Brian Brookshire (Bitcoin Overflow)

@btc_overflow

Head of Bitcoin Strategy @H100Group | H💯DL!

Bạn có thể thích

Look, the strategy is really simple. Keep DCA-ing into #Bitcoin. That's it. Seriously, you can stop reading here.

H100 Update ($H100 $GS9 $HOGPF) Nov 1, 2025. Much time this week was spent on preparation of written materials and documents in relation to execution of steps in our Operation Svalbard roadmap. While we are not at liberty to discuss detailed status updates on current operations,…

Happy Bitcoin white paper day to all those who celebrate.

17 years after the white paper, the Bitcoin network is still operational and more resilient than ever. Bitcoin never shuts down. @SenateDems could learn something from that.

$MSTR highlighted an important point on credit ratings. S&P's methodology excludes unbacked tokens, like bitcoin, from equity—mirroring Basel Accords for banks in BCBS jurisdictions. I.e., exclusion was not purely a judgment call by S&P. The Basel Accords need updating.

$MSTR launching fixed income products in international markets is actually incredibly bullish, not bearish, for non-US BTCTCs. It takes more than one offering to make a market. Credit ratings agencies are not going to change their models for a single issuer. Fixed-income…

It's interesting watching the $MSTR funding strategy take a 180. Prior to this year, it was all about engineering a volatile common stock to monetize volatility. Now it's all about selling low volatility stable cash returns.

Strategy announced clear plans to target Canadian Dollar and Euro denominated fixed-income markets. You know what's interesting about the Nordics? Sweden, Norway, and Denmark don't use Euros. They all have their own currencies.

This bitcoin cycle actually is different. The bid looks different. The price action looks different. The liquidity backdrop is different. The long awaited institutions are actually here this time. Sans a November blow-off top, I think 2026 looks very different to prior patterns.

Since 2017, I have only known "up only" or "down only" in BTC. This is the first year where bitcoin has just consolidated (+15%) and I've actually enjoyed it. BTC has done back to back 140% gains. I am of the belief if BTC did another 140% gain this year, we would most…

The Nordic banks are coming. Nordea, the largest Nordic bank, to offer Bitcoin-linked ETPs trading on its platforms. cryptobriefing.com/nordea-permits…

Even with prefs, this meme is just as relevant today as when I originally posted it. Demand for BTC derivatives is linked to demand for BTC. When looking beyond the immediate term, the question is always the same for me: Do I believe bitcoin's growth story continues? Yes, I do.

I understand the frustration and impatience people have with $MSTR right now, I really do. But Saylor can't do this all by himself. Big daddy bitcoin has to lend a hand for us to reach Valhalla.

Stock market indexes and the ETFs that track them are a key source of passive flows for stocks. Earlier this year, H100 Group was added to the MSCI Global Micro Cap Index. What could be next? This is the universe of ETFs that H100 could potentially grow into.

Next stop: Abu Dhabi 🇦🇪✈️

By how much should a bitcoin related equity outperform bitcoin per year to be worth the counterparty risk, in your view?

China trade negotiations and FOMC this week. Everything else is noise.

*CHINA PURCHASES 180,000 TONS OF U.S. SOYBEANS, THE FIRST ORDER IN MONTHS, AS SHOW OF GOOD FAITH AHEAD OF TOMORROW'S MEETING BETWEEN PRESIDENTS TRUMP & XI

Wild. A private company rivaling U.S. Treasury holdings of the top 20 nations.

With 135 billion of U.S Treasuries, Tether is now the 17th largest holder of U.S debt, passing also South Korea. Soon Brazil!

Looking forward to joining @khingoei, @AlexandreLaizet and @gazza_jenks on stage at @BitcoinConfEUR. We will dive into how a new generation of European Bitcoin treasury companies are structuring capital, strengthening balance sheets and building the corporate layer of Bitcoin.…

"Because we deduct bitcoin assets from equity when we calculate adjusted common equity, the company has negative total adjusted capital of as of second-quarter 2025." Imagine what happens to $MSTR's credit rating when S&P starts treating bitcoin as capital instead of a demerit.

S&P Global: "The strategy also creates an inherent currency mismatch: The company has a long bitcoin position and a short U.S. dollar position." One man's risk factor is another man's core value proposition.

BTCTC credit ratings have arrived. Two things stood out to me in S&P's reasoning: - S&P views bitcoin concentration as a risk factor, but recognizes prudent capital management. - S&P specifically mentioned increasing credit rating over time if use of convertible bonds decreases.

S&P Global Ratings has assigned Strategy Inc a 'B-' Issuer Credit Rating (Outlook Stable) — the first-ever rating of a Bitcoin Treasury Company by a major credit rating agency. strategy.com/press/s-p-glob…

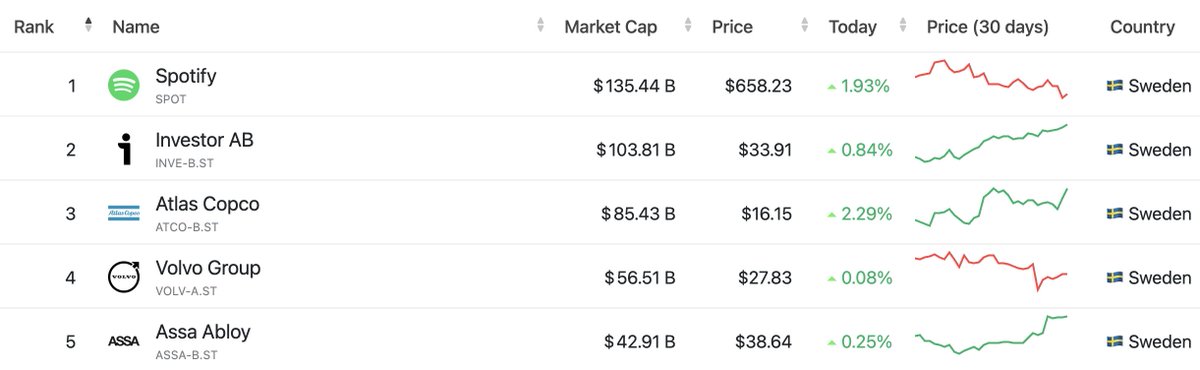

What would it take for H100 to become the most valuable Swedish company? Spotify, the current #1, is 1,200x the size of H100's market cap. 10x BTC price ($1.15M BTC) and 100x BTC holdings (104,666 BTC) at a 1.2x mNAV would get to parity.

United States Xu hướng

- 1. Gameday 35.1K posts

- 2. Christmas 123K posts

- 3. Big Noon Kickoff N/A

- 4. French Laundry N/A

- 5. Disney 95.2K posts

- 6. Social Security 51.7K posts

- 7. #SaturdayVibes 3,900 posts

- 8. vmin 39.6K posts

- 9. Good Saturday 25.9K posts

- 10. Nigeria 503K posts

- 11. #Caturday 3,335 posts

- 12. New Month 324K posts

- 13. #AllSaintsDay 1,569 posts

- 14. Senior Day 1,900 posts

- 15. Texas -3 103K posts

- 16. #saturdaymorning 1,751 posts

- 17. Great Gatsby 9,445 posts

- 18. Hulu 34.3K posts

- 19. Pat McAfee N/A

- 20. #River 5,612 posts

Something went wrong.

Something went wrong.