Trading Strategy

@TradingProtocol

Algorithmic trading protocol for decentralised markets. Automated non-custodial trading, execution directly on-chain across DEXs.

Talvez você curta

Check the latest self-custodial open strategies here: tradingstrategy.ai The Open Strategies #trade automatically on #DEXes and #DeFi protocols. Trading capital is in on-chain vaults so you can withdraw your crypto whenever you want.

On whether RSI (relative strength indicator) has any predictive power

Adding some data to what Mercury said, since RSI is another fantastic example (probably an indicator you will see a lot on the feed soon as well) To be clear: I'm not saying the indicator itself is worthless; its value depends entirely on how you use it. And yelling "RSI…

Aave liquidations jump to all-time high

Q4 2025 is far from over, and yet it's already the largest quarter of the year for liquidations (seen by associated revenue) in Aave. Be mindful of your Health Factor and stay safe out there.

When the knife stops falling and it is safe to catch the red candle

Compelling reversals always start on the low time frame. We want to look for clues that help signal seller exhaustion and buyers stepping in, then make a calculated bet that it will continue to translate into higher timeframes. For me I typically look at the 15min into the 1h…

Bitcoin vs. VIX Volatility!

I ran an analysis comparing historical bitcoin volatility, historical VIX spikes, and historical max bitcoin drawdowns. The data shows that as bitcoin’s volatility decreases over time, the size of its max drawdowns for the same VIX level also decreases. This reflects bitcoin…

The Japanese government's 40-year bonds reach an all-time high. This is significant because of the Japanese carry trade, which has been going on for more than 30 years. The expected unwinding of this carry trade will have a significant impact on the global macroeconomy. The…

A story 35 years in the making *JAPAN'S NIKKEI 225 STOCK AVERAGE BREACHES 40,000 FOR FIRST TIME

How Hyperliquid HLP was manipulated to take the other side of a questionable trade on POPCAT (memecoin).. "When he removed the 8 figs buy wall, he got liquidated on the entire $20M-$30M popcat long within seconds, causing HLP to take over the position." The actual trade…

