Trading Strategy

@TradingProtocol

Algorithmic trading protocol for decentralised markets. Automated non-custodial trading, execution directly on-chain across DEXs.

내가 좋아할 만한 콘텐츠

Check the latest self-custodial open strategies here: tradingstrategy.ai The Open Strategies #trade automatically on #DEXes and #DeFi protocols. Trading capital is in on-chain vaults so you can withdraw your crypto whenever you want.

Bitcoin price has stopped following M2 money supply. What is M2: M2 money supply is a broad measure of the total money available in an economy, encompassing not only the most liquid forms of money like physical currency and demand deposits (which are part of the narrower M1…

In Q3 2025 Sigil Core returned (net of fees): +21.18% vs EUR +20.68 % vs USD +13.41% vs BTC Sigil Stable ended Q3 with +2.89% net, with a Sharpe Ratio of 4.64. Read more here: medium.com/@sigilfund/sig…

The red Friday of October 10th: why some crypto funds are down 50%. Strategies that relied on smooth, trending market conditions proved catastrophically vulnerable. Managers without circuit-breaker logic, tail-risk hedges, or rapid deleveraging protocols faced capital…

On position rebalancing buffer math

I ran a few simulations on historical data to see how buffering affects trading behavior and the performance of a single-coin portfolio using the trend follow signals previously presented. to be clear: this is not about cherry-picking an optimal value - it is about building…

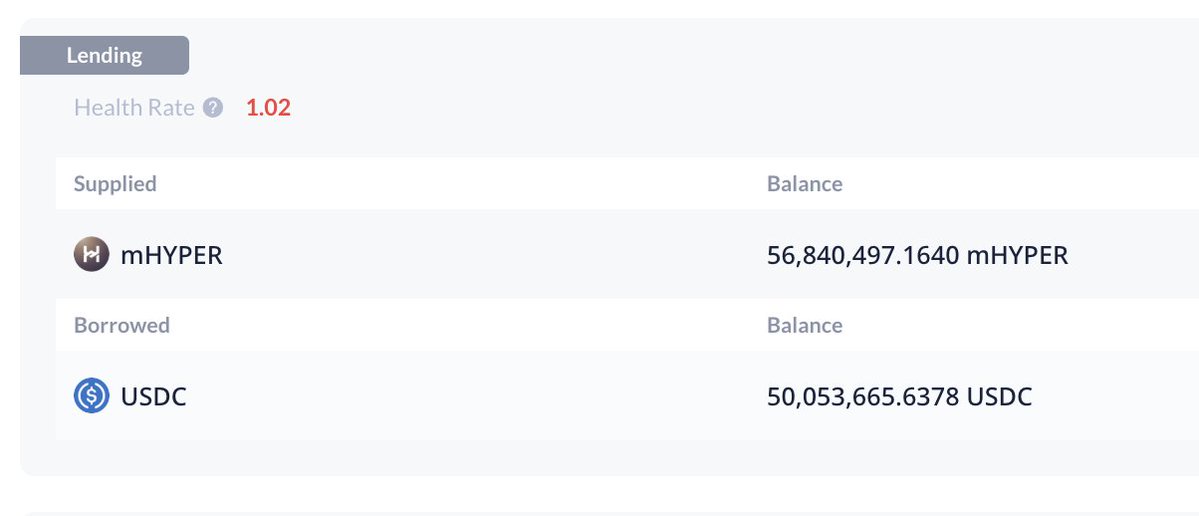

Concrete vault in high demand, people are overpaying to get in.

Some takes on the @ConcreteXYZ @stable farm / vault: - After the vault was instantly filled by the early whale, there is clearly plenty of demand to get in. People are paying $1.1 for a $1 deposit in the vault (was 1.15 earlier!) - Pendle PTs are pricing it at 250% APY fixed…

How Yearn curates its vaults

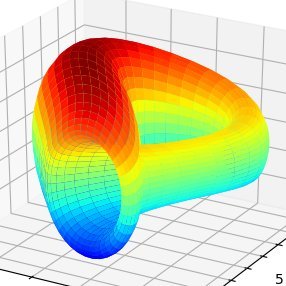

How Curve AMM pools work.

If anyone has ever wondered how Curve's Cryptoswap pools work Here's the WETH-CVX pool rebalancing its Center of Liquidity automatically around the MA price (internal price oracle) for 2 days The pool automatically moves its center of liquidity if it costs less than 50% of the…

Everything with "USD" in its name onchain is not a stablecoin. Here is an onchain trail of xUSD and deUSD that inflated their TVLs by building hidden leverage and vastly fractionalized reserves. xUSD, deUSD, and many other "stablecoins" are more akin to delta-neutral hedge…

Well boys, think I figured out (part of) the scam, and it is a doozy. Strap in. TLDR: Stream (xUSD) and Elixir (deUSD), and likely more, are recursively minting each other tokens in order to inflate there own TVL and create a ponzu the likes of which we haven't seen for awhile…

Trading TLT with calendar-based strategy on the assumption the TLT price follows a monthly cycle

2. Generate Signals We'll first set up an empty data frame to track the long/short signals. Then we create short entry signals on each new month's 1st and 5th day. Similarly, we make long signals 7 days and 1 day before the end of each month.

