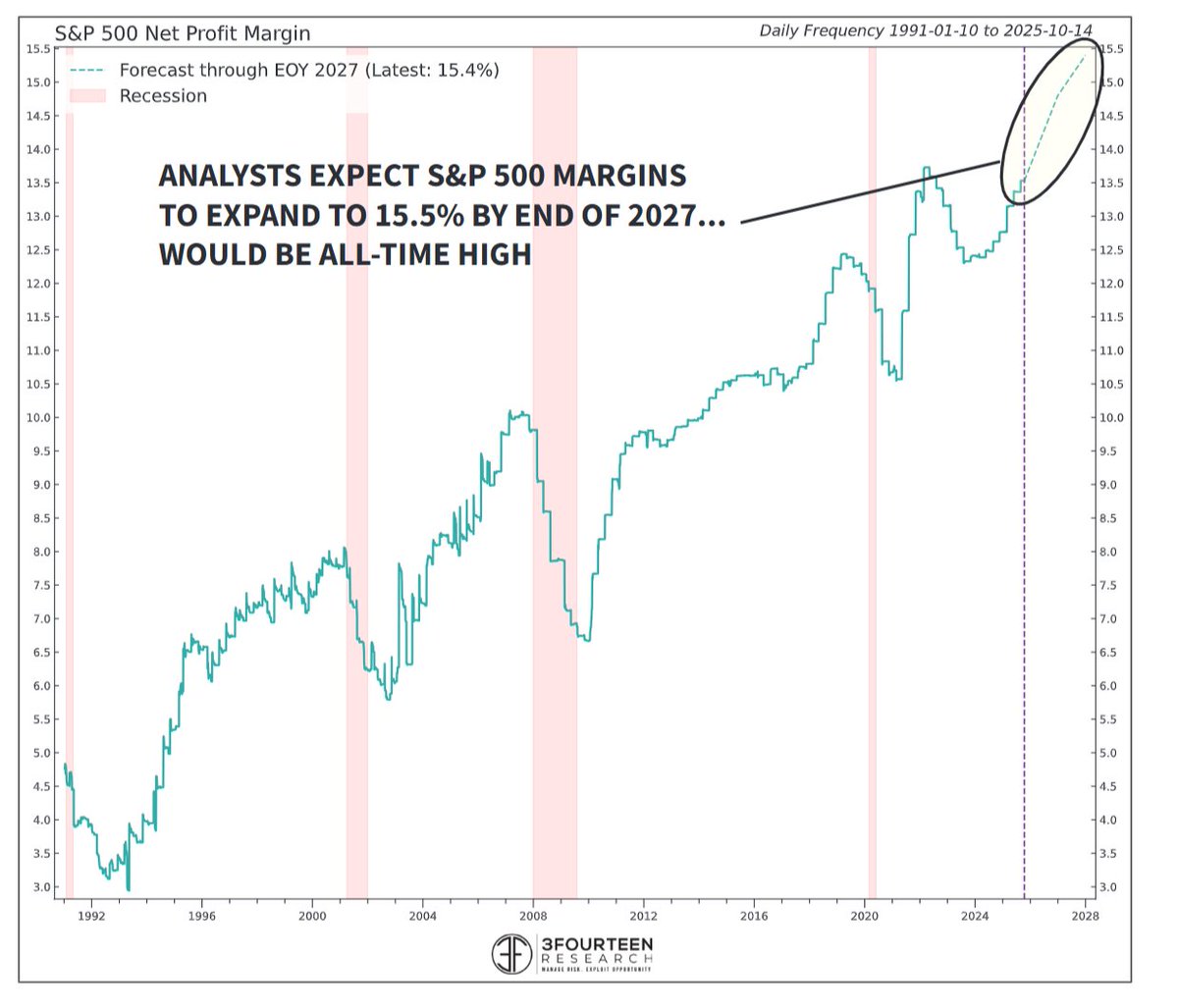

Warren makes a good point. But another way you could phrase it is current multiples are baking in the expectation that record margins rocket even higher (a productivity boom). If that doesn’t happen, then you are left with peak multiples and peak margins.