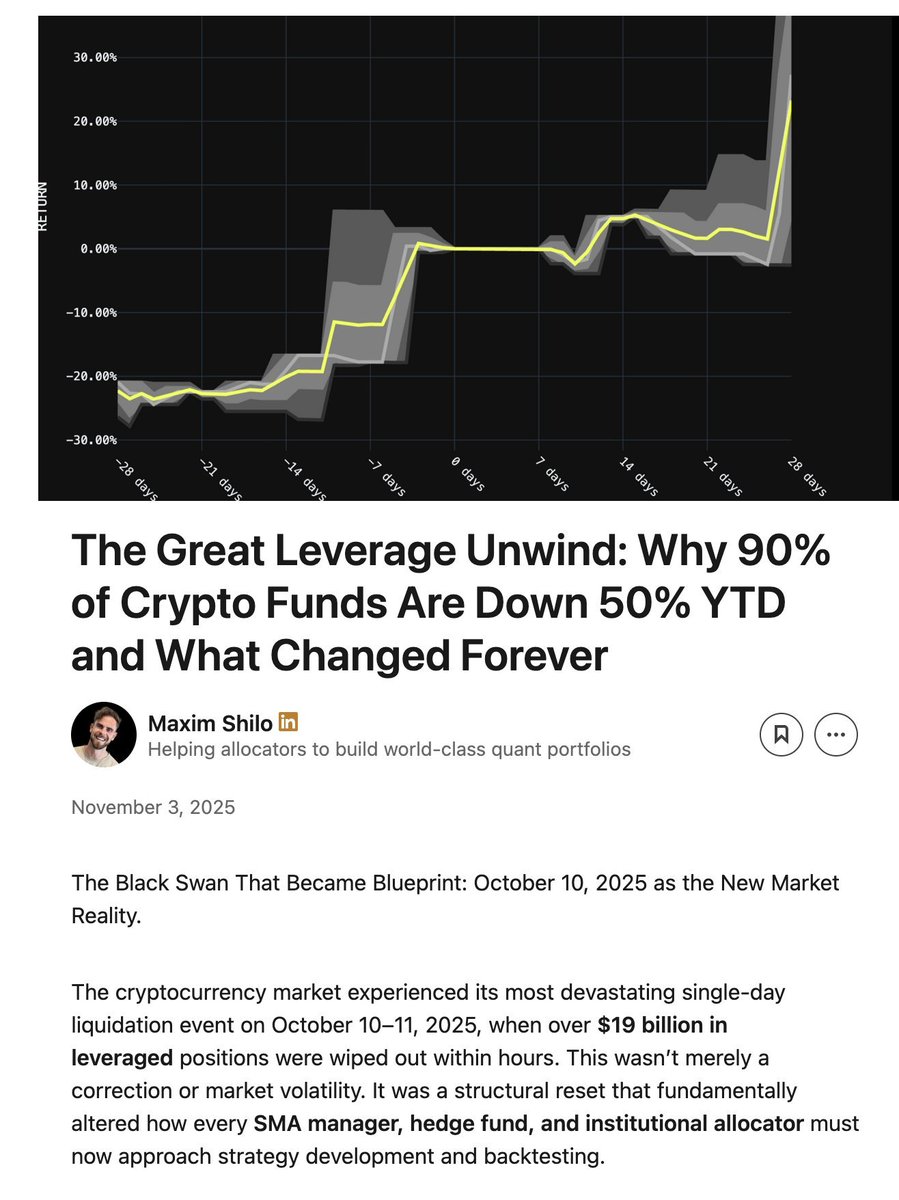

DyDx MegaVault was severely impacted on October 10th. Based on napkin math, it will take ~3 months to recover the loss. More market-making vaults and their Oct 10th charts below.

The difference in perp DEX market-making vaults. - Left: Hyperliquid HLP. Massive profits in the Oct 10th liquidation event. - Right: Lighter LLP. Taking a hit during the event (though very minor). Liquidations are an extremely profitable business. Both vaults have the…