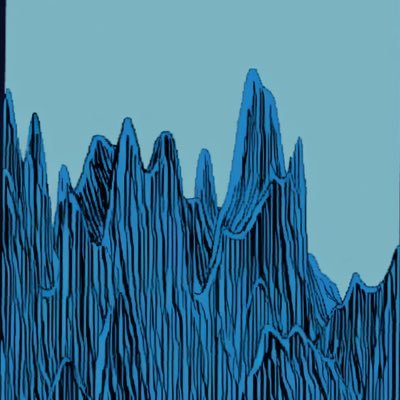

The US stock market is breaking out from its 100-year channel. We live in interesting times.

Monthly chart of the SPX going back to the 1920s. This is a huge week, maybe biggest in decades for markets. We are escaping a century-long channel. It had to happen this way, the Fed, trade deals, Mag 7 earnings... all culminating this week to break to a new level.

How to trade realised vs. implied volatility on stock markets

Implied vs. Realised Correlation - Why the Premium Exists And How Vol Traders Monetize It Through Dispersion Trades🧵 In equity index options, implied correlation almost always trades above realized correlation. This is not an accident; it's a persistent structural feature of…

On the stability of yield bearing stablecoins

Is Yield Fi's yUSD yield stablecoin unbacked? Are liquid vaults participating in illiquid lending deals? Is the whole house of cards pushing TVL to new protocols with unknown risks? We leave it for you, dear reader, to decide in this edition of Spicy Sunday. YieldFi's YUSD…

Good oveview of yield bearing stablecoins

Here's my map of the most popular yield-bearing stablecoins. Important: > TVL = asset market cap (both yield bearing & simple version) > Yield = numbers for the yield bearing version In most cases with dual token design (staked & simple version), 10% – 30% of total stablecoin…

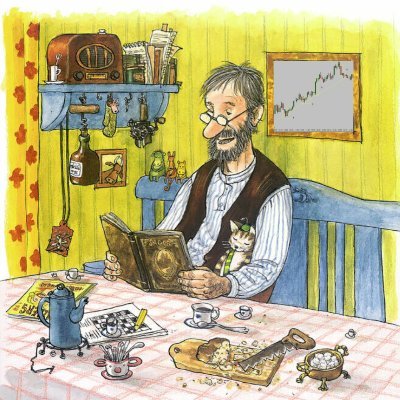

Algorithmic trading lessons learnt from seniors

I've been algorithmic trading for 5 years. In that time, I went from 0 to 10+ live algo strategies making multi 6 figures. Here are 12 things I wish I knew on day 1:

On proprietary managed AMMs where a single professional market maker manages liquidity. Popular on Solana, less established on EVMs.

United States 트렌드

- 1. Cheney 66.9K posts

- 2. Election Day 94.7K posts

- 3. Logan Wilson 5,630 posts

- 4. Good Tuesday 34.2K posts

- 5. GO VOTE 79.9K posts

- 6. Iraq 51.3K posts

- 7. #tuesdayvibe 1,922 posts

- 8. Cuomo 232K posts

- 9. New Jersey 171K posts

- 10. Shota 10.3K posts

- 11. Rolex 16.9K posts

- 12. Taco Tuesday 10K posts

- 13. Jerry 45.8K posts

- 14. Virginia 179K posts

- 15. Alex Karp 6,855 posts

- 16. PUEBLO GARANTIZA LA PAZ 1,594 posts

- 17. VOTE TODAY 63.1K posts

- 18. Halliburton 3,233 posts

- 19. For a 7th 10.9K posts

- 20. Tommy Robinson 40.7K posts

내가 좋아할 만한 콘텐츠

-

Dylan Field

Dylan Field

@zoink -

coordinape

coordinape

@coordinape -

0kage.eth

0kage.eth

@0kage_eth -

SHERLOCK

SHERLOCK

@sherlockdefi -

RWA.xyz

RWA.xyz

@RWA_xyz -

100proof.org

100proof.org

@1_00_proof -

tuba 🦈

tuba 🦈

@0xtuba -

HickupHH3

HickupHH3

@HickupH -

Convex Finance

Convex Finance

@ConvexFinance -

Seeker | Solana Mobile

Seeker | Solana Mobile

@solanamobile -

Figment Capital

Figment Capital

@FigmentCapital -

Taker

Taker

@0xTaker -

W3GG 💛

W3GG 💛

@w3ggofficial -

Andy Li

Andy Li

@andyfeili -

GitPOAP

GitPOAP

@gitpoap

Something went wrong.

Something went wrong.