Nathan Stotlar

@Swerski

Director of Tech, Stark Company Realtors, Fin/Prop Tech Enthusiast, amateur Mortgage/Real Estate market analyst and Father. Views don't represent my employer.

You might like

Plenty of Movement, Not Much Progress; More Volatility Ahead housingnewsletters.com/nathanstotlar/… via @mktnewsletters

Lawmakers introduce bill to block LLPA fee changes dlvr.it/SnDY1Q

BEN FOSTER SAVE FOR WREXHAM 🐉🤯🧤 Former Premier League goalkeeper with the MASSIVE save in added time to secure the win for AFC Wrexham. The drama of football. ❤️❤️

No, There is NOT a New 40yr FHA Loan housingnewsletters.com/nathanstotlar/… via @mktnewsletters

Let me sprinkle my magic on that 2-year yield

MBS Morning: Back to "Zero Days" Without a Systemic Banking Contagion Flare-Up housingnewsletters.com/nathanstotlar/… via @mktnewsletters

An explainer on what is going on with Silicon Valley Bank: - In 2021 SVB saw a mass influx in deposits, which jumped from $61.76bn at the end of 2019 to $189.20bn at the end of 2021. - As deposits grew, SVB could not grow their loan book fast enough to generate the yield they…

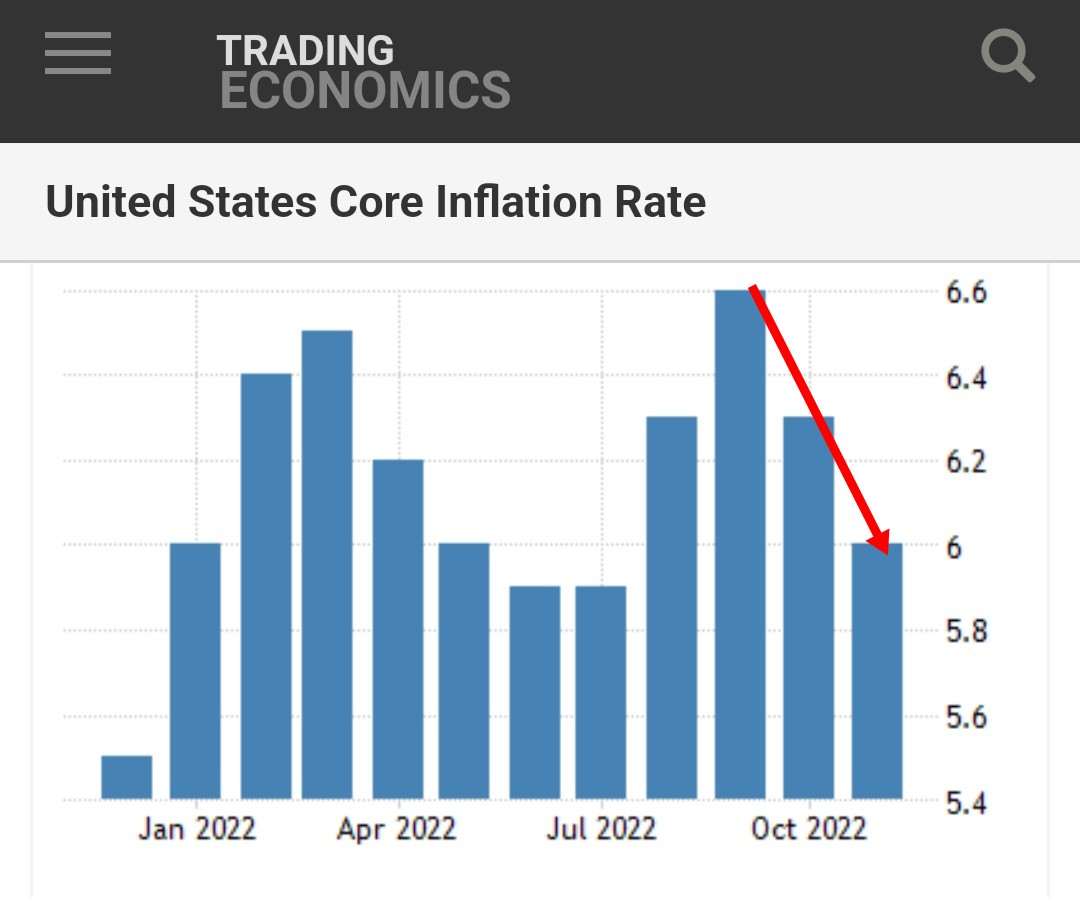

The December CPI is likely to keep the Fed on track to reduce the size of interest-rate increases to a quarter-percentage-point at its meeting that concludes on February 1 wsj.com/articles/infla…

Wells Fargo closes correspondent biz, will shrink servicing portfolio bit.ly/3W075jZ