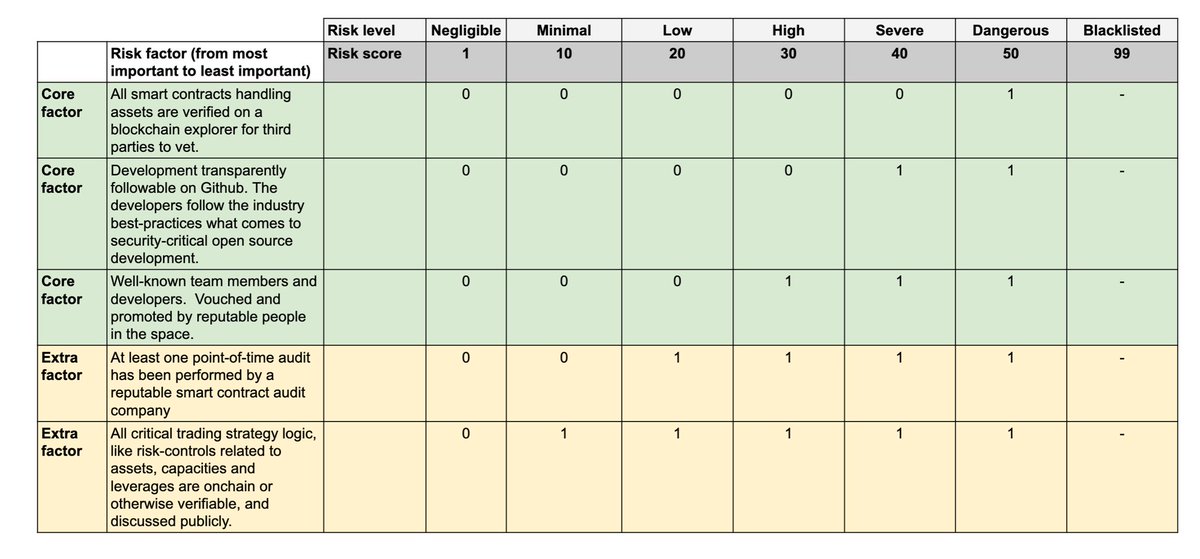

Trading Strategy's DeFi vault report data is now available as a real-time dashboard showing you the best stablecoin DeFi vaults to help you assess investment opportunities. You can find the dashboard here: tradingstrategy.ai/trading-view/v… What are vaults? In decentralised finance, a…

Spread analysis of different exchanges by Steve Paterson from @BurntCanvas linkedin.com/posts/steven-p…

How to invest like Warren Buffett (You also need $300M free cash lying around)

"Berkshire Hathaway recently bought a wind farm in Iowa for $300 million. It was earning $30 million a year pre-tax — that’s a 10% return on a utility-type asset with government-guaranteed contracts for 10 years. There’s no operating risk, no commodity price risk, no political…

Rough risk-reward of different DeFi opportunities by @0xlykt See also the earlier "where does the yield come from" here x.com/TradingProtoco…

The difference in perp DEX market-making vaults. - Left: Hyperliquid HLP. Massive profits in the Oct 10th liquidation event. - Right: Lighter LLP. Taking a hit during the event (though very minor). Liquidations are an extremely profitable business. Both vaults have the…