S&P 500 Is the market overvalued or in a bubble? Contrary to consensus - no. If analysts are correct and margins expand to 15.5% by 2027 (+180 bps), then multiples remain more likely to expand than contract. Less cyclical index composition + higher margins = rising multiples.

Banks, housing, retail, mid-caps rolling over. I’d add one credit crack after another (i.e., BDCs - private credit, getting smoked). Some warning signs about economic momentum. More interesting, in my view, than the newest round of trade headlines.

$SPY -0.7% in the last month $KRE $XRT $XHB smoked Mid-caps down 5%. Few talking about that.

We put this out on BDCs a while back for those who want to better understand the sector… thespreadsite.com/bdc-yields/

Kieran is possibly the best PM on credit I have ever met. Not a punter or big short guy just great all the time. Worth understanding this post

Maybe it’s not that inconsistent. Bond yields falling b/c growth is weak, pricing in cuts. Stocks rallying b/c investors believe the cuts will work (I.e., looking through the soft patch). When/if investors no longer believe the cuts will work (or will cause harm) stocks go down

Not the tightest ever. But yes, tight. Either way. Credit isn’t the forward looking indicator people think. Spreads were at all-time tights in mid-2007. Also, note, unlike stocks, credit has not gotten back to the tights hit early this year. A bit of a divergence Left chart MS

4 prints, not 1. +19, -13,+79, +22 (may-aug). My simplistic view - when the economy is averaging 150k like early this year, there is cushion to absorb headwinds. When it’s averaging 25k that cushion is gone. Things aren’t falling off a cliff. But risks are higher at stall speed.

Worth a quick read

Seems like Trump can use various other measures to reinstitute the tariffs while appealing IEEPA all the way to supreme court, per GS 4. The Trump administration has other authorities it can use to impose tariffs similar to those the court struck down: The administration could…

Which of the following will have the highest total return over the next 12 months:

I believe GS recently put out a 1% annual real return for the SPX over the next 10yrs given starting valuations. Just one forecast, and they may be too pessimistic. But long-term TIPS now pay 2.75% real. For retirees who live off the income on their assets, seems like a gift.

Now above 2.75% on the 30yr TIPS Everybody loved it for years at 1%

United States 趨勢

- 1. #StrangerThings5 150K posts

- 2. Thanksgiving 638K posts

- 3. Reed Sheppard 3,220 posts

- 4. Afghan 254K posts

- 5. Podz 3,044 posts

- 6. robin 70.1K posts

- 7. National Guard 627K posts

- 8. holly 51.8K posts

- 9. BYERS 27.1K posts

- 10. Gonzaga 8,164 posts

- 11. #AEWDynamite 21K posts

- 12. Dustin 86.7K posts

- 13. Michigan 77.8K posts

- 14. Amen Thompson 1,374 posts

- 15. Tini 8,126 posts

- 16. Erica 13.4K posts

- 17. Rahmanullah Lakanwal 96.2K posts

- 18. #Survivor49 3,032 posts

- 19. Will Richard 2,090 posts

- 20. Jardine 6,391 posts

你可能會喜歡

-

CrossBorder Capital/ GLIndexes

CrossBorder Capital/ GLIndexes

@crossbordercap -

Kantro

Kantro

@MichaelKantro -

Joseph Wang

Joseph Wang

@josephwang -

Bob Elliott

Bob Elliott

@BobEUnlimited -

Andy Constan

Andy Constan

@dampedspring -

ʎllǝuuop ʇuǝɹq

ʎllǝuuop ʇuǝɹq

@donnelly_brent -

Paulo Macro

Paulo Macro

@PauloMacro -

Prometheus Research

Prometheus Research

@prometheusmacro -

PPG

PPG

@PPGMacro -

Ian Harnett

Ian Harnett

@IanRHarnett -

Michael Kao

Michael Kao

@UrbanKaoboy -

Tier1 Alpha

Tier1 Alpha

@t1alpha -

SuperMacro

SuperMacro

@super_macro -

3Fourteen Research

3Fourteen Research

@3F_Research -

2 Gray Beards

2 Gray Beards

@2GrayBeards

Something went wrong.

Something went wrong.