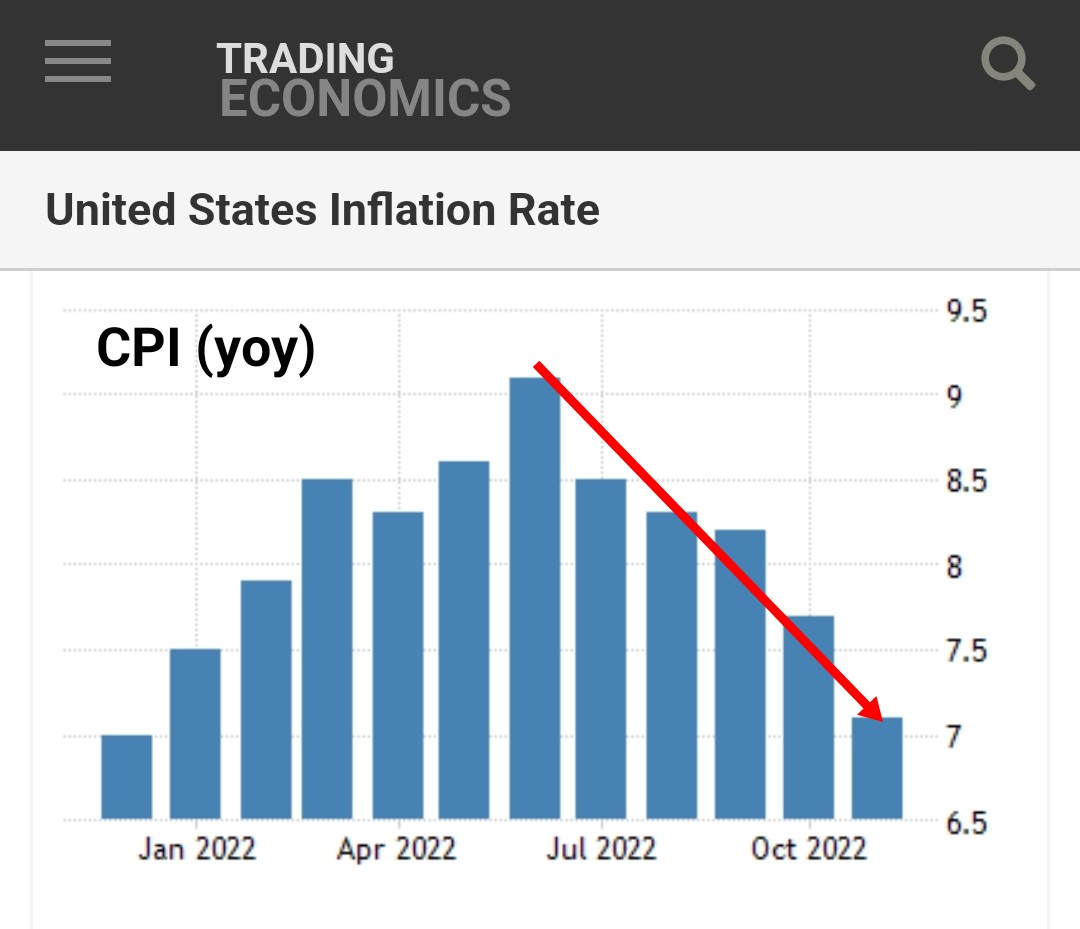

Very very interesting.... #CPI #MBS #mortgagerates

CPI and Core CPI out tomorrow before the bell. 》CPI • Consensus 6.5% YoY, 0% MoM • Down from 7.1% last month • Image 1 》Core CPI • Consensus 5.7% YoY, 0.3% MoM • Down from 6.0% last month • Image 2 If CPI MoM is 0.0%, that would make the 6-month annualized CPI 2.1%

8 Things Home Inspectors Will Look for in That House You Want To Buy newrez.social/R5sD56ht

Healthy money habits aren’t formed overnight, but with small changes over time, you can maintain a budget and get to a stronger financial position. newrez.social/6psDEIgm

Become a financial literacy master starting with having a strong understanding of these two important terms. newrez.social/84-MV3Ib

Don’t be surprised by closing costs! Here is exactly what you can expect to pay when you close on your first home. newrez.social/N-FBIlK5

newrez.social

What Are Closing Costs and How Much Will I Pay?

Learn what closing costs consist of and what you should expect to pay when you purchase your next home.

Managing money with your significant other doesn’t have to be a chore– it can even be fun! Check out these money challenges to try with your partner to give your finances and relationship a healthy boost. newrez.social/4~qpBflt

"You serious Clark?"

*YELLEN SAYS WORLD IS FACING `SERIOUS ECONOMIC HEADWINDS'

MBS Morning: Technical Triggers in Play as Data Nudges 10yr Below 3.50% housingnewsletters.com/nathanstotlar/… via @mktnewsletters #MBS #Fed #mortgagerates #realestatemarket

For example, a borrower who was quoted 7.125% yesterday would be seeing the same terms for a 6.625% rate today. Especially ironic considering Freddie's weekly survey shows rates rising back over 7% (+0.13%) whereas the actual drop this week is -0.52%.

7.7% inflation? Awesome, RALLY ON!!! Huge, Instantaneous Rally After Big CPI Improvement housingbrief.com/r/4GHRNG #mbs #mortgage via @mbslive

United States Trends

- 1. Grammys N/A

- 2. Bad Bunny N/A

- 3. Cher N/A

- 4. Nicki N/A

- 5. Good Monday N/A

- 6. Trevor Noah N/A

- 7. Benito N/A

- 8. Billie N/A

- 9. Luther Vandross N/A

- 10. Jelly Roll N/A

- 11. Kendrick N/A

- 12. D’Angelo N/A

- 13. sabrina N/A

- 14. #GroundhogDay N/A

- 15. AOTY N/A

- 16. Gaga N/A

- 17. Conquered N/A

- 18. Album of the Year N/A

- 19. Tyler N/A

- 20. Pharrell N/A

Something went wrong.

Something went wrong.