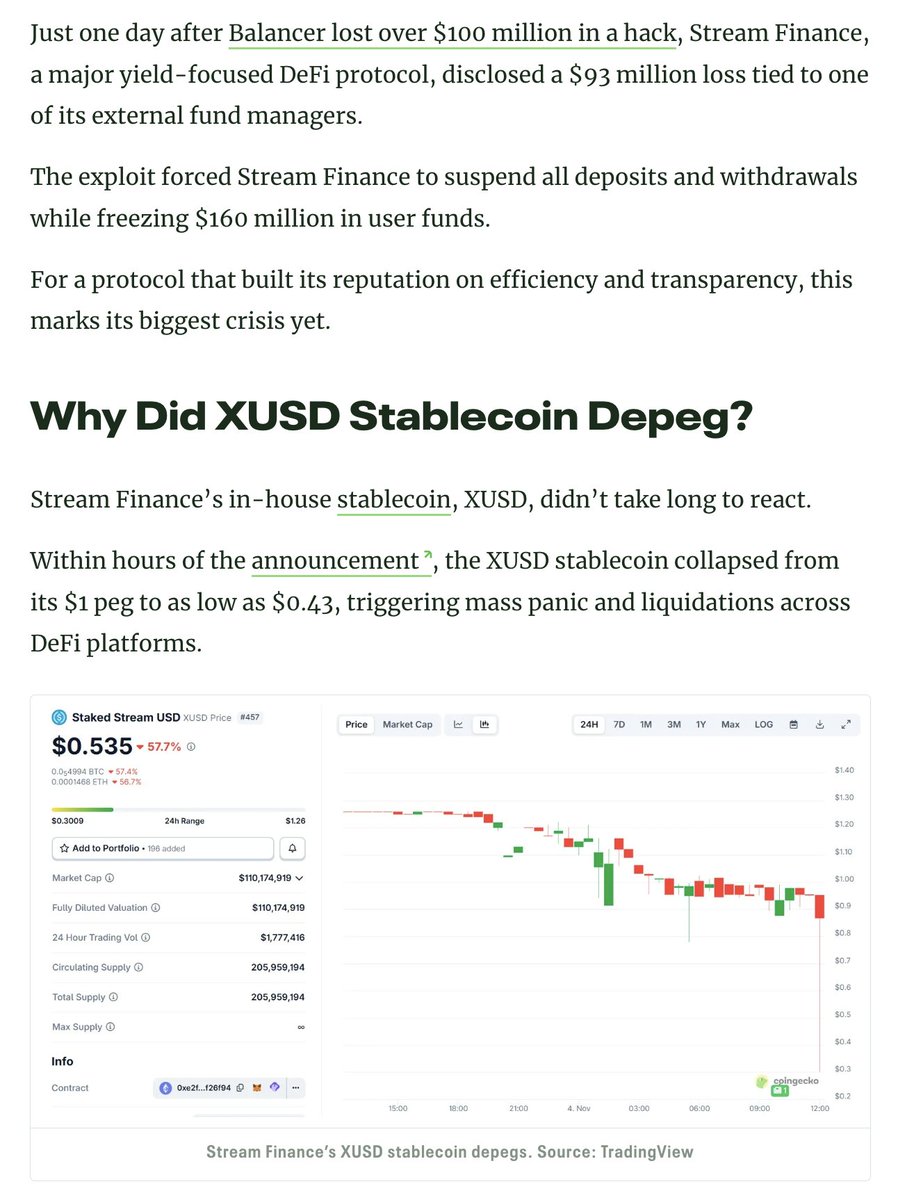

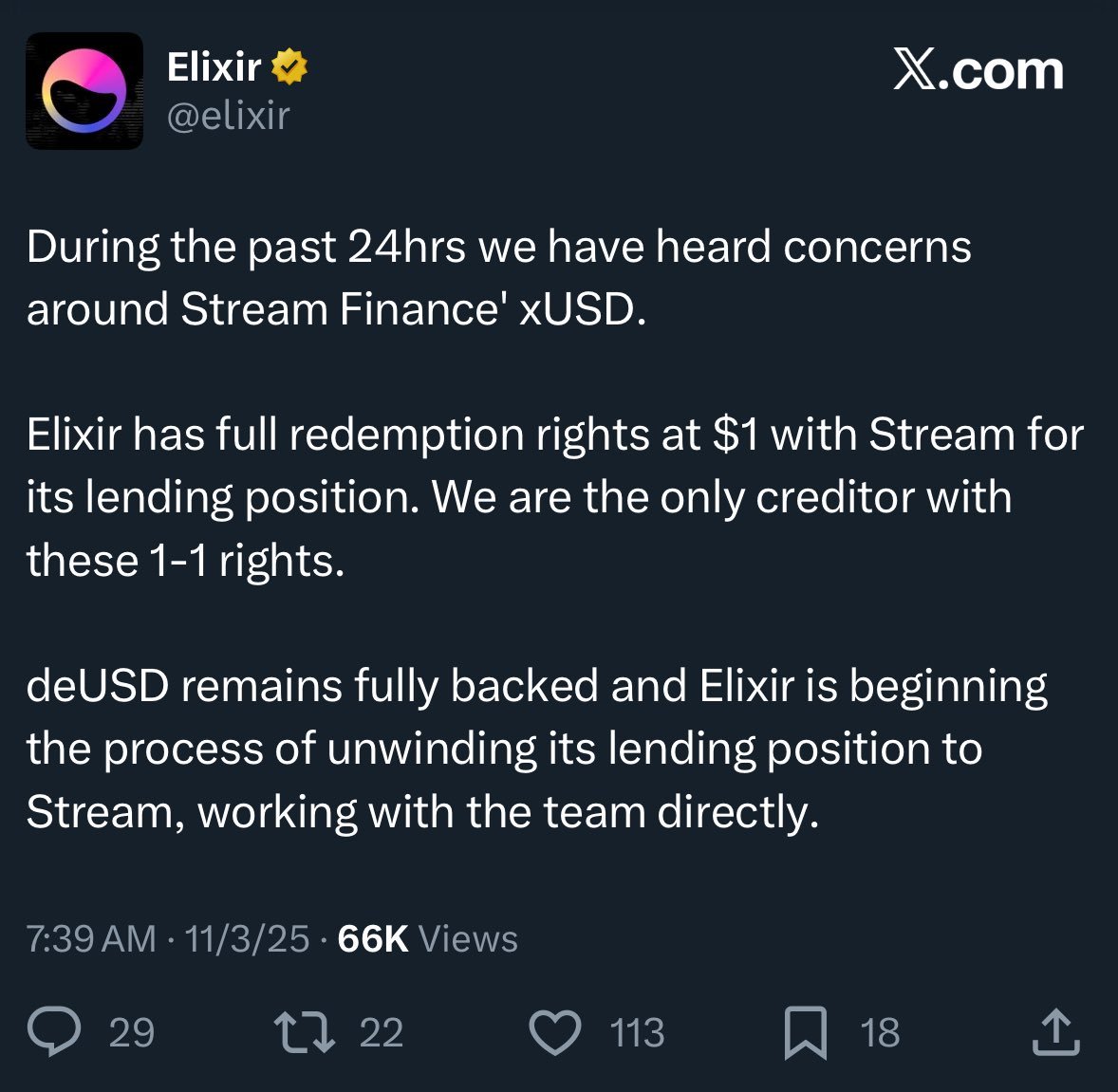

Harvest Finance's Recovery Plan for the Stream XUSD incident. The USDC Autopilot vault on Arbitrum got hit. Once the USDC Autopilot on Arbitrum is unpaused, each existing participant will have instant access to their proportional share of liquid USDC in the vault of approx.…

Where does the DeFi lending yield come from? A useful chart by @andrewhong5297 The last bit "strategy/looping multiplies" is what led to the blow up of Stream xUSD, as described in detail here x.com/TradingProtoco…

Oct 10th Red Friday: the root cause of Stream xUSD blowing up, the longer version Stream xUSD is a "tokenised hedge fund" masquerading as a DeFi stablecoin, claiming to run delta-neutral strategies. Now Stream has gone underwater in questionable circumstances. Over the past five…

United States Tendências

- 1. #AEWFullGear 66.8K posts

- 2. Klay 16.8K posts

- 3. Lando 87.2K posts

- 4. LAFC 13.6K posts

- 5. #LasVegasGP 168K posts

- 6. Swerve 5,966 posts

