The Power Analyst

@ThePowerAnalyst

Research on energy markets, economics, with extra focus on developments that matter to electricity and the environment! #RealPower

You might like

Excellent read and highlights the real issue of the energy transition. The Price Is Wrong — Brett Christophers on saving the planet ft.com/content/0b8a1c… via @ft

EU: Very low price convergence during solar peak today. Interesting north/south splits in Norway and Italy. ^JH

In our Fit for 55-driving the energy transition webinar, we discuss the EU Green Deal proposals, including the expansion of carbon pricing to more sectors & what we think might change as the proposals progress through the EU legislative process: bit.ly/2W86CTH #Fitfor55

Absolutely tremendous collection of slides on the long term history of energy from John Kemp. @JKempEnergy . Not to be missed. fingfx.thomsonreuters.com/gfx/ce/yzdpxly…

UK ETS peaking at £50.23/t but don't forget to add in £18/t for the CPS - thats going now adding £22.5/MWh above the cost of gas ft.com/content/56e02d…

The cost of inaction is too high and businesses who adopt early an alternative (#ppa), meaningful way to purchase or generate (even better!) their electricity requirements will be ahead of their game. #renewables #realpower

Ofgem clarifies how the Transmission Constraint Licence Condition applies to storage participating in the Balancing Mechanism ofgem.gov.uk/system/files/d…

24/7 green procurement ambition will be the norm IMO. @Google has a proven record of being a trend setter when it comes to electricity procurement. Making greener scope 3 emissions could be the next goal perhaps?

2020 was the fourth year in a row that we matched 100% of Google’s global electricity use with purchases of renewable energy. 🌱 goo.gle/3ei5FxK

Goldman Sachs bankers ask for Friday nights and Saturdays off. What is the world coming to ? assets.bwbx.io/documents/user…

Americas' power sector deals jump 45% in Q4 2020, focus on clean energy: EY | #utilities #powermarkets #energytransition * $17.3 billion in 2020 renewable energy deals * Consolidation, #ESG push expected in 2021 @JAndersonEnergy story: plts.co/rn0v50DzgWy

GB, FR: For those who may have missed it, IFA2 is now active as of Friday, and has begun importing from France. Connecting Hampshire and Normandy, the 1GW interconnector spans 240km, over 3 times further than IFA1 at 70km. ^CD theguardian.com/business/2021/…

China added record 72 GW new wind capacity in 2020. 26.32 GW of these are already constructed earlier, but not connected to grid until last year, China Wind Energy Association provided more detailed data on Installed vs On-grid wind capacity below.

We get to breathe fresh air again. Good luck Joe and Kamala!

How Brexit disruption will change London's financial centres ft.com/video/c90a3fd4… via @FT

GB: Wholesale prices are forecast to be above average for the coming week, with evening peaks having potential for high and very high prices due to low wind availability and high thermal utilisation. Britned is expected to be offline, reducing the margins of generation. ^EMH

Short and sweet summary of the energy market in 2020 from @TimeraEnergy timera-energy.com/the-major-ener…

timera-energy.com

The major energy surprises of 2020 - Timera Energy

The major energy surprises of 2020 - Timera Energy

Another interesting read from #WBCSD - this one on cross border #PPAs. Wondering if interest will drop beyond 2021 when #CDP ghg scope 2 exceptions cease. #realpower wbcsd.org/Programs/Clima…

Very important ramp up which makes me think this December’s power demand Xmas patterns

French weekly power exports soar on low domestic demand, #nuclear gains. *Demand seen 12% lower on year for Nov. 1-15 *Nuclear ramps up to 43 GW weekly average *Exports averaged over 10 GW last week 📰 plts.co/dXTG50ClLcX

That route would tick many agenda boxes #energytransition #uk

GB : Rolls-Royce release plans for upto 16 Small Modular Reactors (200-400MW in size). Anticipated £200m investment by UK government. ^PH bbc.co.uk/news/science-e…

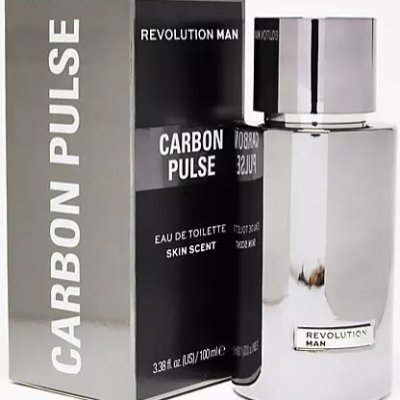

An interesting read with emphasis on EU #power #economics and the future of the #European #carbon markets. COMMENT: All change for the EU #ETS carbon-pulse.com/113353/

United States Trends

- 1. Giants 59.7K posts

- 2. Bills 129K posts

- 3. Bears 53.4K posts

- 4. Caleb 41.9K posts

- 5. Dolphins 28.7K posts

- 6. Josh Allen 13K posts

- 7. Russell Wilson 3,316 posts

- 8. Dart 22.6K posts

- 9. Daboll 7,625 posts

- 10. Browns 32.7K posts

- 11. Henderson 14.3K posts

- 12. Patriots 93.2K posts

- 13. Ravens 32.8K posts

- 14. Drake Maye 12.8K posts

- 15. Vikings 27.5K posts

- 16. JJ McCarthy 4,012 posts

- 17. Bryce 14.1K posts

- 18. Saints 32K posts

- 19. Pats 12.1K posts

- 20. Beane 5,097 posts

Something went wrong.

Something went wrong.