- 7. Hangman 9,008 posts

- 8. Samoa Joe 4,200 posts

- 9. Gambino 1,553 posts

- 10. Ja Morant 7,111 posts

- 11. Bryson Barnes N/A

- 12. Benavidez 15.2K posts

- 13. #byucpl N/A

- 14. Utah 23.5K posts

- 15. LJ Martin 1,225 posts

- 16. Max Verstappen 45.1K posts

- 17. Hook 21.3K posts

- 18. Fresno State N/A

- 19. #Toonami 2,233 posts

- 20. Mark Briscoe 4,227 posts

Talvez você curta

-

Dylan Field

Dylan Field

@zoink -

coordinape

coordinape

@coordinape -

0kage.eth

0kage.eth

@0kage_eth -

SHERLOCK

SHERLOCK

@sherlockdefi -

RWA.xyz

RWA.xyz

@RWA_xyz -

100proof.org

100proof.org

@1_00_proof -

tuba 🦈

tuba 🦈

@0xtuba -

HickupHH3

HickupHH3

@HickupH -

Convex Finance

Convex Finance

@ConvexFinance -

Seeker | Solana Mobile

Seeker | Solana Mobile

@solanamobile -

Figment Capital

Figment Capital

@FigmentCapital -

Taker

Taker

@0xTaker -

W3GG 💛

W3GG 💛

@w3ggofficial -

GitPOAP

GitPOAP

@gitpoap -

Penumbra 🌘

Penumbra 🌘

@penumbrazone

Something went wrong.

Something went wrong.